Derivatives, Black-Scholes & complex financial instruments explained [Thread]

A derivative is any contract that “derives” value from an underlying asset. So if you buy a contract that pays you out every time Arsenal wins, you have a derivative.

You will also be poor & depressed.

You will also be poor & depressed.

You’re a football manager looking to sign 19yo wonderkid striker Jose from OnlyFans FC. Nobody really knows how much Jose is worth.

You figure Jose is worth at least €60m if he can bang in 25 goals this season. But a bigger club might buy him by then.

Enter derivatives...

You figure Jose is worth at least €60m if he can bang in 25 goals this season. But a bigger club might buy him by then.

Enter derivatives...

You approach OnlyFans FC & negotiate for the option to buy Jose at the end of the season for €40m, no matter what happens

OnlyFans FC think Jose will be worth €45m by then. They ask you to pay €5m for this option to buy him for €40m

Option premium: €5m

Strike price: €40m

OnlyFans FC think Jose will be worth €45m by then. They ask you to pay €5m for this option to buy him for €40m

Option premium: €5m

Strike price: €40m

Scenario 1

Jose bangs in 25 goals over the season and is worth €60m. You exercise your option to buy him for just €40m. But you also paid €5m for this option.

60-40-5= 15

You made €15m on this deal.

At the end of the season, your exercised the option "in the money (ITM)"

Jose bangs in 25 goals over the season and is worth €60m. You exercise your option to buy him for just €40m. But you also paid €5m for this option.

60-40-5= 15

You made €15m on this deal.

At the end of the season, your exercised the option "in the money (ITM)"

Scenario 2

Jose spends all season popping bottles in Mayfair and starts doing coke. He scores three goals that season. He’s worth €10m.

You decide not to exercise your option to buy Jose for €40m and lose your €5m. OnlyFans FC gain €5m

Your option is "out the money (OTM)

Jose spends all season popping bottles in Mayfair and starts doing coke. He scores three goals that season. He’s worth €10m.

You decide not to exercise your option to buy Jose for €40m and lose your €5m. OnlyFans FC gain €5m

Your option is "out the money (OTM)

Scenario 3

Jose scores 14 goals including a hat-trick against Liverpool when Trent played RB, so it doesn't really count.

He ends up being worth €45m. At this point, the option was fairly priced. You & OnlyFans FC don't make or lose anything from this arrangement.

Jose scores 14 goals including a hat-trick against Liverpool when Trent played RB, so it doesn't really count.

He ends up being worth €45m. At this point, the option was fairly priced. You & OnlyFans FC don't make or lose anything from this arrangement.

The option to buy Jose at a pre-specified price in the future is a call option.

OnlyFans can also protect themselves from the downside of Jose's coke habit by negotiating an option to sell him for €45m (put option)

If he ends up worth more than €45m, they don't sell him

OnlyFans can also protect themselves from the downside of Jose's coke habit by negotiating an option to sell him for €45m (put option)

If he ends up worth more than €45m, they don't sell him

Black-Scholes is a differential equation solving option prices. Pretty big deal in finance & economics, these dudes won a Nobel Prize for their work. Still, the original equation had many limitations.

In an investment bank nobody works this stuff out manually... ever

In an investment bank nobody works this stuff out manually... ever

Intrinsic value is basically the difference between underlying asset value and the option strike price

Jose is worth €55m half-way through the season, you have the option to buy him for €40m, the intrinsic value of your option is €15m

...but there's still half a season to go

Jose is worth €55m half-way through the season, you have the option to buy him for €40m, the intrinsic value of your option is €15m

...but there's still half a season to go

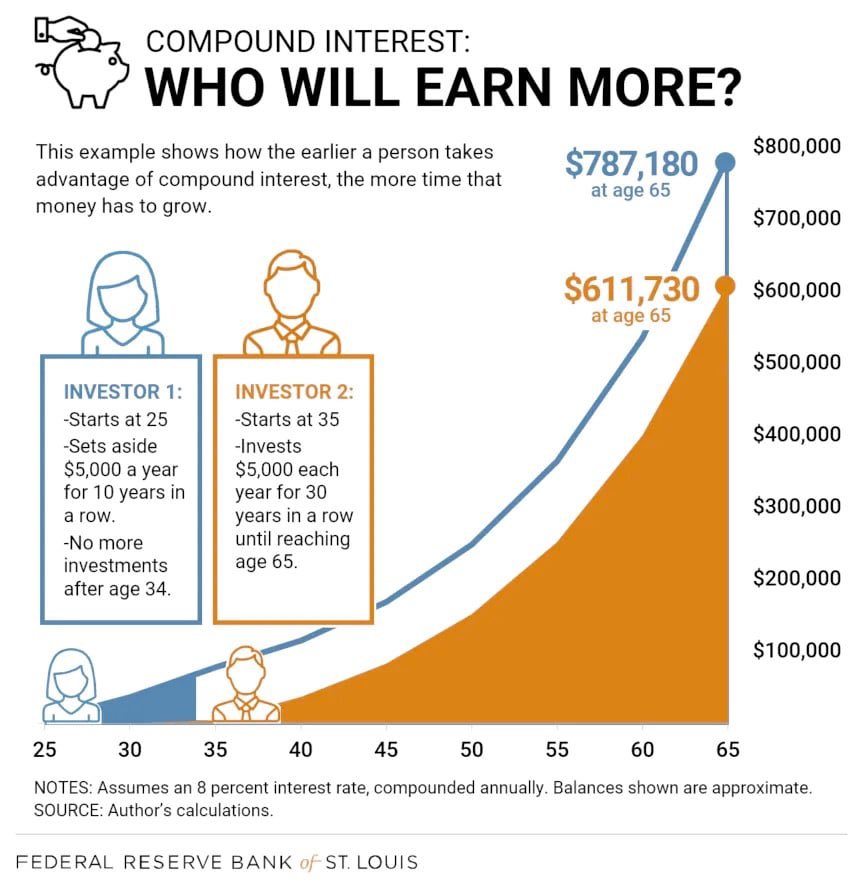

Time decays the value of options

With fewer games left in the season - the fewer goals Jose will realistically score. More games = more opportunities for goals = higher value for Jose.

Time isn't a linear function, decay speeds up faster in the second half of the option life

With fewer games left in the season - the fewer goals Jose will realistically score. More games = more opportunities for goals = higher value for Jose.

Time isn't a linear function, decay speeds up faster in the second half of the option life

Volatility impacts the time value of options

If Jose has 40 games ahead of him & either scores 5 goals or no goals (volatile performance), the time value component of the option to buy Jose will be higher

If there's just 2 games left, volatility will have much less of an impact

If Jose has 40 games ahead of him & either scores 5 goals or no goals (volatile performance), the time value component of the option to buy Jose will be higher

If there's just 2 games left, volatility will have much less of an impact

If you're thinking options are a pretty neat way to gain massive exposure without putting down too much capital - you're right BUT with the wrong strategy... your losses have no floor. It's a bad, bad place to be on the wrong side of an options trade.

Derivatives start becoming dangerous when you stack them. What if you invest in options that are based on the value of your options based on Jose's goals? A derivative of a derivative

Sounds like inception? It really is

Here's Margot Robbie explaining mortgage backed securities

Sounds like inception? It really is

Here's Margot Robbie explaining mortgage backed securities

Many of the early derivatives products were designed to de-risk & hedge out exposure... the irony is it has ended up incentivizing taking on more risk and speculation.

There's a ton of Greek letters behind options strategies, short story - it's easy to get tangled up in them

There's a ton of Greek letters behind options strategies, short story - it's easy to get tangled up in them

What happens when you have excess liquidity, "stonks always go up" & this frenzied volume of call option buying (especially deep out the money options)?

It ends badly.

This is like betting Jose will score 120 goals a season instead of 25. Worse, it creates massive volatility.

It ends badly.

This is like betting Jose will score 120 goals a season instead of 25. Worse, it creates massive volatility.

Before rolling the dice on Jose banging in goals this season & buying up naked call options, remember he may not even be 19yo

That's the market we're in - Fed stimmy pumping liquidity & inflating valuations make everything look attractive

Shout-out for making it to the end!

That's the market we're in - Fed stimmy pumping liquidity & inflating valuations make everything look attractive

Shout-out for making it to the end!

Additional Thread:

https://twitter.com/iamkoshiek/status/1360258388521811971?s=20

If you're into sexy bedtime reading there's a paper I wrote with @Kanshuk a few years ago on pricing & designing a commodity based volatility security using Geometric Brownian Motion. Unlocked countless IB roles before I graduated.

Now I don't use fancy math, I just buy the dip

Now I don't use fancy math, I just buy the dip

• • •

Missing some Tweet in this thread? You can try to

force a refresh