A thought experiment: Sometimes I wring my hands on stocks that I have "missed" that were "obvious" (see previous tweets on $GOOGL). So I thought I would test an extreme version of this bias to see how it fares...

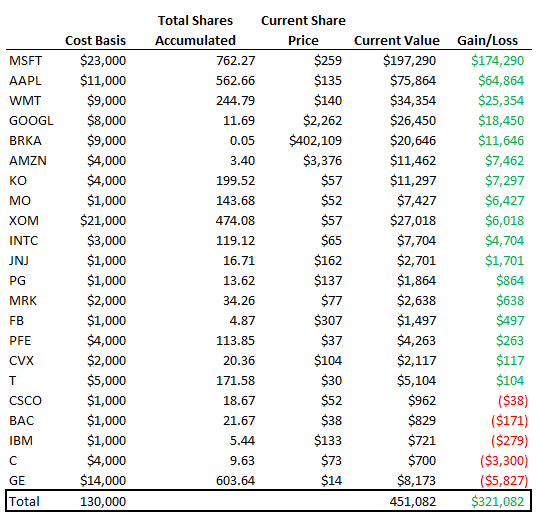

Let's say you bought the 5 largest stocks by market cap each year since 1995. You equal weight them and you invest in them on Day 1 of that year. For my experiment I just assumed I buy $1000 worth of each of the top 5, or $5000 total every year.

Despite accumulating a ton of shares in losers like $GE, you also accumulated a lot of $MSFT, $AAPL, $WMT, and $GOOGL. Remember, you only bought these stocks when they were a top 5 market cap company. This is perhaps the worst "market timing" strategy imaginable.

If, instead of buying the top 5, you bought $5000 worth of S&P500 instead, you'd end up with 108.5 accumulated shares, and at the current index price of $4,161, you'd have a stake worth $451,385. Basically exactly the same as the top 5 market cap strategy.

BUT, I have glaringly omitted two very important variables, dividends accumulated and spin-offs. $MO split into $MO, $PM and Kraft which became $KHC. $MRK and $GE are spinning off divisions now. I'm sure there are more that I'm missing.

In other words, I've significantly underrepresented the returns from accumulating the top 5 mkt cap companies. My guess (without running the full math) is that with spinoffs/dividends, that strategy actually outperforms the S&P.

Moral of the story for me: there is no such thing as "missing" an investment. If your horizon is long enough, even an asinine strategy of buying the largest of large companies works over time. You can buy $MSFT, $GOOGL, $AAPL, etc at this point in time and probably still do well

• • •

Missing some Tweet in this thread? You can try to

force a refresh