1/ Can Momentum Investing Be Saved? (Arnott, Kalesnik, Kose, Wu)

"Live results for mutual funds that take on a momentum factor loading are surprisingly weak. But momentum can probably be saved, even net of fees and trading costs."

papers.ssrn.com/sol3/papers.cf…

"Live results for mutual funds that take on a momentum factor loading are surprisingly weak. But momentum can probably be saved, even net of fees and trading costs."

papers.ssrn.com/sol3/papers.cf…

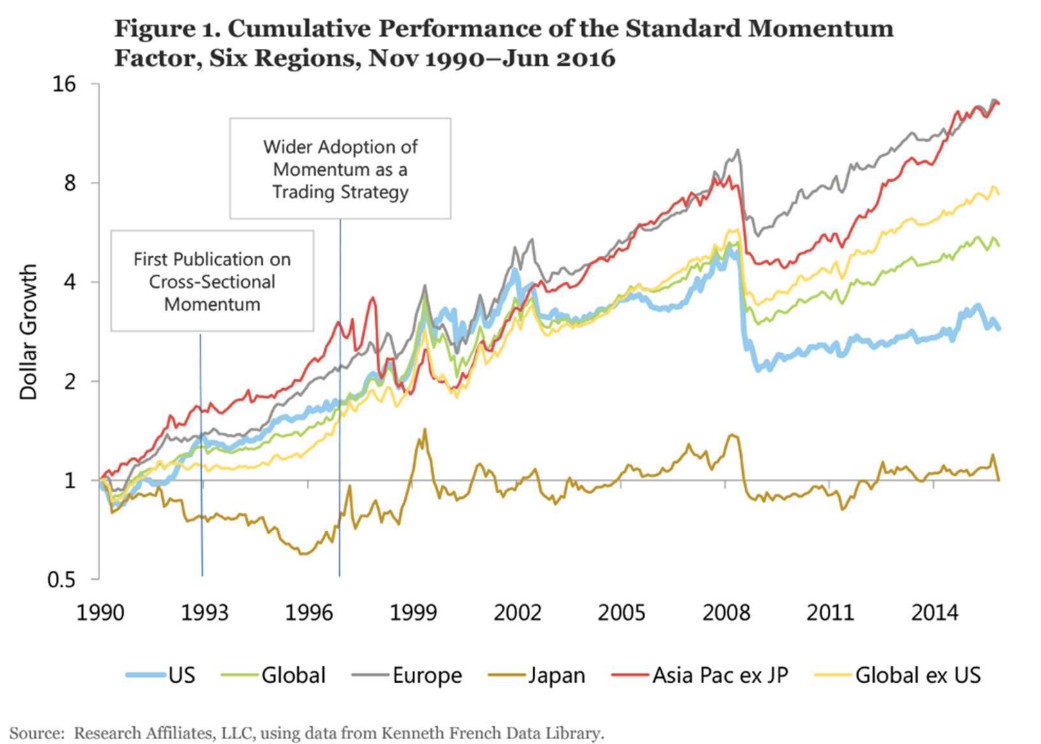

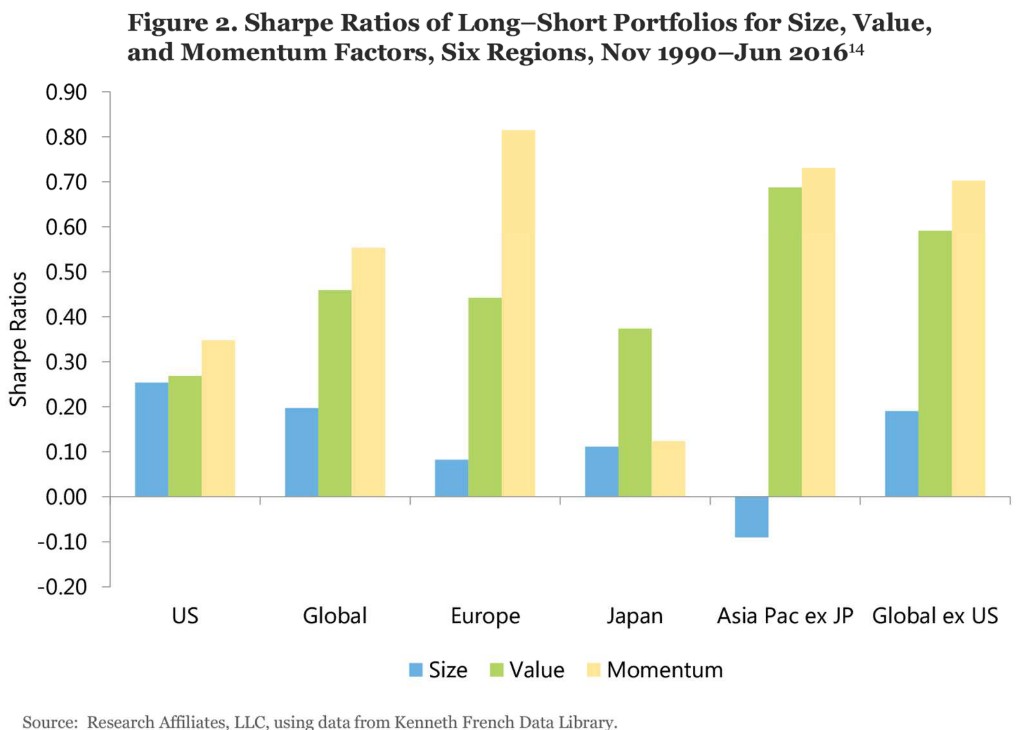

2/ "A momentum strategy is very vulnerable to crashes that tend to occur when the momentum trade is relatively expensive and in periods of heightened volatility. Its performance has also shown dismayingly high global correlation—especially during the crashes—since about 1999."

3/ "Momentum dominates everywhere except Japan. Since being documented in US stocks, the effect has also been documented in many other asset classes. So on paper, momentum looks fantastic!

"Sadly, live results net of trading costs hint at trouble for momentum investors."

"Sadly, live results net of trading costs hint at trouble for momentum investors."

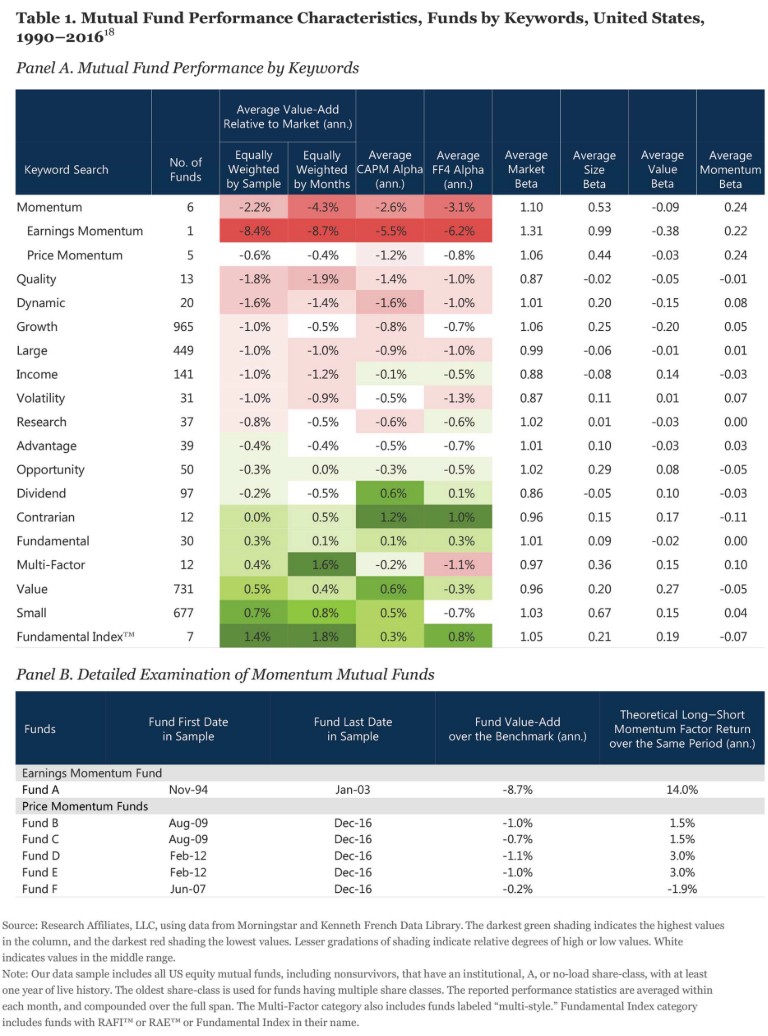

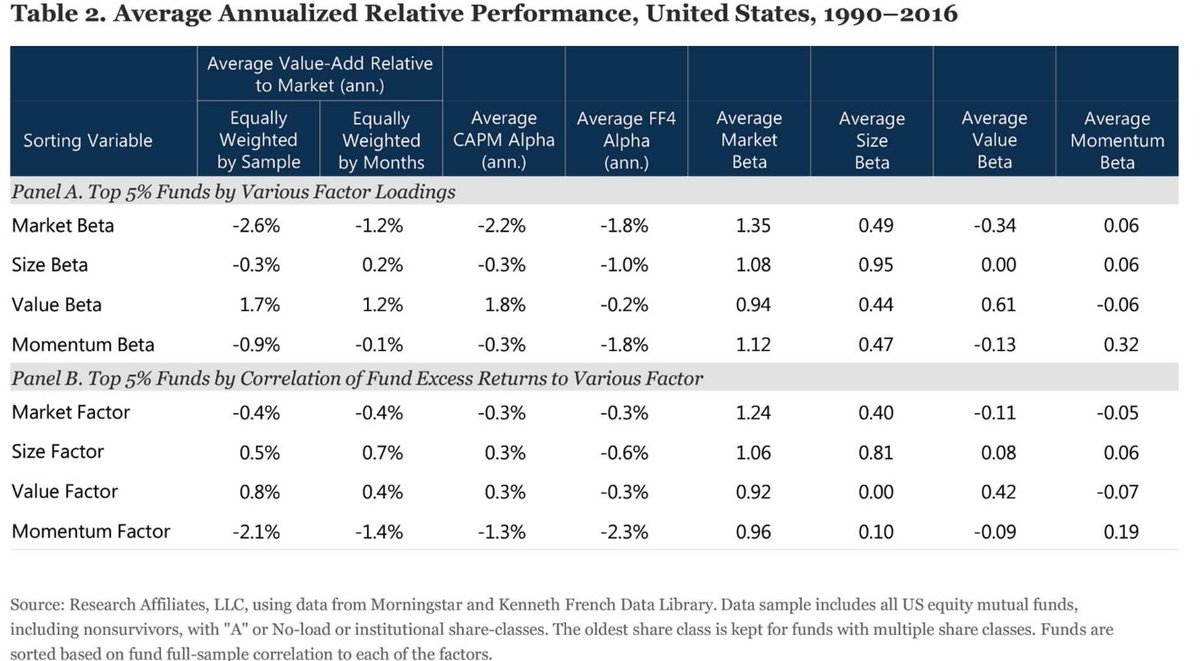

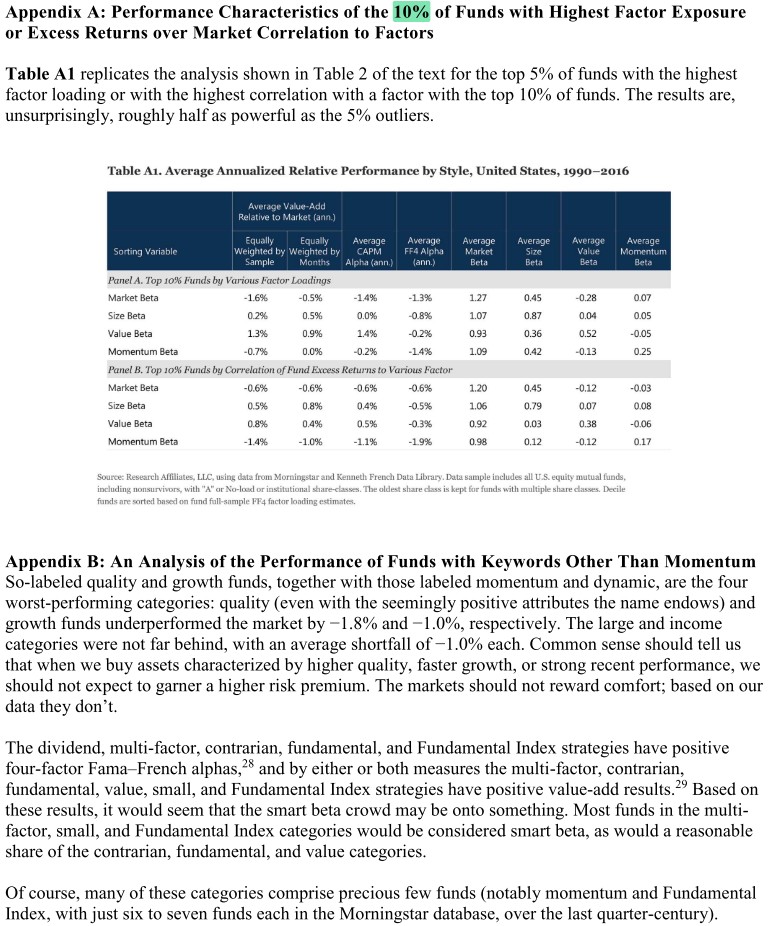

4/ "Performance is skewed downward by the poor results of the single earnings momentum fund. But the other five hardly show exemplary results, even though the factor itself delivered a return of nearly 5.0%/year since 1990 and over 3.0%/year since the 2009 momentum crash."

5/ "Mutual fund data show that investors are able to benefit (a little) from the value effect, net of all fees and trading costs.

"The same data show that investors are not able to benefit from momentum, even during a quarter-century with robust paper momentum performance."

"The same data show that investors are not able to benefit from momentum, even during a quarter-century with robust paper momentum performance."

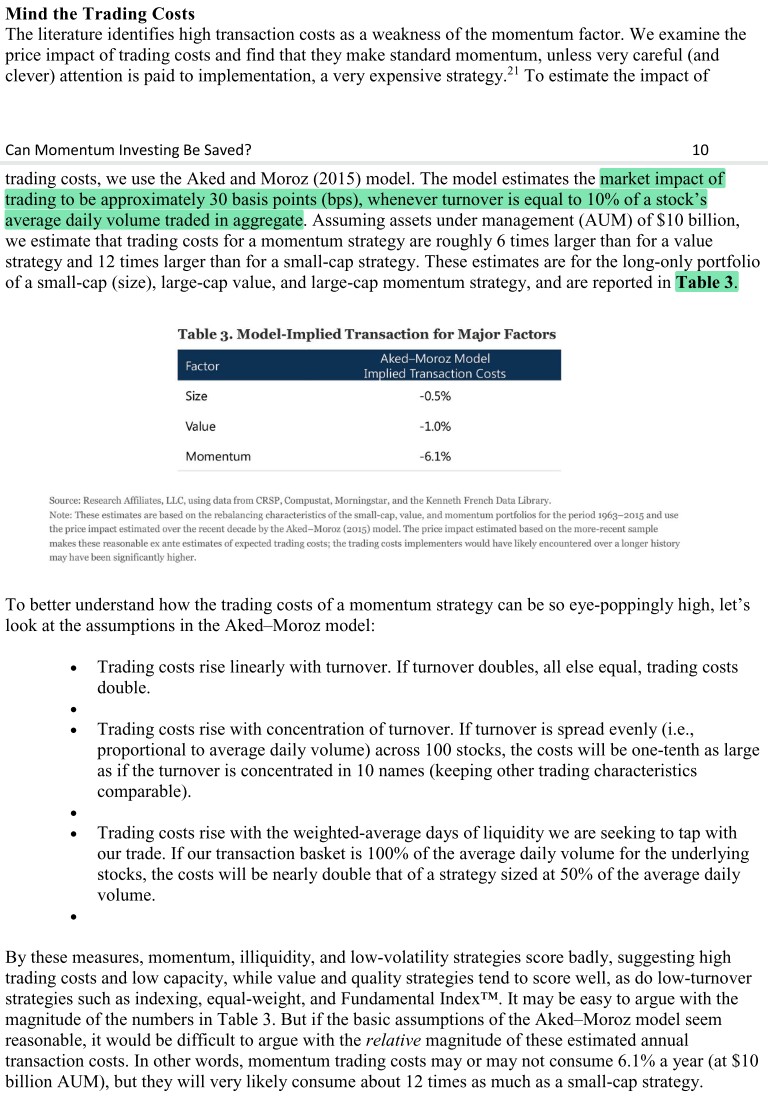

6/ Trading costs are very high for the default definition of momentum (6.1%/year vs. 0.5% for size and 1.0% for value). This seems to come from the strategy's turnover and the concentration of its turnover (among a small group of stocks and also in time series).

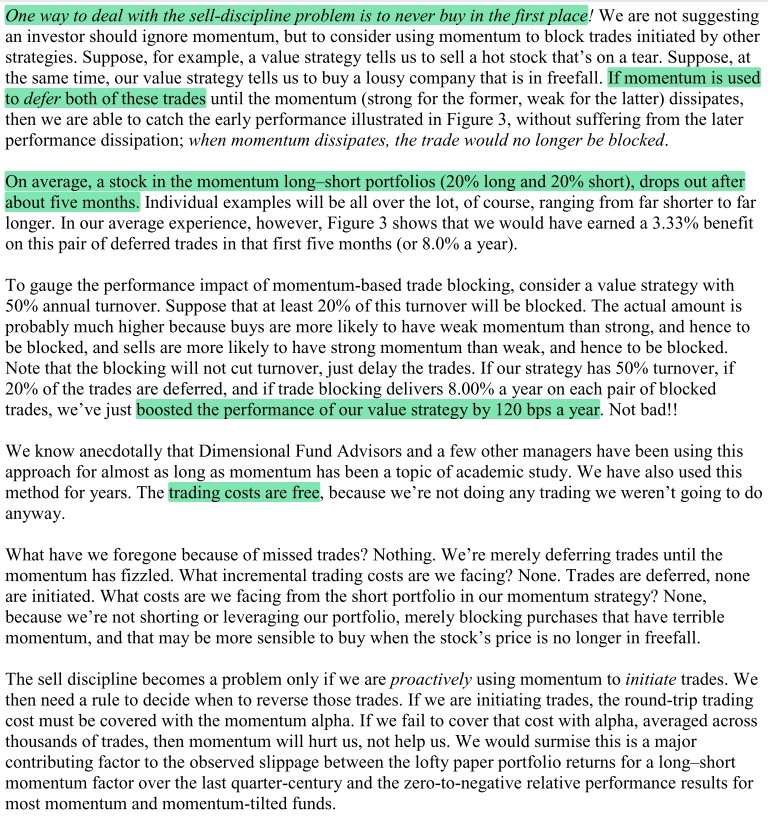

7/ "Momentum has a half-life of barely three months. Value overcomes momentum, on average, in less than a year (and overwhelms its cumulative gain in less than two years).

"For momentum—perhaps uniquely among all major

factors—the sell discipline is extraordinarily important."

"For momentum—perhaps uniquely among all major

factors—the sell discipline is extraordinarily important."

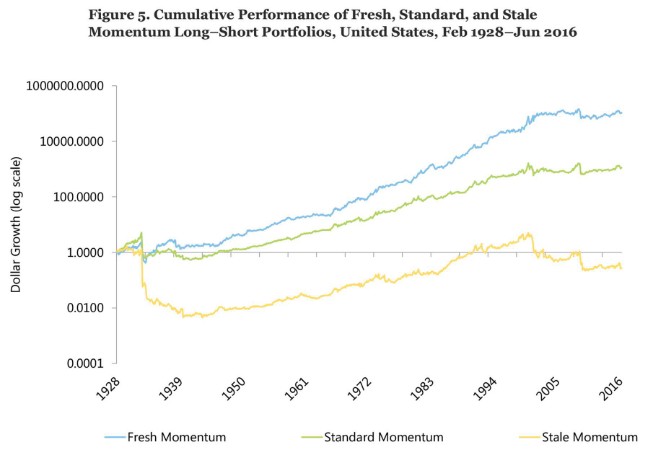

8/ One way to address this problem is to use momentum to delay trades for a strategy with lower turnover (for example, value). The authors use a back-of-envelope calculation to estimate a 1.2% performance boost for value with no increase in costs.

Also:

.

Also:

https://twitter.com/ReformedTrader/status/1352310427091259392

.

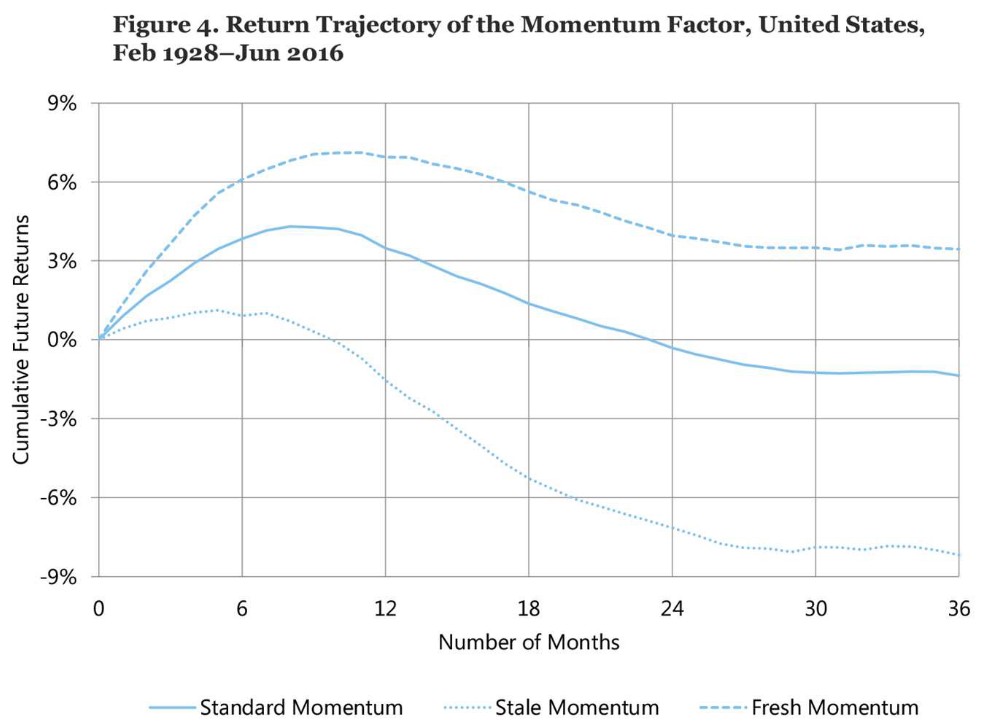

9/ Fresh momentum outperforms stale momentum without requiring a shorter holding period.

Stale momentum = top quintile of momentum over the past year AND the year before that

Fresh momentum = top quintile of momentum over the past year AND bottom quintile the year before that

Stale momentum = top quintile of momentum over the past year AND the year before that

Fresh momentum = top quintile of momentum over the past year AND bottom quintile the year before that

10/ When all forms of momentum are rebalanced monthly, fresh momentum outperforms with less vulnerability to momentum crashes.

One interpretation is that fresh momentum avoids buying overly expensive winners and avoids shorting overly cheap losers, so it's value + momentum.

One interpretation is that fresh momentum avoids buying overly expensive winners and avoids shorting overly cheap losers, so it's value + momentum.

11/ Related research:

Fact, Fiction and Momentum Investing

Value and Momentum Everywhere

Implementing Momentum: What Have We Learned?

Fact, Fiction and Momentum Investing

https://twitter.com/ReformedTrader/status/1130651433068507138

Value and Momentum Everywhere

https://twitter.com/ReformedTrader/status/1190258717779849216

Implementing Momentum: What Have We Learned?

https://twitter.com/ReformedTrader/status/1352303639734325248

• • •

Missing some Tweet in this thread? You can try to

force a refresh