1/ Crowding and Factor Returns (Kang, Rouwenhorst, Tang)

"We construct a direct measure of factor strategy crowding that is based on CFTC aggregate positioning. Crowding measure has a strong negative predictive impact on expected factor returns."

papers.ssrn.com/sol3/papers.cf…

"We construct a direct measure of factor strategy crowding that is based on CFTC aggregate positioning. Crowding measure has a strong negative predictive impact on expected factor returns."

papers.ssrn.com/sol3/papers.cf…

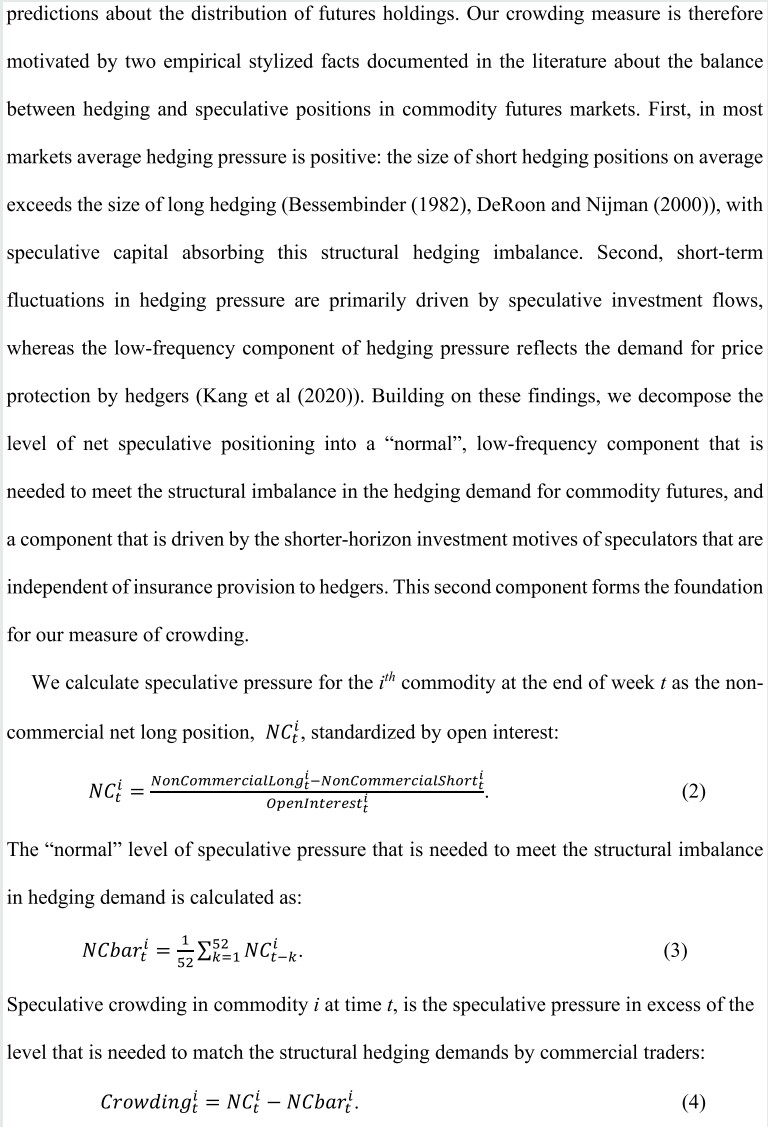

2/ Crowding at the commodity level = excess speculative pressure (deviation of non-commercial traders’ positions from the 52-week average, scaled by open interest)

"We will show that it is straightforward to aggregate individual commodity crowding to the factor strategy level."

"We will show that it is straightforward to aggregate individual commodity crowding to the factor strategy level."

3/ "Speculative positions show substantial short-term variation (σ ≈ 15%) that is independent from accommodating the hedging demands of commercial traders, which are unlikely to vary substantially at the weekly horizon."

4/ "Individual commodity crowding has a strong predictive power on the subsequent returns in both univariate and multivariate specifications with controls."

Q = change in net long commercial long positions

SHP = smoothed component of hedging pressure

Q = change in net long commercial long positions

SHP = smoothed component of hedging pressure

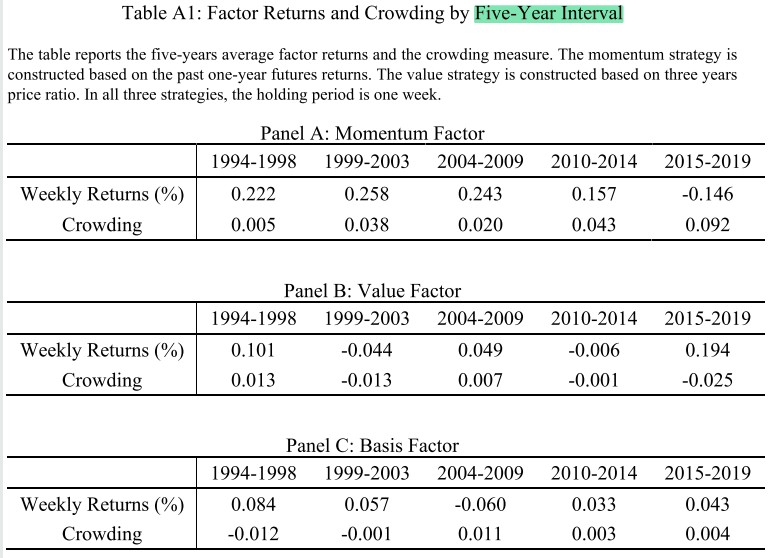

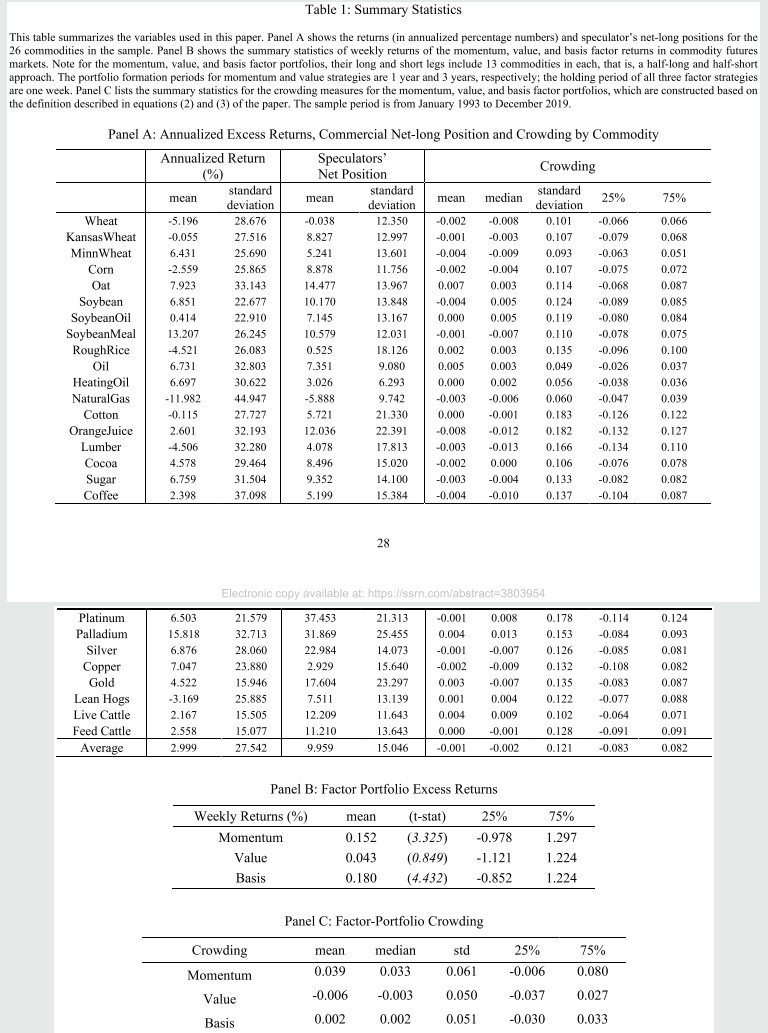

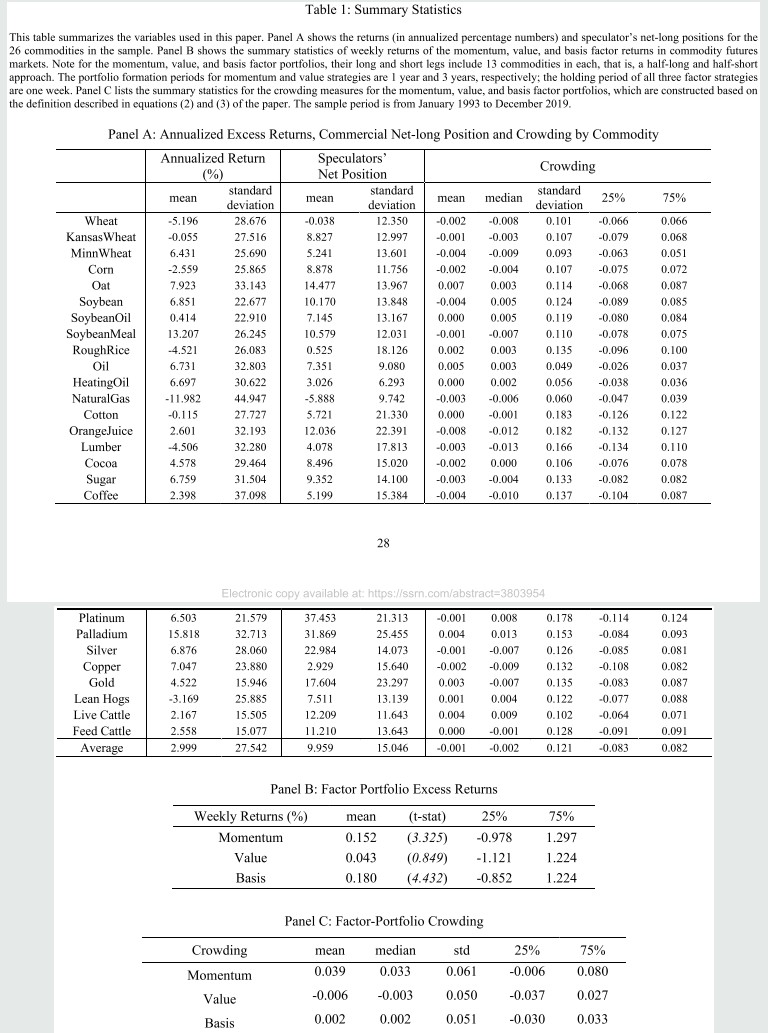

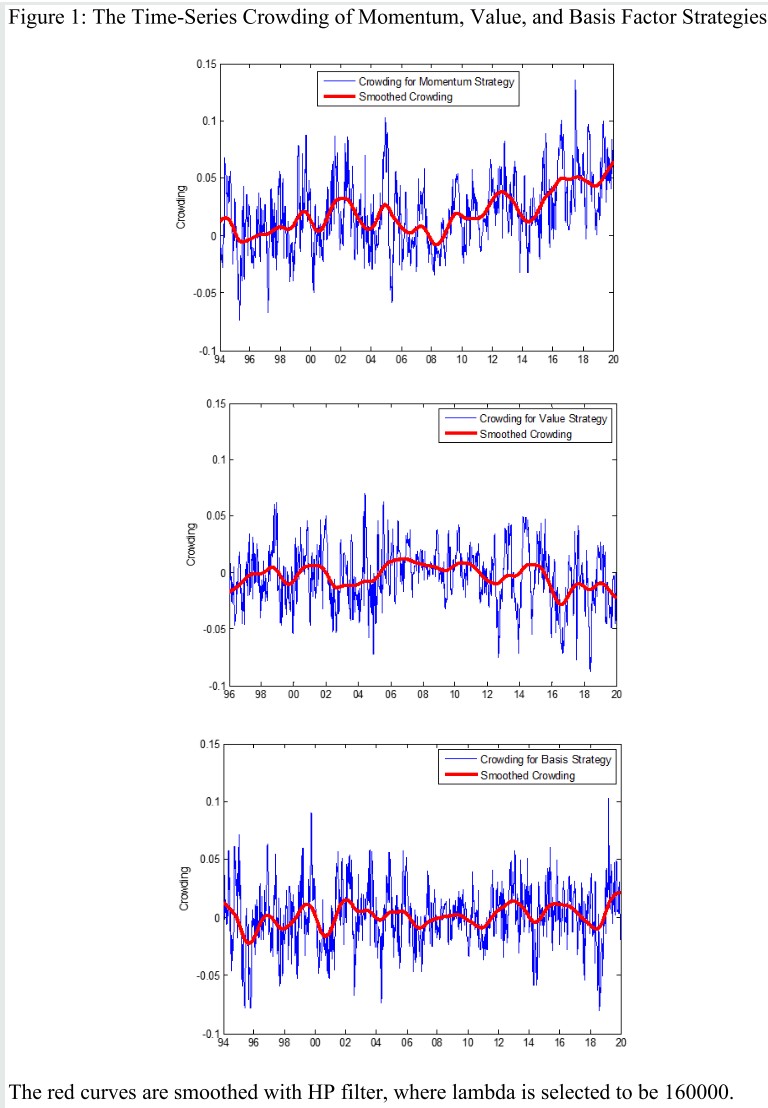

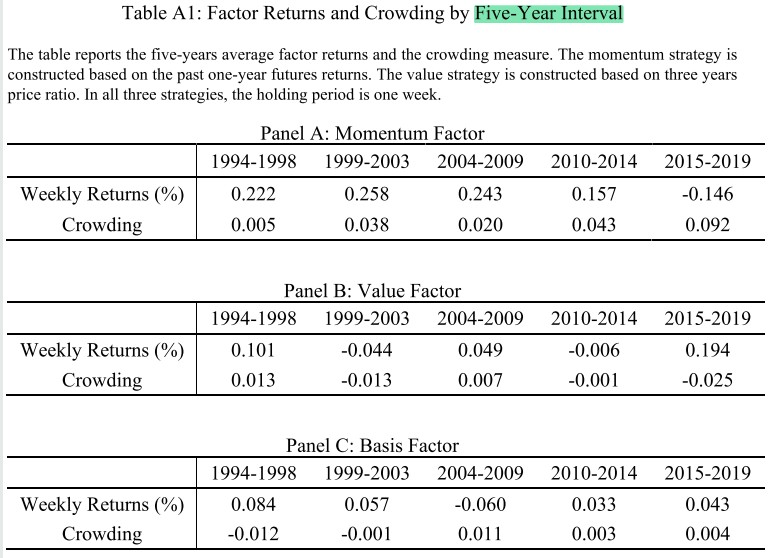

5/ "Average crowding levels are close to zero for value and basis strategies but positive for momentum.

"Momentum exhibits an upward trend in crowding over the sample. Based on our results from commodity-level crowding, this would predict a reduction of returns over time."

"Momentum exhibits an upward trend in crowding over the sample. Based on our results from commodity-level crowding, this would predict a reduction of returns over time."

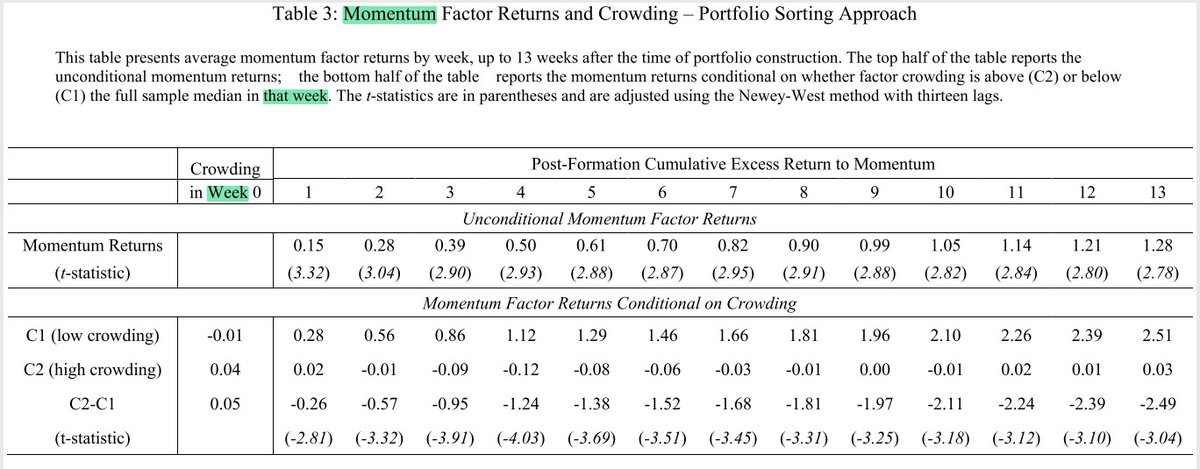

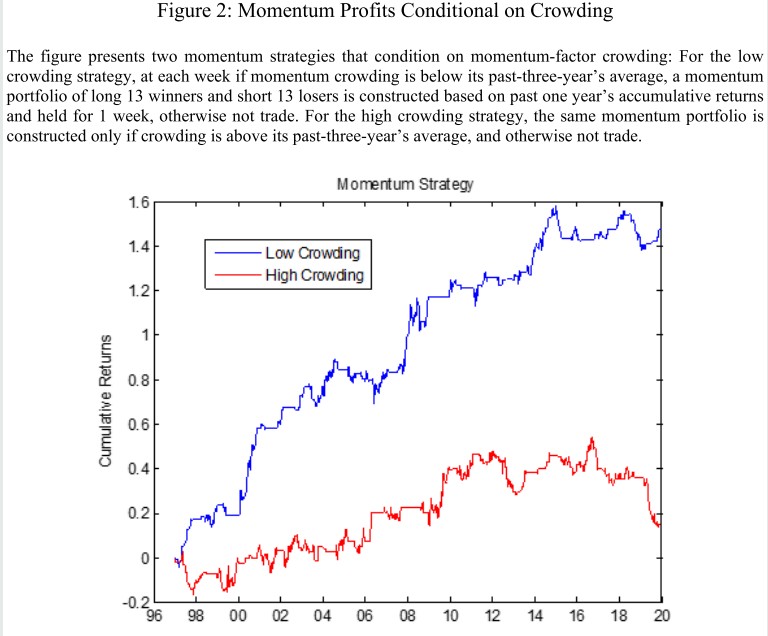

6/ "When crowding is low, momentum is highly profitable: its post-ranking return increases from 0.28% in the first week to 2.51% in week 13.

"In contrast, profitability is absent in periods of high crowding. Up to 13 weeks, cumulative momentum profits fluctuate around zero."

"In contrast, profitability is absent in periods of high crowding. Up to 13 weeks, cumulative momentum profits fluctuate around zero."

7/ "Sorting conditional on the full-sample median embeds a forward-looking bias. To address this concern, we also classify crowding levels by taking deviations from its trailing three-year (156-week) moving average.

"These findings mirror our conclusion from Table 3."

"These findings mirror our conclusion from Table 3."

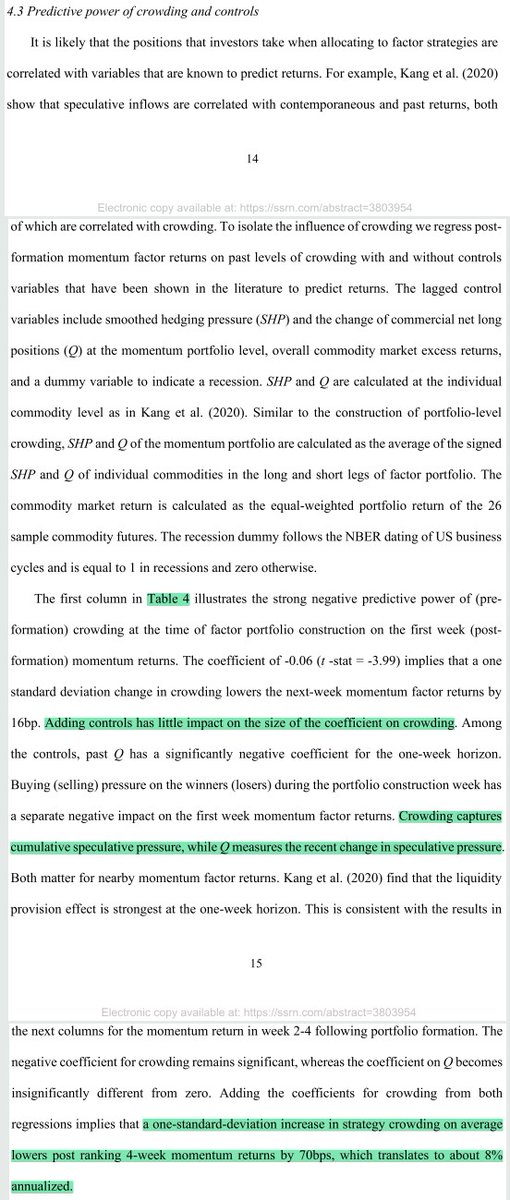

8/ "Controls have little impact on the size of the crowding coefficient.

"Crowding captures cumulative speculative pressure, while Q measures the recent change in pressure.

"A 1σ increase in strategy crowding lowers post-ranking 4-week momentum returns by 70bps (8% annualized).

"Crowding captures cumulative speculative pressure, while Q measures the recent change in pressure.

"A 1σ increase in strategy crowding lowers post-ranking 4-week momentum returns by 70bps (8% annualized).

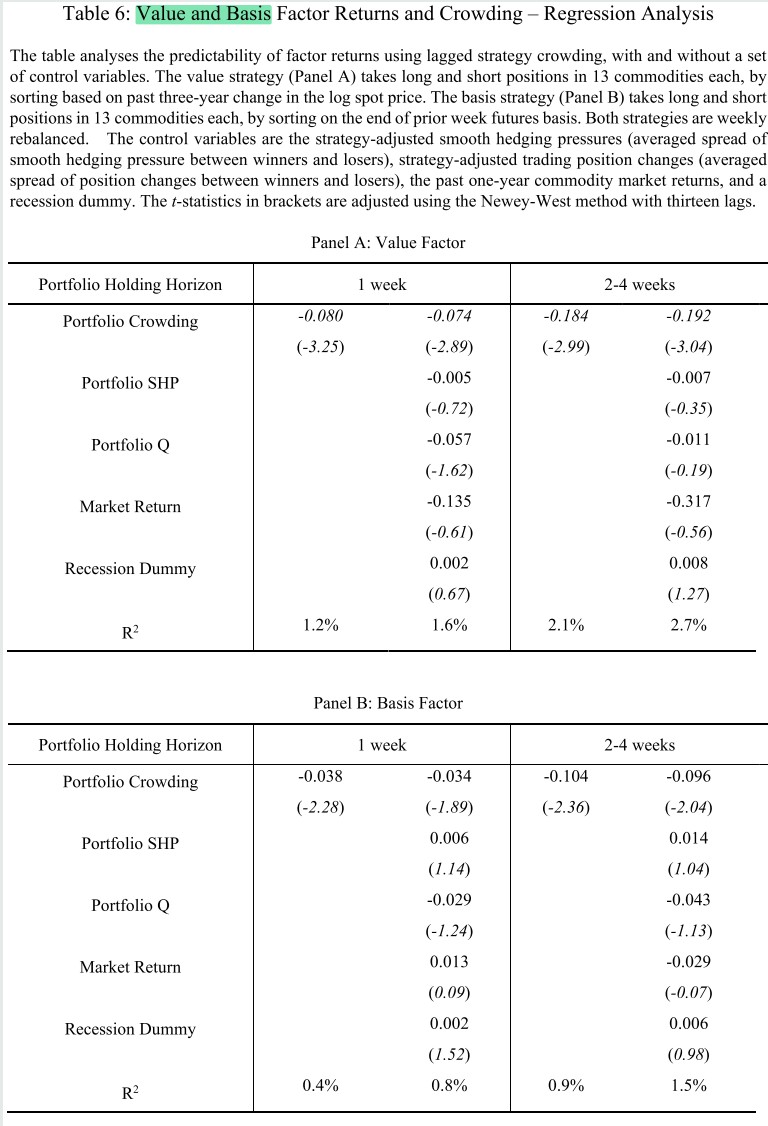

9/ For value and basis strategies, "returns are significantly higher during weeks of low crowding

and lower when crowding is high. Stated differently, excess return to factors strategies in commodity futures primarily accrues during weeks when crowding is low."

and lower when crowding is high. Stated differently, excess return to factors strategies in commodity futures primarily accrues during weeks when crowding is low."

10/ "These findings are unchanged when we remove the forward-looking aspect. Most of the positive average excess returns of the value and basis factors accrue in low-crowding weeks. Low or negative average returns are earned during episodes of high crowding."

11/ "As before, the predictive power of crowding is robust to the inclusion of controls. A 1σ increase of crowding of the value (basis) factor portfolio decreases the next-week strategy return by 19 (9) bps and next four-week return by 67 (33) bps, respectively."

12/ "Momentum has become more crowded and has also experienced low returns.

"Our results echo Hanson and Sunderam, who show that factor returns in equity markets decline when there is more capital allocated to short-interest positions that aligns with factor positions."

"Our results echo Hanson and Sunderam, who show that factor returns in equity markets decline when there is more capital allocated to short-interest positions that aligns with factor positions."

13/ "When a factor performs well, crowding increases after controlling for past crowding.

"Crowding in momentum and (to some extent) basis loads negatively on proxies for funding liquidity. Crowding in value responds to these proxies with the opposite sign (marginally sig.)."

"Crowding in momentum and (to some extent) basis loads negatively on proxies for funding liquidity. Crowding in value responds to these proxies with the opposite sign (marginally sig.)."

14/ "In individual commodities, returns positively predicts future crowding.

"Both the factor-related component of the return as well as the component of the commodity return that is orthogonal to the factor have predictive power for commodity-level crowding."

"Both the factor-related component of the return as well as the component of the commodity return that is orthogonal to the factor have predictive power for commodity-level crowding."

15/ "High crowding of positions by money managers (including hedge funds and CTAs) predicts lower subsequent factor returns for all the three factors strategies, both with and without controls. Our prior results are therefore robust to alternative speculative trader definitions."

16/ "Including the Lou and Polk co-movement proxy has little impact on the coefficient estimates of our crowding measure.

"The co-movement proxy itself has coefficients that are not stat. significant. The measure may be noisy due to the limited cross-section of commodities."

"The co-movement proxy itself has coefficients that are not stat. significant. The measure may be noisy due to the limited cross-section of commodities."

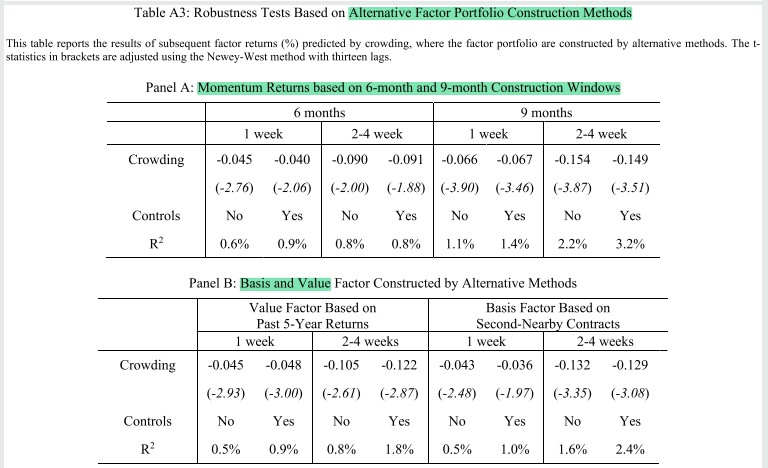

17/ ROBUSTNESS TESTS

"Our crowding measure significantly predicts subsequent factor returns that are constructed on longer-dated futures contracts."

"Our crowding measure significantly predicts subsequent factor returns that are constructed on longer-dated futures contracts."

18/ "We now base the value factor on past 5-year returns and generate the basis factor using the futures price difference between the second-nearby and third-nearby contracts. For all these alternative factor portfolio construction methods, we obtain broadly similar conclusions."

19/ "A crowding measure based on the number of traders instead of the numbers of contracts generates qualitatively similar results (with lower t-stats). This perhaps is not surprising; the aggregate size of the overall position is more relevant than the number of traders."

20/ "Our finding of factor return predictability remains robust using speculative pressure in excess of the level required to meet the structural hedging demand of commercial traders (52-week MA of the commercials' net short position) as an alternative measure of crowding."

21/ "A crowding measure based on DCOT money managers’ position data significantly predicts individual commodity returns over the next 1 to 4 weeks. These results further confirm that money managers constitute the primary category of traders who engage in speculative crowding."

22/ CONCLUSION

"During our sample period from 1993 to 2019, factor premiums are accumulated primarily during periods of low crowding.

"Our findings suggest that crowding and the reduction of factor strategy returns are related to a decline in the cost of arbitrage capital."

"During our sample period from 1993 to 2019, factor premiums are accumulated primarily during periods of low crowding.

"Our findings suggest that crowding and the reduction of factor strategy returns are related to a decline in the cost of arbitrage capital."

23/ Related reading

THREAD for research on the effectiveness of L/S sentiment (COT data) in futures markets

What Happens with More Funds than Stocks?

Impact of Crowding in Alternative Risk Premia Investing

THREAD for research on the effectiveness of L/S sentiment (COT data) in futures markets

https://twitter.com/ReformedTrader/status/1284561910193467394

What Happens with More Funds than Stocks?

https://twitter.com/ReformedTrader/status/1349038269573464064

Impact of Crowding in Alternative Risk Premia Investing

https://twitter.com/ReformedTrader/status/1336383776570503168

• • •

Missing some Tweet in this thread? You can try to

force a refresh