1/17 I recently opened a longterm position in $BFLY. They offer a semiconductor-based ultrasound. DYODD

@Arkinvest @kingtutspacs @SpacTiger @AbacusCap @SpacGuru @DoctorSpac @ajitosu @_El_Profesorr @IPO201 @chriskatje @saxena_puru @DJohnson_CPA @stocktalkweekly @JonahLupton

@Arkinvest @kingtutspacs @SpacTiger @AbacusCap @SpacGuru @DoctorSpac @ajitosu @_El_Profesorr @IPO201 @chriskatje @saxena_puru @DJohnson_CPA @stocktalkweekly @JonahLupton

2/17 Market-leading device: 15% faster frame rates and 60% faster pulse repetition frequency; optimized beamforming and Innovative low-noise, low-power consumption semiconductor process. It uses a silicon chip, disrupting legacy ultrasound devices that use piezoelectric crystals

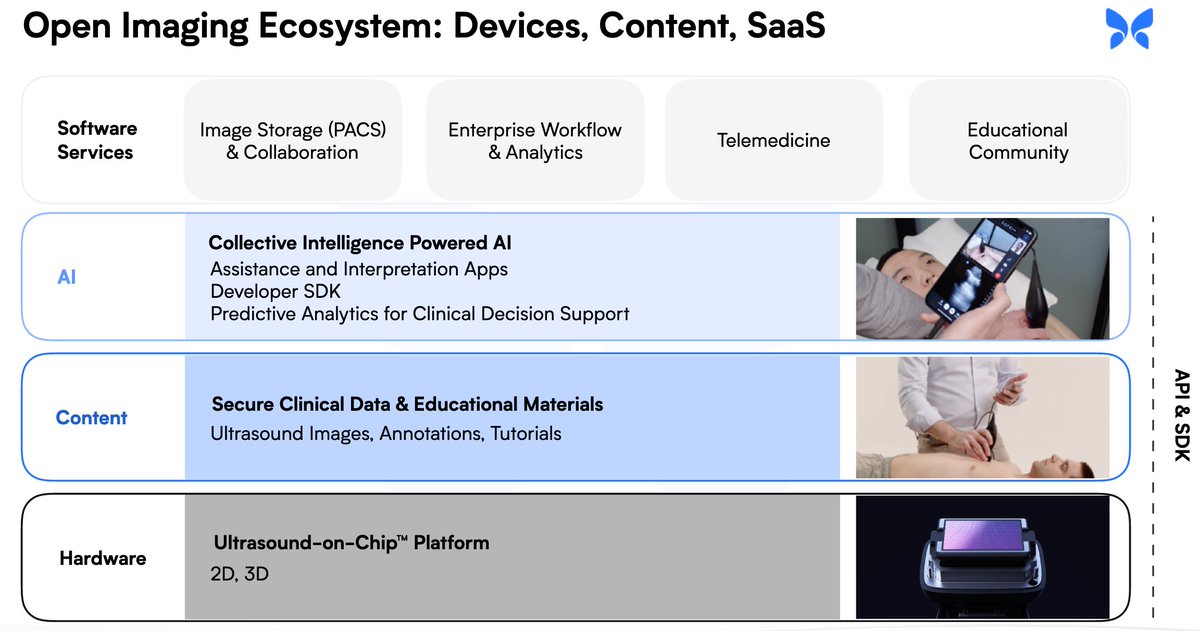

4/17 The device is powered by a battery and connects to portable devices allowing for TeleGuidance by remote practitioners, use of AWS, artificial intelligence and technological enhancements: easy-to-use app with powerful advanced imaging capabilities.

aws.amazon.com/de/solutions/c…

aws.amazon.com/de/solutions/c…

5/17 20 clinical applications include B-Mode, Color Doppler, Measurements, annotations and labels, Image capture, Power Doppler, Pulsed Wave Doppler, M-Mode, Midline, OB Calculations, Pelvic volume calculation, Needle Viz, Biplane Imaging, Lung Protocol

6/17 $BFLY offers devices for $1.999 and plans from $1,200/yr with cloud access and AI. The device has excellent user ratings with minor criticism.

-> 4.3/5 - Google play ratings

Interesting product Review:

epmonthly.com/article/produc…

-> 4.3/5 - Google play ratings

Interesting product Review:

epmonthly.com/article/produc…

7/17 Legacy ultrasounds costs ranges from $20,000 to $200,000+ and don’t include features that make day-to-day operation in point-of-care environments easy, fast and intuitive. $BFLY core technology is a silicon chip, disrupts these legacy devices that use piezoelectric crystals.

8/17 $BFLY disrupts a large TAM + benefits from macro trends (aging population, chronic disease proliferation, move from hospital to home settings, wellness monitoring) and tailwinds (AI empowered decisions, value-based care adoption, new imaging settings and medical education)

9/17 Have personally spoken to a renowned Gyn. on the uses and the necessity of disrupting this market. She was pleased and deemed the offered uses as „easily sufficient“. „Price point and accessibility is the driving issue“. She confirmed $BFLY presented circumstances.

10/17 $BFLY TeleGuidance is the world’s first integrated ultrasound telemedicine platform and offers:

- remote access of device

- video call with $BFLY App

- Guide users with augmented reality

- remote access of device

- video call with $BFLY App

- Guide users with augmented reality

11/17 $BFLY IQ Vet offers veterinary portable ultrasound: 12 customized presets and a streamlined touch interface with remote access supported by artificial intelligence.

12/17 unbiased party: "Enabling of echo exams with a cell phone and integration of AI helps rapidly interpret the exam and offer clinical decision support that can greatly empower a rural clinician“ and allows other point-of-care locations to have increased diagnostic capability

13/17 Qualitative Valuation is high, but competitive moat is large + cash to fuel long term growth + excellent long term gross margin target. At $17,08 share price -> 3.267B market cap.

14/17 The SPAC deal allowed $549M Cash to fuel growth. Future dilution expected from warrants and options outstanding and available for grant held by „legacy Butterfly“. (Reminder: Below presentation is for a SPAC share price at $10)

15/17 Reminder: EBITDA and Cash flow is expected to be positive for $BFLY in 2024. Numbers were still in its infancy but I expected $BFLY to have a strong future due to its competitive moat and strong customer demand. This is fueled by cash on hand and a strong management.

16/17 $BFLY has an excellent management team, notably J. Rothberg:

- invented & commercialized high-speed DNA sequencing

- founded companies including 454 Life Sciences, Ion Torrent, RainDance Technologies, ClariFI, Hyperfine Research, Quantum-Si, AI Therapeutics, 4Catalyzer

- invented & commercialized high-speed DNA sequencing

- founded companies including 454 Life Sciences, Ion Torrent, RainDance Technologies, ClariFI, Hyperfine Research, Quantum-Si, AI Therapeutics, 4Catalyzer

17/17 $BFLY has many renowned investors, including @arkinvest

. Cathy recently & aggressively added 6,571,003 shares for $ARKG -> worth $112,232,731.24 (as of 04/07/2021) -> approx 3.99% of the company.

Sorry for the lengthy thread - my 2 cents.

. Cathy recently & aggressively added 6,571,003 shares for $ARKG -> worth $112,232,731.24 (as of 04/07/2021) -> approx 3.99% of the company.

Sorry for the lengthy thread - my 2 cents.

17a/17 Promising Future: "home health" model.

- remote monitoring of congestive heart failure allow clinical decisions without hosptial visit

- CHF hospital costs: approx $11B annually

- current collab with American College of Cardiology

- remote monitoring of congestive heart failure allow clinical decisions without hosptial visit

- CHF hospital costs: approx $11B annually

- current collab with American College of Cardiology

17b/17 Future "Home Health" targets:

- urinary incontinence, approx 25M US patients

- Dialysis (-> strong competition), approx 0,5M

- remote patient monitoring & long-term care -> largely untapped market

Interesting read on future company plans:

sec.report/Document/00011…

- urinary incontinence, approx 25M US patients

- Dialysis (-> strong competition), approx 0,5M

- remote patient monitoring & long-term care -> largely untapped market

Interesting read on future company plans:

sec.report/Document/00011…

17c/17 The ultrasound also provides great social value:

nytimes.com/2019/04/15/hea…

escholarship.org/uc/item/9sv201…: POCUS was felt to have the potential to reduce or prevent morbidity and mortality in 45% of cases in which it was not used. Cardiac and lung were among the most useful appl

nytimes.com/2019/04/15/hea…

escholarship.org/uc/item/9sv201…: POCUS was felt to have the potential to reduce or prevent morbidity and mortality in 45% of cases in which it was not used. Cardiac and lung were among the most useful appl

17d/17 Further reads confirm quality of product & use case

ESR: link.springer.com/article/10.118…

Possibilites & Limitations: ncbi.nlm.nih.gov/pmc/articles/P…

Disrupting clinics: thischangedmypractice.com/portable-ultra…

Lung-Treatment analysis: umbjournal.org/article/S0301-…

Evaluation: link.springer.com/article/10.118…

ESR: link.springer.com/article/10.118…

Possibilites & Limitations: ncbi.nlm.nih.gov/pmc/articles/P…

Disrupting clinics: thischangedmypractice.com/portable-ultra…

Lung-Treatment analysis: umbjournal.org/article/S0301-…

Evaluation: link.springer.com/article/10.118…

• • •

Missing some Tweet in this thread? You can try to

force a refresh