FT reports that Terry Smith took home £30m last year. Unfortunately, they got this totally wrong. Why? Well they failed to watch my video about related party transactions. And I even used Fundsmith as an example. Read on for more......

ft.com/content/8420a1…

ft.com/content/8420a1…

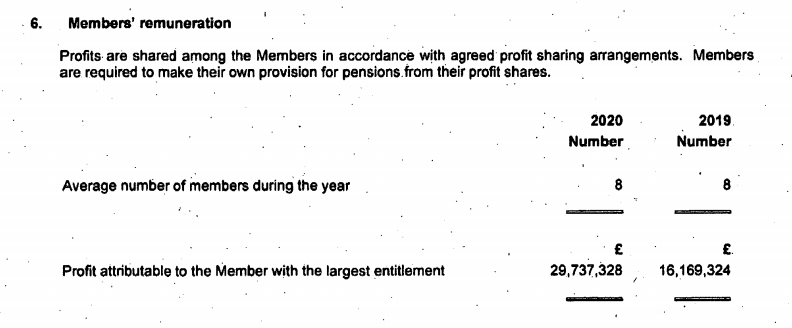

In the latest video on my YouTube channel (out today!), we explain how investors could under-estimate how much Terry Smith takes home. This is exactly the trap that the FT has fallen into. They have taken the highest paid member's pay and assumed that was Terry.

Now the highest paid partner may well be Terry Smith, and I would say he deserves it as he has been an absolutely stellar fund manager. The business generated revenues of £228m last year and has AUM of c.$23bn per the FT. But that profit figure of £49m is rather understated...

.. because it's derived after £180m of admin expenses, for a company that has 23 staff and 8 partners. The reason is in the related parties note: £156m was paid to FISL, a related party....

I explain in the video that this appears to be a Mauritius entity, controlled by Terry Smith and is likely a better indicator of what Terry Smith made last year. Well done Terry and well deserved. Poor job FT, watch the video for more...

• • •

Missing some Tweet in this thread? You can try to

force a refresh