Let’s not get lost in semantics on Impermanent Loss

I'm now seeing the following on crypto twitter: “AMM protocols trying to solve IL are a waste of time, YOU CAN’T SOLVE IL!”

Discussions on IL & methods to address it are confused by vague terms like “solved” & “mitigated”

👇

I'm now seeing the following on crypto twitter: “AMM protocols trying to solve IL are a waste of time, YOU CAN’T SOLVE IL!”

Discussions on IL & methods to address it are confused by vague terms like “solved” & “mitigated”

👇

Impermanent loss indeed cannot be solved. Full stop. We’ve known that for a while

Just as insurance cos don’t prevent houses from burning down, neither does Bancor prevent IL from occurring

But is StateFarm wasting its time because its services do nothing to fire-proof houses?

Just as insurance cos don’t prevent houses from burning down, neither does Bancor prevent IL from occurring

But is StateFarm wasting its time because its services do nothing to fire-proof houses?

IL is a risk - pure and simple, and it will always exist. The question is: who is best to deal with this risk?

Is it the individual LP? What if they don’t want to actively manage sophisticated hedging strategies that try to mitigate IL risk?

Is it the individual LP? What if they don’t want to actively manage sophisticated hedging strategies that try to mitigate IL risk?

Should we just let the pros handle it?

“We’ve had a good run guys, but let’s let the pros take over now”. The winners become a small group of active trading firms who extract all the fees, while liquidity sources are centralized within the hands of a few powerful market-makers.

“We’ve had a good run guys, but let’s let the pros take over now”. The winners become a small group of active trading firms who extract all the fees, while liquidity sources are centralized within the hands of a few powerful market-makers.

Imo we should empower the individual LP to succeed. That is the beauty of AMMs after all - level playing fields that turn pooled market-maker liquidity into a new, accessible asset class - & this requires a decentralized protocol that effectively manages IL risk for LPs.

Now the cool thing about risk is anywhere it exists, there is usually a group of people willing to manage & mitigate it, and try to make money off providing such a service

See: insurance companies

See: insurance companies

Insurance companies don’t eliminate the risk of my house burning down. But they do give me peace of mind that I’ll get reimbursed if it happens - and that’s something I’m willing to pay for.

This, in a nutshell, is what Bancor V2.1 is: an AMM protocol that allows an infinite number of people ( $BNT holders) to make money off managing and back-stopping IL risk for individual LPs

By sharing profits & losses across many AMM pools, we can diversify IL risk across a wide array of tokens to eliminate IL.

Some pools are profitable for the protocol, others incur higher IL

If premiums > liabilities, the IL does disappear, on average

blog.bancor.network/bancor-v2-1-pr…

Some pools are profitable for the protocol, others incur higher IL

If premiums > liabilities, the IL does disappear, on average

blog.bancor.network/bancor-v2-1-pr…

Meanwhile, more LPs are getting their first taste of IL-free liquidity provisioning on Bancor, with nearly $2B TVL

LPs not only include retail holders but also massive funds & institutions that want passive, high-yield returns on assets they're long on

blog.bancor.network/bancor-v2-1-st…

LPs not only include retail holders but also massive funds & institutions that want passive, high-yield returns on assets they're long on

blog.bancor.network/bancor-v2-1-st…

Notably, IL risk is transferred from LPs to the protocol, which manages IL risk & sells insurance against it in a way that is profitable for $BNT holders

LPs who originally swore off AMMs due to IL now have access to an IL-free solution where the risk is managed by the BancorDAO

LPs who originally swore off AMMs due to IL now have access to an IL-free solution where the risk is managed by the BancorDAO

But “muh efficiency” you say?

We’ve been experimenting with AMM amplification (what Uni calls “concentrated liquidity”) for volatile tokens since 2019 and are intimately familiar with the tradeoffs involved including massively increased IL risk.

We’ve been experimenting with AMM amplification (what Uni calls “concentrated liquidity”) for volatile tokens since 2019 and are intimately familiar with the tradeoffs involved including massively increased IL risk.

Uni has tried to lessen the blow to LPs by calling it “inventory risk” - ie, provide two tokens, and risk holding 100% of the token that dumps relative to the other, thereby missing out on the gains of the token that pumped - you know, the one you’re long on

With IL, you’re effectively telling someone who’s bullish on a token to sell it off as it moons, in exchange for trading fees & rewards - which may work for some ppl who want to take profits, but not for those who are bullish on a token and want to ride its pumps

So Bancor v2.1 solved for this. If your tokens are precious to you, and you’re thinking about holding them for at least 100 days, providing liquidity is a no-brainer.

https://twitter.com/cryptotryne/status/1380259698239275010?s=20

On the efficiency side, our 2+ years experimenting with amplification and bending the curve to concentrate liquidity has yielded some interesting findings.

We believe we have an approach to concentrate liquidity & improve efficiency w/o making such costly tradeoffs for LPs & w/o turning AMMs into a world dominated by a small handful of active trading firms, with passive LPs hopelessly waiting for a yield aggregator to save them

We’ll be sharing details on our approach soon, and in the meantime, if you want to collect HODL returns on your tokens with single-sided exposure and 100% IL protection, without ever needing to hold $BNT, check out: bancor.network

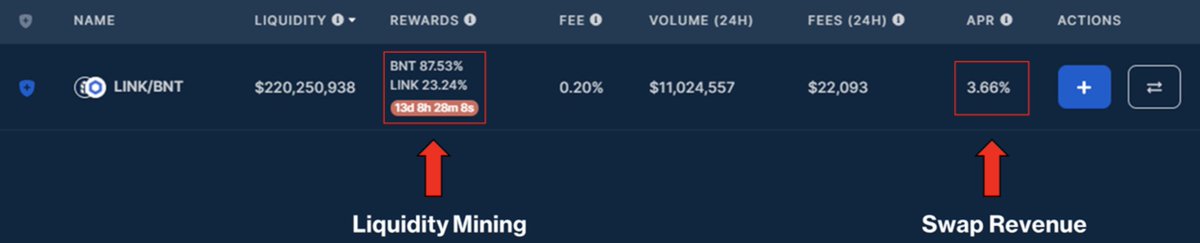

The “Rewards” column indicates annual yield from $BNT liquidity mining rewards

The “APR” column indicates annual yield from swap fees, paid in the token staked

We’ve seen APRs range from 20-200+%

LP tutorial by @Jihoz_Axie :

The “APR” column indicates annual yield from swap fees, paid in the token staked

We’ve seen APRs range from 20-200+%

LP tutorial by @Jihoz_Axie :

Keep in mind, these yield percentages are inherently different from what other AMM protocols display, given there is zero IL eating into your returns if you’re in a pool for 100 days or more.

Today if you want higher efficiency on your staked capital, as a Bancor LP, you can now borrow against staked BNT, via vBNT and Bancor Vortex.

ie., Provide BNT liquidity, get vBNT, swap vBNT for other tokens (ETH, LINK, BNT) & go nuts. Be mindful of the risks too!

ie., Provide BNT liquidity, get vBNT, swap vBNT for other tokens (ETH, LINK, BNT) & go nuts. Be mindful of the risks too!

vBNT burning, which was activated last week and is ramping up now, is designed in part to lower these borrowing risks:

blog.bancor.network/vbnt-burning-i…

blog.bancor.network/vbnt-burning-i…

Stay tuned gov.bancor.network for proposals for future protocol upgrades that improve efficiency without such large sacrifices & seek to maintain broad, competitive involvement in market-making that it is accessible (& highly lucrative!) for active & passive LPs, big & small

• • •

Missing some Tweet in this thread? You can try to

force a refresh