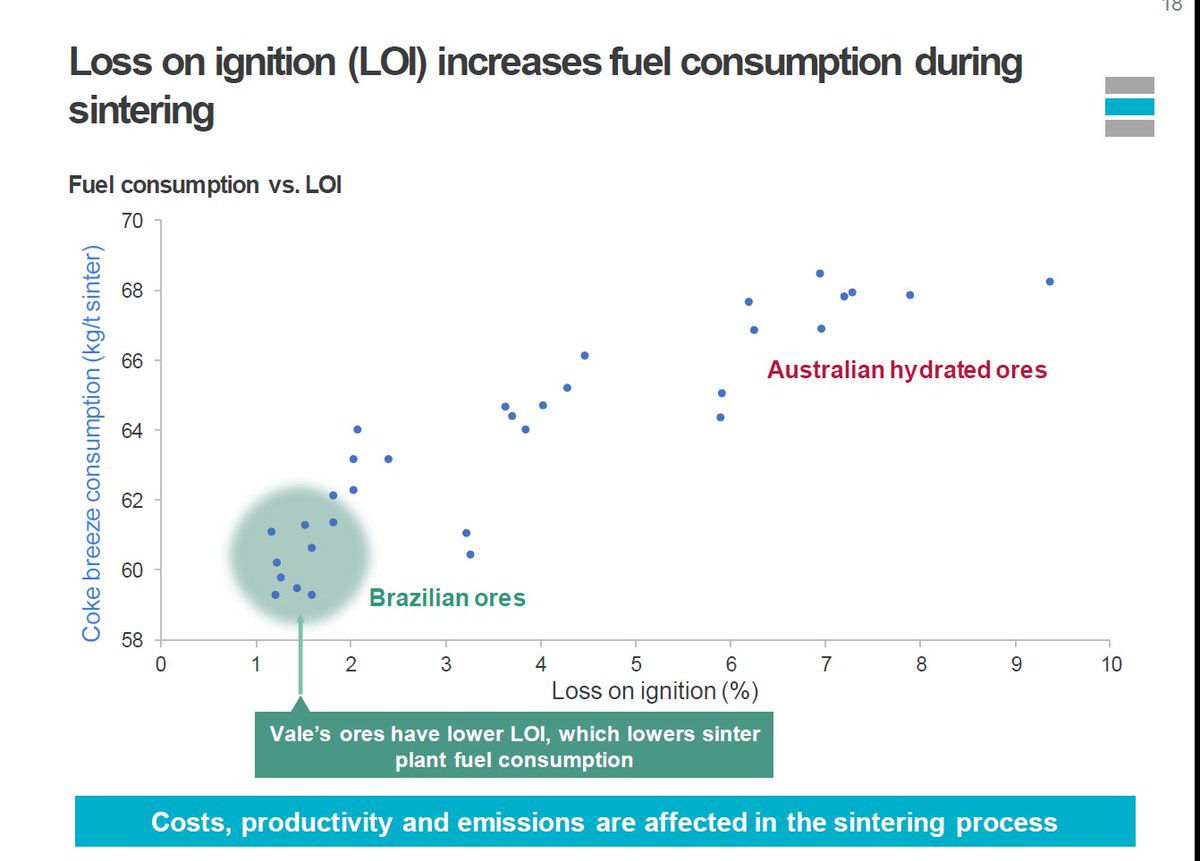

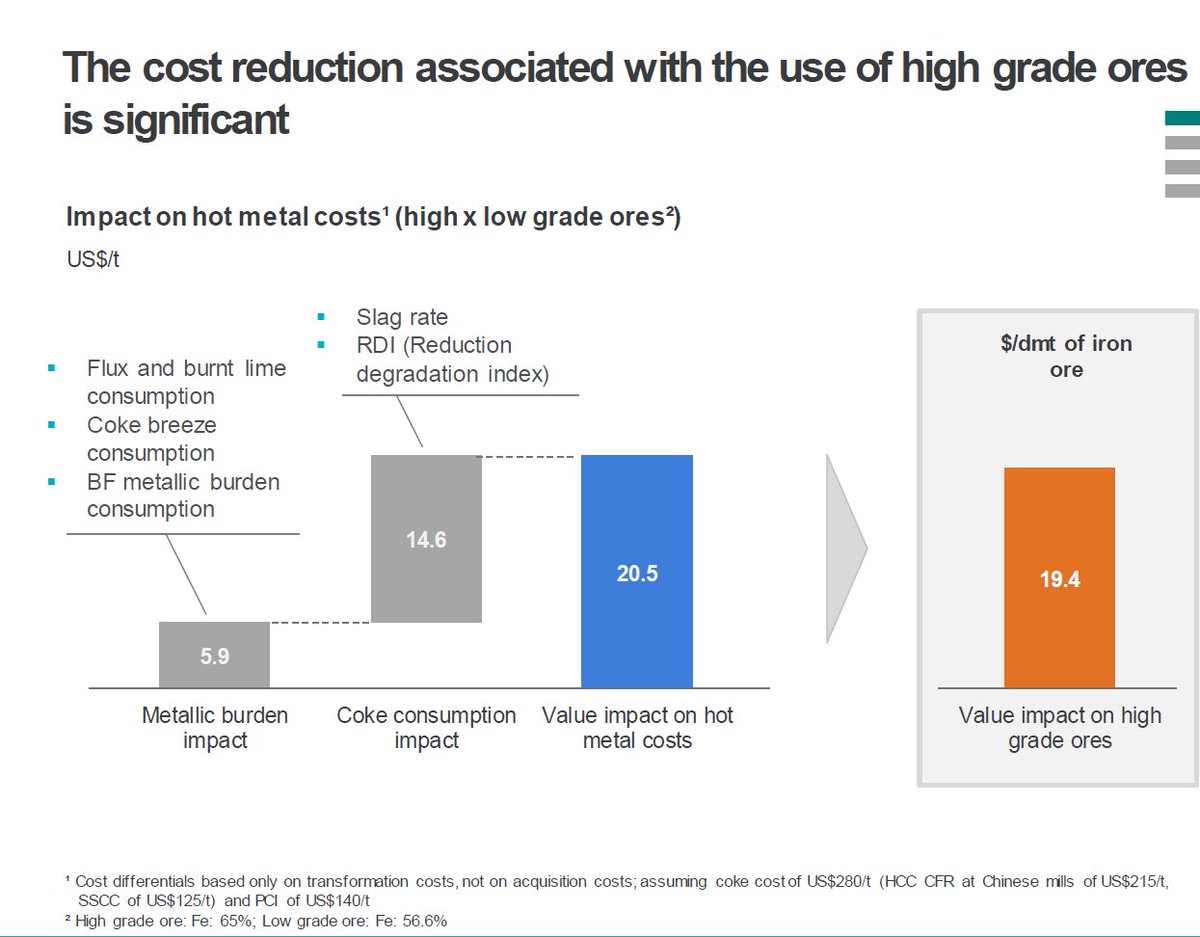

Koala wonders who could be a benificiary of a carbon price / trading mechanism being implemented in China, some slides 1/n

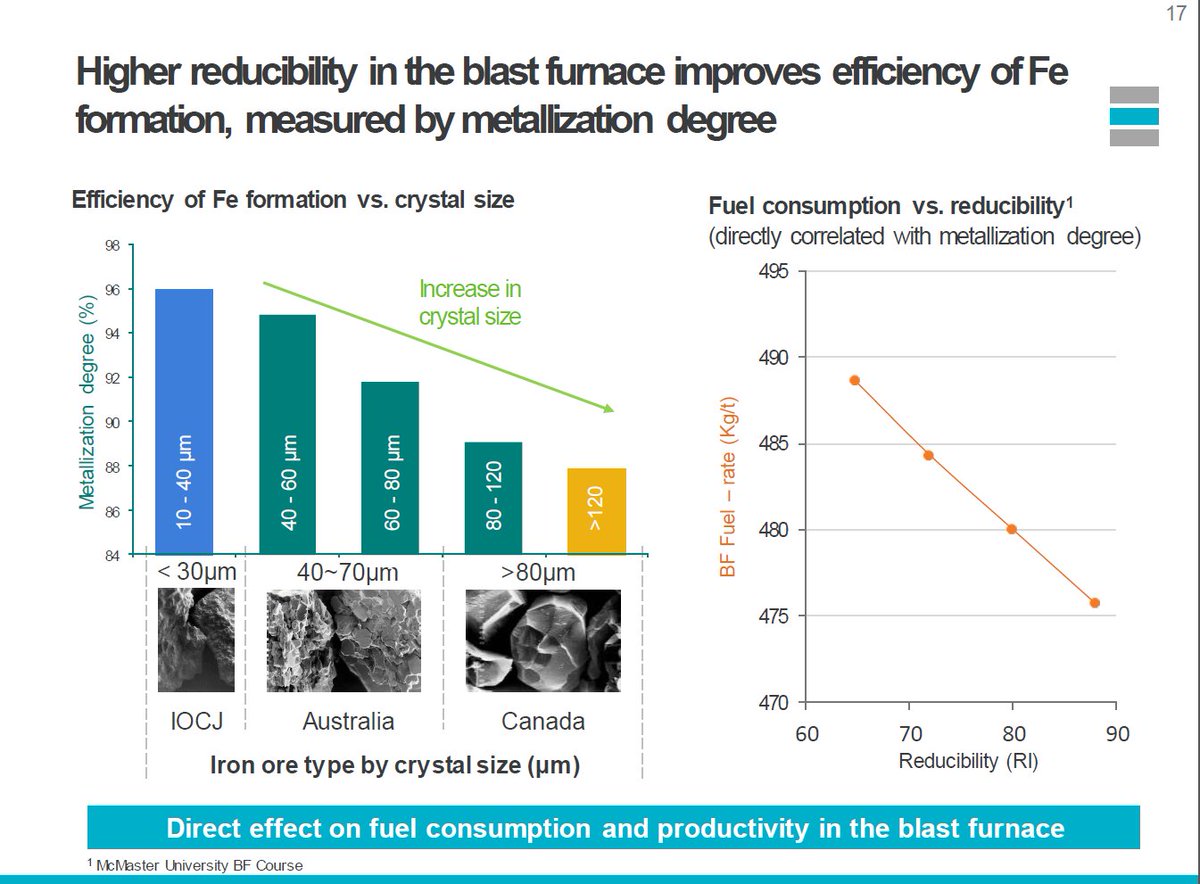

And that scrap will be our savior hypothesis? Ah, speak for yourself but the koala prefers high quality steel that will accomplish what is required of it in a building or an automobile 6/n

It's amazing how maintaining a library of old presentations over the years is a unique resource to understand where the world is going and what trends are accelerating 7/n

Especially when you realize the data shows EAFs still require metallics to supplement their scrap feeds (which a separate topic entirely, scrap is going to get weird next 10 years) 8/n

So what's the conclusion here?

Take step back from the last qtr, the last yr, or even the last 2 yrs, the longer term trends are there but everyone is just focused on the next print & their next bonus cycle

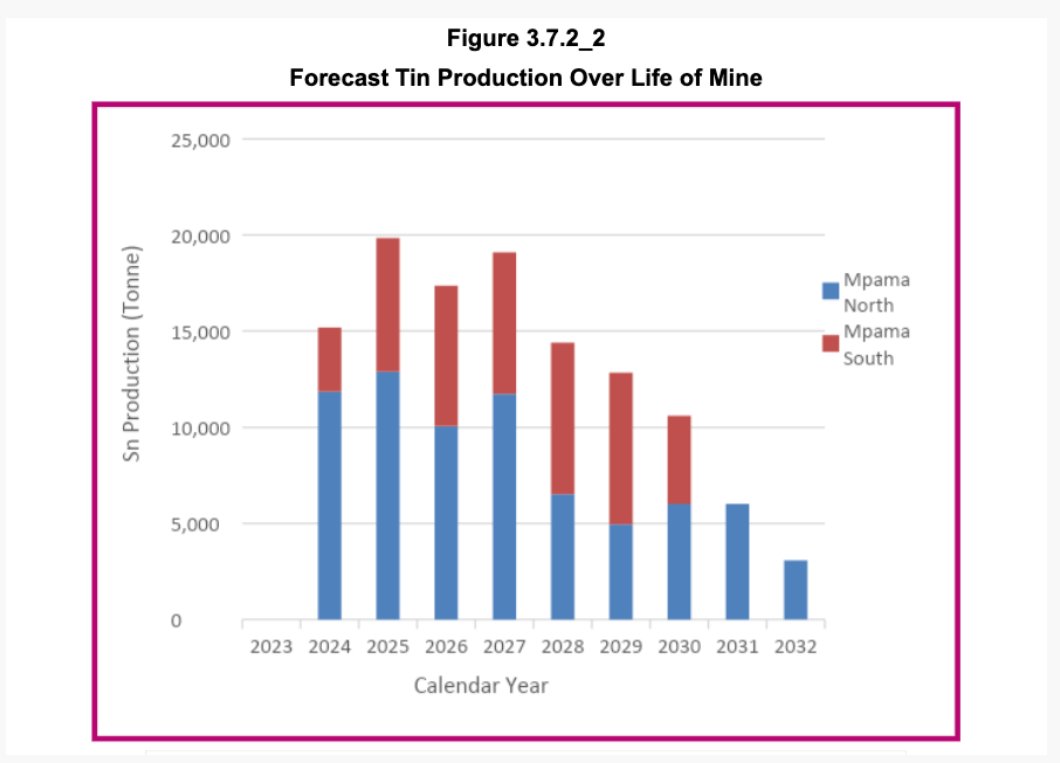

Oh, and Simandou is 10+ yrs away from hitting 100MM tpa production 9/9

Take step back from the last qtr, the last yr, or even the last 2 yrs, the longer term trends are there but everyone is just focused on the next print & their next bonus cycle

Oh, and Simandou is 10+ yrs away from hitting 100MM tpa production 9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh