New paper: Searching for Superstars 🌟

• Ability to attract talent is a moat 🏰

• Companies hiring talent from elite competitors and universities outperform 📈

• Company social networks / PageRank 🕸️

• March Madness-themed bonus section 🏀

(not investment advice)

Thread 🧵

• Ability to attract talent is a moat 🏰

• Companies hiring talent from elite competitors and universities outperform 📈

• Company social networks / PageRank 🕸️

• March Madness-themed bonus section 🏀

(not investment advice)

Thread 🧵

(0/10) Full paper here:

Blog: sparklinecapital.com/post/searching…

PDF: sparklinecapital.files.wordpress.com/2021/04/sparkl…

Blog: sparklinecapital.com/post/searching…

PDF: sparklinecapital.files.wordpress.com/2021/04/sparkl…

(1/10) Superstars and Power Laws

The performance gap between the best and average worker is growing. However, unlike in sports, investors lack metrics to identify teams with top-tier talent.

The performance gap between the best and average worker is growing. However, unlike in sports, investors lack metrics to identify teams with top-tier talent.

(2/10) Human Capital Map

To solve this problem, we build a "social network" based on human capital flows from one company to another.

To solve this problem, we build a "social network" based on human capital flows from one company to another.

(3/10) Superstar Aggregators

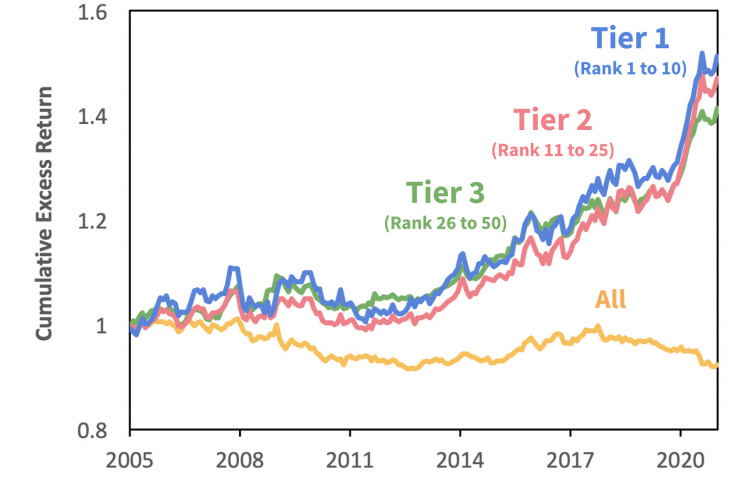

We apply the PageRank algorithm to this network to find companies that are winning the War for Talent. We run a backtest and find these firms have outperformed the stock market.

We apply the PageRank algorithm to this network to find companies that are winning the War for Talent. We run a backtest and find these firms have outperformed the stock market.

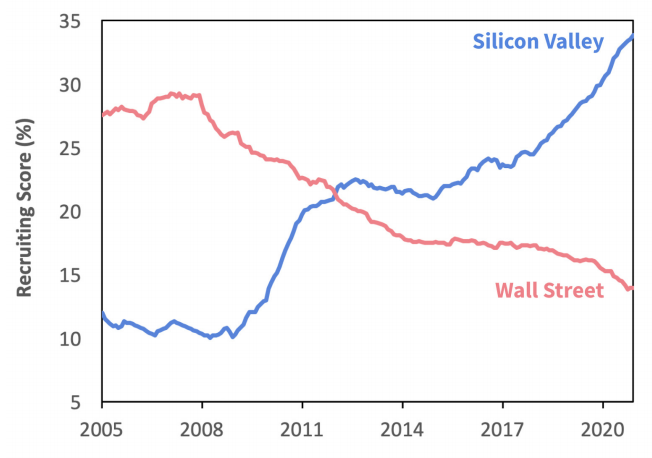

(4/10) Wall Street vs. Silicon Valley

From a macro level, superstar talent has been fleeing Wall Street into Silicon Valley's open arms.

From a macro level, superstar talent has been fleeing Wall Street into Silicon Valley's open arms.

(5/10) Industry Clusters

Our graph allows us to cluster firms based on their hiring patterns. This provides a useful alternative to static industry classifications (GICS, SIC).

Our graph allows us to cluster firms based on their hiring patterns. This provides a useful alternative to static industry classifications (GICS, SIC).

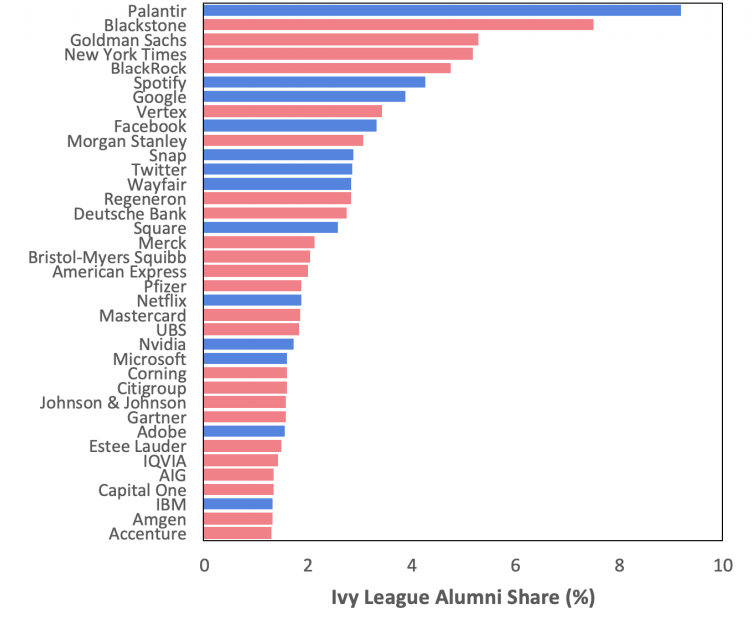

(6/10) University Alumni Portfolios

We build portfolios of companies that employ high concentrations of alumni from top universities. Here are the employers with the highest concentration of Ivy League grads.

We build portfolios of companies that employ high concentrations of alumni from top universities. Here are the employers with the highest concentration of Ivy League grads.

(7/10) US News & World Report

Using US News & World Report rankings, we find that companies able to attract grads of the top 50 universities have outperformed.

Using US News & World Report rankings, we find that companies able to attract grads of the top 50 universities have outperformed.

(8/10) March Madness 🏀

We use hierarchical clustering to build a March Madness-style "bracket." Each match will be decided by a horse race of 2005-2020 performance of each school. Before you peek at the next Tweet, place your bets! 🏇

We use hierarchical clustering to build a March Madness-style "bracket." Each match will be decided by a horse race of 2005-2020 performance of each school. Before you peek at the next Tweet, place your bets! 🏇

(10/10) Conclusion

As in sports, the economy is increasingly driven by superstar talent. Companies with superstar teams have beat the market. Human capital flows allow us to find these winning franchises.

If interested, here is my monthly newsletter 📨:

share.hsforms.com/1JcZ0c8ySRbWIZ…

As in sports, the economy is increasingly driven by superstar talent. Companies with superstar teams have beat the market. Human capital flows allow us to find these winning franchises.

If interested, here is my monthly newsletter 📨:

share.hsforms.com/1JcZ0c8ySRbWIZ…

• • •

Missing some Tweet in this thread? You can try to

force a refresh