Professor @EconCalgary | Fiscal/Econ Policy Director @policy_school | Alum @econuoft @SFUBeedie | Contributor @TheHubCanada | 💻 📊 📝 🍻

3 subscribers

How to get URL link on X (Twitter) App

TL;DR: Carbon taxes in Canada, such as the federal $80/tonne emissions price, are often criticized for raising costs. But we find that emissions pricing increases domestic food costs modestly—about 0.8%—with imports shrinking the overall impact on food prices to about 0.5%.

TL;DR: Carbon taxes in Canada, such as the federal $80/tonne emissions price, are often criticized for raising costs. But we find that emissions pricing increases domestic food costs modestly—about 0.8%—with imports shrinking the overall impact on food prices to about 0.5%.

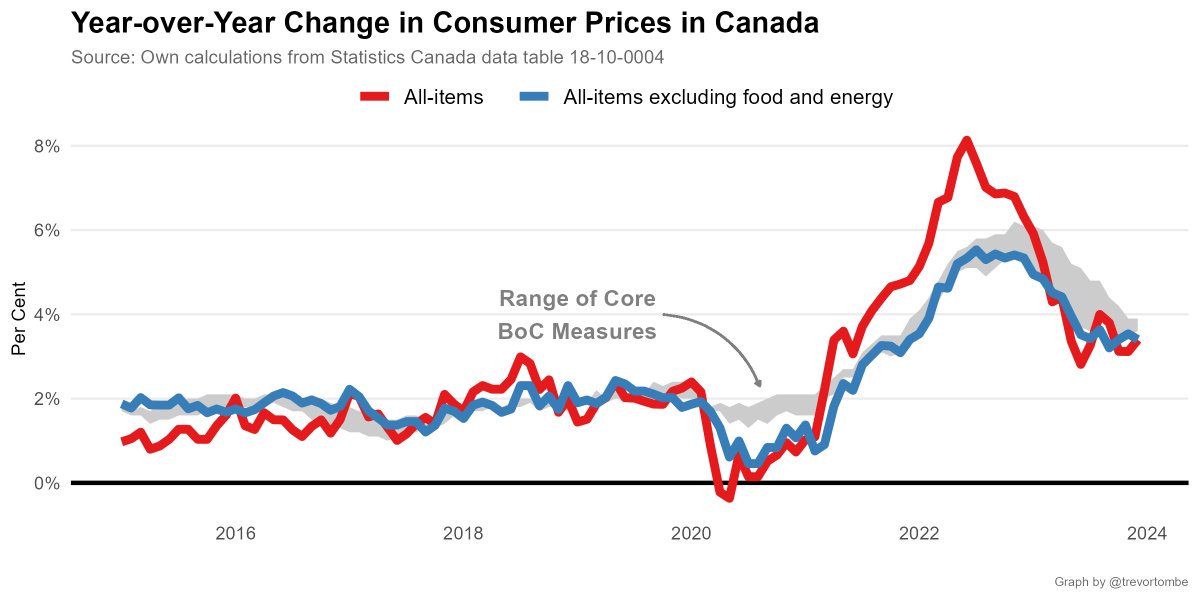

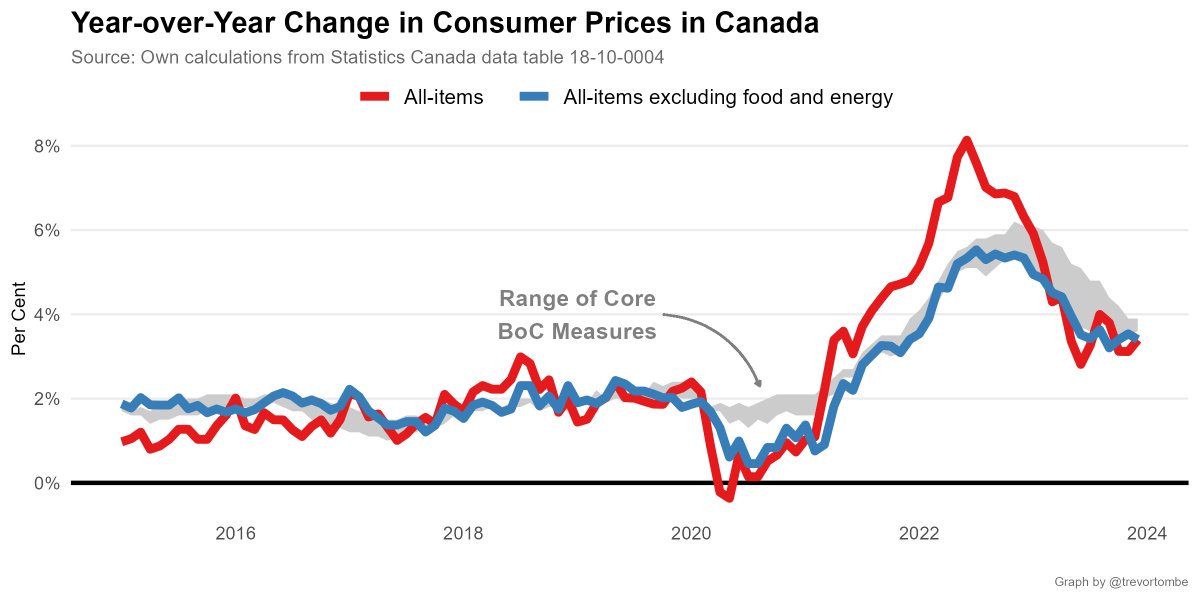

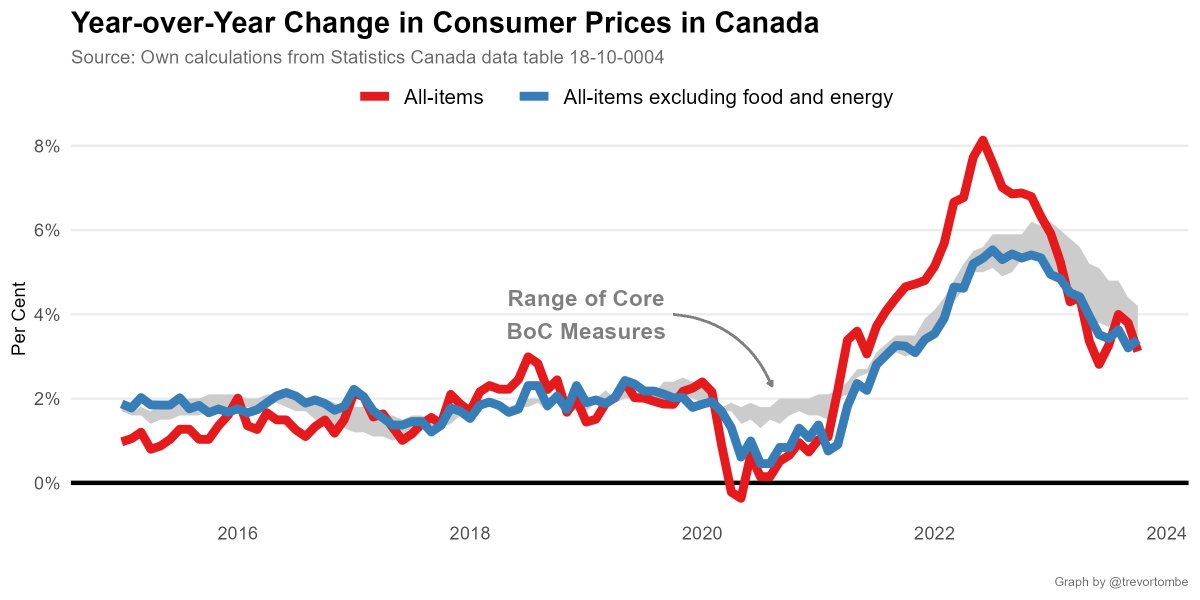

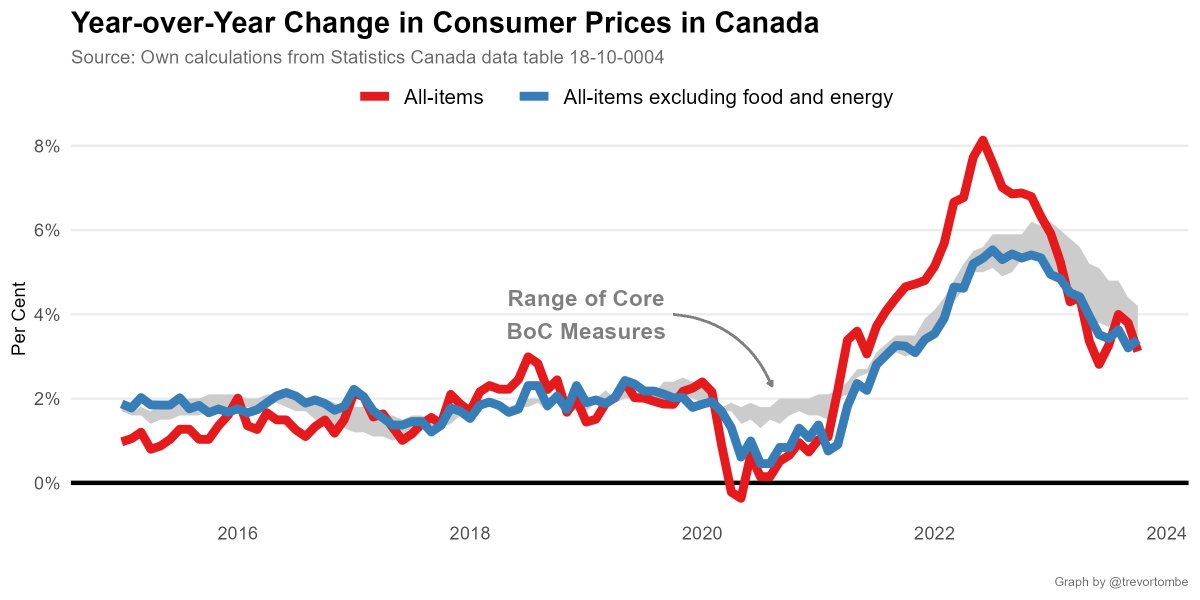

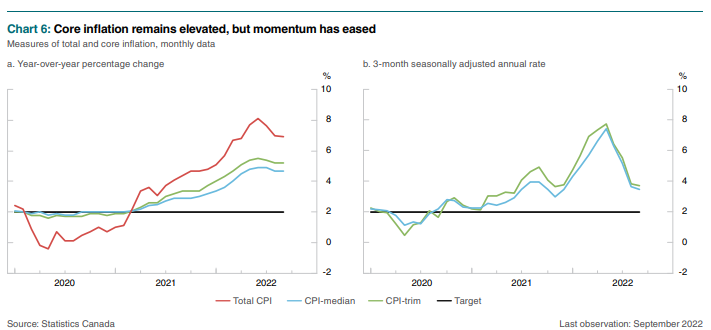

The key Bank of Canada core measures of inflation have also remained within the target range -- lower than 2% -- over the past 3 months. This is what the bank is looking forward before lowering rates.

The key Bank of Canada core measures of inflation have also remained within the target range -- lower than 2% -- over the past 3 months. This is what the bank is looking forward before lowering rates.

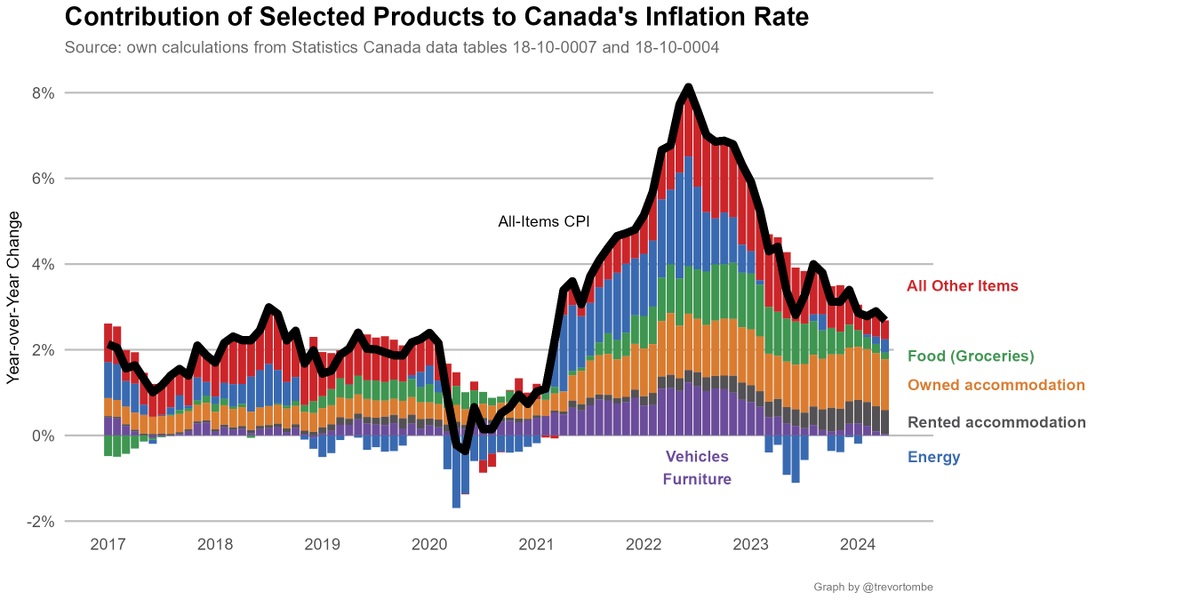

Looking at the headline rate, shelter is larger contributor. Rent accounts for ~0.5 points of the 2.9, mortgage interest costs ~1.0 points.

Looking at the headline rate, shelter is larger contributor. Rent accounts for ~0.5 points of the 2.9, mortgage interest costs ~1.0 points.

This is higher than last month, true, but it doesn't mean the inflation situation is worsening. I noted this yesterday, saying 3.4% was the number to watch.

This is higher than last month, true, but it doesn't mean the inflation situation is worsening. I noted this yesterday, saying 3.4% was the number to watch. https://x.com/trevortombe/status/1746926368896549304?s=20

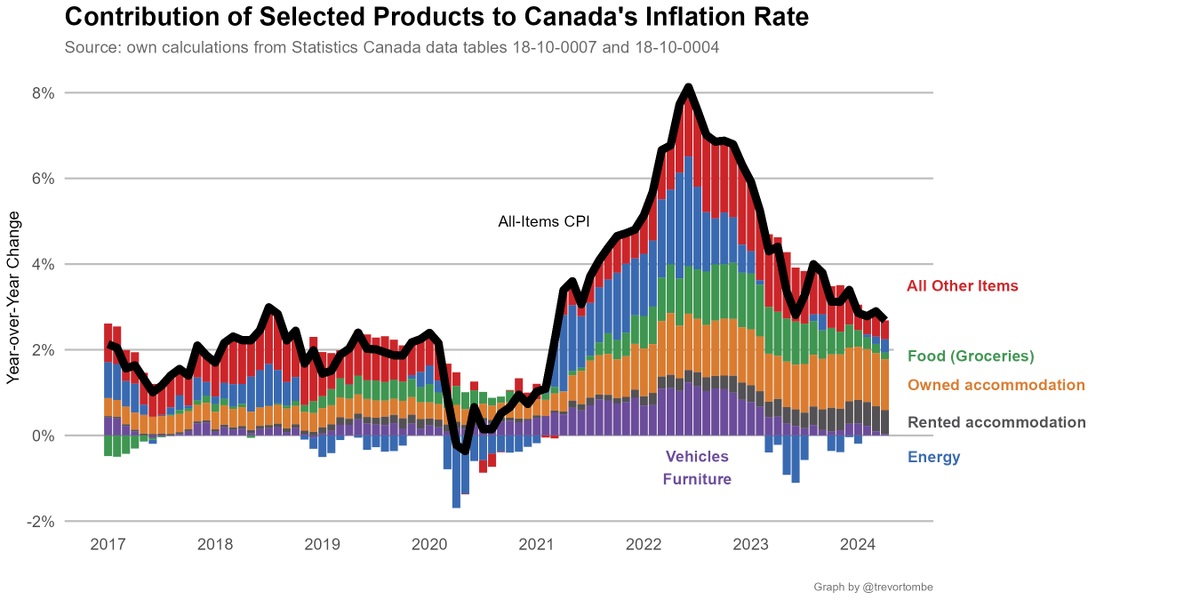

A big part of the reason is from lower gasoline prices. That's anticipated because oil prices were down. There's a tight connection between energy's contribution to CPI and oil prices (obviously). This has been a consistent story over the past two years.

A big part of the reason is from lower gasoline prices. That's anticipated because oil prices were down. There's a tight connection between energy's contribution to CPI and oil prices (obviously). This has been a consistent story over the past two years.

https://twitter.com/CGriwkowsky/status/1720839143008395654The GST adds 5% to the cost of purchasing a good or service subject to this tax. Not all items are subject to it, though. I (roughly) estimate that, overall, the GST adds an average of 2.3% for consumer expenditures as a whole. (From here: )www150.statcan.gc.ca/t1/tbl1/en/tv.…

On a monthly basis, the seasonally adjusted change in core inflation in Sept was good (0.1%) -- a welcome improvement over July and August. I'll unpack some other developments in the thread below.

On a monthly basis, the seasonally adjusted change in core inflation in Sept was good (0.1%) -- a welcome improvement over July and August. I'll unpack some other developments in the thread below.

Also interesting is the reversal not only in the government's spending restraint but also in its debt reduction plans. Basically holding the line now.

Also interesting is the reversal not only in the government's spending restraint but also in its debt reduction plans. Basically holding the line now.

https://twitter.com/MikePMoffatt/status/1603894948490788865I can finally update my EQ assignment for the @policy_school public finance students! They've been stuck in 2018/19 for years now... 2023/24 makes the calculation interesting again!!

https://twitter.com/CTVNews/status/1597692271138324485First, here's the full picture of the Bank of Canada's finances for 2021 before all the fun started.

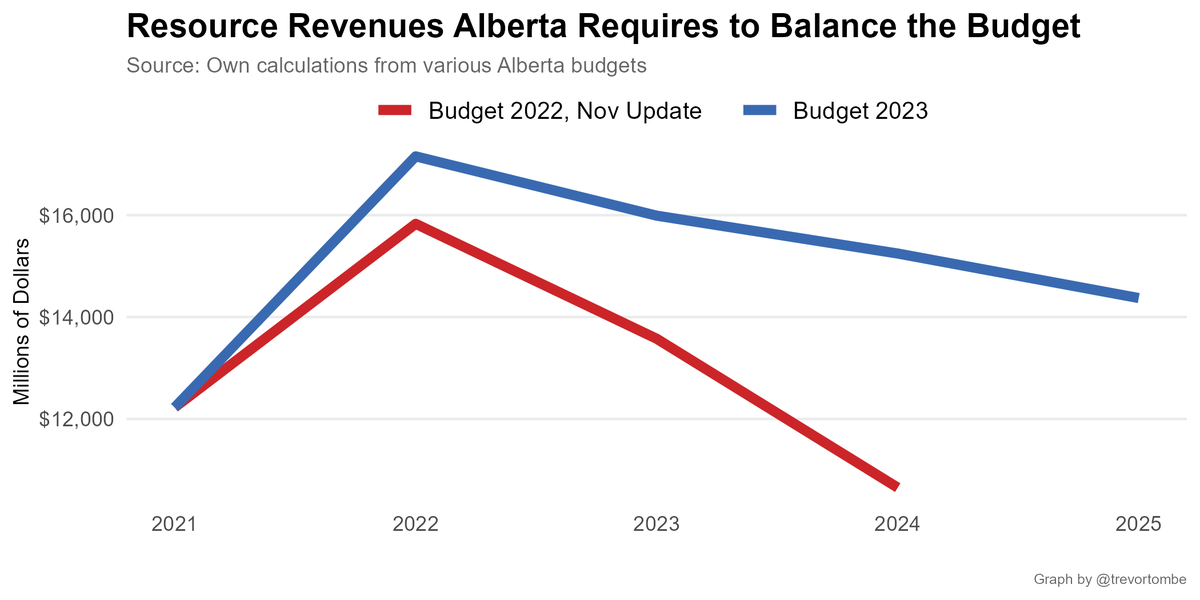

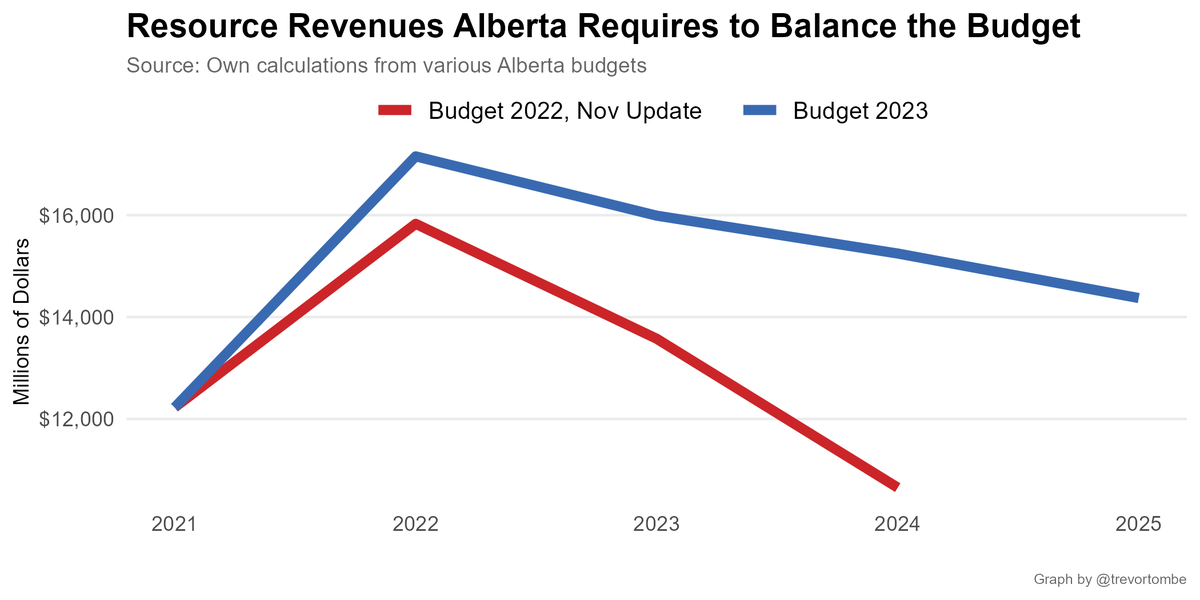

Hard to be precise, but it looks like the overwhelming majority of the increase in income taxes is due to high oil prices.

Hard to be precise, but it looks like the overwhelming majority of the increase in income taxes is due to high oil prices.

This isn't just nitpicking, it's an important head scratcher. They say clearly that rates will need to rise further *because* inflation is persistently high (sorta). But their own projections are for it to fall back below 3 percent by Q4 2023.

This isn't just nitpicking, it's an important head scratcher. They say clearly that rates will need to rise further *because* inflation is persistently high (sorta). But their own projections are for it to fall back below 3 percent by Q4 2023.

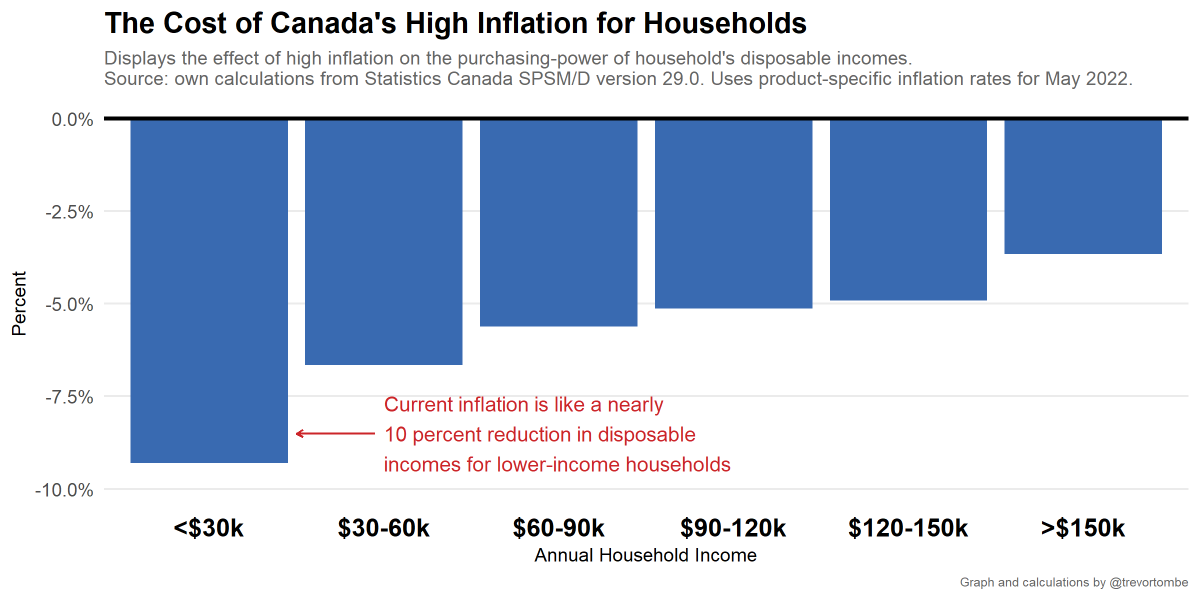

I estimate the effect of price increases on household disposable incomes here 👇. The high rates for May (reported today) are like a nearly 10 percent reduction in the disposable incomes of the lowest income families. Let that sink in a moment.

I estimate the effect of price increases on household disposable incomes here 👇. The high rates for May (reported today) are like a nearly 10 percent reduction in the disposable incomes of the lowest income families. Let that sink in a moment.

This is not to deny the financial pressures that price increases create. But it shows that the biggest pressures are narrowly concentrated. This may matter for policy makers trying to figure out where to direct efforts and to understand what is going on.

This is not to deny the financial pressures that price increases create. But it shows that the biggest pressures are narrowly concentrated. This may matter for policy makers trying to figure out where to direct efforts and to understand what is going on.