Today's COVID vaccination update:

- Total shots given: 8,898,865

- Shots per 100 people: 23.4

- Shots reported today: 297,534

- Inventory: 9.4 days (at avg pace)

Source: covid19tracker.ca/vaccinationtra…

- Total shots given: 8,898,865

- Shots per 100 people: 23.4

- Shots reported today: 297,534

- Inventory: 9.4 days (at avg pace)

Source: covid19tracker.ca/vaccinationtra…

Canada is now up to 8.9 million shots given -- which is 77.6% of the total 11.5M doses available. Over the past 7 days, 1,226,790 doses have been delivered to provinces.

And so far 840k are fully vaccinated with two shots.

And so far 840k are fully vaccinated with two shots.

Canada's pace of vaccination:

Today's 297,534 shots given compares to an average of 272,674/day over the past week and 185,681/day the week prior.

- Pace req'd for 2 doses to 75% of Canadians by Sept 30: 284,693

- At current avg pace, we reach 75% by Oct 2021

Today's 297,534 shots given compares to an average of 272,674/day over the past week and 185,681/day the week prior.

- Pace req'd for 2 doses to 75% of Canadians by Sept 30: 284,693

- At current avg pace, we reach 75% by Oct 2021

But based on just the share of people with 1 or more doses (a weaker threshold), at Canada's current pace we reach 25% by April, 50% by May, and 75% by July 2021.

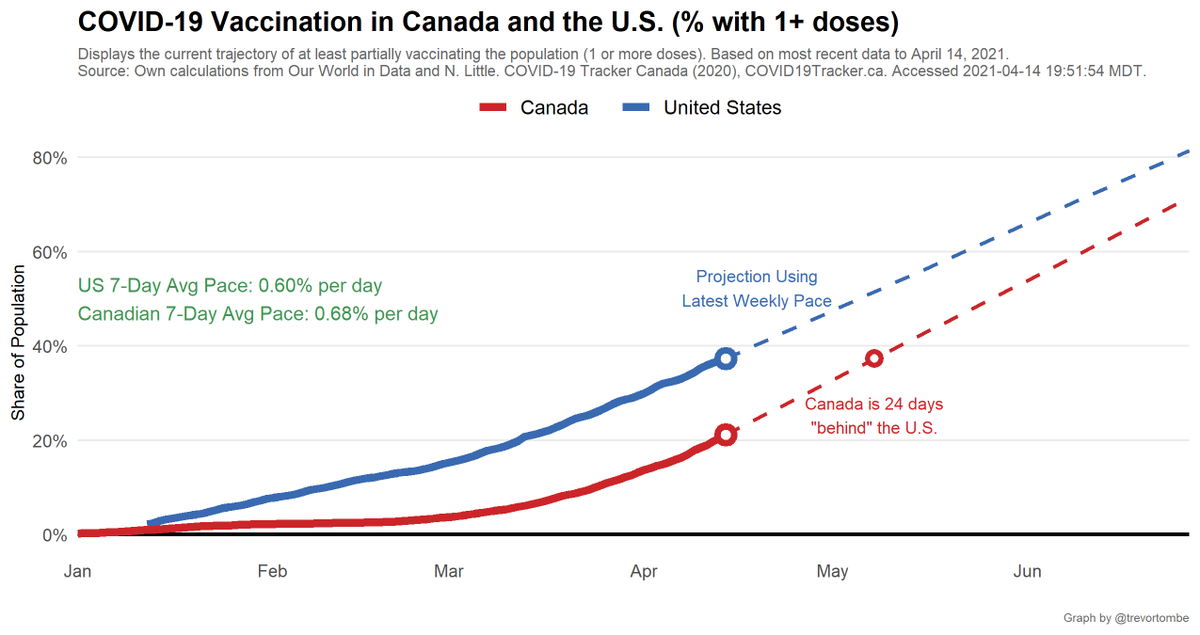

For context, at Canada's latest 7-day average daily pace, the share of people with 1 or more doses increases by 0.68% per day. The U.S. average increase is 0.60% per day. For Canada to reach the current U.S. share would take 24 days.

Turning to individual provinces, here's doses administered over time and the latest share of deliveries used. SK leading with 92.0% of delivered doses administered while NU has administered 63.7%.

Note: Shares >100% are due to squeezing 'extra' doses from vaccine vials.

Note: Shares >100% are due to squeezing 'extra' doses from vaccine vials.

Vaccination pace varies widely. Here's time to reach 75% of adults w/ 1+ doses based on the latest 7-day average daily pace.

- SK fastest at 41 days.

- PE slowest at 77 days.

On pace for June goal: SK, QC, MB, NL, BC, ON, AB, NB, NS, PE

Not on pace:

- SK fastest at 41 days.

- PE slowest at 77 days.

On pace for June goal: SK, QC, MB, NL, BC, ON, AB, NB, NS, PE

Not on pace:

And here's where things stand today:

- Highest overall: YT at 59% receiving at least one shot

- Most 1st doses only: QC at 24% receiving that shot

- Most Fully Vaccinated: NA at NA

- Fewest Vaccinated: NA at NA

- Highest overall: YT at 59% receiving at least one shot

- Most 1st doses only: QC at 24% receiving that shot

- Most Fully Vaccinated: NA at NA

- Fewest Vaccinated: NA at NA

How does Canada compare to others? Currently, Canada ranks 7th out of 37 OECD countries in terms of the share of the population that is at least partially vaccinated. In terms of total doses per 100, Canada is 12th.

Source: ourworldindata.org/covid-vaccinat…

Source: ourworldindata.org/covid-vaccinat…

Finally, here's a selection across several metrics/groups of how Canada ranks globally. Quite well overall!

• • •

Missing some Tweet in this thread? You can try to

force a refresh