The Robotaxi Repo - Part 2: A theory of how Tesla utilizes lease accounting and Robotaxis to turn collateralized borrowings into sales and achieve paper profitability. $TSLA $TSLAQ (1/25)

Disclaimer: I have no claim of actual knowledge, all information is sourced from public information. This is not investment advice and all opinions are my own. (2/25)

The Robotaxi Repo Theory: Tesla overstated S/X sales in 2018 using new lease accounting methods, however this led to large 1Q19 writeoff. To avoid further writeoffs, TSLA declares cars appreciating assets in 2Q19, allowing collateralized borrowing to be considered sales. (3/25)

There is significant evidence to support this theory, including many accounting red flags, financial evidence in Tesla's international revenue, and qualitative statements by Tesla in 2Q19 seemingly meant to support and disclose this concept (4/25)

Under Tesla's lease accounting, certain international leases are considered sales, if the expected future market value exceeds the buyback obligation. Only international leases are considered sales in this fashion. (5/25)

However a pure repo could still not be considered a sale, since the backback obligation would exceed the purchase price, and cars depreciate. (6/25)

However, in 2Q19, Tesla declares that their cars will appreciate. With an appreciating asset, a repo could indeed be booked as a sale. This would allow TSLA to book collateralized borrowings or inventory repos as sales (7/25)

Red flag: Tesla was widely reported to be under significant financial stress in 2019, with Musk stating later that the company had just 1 month of cash at points during the Model 3 ramp, yet began turning consistent profit in 3Q19 (8/25)

Red Flag: Tesla had turned over two CAO and one CFO in the past year, during which it adopted ASC 606, an industry standard change, but one that provided management more leeway in booking leases as sales. (9/25)

Red Flag: Revenue Recognition for international leases has several eye-raising components and could be used as way to overstate sales, subject to aggressive management assumptions. Domestic and direct leases are not booked in this way. (10/25)

Red Flag: In 1Q19, Tesla re-writes its rev. recognition section from the 2018 10k, creating ambiguity between its rev. recognition and revenue by source disclosure. In 2019 there are meaningfully fewer "Auto sales with RVG" despite Intl revenues increasing dramatically (11/25)

Red Flag: In its 2019 Audit, PWC adds two "Critical Audit Matters": International Lease Revenue Recognition and warranty accounting. (12/25)

Red Flag: From 4Q18 to 2Q19 Tesla dramatically reduced the detail and commentary provided in its quarterly production and delivery disclosures, and stopped disclosing customer vehicles in transit. (13/25)

Red Flag: Tesla demonstrates key characteristics noted in SAS 82 (audit guidelines) for "classic risk factors associated with management fraud", including compensation structure, obsession with stock price, aggressive targets, cash flow issues, and subjective accounting (14/25)

Financial Evidence: Beginning in 2Q19, "Other" international revenue increases dramatically while inventory declines to 4 year lows. This growth focused company provides almost detail on this growth (15/25)

It is assumed that Intl rev. growth is due to growth in EU, however using EU registration data, we can segregate into EU/China/Other. Unlike EU/China which decreased in late '18, and rebounded in 2019, Other increased throughout the two years with the exception of 1Q19 (16/25)

The $500M 1Q19 writedown fills the hole in Other Intl Rev., indicating that this is where there international leases booked as sales show up. this supports that '18 sales were overstated, written down in 1Q19, but the growth in this rev. continued without further writeoff (17/25)

Qualitative Evidence: In 2Q19, Tesla claims its cars are appreciating assets due to future revenue from non-existent robotaxi network. This claim is repeated at Autonomous Day in April. The specificity of this language w/r/t lease accounting loophole is significant (18/25)

At Autonomous Day, Musk references a change in leases, TSLA will receive cars back, Model 3 appreciates, and "customers" are fronting money for robotaxi network. When asked about financing and B/S commitment, Musk: "I think we'll make the moves we think we should make" (19/25)

Tesla has a history of using product announcements to push through questionable corporate actions: See Solar Roof Tile to gain support for terrible SolarCity acquisition (20/25)

In 2019, CarMax stopped listing used Teslas just as Carvana began listing them. In 2020, Carvana began listing used 2019 Model 3s above the current listing price of a new car. If Tsla was merely trying to influence real RVG, why take extreme step of showing appreciation? (21/25)

Result: Despite noted financial stress in 2019, Tesla miraculously shows profitability beginning in 3Q19 and every quarter since. In May 2019 Morgan Stanley had a $10 (pre-split) downside price for TSLA given financial stress and demand issues (22/25)

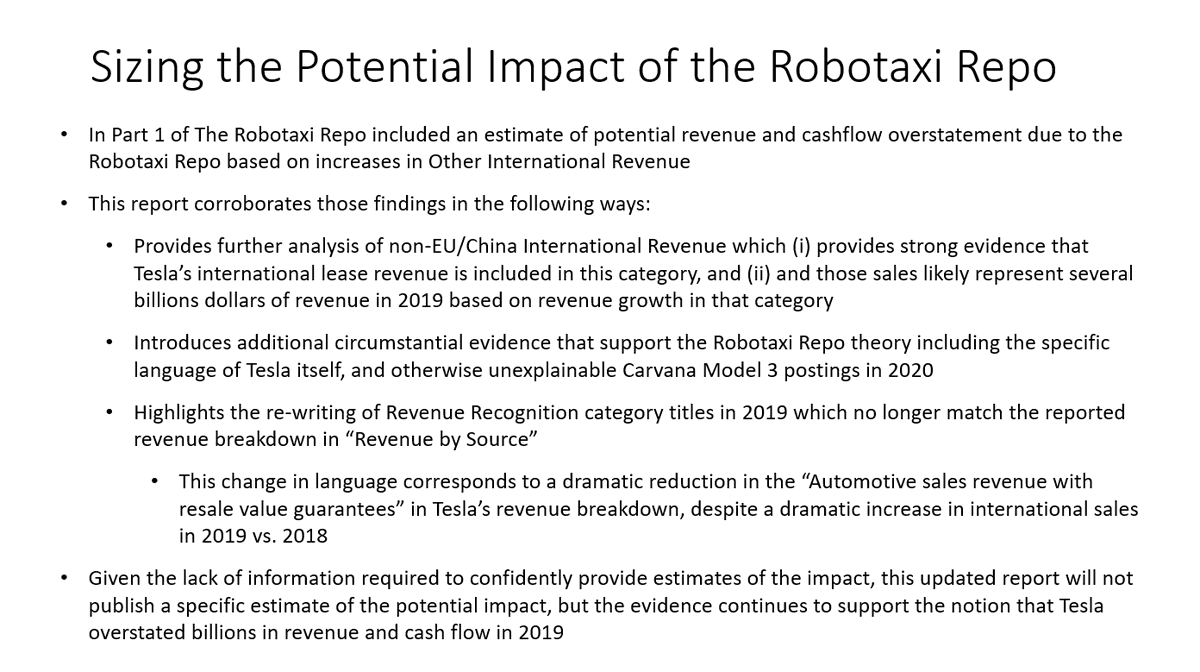

Robotaxi Repo 1 estimated billions in overstated sales based on Intl rev. This report provides further evidence for the theory and quantum of impact, but given the lack of information required to provide a confident estimate, this report will not estimate of the impact. (23/25)

Historical Parallels: Enron was named the America's Most Innovative company from 1996-2001. Stock exploded at height of dot-com boom (P/E of 70). Their accounting scandal involved repos, booking profits off expected future values, and moving debts of B/S. (24/25)

@TESLAcharts @zerohedge @DonutShorts @StanphylCap @WallStCynic @bgrahamdisciple @BradMunchen @DowneastCapital

• • •

Missing some Tweet in this thread? You can try to

force a refresh