This is the story of this week (WIT) trade.

09/04/2021 - Friday

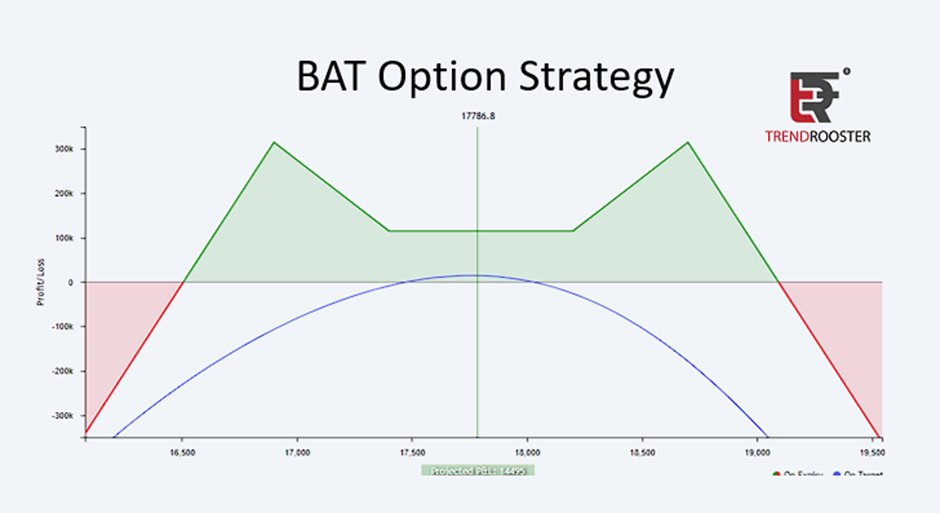

As per rule book I started the weekly #IM3 model on Last Friday. This model is versatile enough and works on most of the IV environments. It comes with 50% hedge of all the Sells involved.

09/04/2021 - Friday

As per rule book I started the weekly #IM3 model on Last Friday. This model is versatile enough and works on most of the IV environments. It comes with 50% hedge of all the Sells involved.

09/04/2021 - Friday

09/04(Friday) movement was within the 1SD boundaries and didn’t require any adjustments. Capital used ~12L

09/04(Friday) movement was within the 1SD boundaries and didn’t require any adjustments. Capital used ~12L

12/04/2021 - Monday

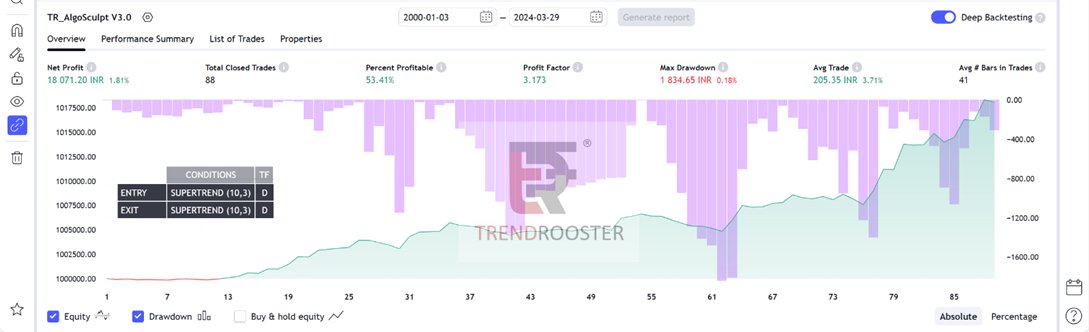

Big Gap down and its almost -900 points or so. That is about to threaten the Put side wing thus initiated the adjustment. And made the profile centre and covered 1SD. Capital used ~20L

Big Gap down and its almost -900 points or so. That is about to threaten the Put side wing thus initiated the adjustment. And made the profile centre and covered 1SD. Capital used ~20L

12/04/2021 – Monday (later part)

After gap down, BankNifty was down another -1100 points or so. Hence, adjusted the option profile. Capital Used ~25L

After gap down, BankNifty was down another -1100 points or so. Hence, adjusted the option profile. Capital Used ~25L

13/04/2021 – Tuesday

Banknifty opened normal and no gaps, this was the big relief though. However, BN moved +600 points in morning session itself and it is about to threaten the Call side wing.I had adjusted the profile progressively. This was the profile by end of the morning.

Banknifty opened normal and no gaps, this was the big relief though. However, BN moved +600 points in morning session itself and it is about to threaten the Call side wing.I had adjusted the profile progressively. This was the profile by end of the morning.

Strategy gained enough juice (theta) and it is more than +2% of ROI. Exited the whole and booked profit. All the trades are shared and discussed in our Weekly Income Trade groups.

• • •

Missing some Tweet in this thread? You can try to

force a refresh