Long $MVBF:

At the surface, this is a small W. Va. bank trading around 1.7x TBV.

But a deeper looks shows that it's a fintech play with exposure to Credit Karma, crypto (Kraken) and most importantly igaming (Draftkings, Fanduel, etc)

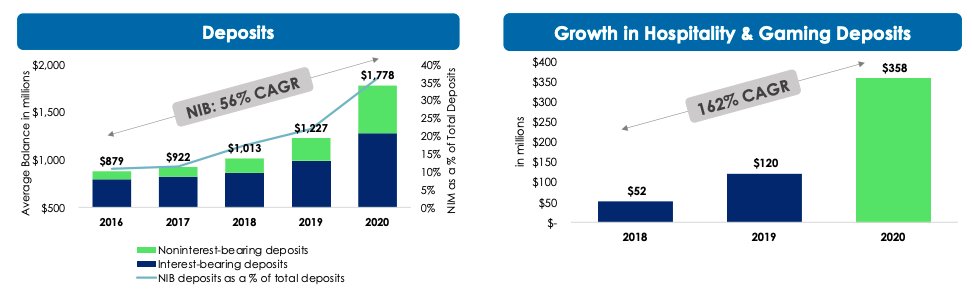

Gaming deposits grew 70% from Q3 to Q4!

At the surface, this is a small W. Va. bank trading around 1.7x TBV.

But a deeper looks shows that it's a fintech play with exposure to Credit Karma, crypto (Kraken) and most importantly igaming (Draftkings, Fanduel, etc)

Gaming deposits grew 70% from Q3 to Q4!

Around 2014-15, MVB was growing loan portfolio at 20% CAGR, but the deposits were not growing.

So CEO Larry Mazza and team went towards fintech as a way to get low cost deposits.

So CEO Larry Mazza and team went towards fintech as a way to get low cost deposits.

Larry: "We get deposits nationally but still loan locally”...

They are the bank for U.S. operations of Tipico, Score (tie up with Penn National gaming), and Betfred. MVB also has clients in FanDuel, DraftKings and Credit Karma.

Total 22 gaming client as of now

They are the bank for U.S. operations of Tipico, Score (tie up with Penn National gaming), and Betfred. MVB also has clients in FanDuel, DraftKings and Credit Karma.

Total 22 gaming client as of now

They are now the 21st bank in the US in terms of number of accounts... all acquired through partners with low CAC.

So there's fast growth at cheap price here.

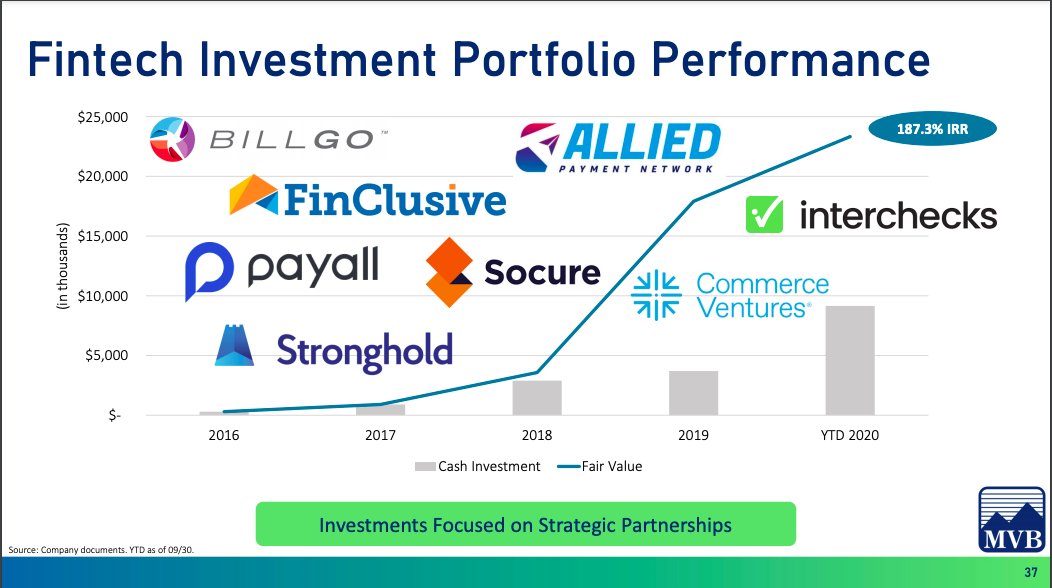

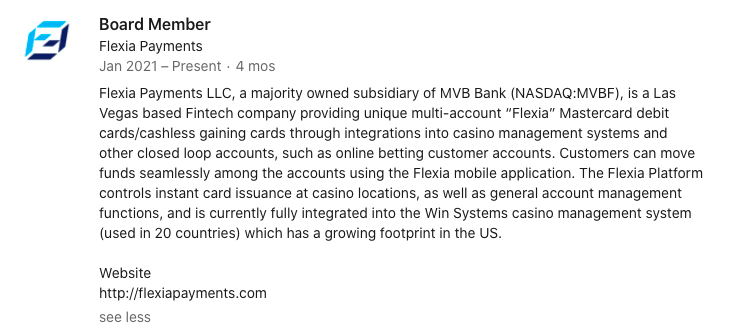

There's optionality on the tech side - MVB has invested in fintech startups as well as bought startups (GRAND app, Flexia).

If these startup investments work out, that's great for investors. If they don't, MVB can acqui-hire

There's optionality on the tech side - MVB has invested in fintech startups as well as bought startups (GRAND app, Flexia).

If these startup investments work out, that's great for investors. If they don't, MVB can acqui-hire

MVB has an entire Fintech division which is growing fast - added 140 FTE to 400 existing last year. Allows full remote work.

Job postings give some hint -- GRAND app & Flexia payment for integrated online/offline payments for gaming to transfer money across gaming apps

Job postings give some hint -- GRAND app & Flexia payment for integrated online/offline payments for gaming to transfer money across gaming apps

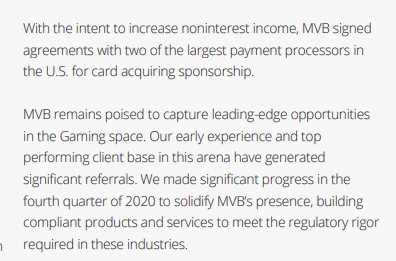

There are deals here with payment processors, and referrals from existing igaming customers to get new customers

There are unknowns here on fintech side because MVB hasn't actively promoted it and some things are still cooking.

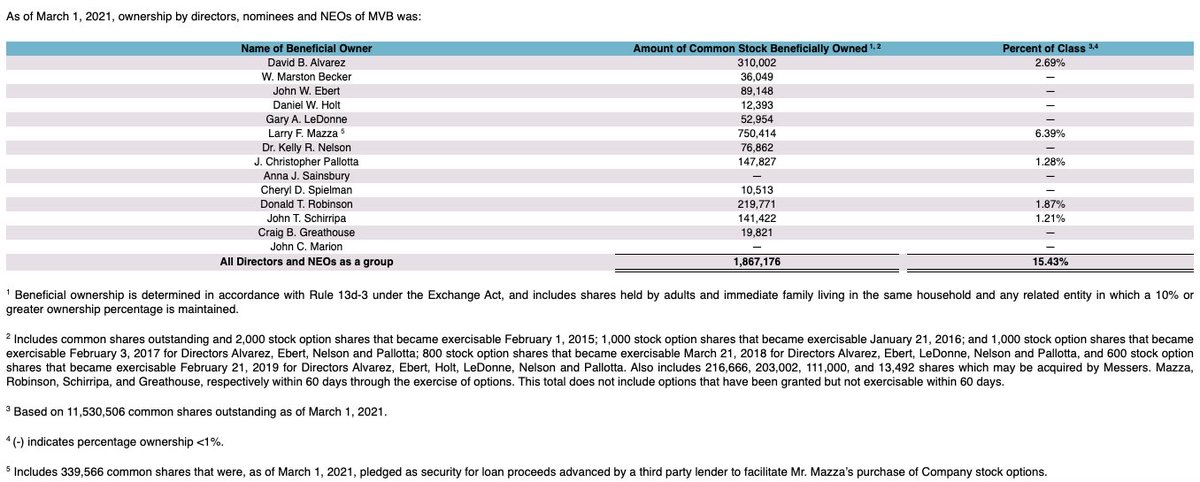

But Larry (CEO) has a definite view of the future and is creating it. While doing so, he's betting big - owns 6% of stock. Even borrowed money to exercise options

But Larry (CEO) has a definite view of the future and is creating it. While doing so, he's betting big - owns 6% of stock. Even borrowed money to exercise options

Larry lives in West Virginia. Makes $1-$2M a year and has $22M in MVBF stock. I'd say he's got half of his net worth in it. Big bet!

In December, he plunked $2.5M to exercise options in December, while MVBF was trying to buy back ~20% of stock through dutch auction

In December, he plunked $2.5M to exercise options in December, while MVBF was trying to buy back ~20% of stock through dutch auction

When asked about what fintech banking-as-a-service co. he admires, Larry said Live Oak Bank and nCino (nCino is 7-8x Live Oak size). He hinted that it's the reason the Fintech division is separate from MVB the bank

h/t to @hareng_rouge for bringing this to my notice and for discussions

Based on the Flexia payments team, seems that MVB bought this company with existing business they do with Mexican casinos.. So the solution exists, it's applying it to US casinos and online gaming customers.

"Acquisition of Trabian will significantly enhance our expanding Fintech vertical" - Larry

Trabian CEO: "We’ll also play a role in MVB’s developing venture space, an area on which I’ll be particularly (but not exclusively) focused."

Trabian customer is BillGo (Larry is on BoD)

Trabian CEO: "We’ll also play a role in MVB’s developing venture space, an area on which I’ll be particularly (but not exclusively) focused."

Trabian customer is BillGo (Larry is on BoD)

Sold 4 bank centers and their associated high cost deposits.

Larry: "latest in a series of opportunistic activities undertaken by MVB"

businesswire.com/news/home/2021…

Larry: "latest in a series of opportunistic activities undertaken by MVB"

businesswire.com/news/home/2021…

Lot of moving pieces at MVB:

1. deposits from gaming apps, ramping commercial & govt lending

2. igaming / crypto play with GRAND app to transfer money

3. tech for banks with Trabian acquisition + Victor startup

4. Casino play w/ Flexia card

5. other fintech investments

1. deposits from gaming apps, ramping commercial & govt lending

2. igaming / crypto play with GRAND app to transfer money

3. tech for banks with Trabian acquisition + Victor startup

4. Casino play w/ Flexia card

5. other fintech investments

Interesting bits from latest 10-Q:

1. Flexia is about getting team & exclusive license for US/ Canada for product that already sells in Mexico (integrates with casino Win systems)

2. Reading between the lines- paid mostly cash to acquire Trabian

(Larry doesn’t want to give stock)

1. Flexia is about getting team & exclusive license for US/ Canada for product that already sells in Mexico (integrates with casino Win systems)

2. Reading between the lines- paid mostly cash to acquire Trabian

(Larry doesn’t want to give stock)

30 igaming customers

Chartwell: 50 ppl compliance

Paladin: fraud consulting

Fintech now called "Edge ventures"

1. GRAND: bank app for gaming, crypto & cannabis

2. Flexia: cashless casinos

3. Victor: BaaS, Credit Karma (4M accounts in 1.5 yr)

4. payments

Chartwell: 50 ppl compliance

Paladin: fraud consulting

Fintech now called "Edge ventures"

1. GRAND: bank app for gaming, crypto & cannabis

2. Flexia: cashless casinos

3. Victor: BaaS, Credit Karma (4M accounts in 1.5 yr)

4. payments

https://twitter.com/brianlovesbanks/status/1395804555011571717?s=20

Credit Karma, thru MVBF, has 3.8 million accounts. They don’t break out how many of 110 million accounts are US based... but MVBF + Credir Karma accounts have room to grow

Credit Karma + Intuit TurboTax are using tax refunds to acquire more users for their bank accounts (powered by MVBF). So MVBF is going to have a pop in deposits

businesswire.com/news/home/2021…

businesswire.com/news/home/2021…

• • •

Missing some Tweet in this thread? You can try to

force a refresh