The BNF OI puzzle, what I think happened. This is post mortem analysis 😀

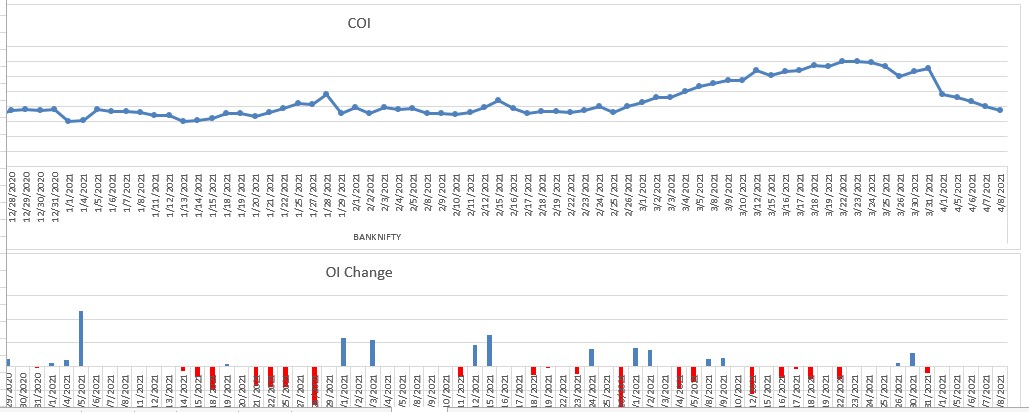

COi was going up like crazy since early March, positions were being created in far month ( go thru my previous tweets)

COi was going up like crazy since early March, positions were being created in far month ( go thru my previous tweets)

OI = net shorts = net longs. So informed traders were taking a huge position expecting a parabolic move ( we did not know whether up or down). As of now, my guess is that the whole position was a long position. Someone had the info of the rate cut

You can see that the positions were cut hugely on 1st April. What happened on 1st April ?

This happened 👇👇

This happened 👇👇

If the rollback did not happen ( due to whatever reason), BNF would have gapped up by 1000-1500 points and the shorts would have been killed, and longs would have been laughing all the way to the bank. See the cut on 1st April

But since the rollback did happen, what we now had were trapped longs. that's why we are seeing any upmove getting sold as longs get rid of their positions. COI now is down to normal levels as you can see

My guess is there are still some longs trapped, so as long we do not close above 33600 chances are we will see one more spike and climax selling on the downside. There is a strong supply in the 33400-33600 zone. the 33600 figure is quantitative

*change

• • •

Missing some Tweet in this thread? You can try to

force a refresh