BattCharts by #BattChat

🔋📈🔋📊🔋📉

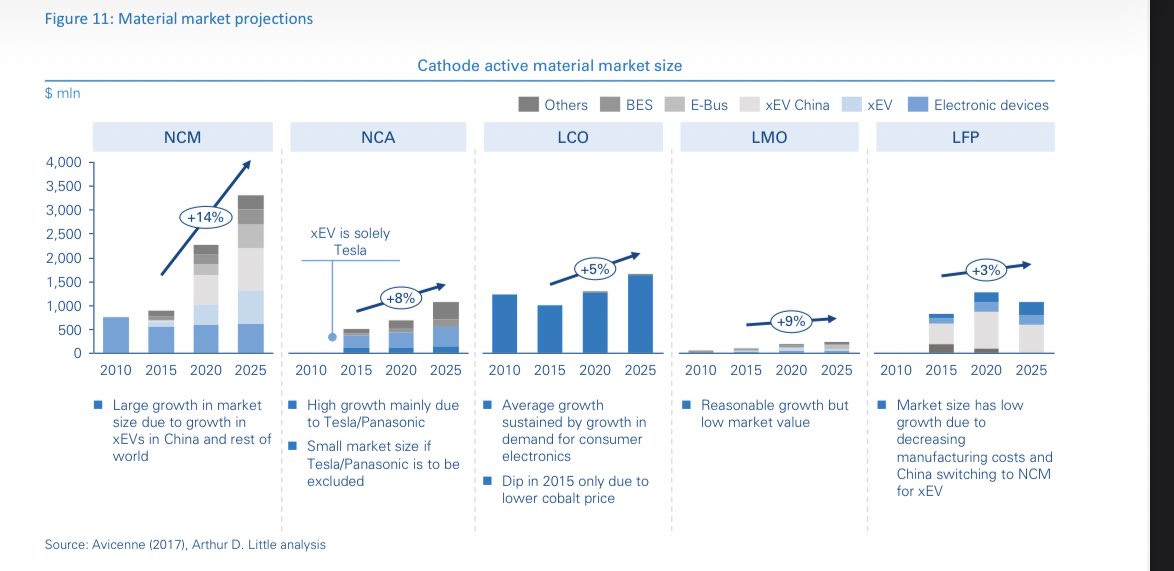

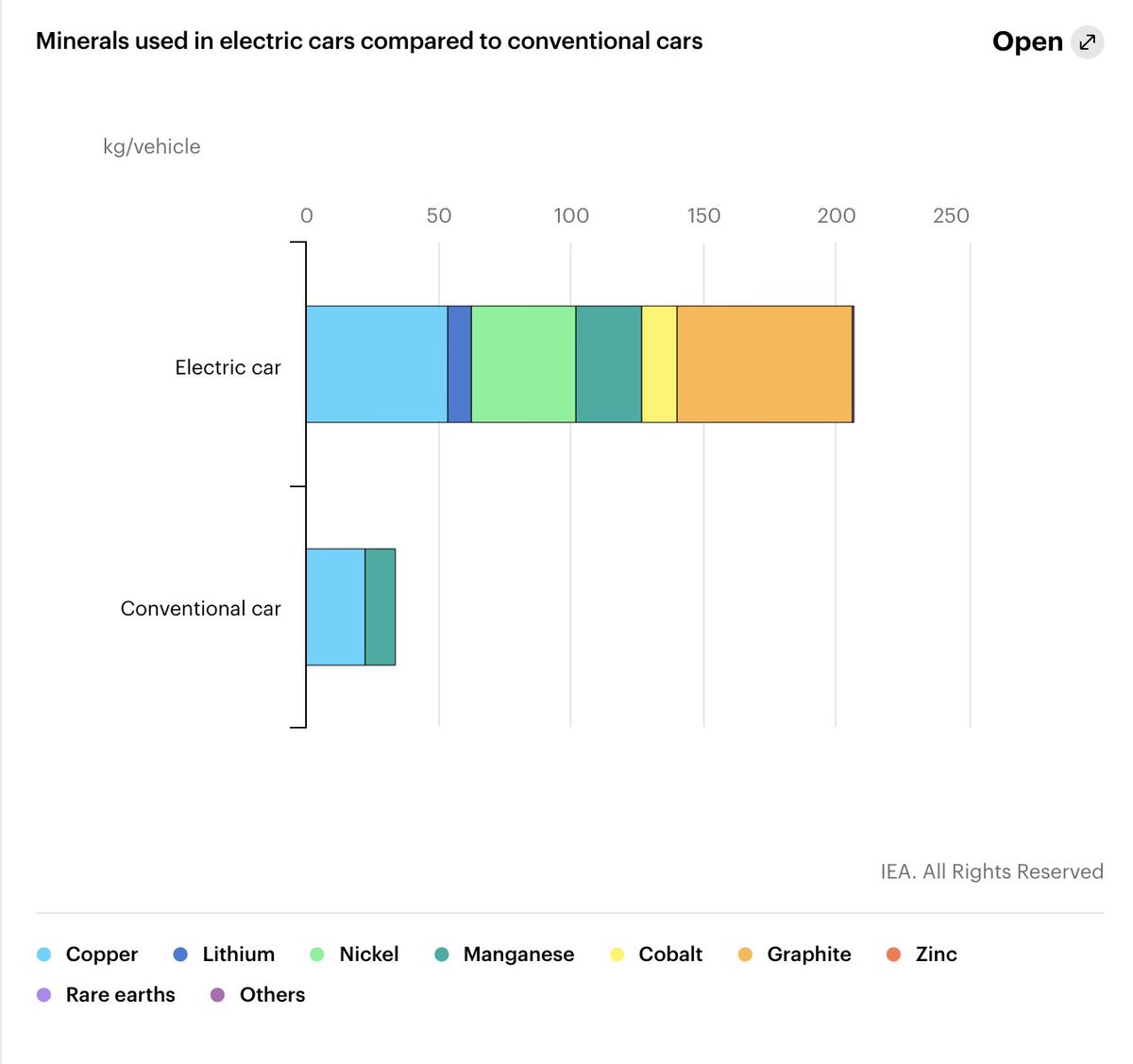

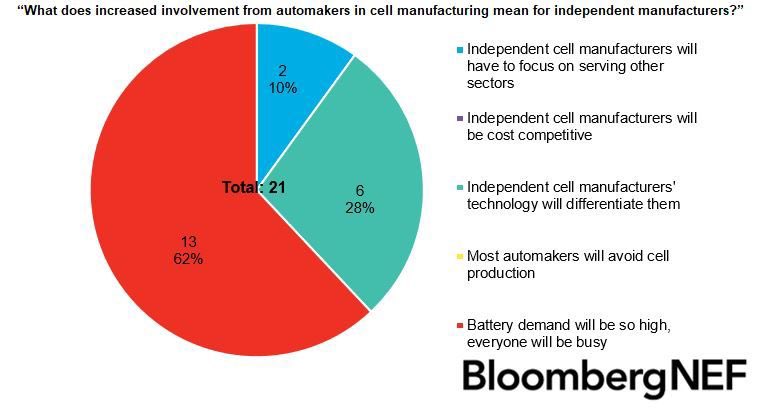

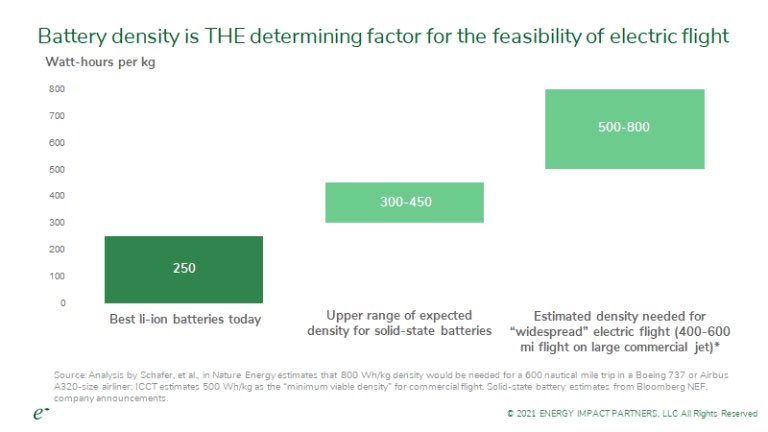

Aggregating random battery charts, figures, and forecasts from across #batterytwitter

🔋📈🔋📊🔋📉

Aggregating random battery charts, figures, and forecasts from across #batterytwitter

• • •

Missing some Tweet in this thread? You can try to

force a refresh