1/ Best Strategies for Inflationary Times (Neville, Draaisma, Funnell, Harvey, Hemert)

"Unexpected inflation is bad for bonds and equities, with local inflation mattering most, while commodities and futures trend following performance is strong."

papers.ssrn.com/sol3/papers.cf…

"Unexpected inflation is bad for bonds and equities, with local inflation mattering most, while commodities and futures trend following performance is strong."

papers.ssrn.com/sol3/papers.cf…

2/ Inflationary regimes are when:

* YOY CPI ≥ 5% and is above 50% of its highest level over the past 24 months, OR

* YOY CPI ≥ 2%, is below 50% of its highest level over the past 24 months, then re-accelerates to ≥ 5%

* Episode length ≥ 6 months

Reported returns are CAGRs.

* YOY CPI ≥ 5% and is above 50% of its highest level over the past 24 months, OR

* YOY CPI ≥ 2%, is below 50% of its highest level over the past 24 months, then re-accelerates to ≥ 5%

* Episode length ≥ 6 months

Reported returns are CAGRs.

3/ Bonds & equities (commodities, trend following) perform poorly (well) during inflationary regimes.

For companies, costs may tend to rise faster than output prices.

NOTE: Strong trend performance may be partly from the way inflation regimes are defined (length ≥ 6 months).

For companies, costs may tend to rise faster than output prices.

NOTE: Strong trend performance may be partly from the way inflation regimes are defined (length ≥ 6 months).

4/ "One concern is whether each regime is driven by a different component of the CPI and therefore unique. The data suggest this is not the case.

"All of the components experience higher rates of price rises in inflationary regimes (at least twice as high in 59% of instances)."

"All of the components experience higher rates of price rises in inflationary regimes (at least twice as high in 59% of instances)."

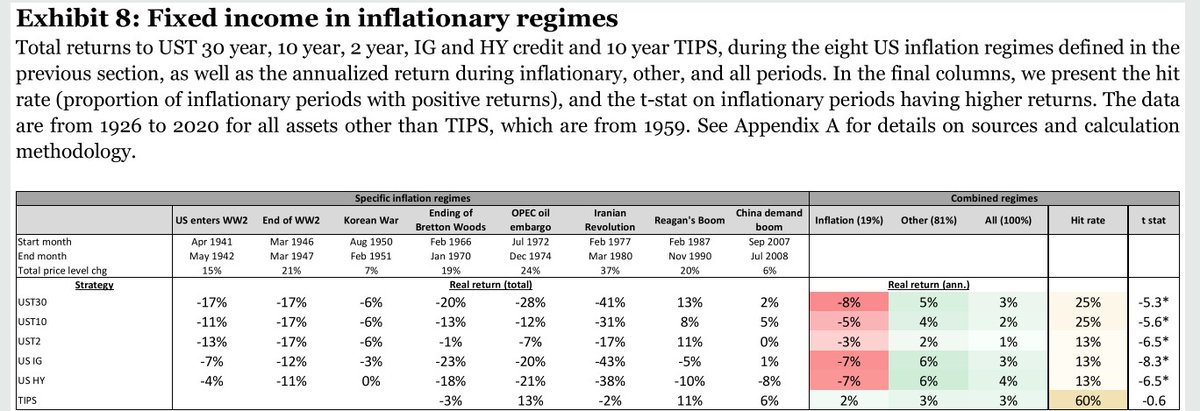

5/ "For U.S. equities (bonds), the real return averages -7% (-5%) during inflationary times, with negative returns in 75% (75%) of regimes.

"Consequently, the 60-40 equity-bond portfolio performs poorly during inflationary regimes, with a -6% real annualized return."

"Consequently, the 60-40 equity-bond portfolio performs poorly during inflationary regimes, with a -6% real annualized return."

6/ "Equities benefit from rising inflation if the starting level is below median (deflation risk) but are hurt if it is above median (escalation risk).

"The negative relation between bond returns and inflation changes does not depend much on the starting level of inflation."

"The negative relation between bond returns and inflation changes does not depend much on the starting level of inflation."

7/ "The energy sector lags the commodity it produces. Reasons may include operational issues (wage inflation, geopolitical turbulence) and companies' hedging strategies.

"For financials, default risk dominates rising rates, and there can be a lag between inflation/tightening."

"For financials, default risk dominates rising rates, and there can be a lag between inflation/tightening."

8/ "Neither IG nor HY protected purchasing power.

"IG and HY in excess of government bonds did not historically provide inflation protection.

"The starting TIPS yield in inflation regimes was +2.4%. Now it is -0.7%, so they may not provide the same level of protection today."

"IG and HY in excess of government bonds did not historically provide inflation protection.

"The starting TIPS yield in inflation regimes was +2.4%. Now it is -0.7%, so they may not provide the same level of protection today."

9/ "All commodities have positive annualized real returns during inflationary regimes.

"Foodstuffs do least well but still generate strongly positive real annual returns. This may be idiosyncratic due to legislation across the 1960s designed to bring food prices down."

"Foodstuffs do least well but still generate strongly positive real annual returns. This may be idiosyncratic due to legislation across the 1960s designed to bring food prices down."

10/ "There is a positive relationship between the 12-month real return to the equally-weighted commodity basket and the contemporaneous change in the inflation rate, irrespective of the starting level of inflation. It may be stronger when inflation is in the top two quintiles."

11/ "U.S. residential real estate has an annualized real return of -2% (+2%) in inflationary (other) regimes."

Residential real estate provided some (but mediocre) inflation protection in the U.K.

In Japan, it historically worked well but may have been influenced by bubbles.

Residential real estate provided some (but mediocre) inflation protection in the U.K.

In Japan, it historically worked well but may have been influenced by bubbles.

12/ "Generally, collectibles have lived up to their reputation as a store of value in inflationary times.

"However, the asset class is unlikely to be part of an institutional portfolio, given small traded volumes."

"However, the asset class is unlikely to be part of an institutional portfolio, given small traded volumes."

13/ "We incorporate estimated costs, based on our live experience trading similar L/S books (combined transaction, slippage, funding, and short-selling). The estimates are at the maximum of the range in Harvey et al.: 2.0% (0.8%) per annum for stock factor (futures) strategies."

14/ "Smaller companies perform poorly in inflationary regimes.

"Value might be surprisingly weak, as growth stocks are often assumed to be adversely sensitive to unexpected inflation.

"Cross-sectional equity momentum performs well.

"Quality holds up well; low beta is weak."

"Value might be surprisingly weak, as growth stocks are often assumed to be adversely sensitive to unexpected inflation.

"Cross-sectional equity momentum performs well.

"Quality holds up well; low beta is weak."

15/ "We construct a time-series momentum strategy with a 10% ex-ante annualized vol target. The weights to historical lags in the trend definition are chosen to best approximate the BTOP50 trend-following index returns.

"Trend following appears to provide inflation protection."

"Trend following appears to provide inflation protection."

16/ "Equities and bonds perform worst during their own countries’ inflation periods. There may be benefits to international diversification.

"Commodities and trend following perform particularly well when all three countries are in an inflationary regime (4% of sample months)."

"Commodities and trend following perform particularly well when all three countries are in an inflationary regime (4% of sample months)."

17/ "Looking at averages over all regimes may be misleading.

* Gold’s ability to hedge unexpected inflation is driven by a single observation: 1979.

* Today, only 11% of GDP is driven by manufacturing.

* High volatility (gold, bitcoin) may lead to unreliable inflation hedging."

* Gold’s ability to hedge unexpected inflation is driven by a single observation: 1979.

* Today, only 11% of GDP is driven by manufacturing.

* High volatility (gold, bitcoin) may lead to unreliable inflation hedging."

18/ Related research:

Average Annual Inflation Rates by Decade

The Rate of Return on Everything

Commodity Futures Risk Premium: 1871–2018

Average Annual Inflation Rates by Decade

https://twitter.com/ReformedTrader/status/1231824161497944065

The Rate of Return on Everything

https://twitter.com/ReformedTrader/status/1259281594281373697

Commodity Futures Risk Premium: 1871–2018

https://twitter.com/ReformedTrader/status/1197403201424642048

19/ Conquering Misperceptions about Commodity Futures Investing

Two Centuries of Commodity Futures Premia: Momentum, Value and Basis

Building a Better Commodities Portfolio

https://twitter.com/ReformedTrader/status/1289711289611087872

Two Centuries of Commodity Futures Premia: Momentum, Value and Basis

https://twitter.com/ReformedTrader/status/1207072097974902785

Building a Better Commodities Portfolio

https://twitter.com/ReformedTrader/status/1316479649585659905

20/ The Trend is Our Friend: Risk Parity, Momentum and Trend Following in Global Asset Allocation

Trend-Following, Risk-Parity and the Influence of Correlations

Can Risk Parity Outperform If Yields Rise?

https://twitter.com/ReformedTrader/status/1335726380512776192

Trend-Following, Risk-Parity and the Influence of Correlations

https://twitter.com/ReformedTrader/status/1347246024293695490

Can Risk Parity Outperform If Yields Rise?

https://twitter.com/ReformedTrader/status/1337205904932945921

21/ Getting to the Core: Inflation Risks Within and Across Asset Classes

https://twitter.com/ReformedTrader/status/1383975582027763714

22/ Total Returns to Single Family Rentals

https://twitter.com/ReformedTrader/status/1393989847417647106

23/ "It is possible that recent high inflation will be transitory, but policy-makers *desire* more inflation.

"More than just changing asset classes, adjusting for an inflation regime involves strategic thinking with a focus on trend-following."

mrzepczynski.blogspot.com/2021/05/protec…

"More than just changing asset classes, adjusting for an inflation regime involves strategic thinking with a focus on trend-following."

mrzepczynski.blogspot.com/2021/05/protec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh