Option profile Trader | MBA (HULL, UK). | #OptionTrading | யாதும் ஊரே யாவரும் கேளிர் | தமிழன் |

How to get URL link on X (Twitter) App

Understanding the Super Trend Indicator

Understanding the Super Trend Indicator

Finding 123 pattern in objective way is super hard and we believe that we have the framework that would help us to identify while it happens in live market.

Finding 123 pattern in objective way is super hard and we believe that we have the framework that would help us to identify while it happens in live market.

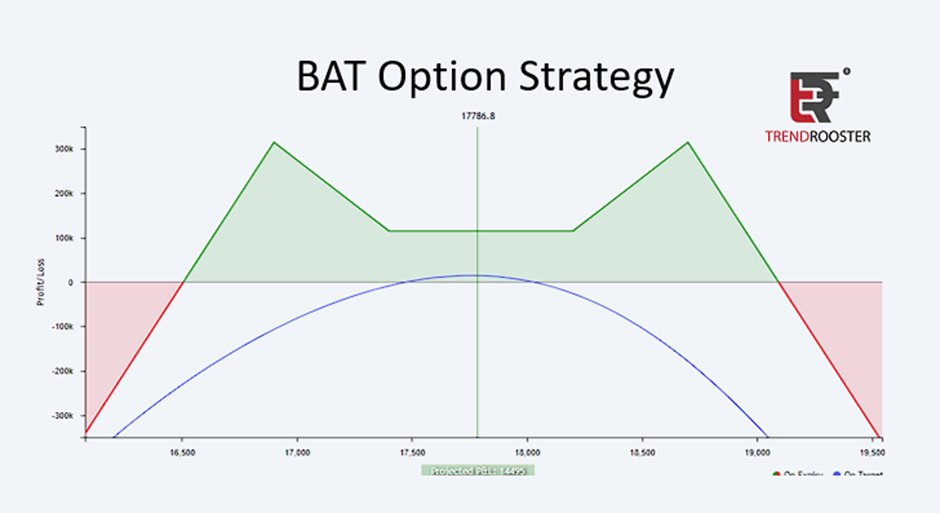

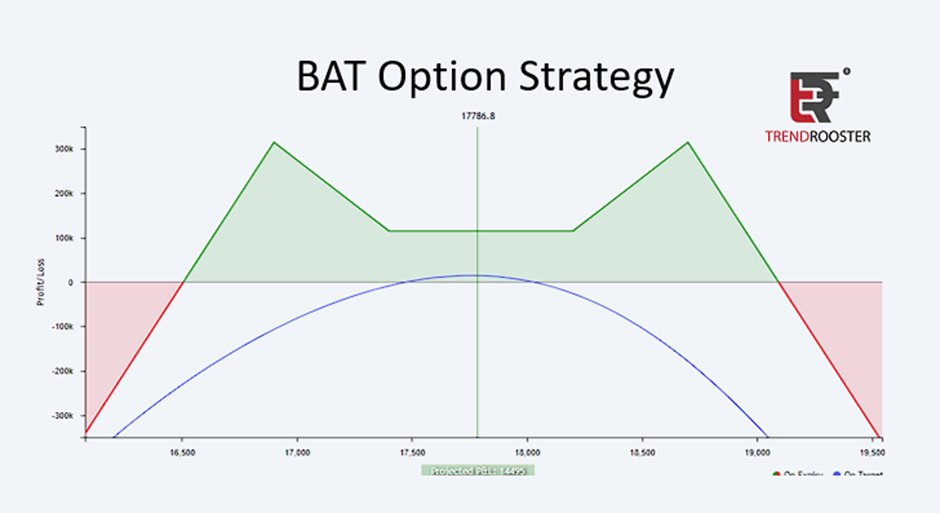

(i) BAT Strategy Construction.

(i) BAT Strategy Construction.

We all know 1SD on the normal distribution it covers 68% probability. This is well known fact and it will remain same. Of course, once the distribution is changed based on movement, time duration or volatility it will increase or decrease the 1SD level.

We all know 1SD on the normal distribution it covers 68% probability. This is well known fact and it will remain same. Of course, once the distribution is changed based on movement, time duration or volatility it will increase or decrease the 1SD level.

09/04/2021 - Friday

09/04/2021 - Friday