1/ In the 1920's, Germany experienced hyperinflation because it had a large amount of public debt from World War 1, which its central bank covered by printing money. The central bank governor sought to "buy time" for the politicians.

I see so much of Lebanon in there. 👇

I see so much of Lebanon in there. 👇

** The excerpts below are from the book "Lords of Finance" by Liaquat Ahamed about the role of central bankers in the period between World War 1 and World War 2.

The passages are not that long. I really recommend reading them.

The passages are not that long. I really recommend reading them.

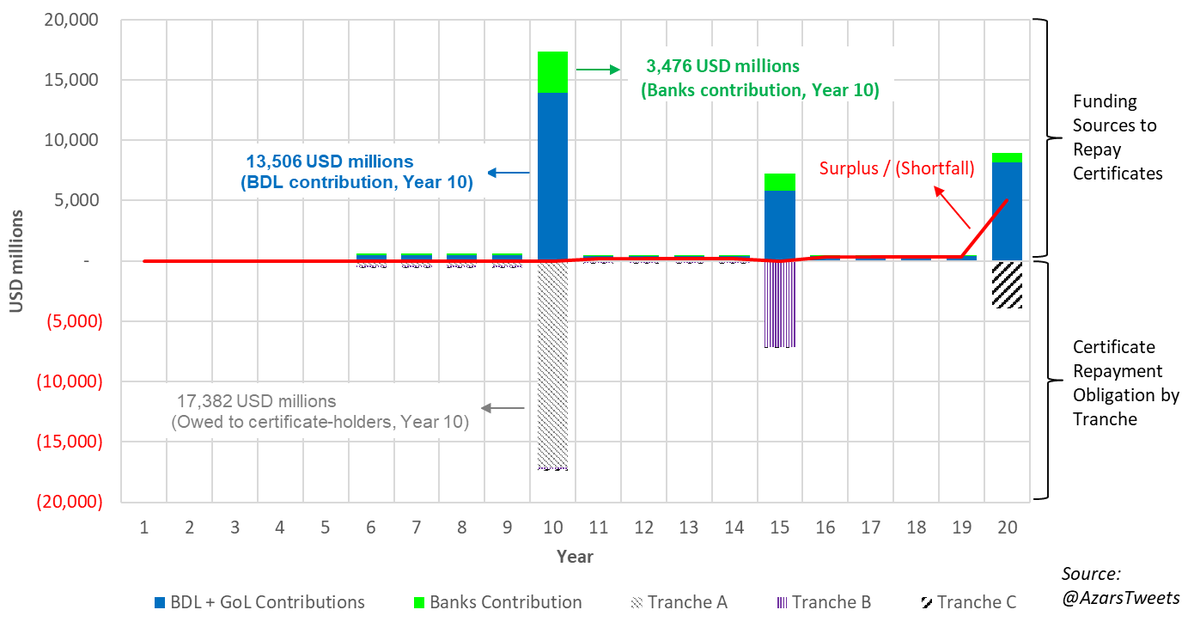

2/ The central bank governor allowed the Reichsbank to keep printing money to fund the public sector (for Leb, this could include the Govt + BDL debts, as is happening now). People wondered why he never "stopped the printers".

Intentional or ignorance?

Intentional or ignorance?

4/ He sought to "buy time" for the politicians. It failed. Eventually, Germany hit a trigger point and the currency totally fell apart.

Sound familiar?

Sound familiar?

5/ He never admitted to his mistakes and, eventually, the currency became worthless, and commerce became impossible.

6/ He refused to take responsibility for his role in the crisis and change course. Instead, he dug in, blamed others, and "hid the losses" by giving the illusion of solvency.

This is the consequence of pretending there are no losses that need to sorted out.

This is the consequence of pretending there are no losses that need to sorted out.

7/ Outside observers noted that it would be impossible to hope for a recovery "unless power is taken entirely from the lunatics presently in charge."

8/ How was this affecting the average German citizens?

"Fresh Dollar" concept, whereby people earning foreign income live luxuriously because of the currency devaluation, while locals suffer.

"Fresh Dollar" concept, whereby people earning foreign income live luxuriously because of the currency devaluation, while locals suffer.

10/ A strange mental illness emerged because of the hyperinflation: Cypher Stroke.

Even your average housewife began to closely track the hourly exchange rate (addeh el dollar?).

Eventually, people dropped the German Mark and turned to barter or foreign currencies.

Even your average housewife began to closely track the hourly exchange rate (addeh el dollar?).

Eventually, people dropped the German Mark and turned to barter or foreign currencies.

11/ Beneficiaries of the crisis: "Speculators" and "Profiteers from Imported Commodities".

Dollar mad3oom? Politicians and others with money abroad buying up assets (and people) in Lebanon at fire sale prices? Someone always benefits.

Dollar mad3oom? Politicians and others with money abroad buying up assets (and people) in Lebanon at fire sale prices? Someone always benefits.

12/ The "Rise of Extremism" and "Destruction of Social Values".

You all know what happened soon after this episode in Germany.

You all know what happened soon after this episode in Germany.

13/ Keynes made the following observations at the time: The End of Civilization.

In the longer text, he's referring to the war, but fundamentally he's referring to the "incompetent" & "wicked" politicians' refusal to do anything to stop the accumulation of losses.

In the longer text, he's referring to the war, but fundamentally he's referring to the "incompetent" & "wicked" politicians' refusal to do anything to stop the accumulation of losses.

• • •

Missing some Tweet in this thread? You can try to

force a refresh