1/ Idiosyncratic Skewness of Commodity Futures Returns (Han, Mo, Su, Zhu)

"A novel asymmetry measure, IE, is better at capturing the effect of idiosyncratic skewness and largely accounts for the skewness effect documented in previous studies."

papers.ssrn.com/sol3/papers.cf…

"A novel asymmetry measure, IE, is better at capturing the effect of idiosyncratic skewness and largely accounts for the skewness effect documented in previous studies."

papers.ssrn.com/sol3/papers.cf…

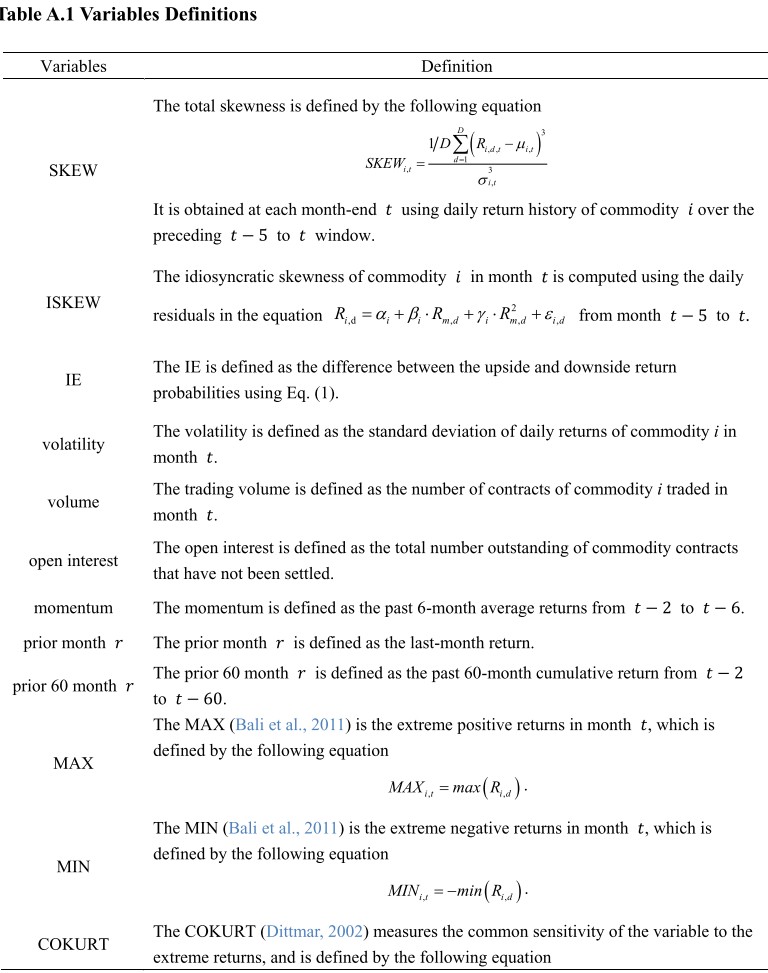

2/ "We employ Jiang et al.'s new measure of idiosyncratic skewness: the excess tail probability where the probabilities are evaluated at a half SD away from the mean (zero)."

x= idiosyncratic individual commodity return based on six months of residuals using GSCI as the market

x= idiosyncratic individual commodity return based on six months of residuals using GSCI as the market

3/ "An increase in the idiosyncratic skewness will reduce the expected returns of commodities even after controlling for other characteristics. This implies that idiosyncratic skewness, as measured by IE,

captures additional information beyond those characteristics."

captures additional information beyond those characteristics."

4/ "For the traditional measure of idiosyncratic skewness, the effect is still negative but becomes marginally significant or insignificant.

"Thus, IE is a better measure than the traditional idiosyncratic skewness to capture the skewness effect."

"Thus, IE is a better measure than the traditional idiosyncratic skewness to capture the skewness effect."

5/ "To alleviate the problem of multicollinearity, we replace the total skewness with its component that is orthogonal to IE.

"Results suggest that the effect of the skewness in the commodity futures markets is mainly driven by the idiosyncratic skewness (IE)."

"Results suggest that the effect of the skewness in the commodity futures markets is mainly driven by the idiosyncratic skewness (IE)."

6/ "Since the preference for idiosyncratic skewness reflects a gambling motivation (Barberis and Huang, 2008; Mitton and Vorkink, 2007), we also test the robustness by adding proxies for the gambling preference as additional control variables."

7/ "The financial crisis does not have any significant impact on the effect of IE (the dummy variable always has insignificant coefficients).

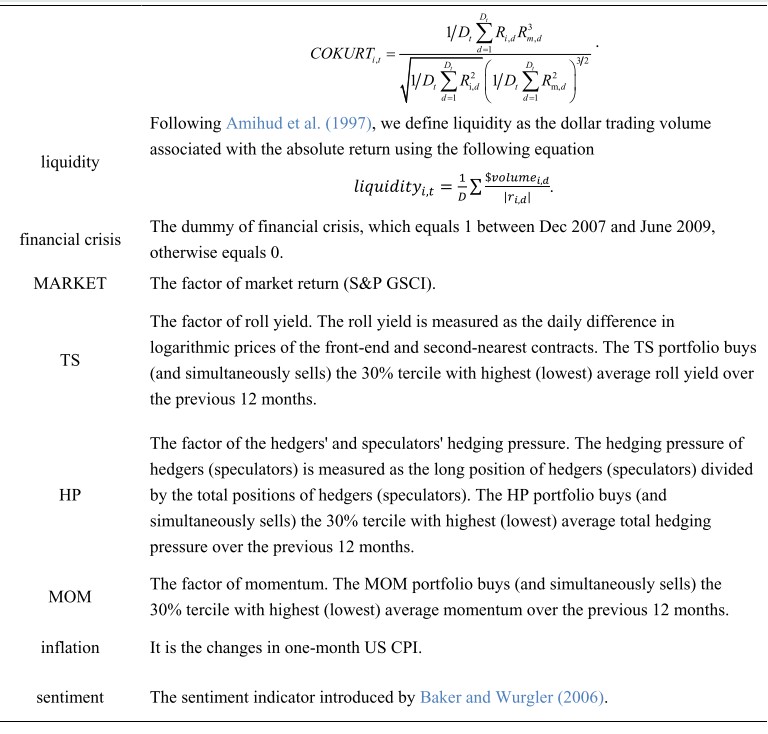

"The negative effect of IE is robust when commodity contracts are rolled a month prior to maturity rather than on the maturity date."

"The negative effect of IE is robust when commodity contracts are rolled a month prior to maturity rather than on the maturity date."

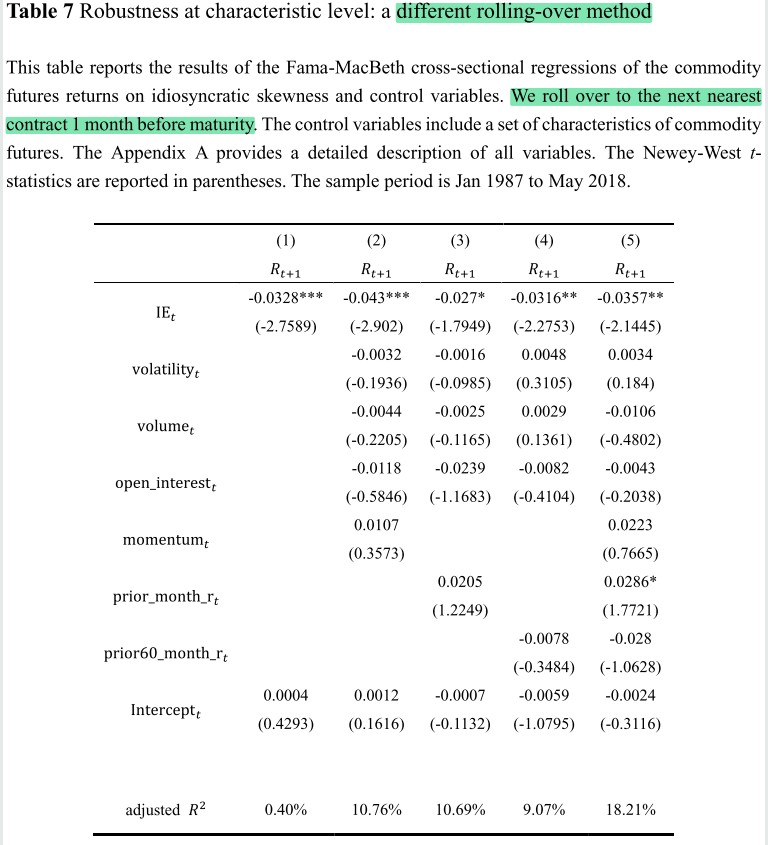

8/ "The profitability of a long/short portfolio based on idiosyncratic skewness cannot be fully explained by traditional risk factors in the commodity futures markets."

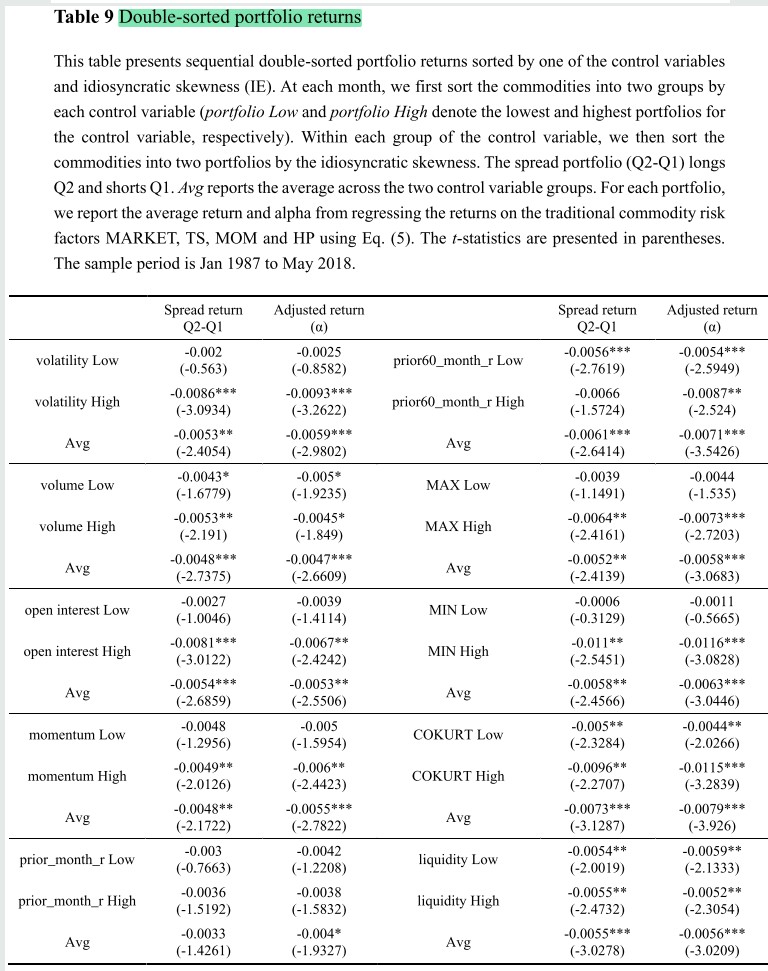

9/ "In sequential double-sorts, the IE effect cannot be explained by other control variables (consistent with the results from Section 3)."

10/ "Results imply that idiosyncratic skewness is the main component of skewness effect in the commodity futures markets (consistent with the findings in Section 3)."

11/ "Significant profits persist for months after formation, suggesting that the IE effect is rather stable. The magnitude of the spread is largely stable over 12 months."

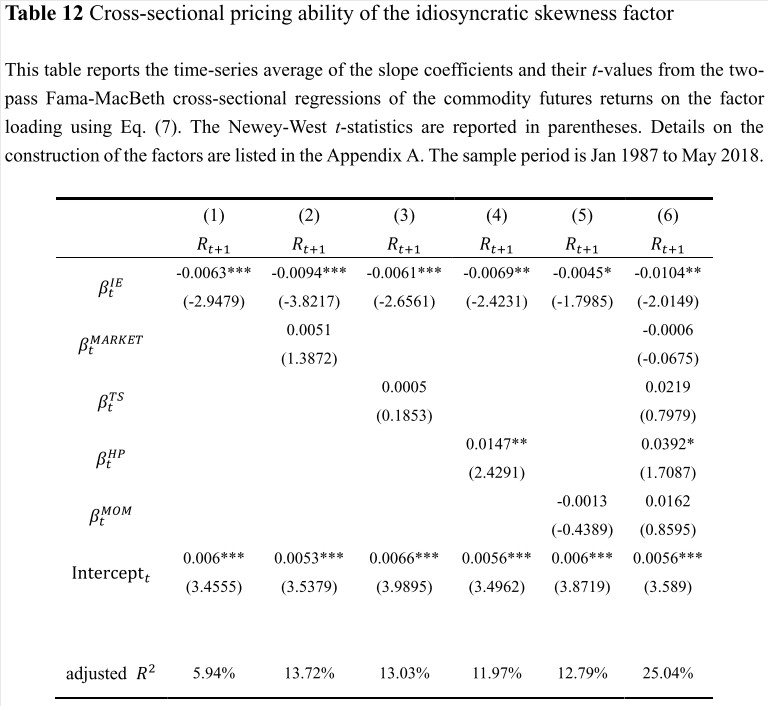

12/ "Investors require compensation for exposure to commodity futures with more negative levels of idiosyncratic skewness. After controlling for traditional risk factors separately or jointly, the price of IE is still negative and significant."

13/ "The information content in idiosyncratic skewness is not a proxy for alternative economic and financial risk factors (Amihud liquidity beta, inflation beta, or sentiment beta)."

14/ Related research

Factor-Based Commodity Investing

Long-Short Commodity Investing: A Review of the Literature

Factor-Based Commodity Investing

https://twitter.com/ReformedTrader/status/1280623560516530176

Long-Short Commodity Investing: A Review of the Literature

https://twitter.com/ReformedTrader/status/1275543016980180994

• • •

Missing some Tweet in this thread? You can try to

force a refresh