Bonds are probably the hardest piece of @OlympusDAO to understand. But they're also one of the most important, and sometimes the most lucrative.

A thread on what bonds are, how they fit into the big picture, and how they're going

👇👇👇👇👇👇👇👇👇👇👇👇👇👇

A thread on what bonds are, how they fit into the big picture, and how they're going

👇👇👇👇👇👇👇👇👇👇👇👇👇👇

Bonds are the treasury's way of capturing liquidity. They give users the ability to trade SLP tokens for $OHM directly with the protocol.

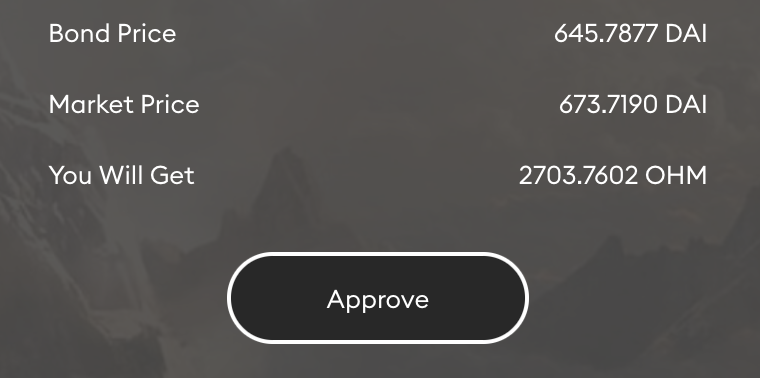

Our website displays the bond price in DAI for you, because it's effectively a trade at that price

Our website displays the bond price in DAI for you, because it's effectively a trade at that price

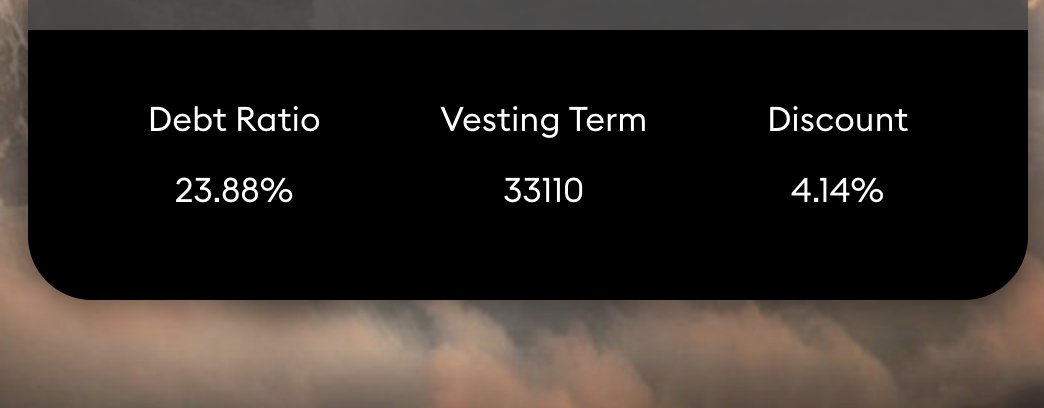

When you make the trade, you're put on a vesting schedule. Over the course of 15 epochs (5 days), the $OHM you bought becomes redeemable.

You're incentivized to bond by a discount. The discount increases and decreases along with debt outstanding (more bonds = lower discount)

You're incentivized to bond by a discount. The discount increases and decreases along with debt outstanding (more bonds = lower discount)

Both of these mechanisms constrain bond inflow. We basically prevent our own growth.

We do so for the sake of longevity. If you haven't learned by now that super rapid growth rarely ends well, you're probably ngmi.

Slow and steady always wins in the end

We do so for the sake of longevity. If you haven't learned by now that super rapid growth rarely ends well, you're probably ngmi.

Slow and steady always wins in the end

The liquidity from a bond is locked in the treasury and used to back new $OHM.

That liquidity now belongs to the market and, by extension, the token holders. The more liquidity the protocol builds up, the more confident holders can feel. This wards away bad thoughts of -3, -3

That liquidity now belongs to the market and, by extension, the token holders. The more liquidity the protocol builds up, the more confident holders can feel. This wards away bad thoughts of -3, -3

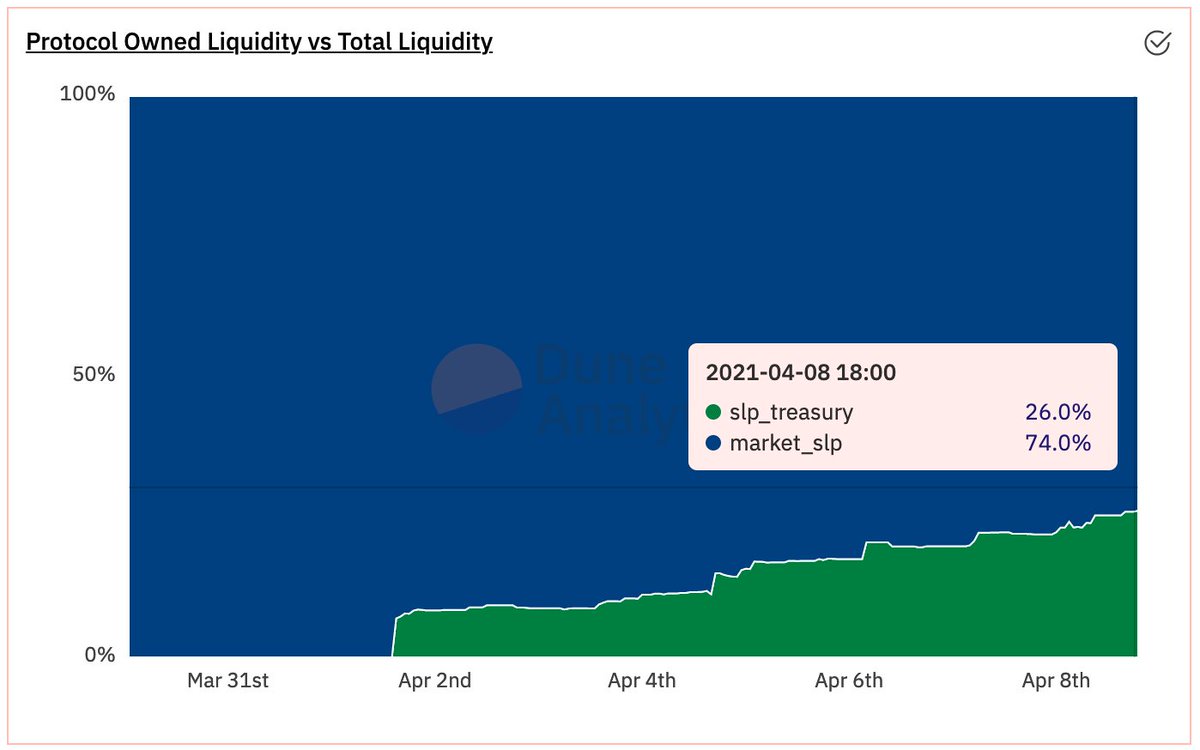

Slowly, more and more of the pool will become protocol owned. This is the best liquidity you can ask for; it will stay there no matter what. Up to $10k or down to $0 its there, for zero reward. Find another LP who will do that.

It also lets you sell at the market price ;)

It also lets you sell at the market price ;)

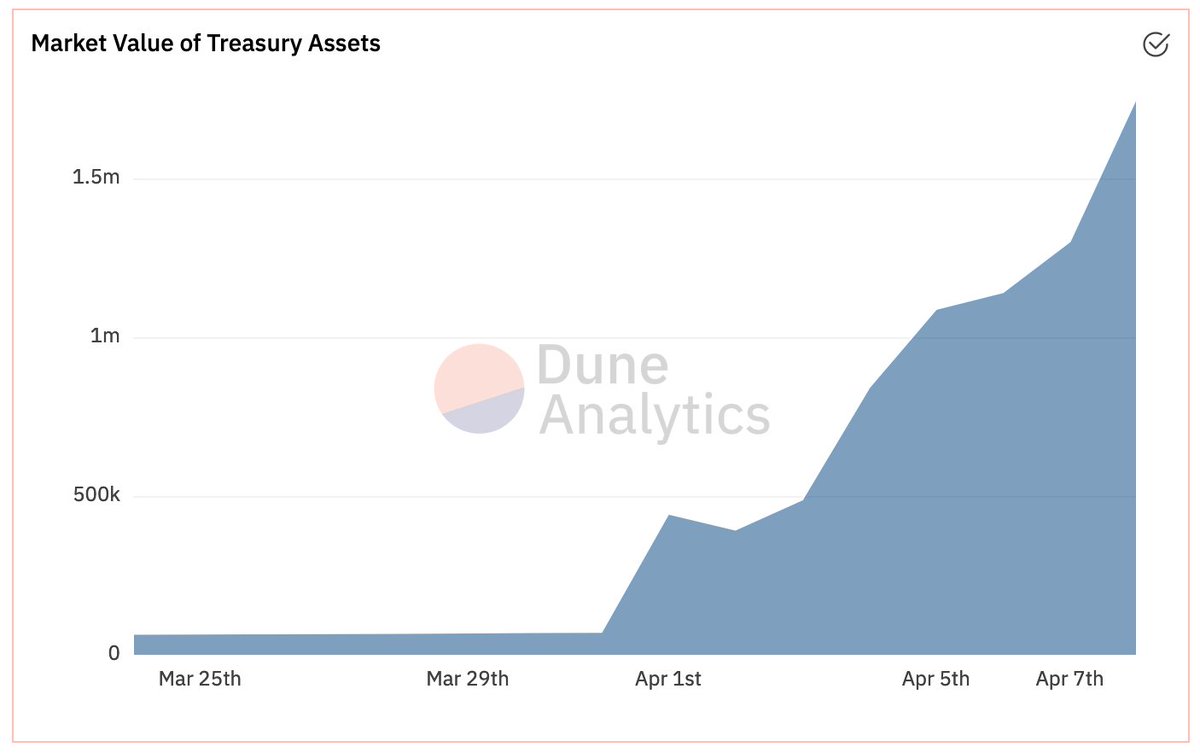

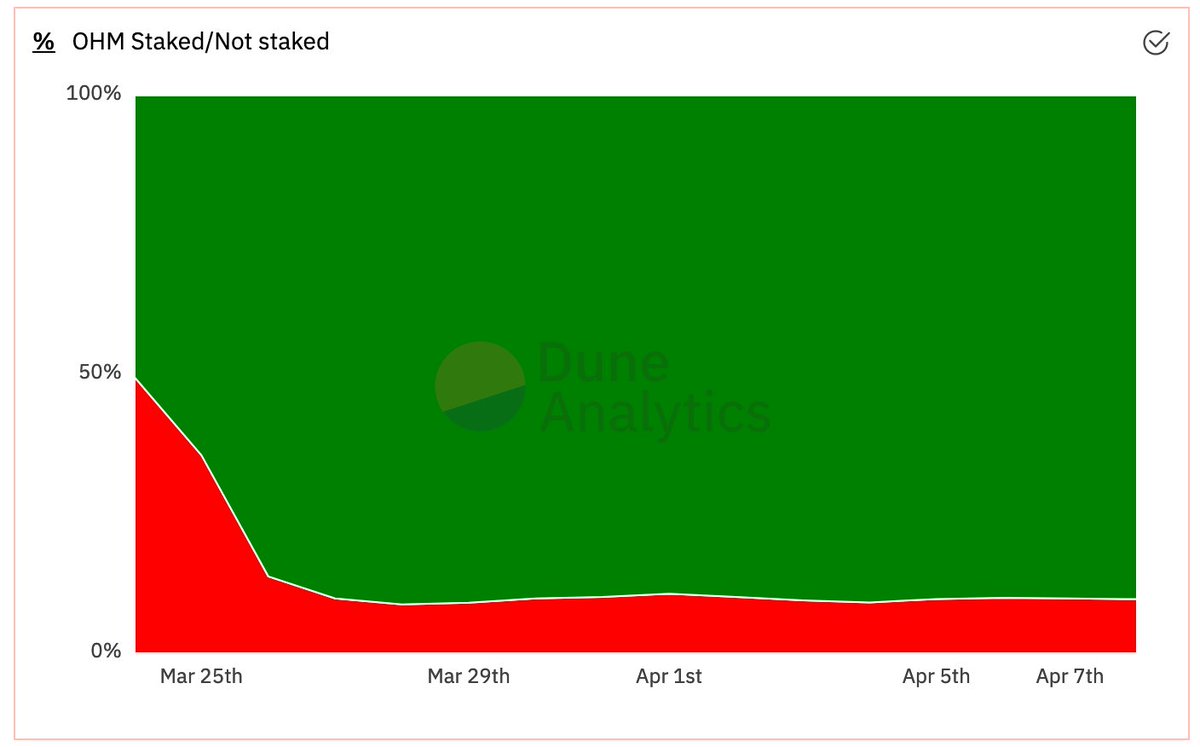

We are already seeing this happen. Since launching bonds a week ago, the protocol has accumulated 26% of the pool (~$1.7m worth of liquidity)

Pair this with the diamond-handed 3,3ing ohmies and you start to see the bigger picture.

New supply is preceded by locked liquidity. Most of that supply ends up in staking. What gets sold goes into a larger and larger pool.

And slowly, quietly, number goes up

New supply is preceded by locked liquidity. Most of that supply ends up in staking. What gets sold goes into a larger and larger pool.

And slowly, quietly, number goes up

All of this serves to create a long-term, sustainable bootstrapping mechanism for the protocol, with participants as the main beneficiaries.

A good system shouldn't offer one opportunity to "make it"; it should offer them in perpetuity with diminishing returns

A good system shouldn't offer one opportunity to "make it"; it should offer them in perpetuity with diminishing returns

This is how you produce wealth; slowly, through compounding gains.

We are not trying to get rich. We are trying to become wealthy.

We are not trying to get rich. We are trying to become wealthy.

Tldr;

- Bonds give users the opportunity to buy OHM at discounts to the market.

- Bonds facilitate the system by permanently locking liquidity on the behalf of token holders.

- Bonds boost the balance sheet of the treasury and allow us to mint new $OHM

- Bonds give users the opportunity to buy OHM at discounts to the market.

- Bonds facilitate the system by permanently locking liquidity on the behalf of token holders.

- Bonds boost the balance sheet of the treasury and allow us to mint new $OHM

A big shoutout to @sh4dowlegend for creating a Dune dashboard for Olympus.

Also thanks to all those who have participated in bonds so far.

Also thanks to all those who have participated in bonds so far.

If you'd like to learn more about what we're doing, join the discord or check out the links below:

discord.gg/6HUNj6jPvP

medium.com/@olympusdao

app.gitbook.com/@ohmzeus/s/oly…

discord.gg/6HUNj6jPvP

medium.com/@olympusdao

app.gitbook.com/@ohmzeus/s/oly…

Adding this due to relevance olympusdao.medium.com/1-1-to-3-3-the…

• • •

Missing some Tweet in this thread? You can try to

force a refresh