WE ALL LOVE AAPL, RIGHT ?

But don't overestimate the returns on the stock

AAPL is no longer a high-growth stock

- organic growth is only around +7% per annum

- and it relies upon Stock Buybacks and Dividends for investor returns

LET'S TAKE A LOOK

But don't overestimate the returns on the stock

AAPL is no longer a high-growth stock

- organic growth is only around +7% per annum

- and it relies upon Stock Buybacks and Dividends for investor returns

LET'S TAKE A LOOK

RECENT PERFORMANCE - TSLA

COVID Trough was around $80

Current level is around $680

--> 8.5x return

WHICH ONE WOULD YOU RATHER HAVE OWNED ?

COVID Trough was around $80

Current level is around $680

--> 8.5x return

WHICH ONE WOULD YOU RATHER HAVE OWNED ?

ORGANIC GROWTH - TSLA

Unit Volume growth : 0.5 million --> 25.0 million

--> 50x over 10 years to 2031

Unit Volume growth : 0.5 million --> 25.0 million

--> 50x over 10 years to 2031

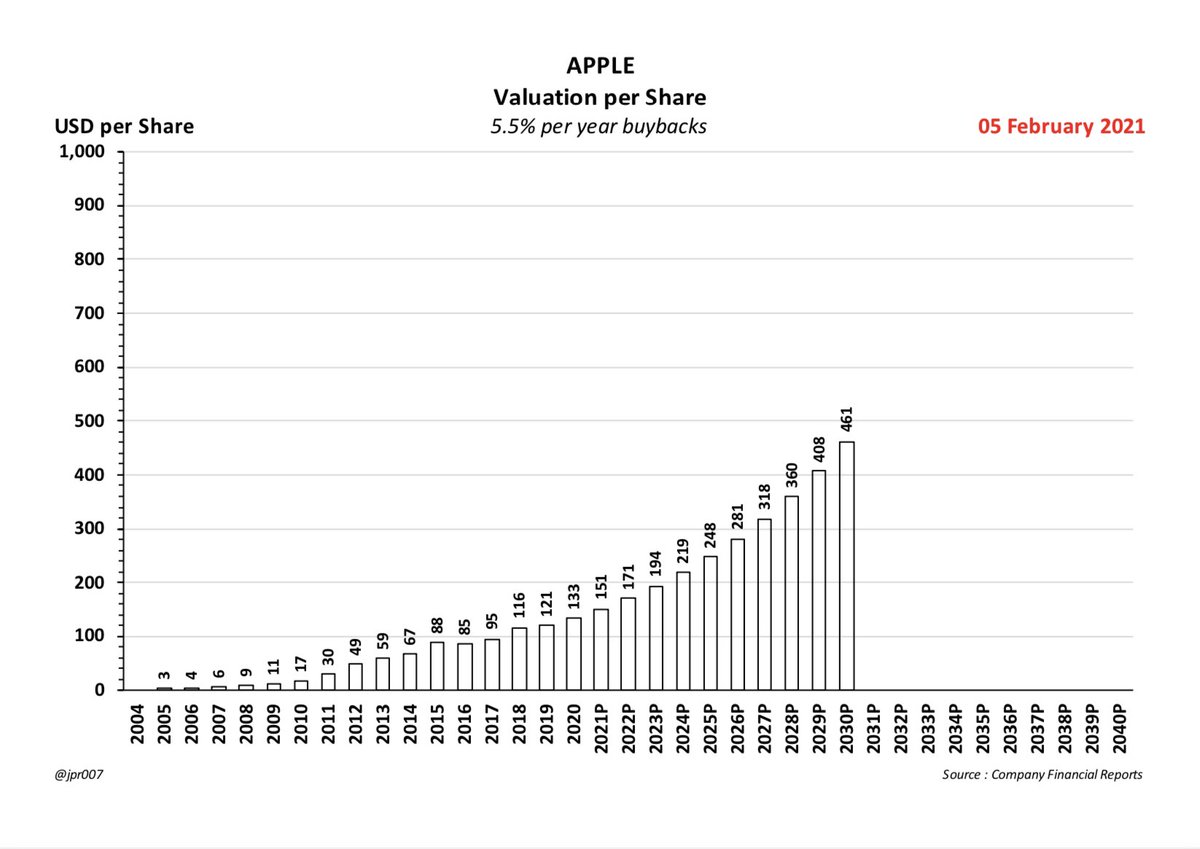

TOTAL RETURN - AAPL

Revenue growth : +7% per annum

Stock Buybacks : +5.5% per annum

Dividend Yield : +0.65% per annum

Total = +13.15% per annum

--> 3.44x over 10 years to 2031

Revenue growth : +7% per annum

Stock Buybacks : +5.5% per annum

Dividend Yield : +0.65% per annum

Total = +13.15% per annum

--> 3.44x over 10 years to 2031

This means that AAPL does not pass our 15% investment hurdle rate and its discounted future value would be steadily declining when viewed from the present

TOTAL RETURN - TSLA

$680 today

$5,300 in 2031

--> 7.8x return over 10 years to 2031

= +22.8% per annum CAGR

WHICH ONE WOULD YOU PREFER TO OWN TODAY ?

$680 today

$5,300 in 2031

--> 7.8x return over 10 years to 2031

= +22.8% per annum CAGR

WHICH ONE WOULD YOU PREFER TO OWN TODAY ?

VALUATION RISK - AAPL

AAPL is trading at a P/E Multiple of 35.2x today

As its maturity and declining growth become better recognized, this should trend down closer to 20x compatible with a normal market

AAPL is trading at a P/E Multiple of 35.2x today

As its maturity and declining growth become better recognized, this should trend down closer to 20x compatible with a normal market

VALUATION RISK - AAPL continued

AAPL's P/E Multiple declining from 35.2x down to 20x will cut its future stock price

$132 at +13.15% per annum --> $454 in 2031

$454 x 20/35.2 = $258 per share

--> 1.95x return over 10 years to 2031

= +6.9% per annum CAGR

+0.65% for Dividends

AAPL's P/E Multiple declining from 35.2x down to 20x will cut its future stock price

$132 at +13.15% per annum --> $454 in 2031

$454 x 20/35.2 = $258 per share

--> 1.95x return over 10 years to 2031

= +6.9% per annum CAGR

+0.65% for Dividends

VALUATION RISK - TSLA

TSLA is trading at a P/E Multiple of 10.4x today

Our 2031 Valuation has priced it at 20x compatible with a normal market

- so the Valuation Risk has already been normalized into the future stock price numbers

TSLA is trading at a P/E Multiple of 10.4x today

Our 2031 Valuation has priced it at 20x compatible with a normal market

- so the Valuation Risk has already been normalized into the future stock price numbers

WHICH ONE WOULD YOU PREFER TO OWN TODAY ?

On an "apples-to-apples" valuation basis :

AAPL = 1.95x over 10 years to 2031

--> +6.9% per annum CAGR and 7.65 with Dividends

TSLA = 7.8x over 10 years to 2031

--> +22.8% per annum CAGR without counting potential Dividends

COMPARE

On an "apples-to-apples" valuation basis :

AAPL = 1.95x over 10 years to 2031

--> +6.9% per annum CAGR and 7.65 with Dividends

TSLA = 7.8x over 10 years to 2031

--> +22.8% per annum CAGR without counting potential Dividends

COMPARE

• • •

Missing some Tweet in this thread? You can try to

force a refresh