Leadership on finance, fitness & fulfilment 📈👟✨//Serial entrepreneur & investor // Certified Personal Trainer (ISSA-CPT) // Founder: @banker__x, @flexwellness

17 subscribers

How to get URL link on X (Twitter) App

here's why banks, brands & advertisers are competing for the attention of the women

here's why banks, brands & advertisers are competing for the attention of the womenhttps://x.com/iamkoshiek/status/1959153261774025176?s=20

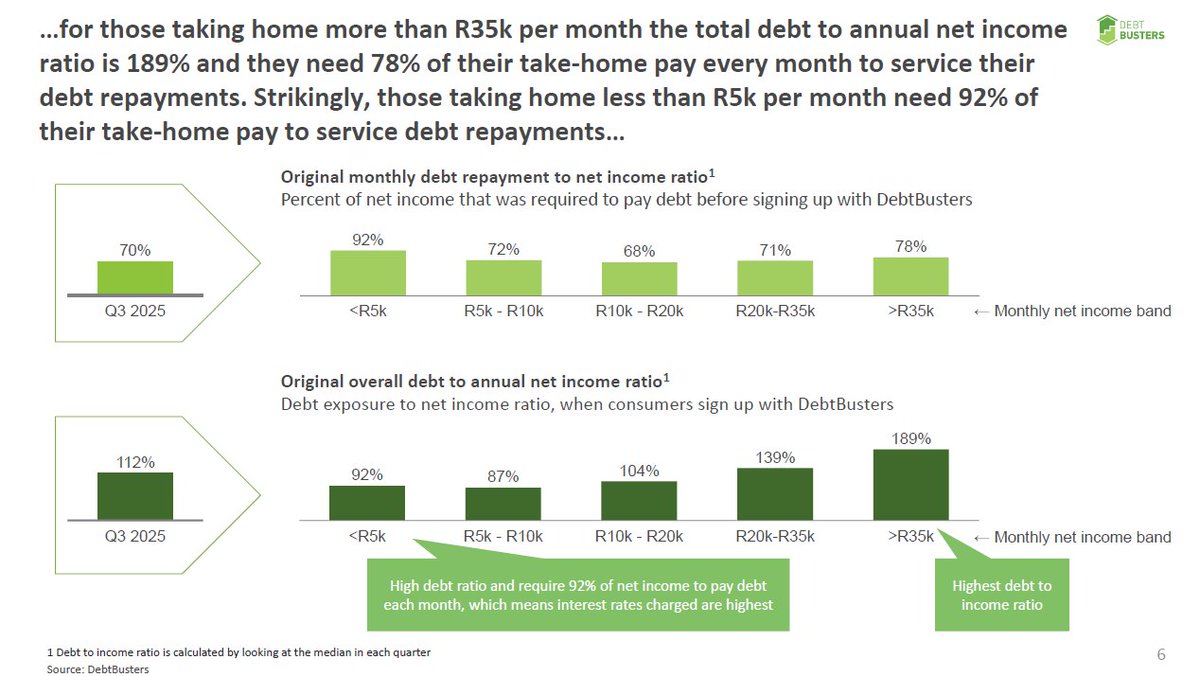

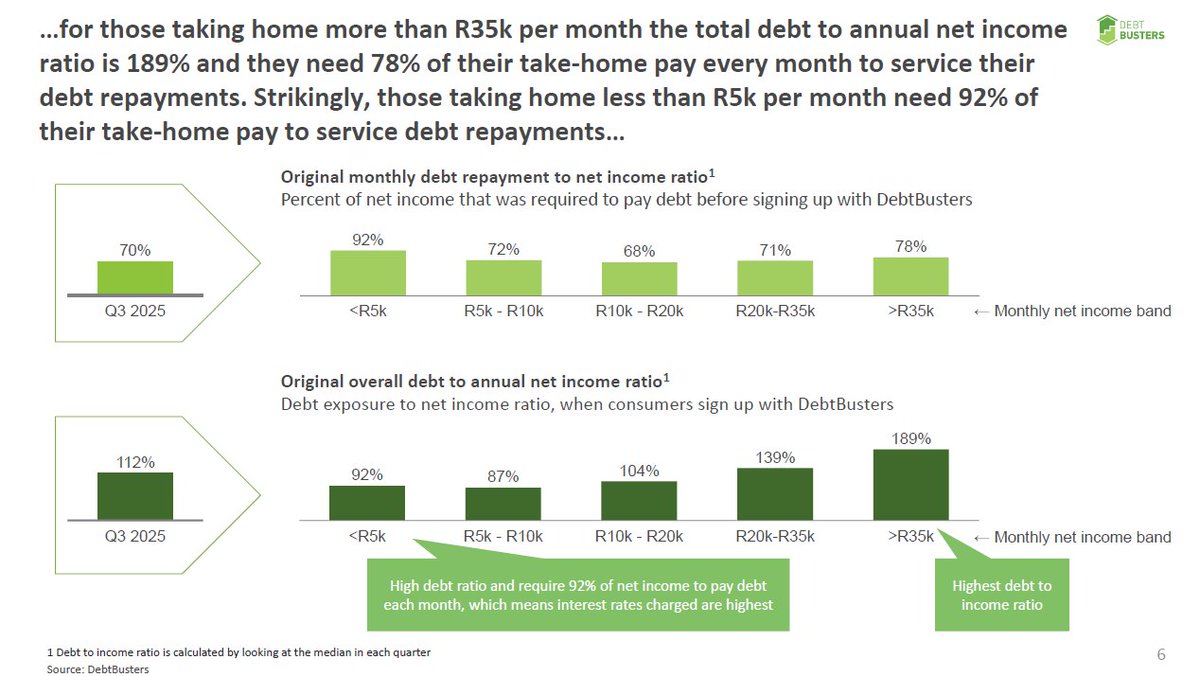

you can survive being heavily over-leveraged in a low interest rates environment

you can survive being heavily over-leveraged in a low interest rates environment

Lesson #1: you can’t invest money you don’t have

Lesson #1: you can’t invest money you don’t have

the biggest culprits of publishing paralysing fear & doomsday prophecies:

the biggest culprits of publishing paralysing fear & doomsday prophecies:

wait — why is there such limited local media coverage for positive news?!

wait — why is there such limited local media coverage for positive news?!

what isn't being widely reported (yet) is how the ongoing Springboks private equity ownership discussion has impacted anchor sponsor relationships

what isn't being widely reported (yet) is how the ongoing Springboks private equity ownership discussion has impacted anchor sponsor relationships

having spent MANY years in the investment banking engine room, it's very common to cherry-pick economic data to support any narrative

having spent MANY years in the investment banking engine room, it's very common to cherry-pick economic data to support any narrative

1. Train your mind 🧠

1. Train your mind 🧠