New paper from Harvard comparing different electric sector policies: Robust Decarbonization of the US Power Sector.

Big winners: Clean Electricity Standard (CES), Tradeable performance Standard (TPS), and a #CarbonTax. Let's compare. (1/10) scholar.harvard.edu/stock/publicat…

Big winners: Clean Electricity Standard (CES), Tradeable performance Standard (TPS), and a #CarbonTax. Let's compare. (1/10) scholar.harvard.edu/stock/publicat…

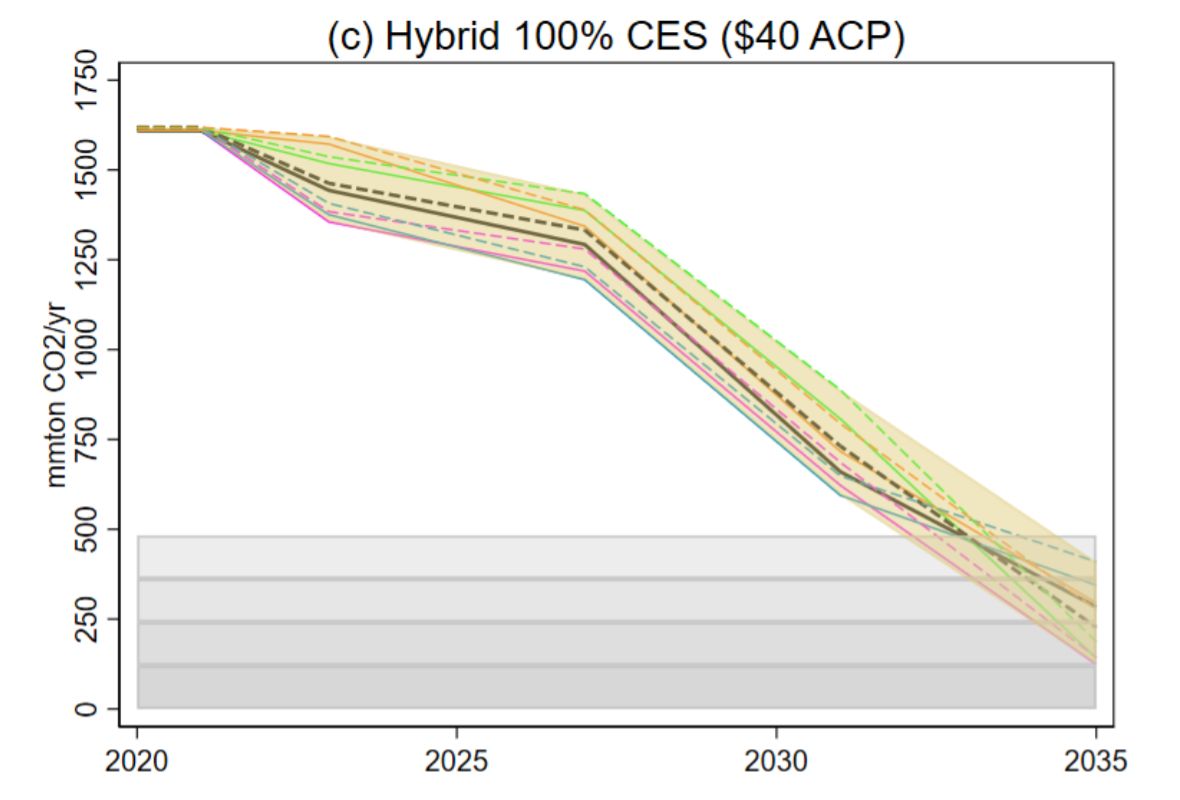

A hybrid CES with $40/mWh Alternative Compliance Payment gives solid results across all scenarios (fuel prices, demand levels, etc.). Hybrid means that natural gas gets partial credit which favors it over coal. This is modeled after the CLEAN Futures Act. (2/10)

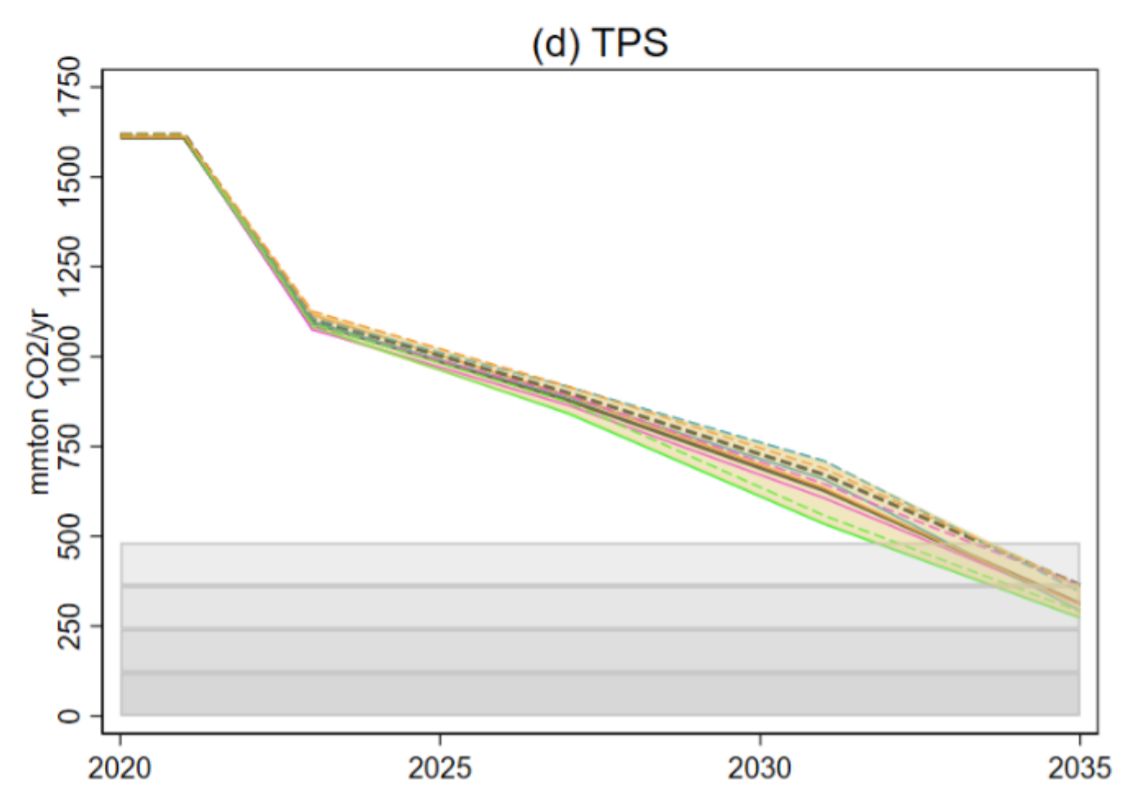

The Tradeable performance Standard (TPS) also does quite well. This is based off of the Clean Power Plan and is essentially an emissions-based cap and trade for the electricity sector. (3/10)

The $40/ton carbon tax (rising 3% annually) gives very quickest reductions in emissions. Doesn't quite hit the target for reductions in one scenario (79% instead of 80%). Because of the quick reductions, cumulative emissions are often more than 2x the CES policy. (4/10)

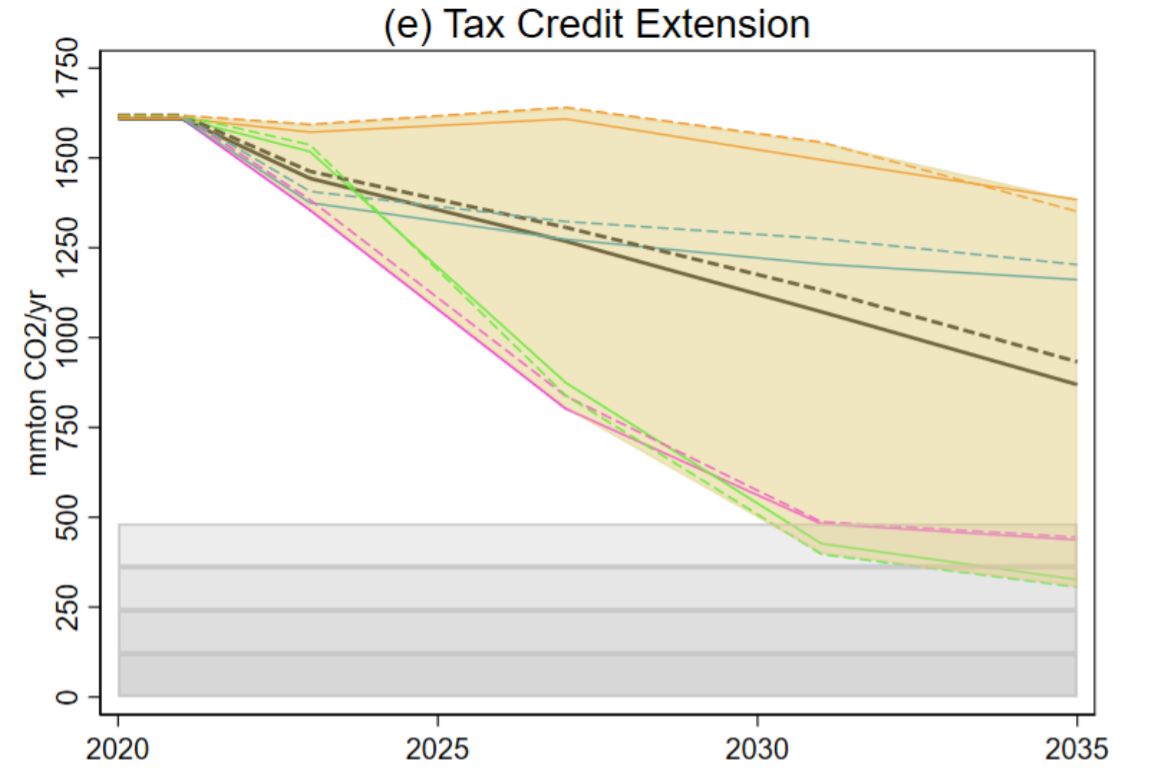

They also modeled extending the producer and investment tax credits (PTC and ITC). These did well in some scenarios but failed in others and were generally expensive in terms of govt spending. (5/10)

Putting the Hybrid CES and the tax credits as called for in the American Jobs Plan, did not really yield much greater results than the CES alone, but does shift costs from ratepayers to tax payers which is likely to be more progressive. (6/10)

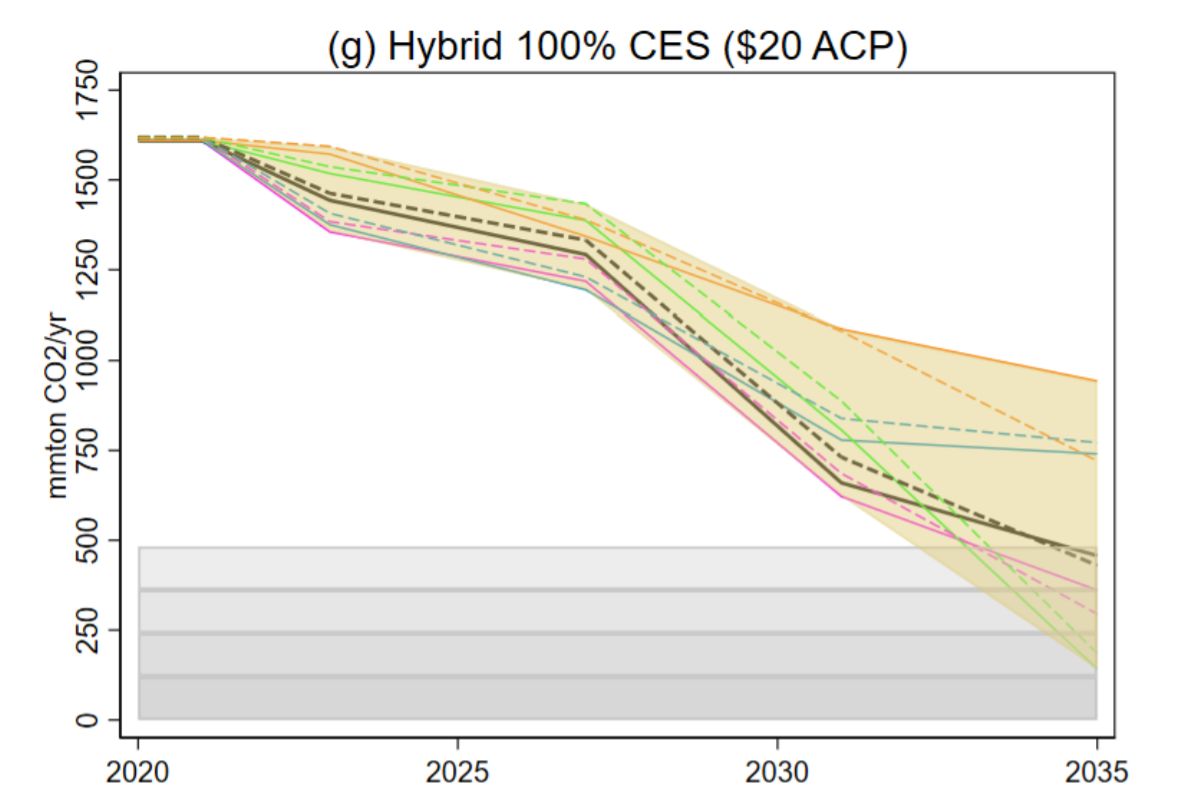

Note that a Hybrid CES with a $20/mWh Alternative Compliance Payment does much worse in a lot of scenarios, where the ACP is not high enough to drive out fossil generation. (7/10)

Whereas a $20/ton carbon price (which is very modest) still gives drastic emission reductions in the first few years, but the reductions are not deep enough for the longer term goals. (8/10)

I would love to see them model a more steeply rising #CarbonTax like the Energy Innovation Act which starts at $15/ton and rises by $10/year. I'm confident this would have hit the 2035 decarbonization targets easily. (9/10) energyinnovationact.org

I also wonder about other policy combinations - a hybrid CES plus a $40/ton carbon price, or even a $20/ton price. It's likely that if you add a base level carbon price the CES can be simpler and may not need to give gas partial credit to displace coal. (10/10)

Using @EnergyInnovLLC's Energy Policy Simulator I was able to combine a 100% by 2035 CES and a $40/ton price (rising 3% annually). As expected, you get a steep initial drop from the moderate price and then a steady decline from the CES. Best of both worlds?

• • •

Missing some Tweet in this thread? You can try to

force a refresh