I am not as smart as I sound, so please don't listen to me

3 subscribers

How to get URL link on X (Twitter) App

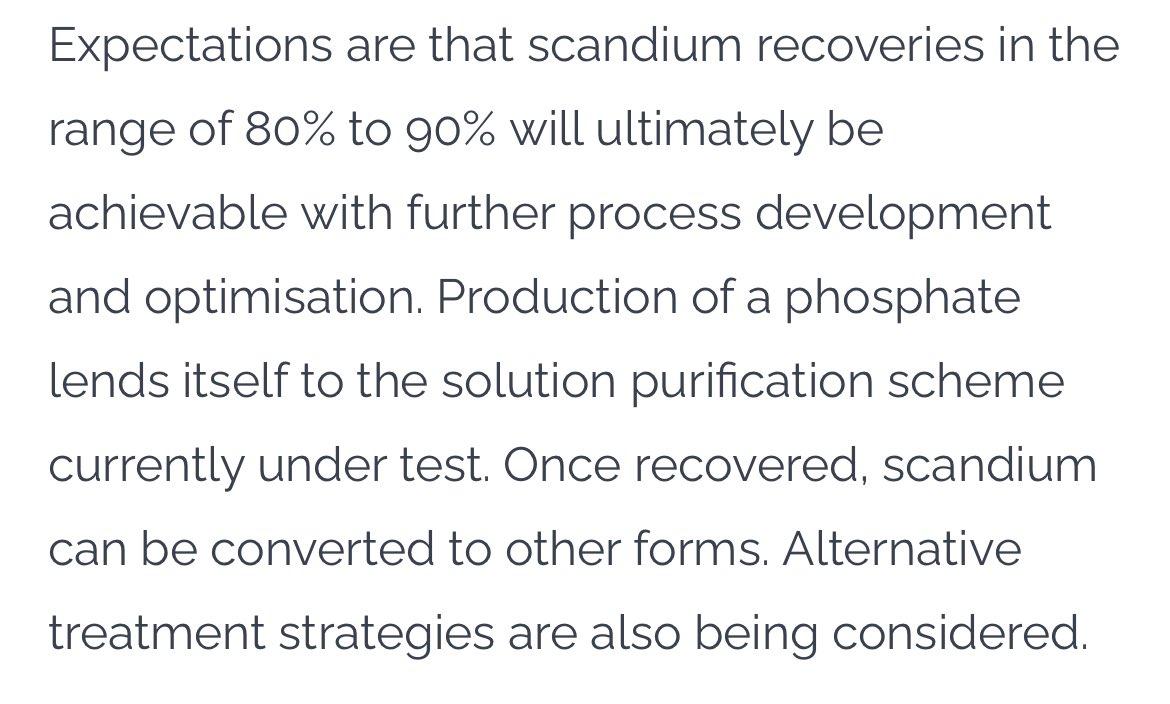

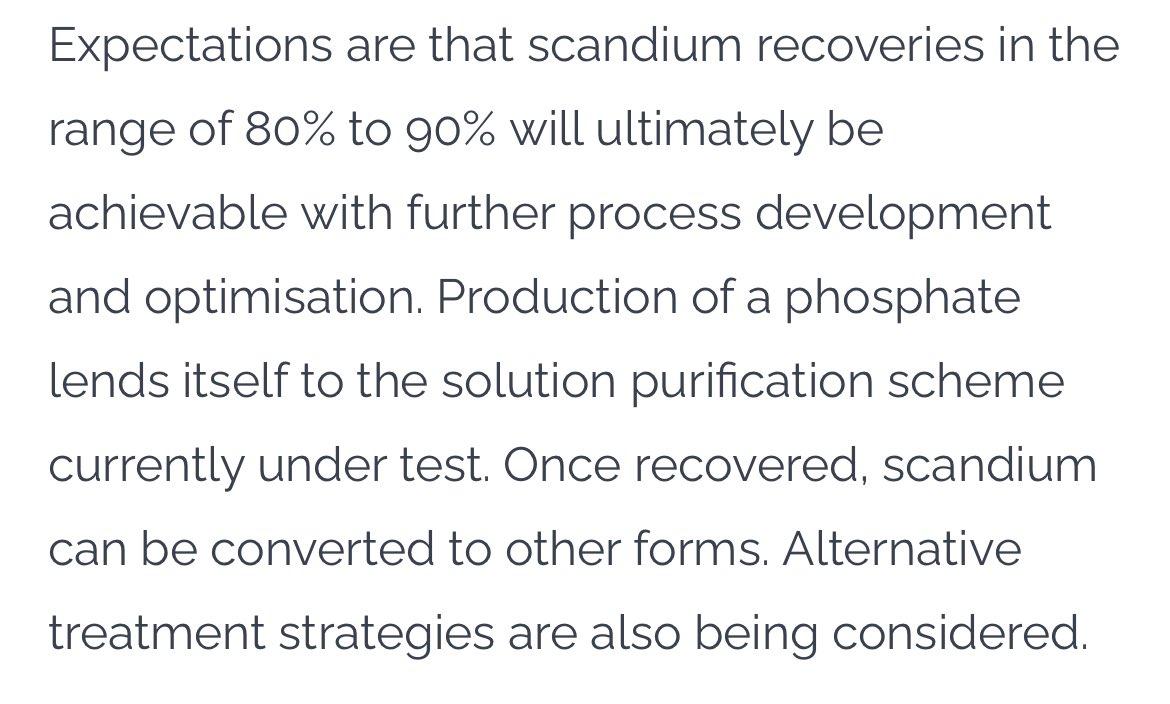

https://twitter.com/MiningGrade/status/1628393791366262792The koala has heard mgmt team’s verbally say what the range of targeted recoveries are based on similar deposits/peers but never put in a news release until met work empirically proved it. Metallurgy is show don’t tell. Btw, how did they come up with that recovery range? 2/n

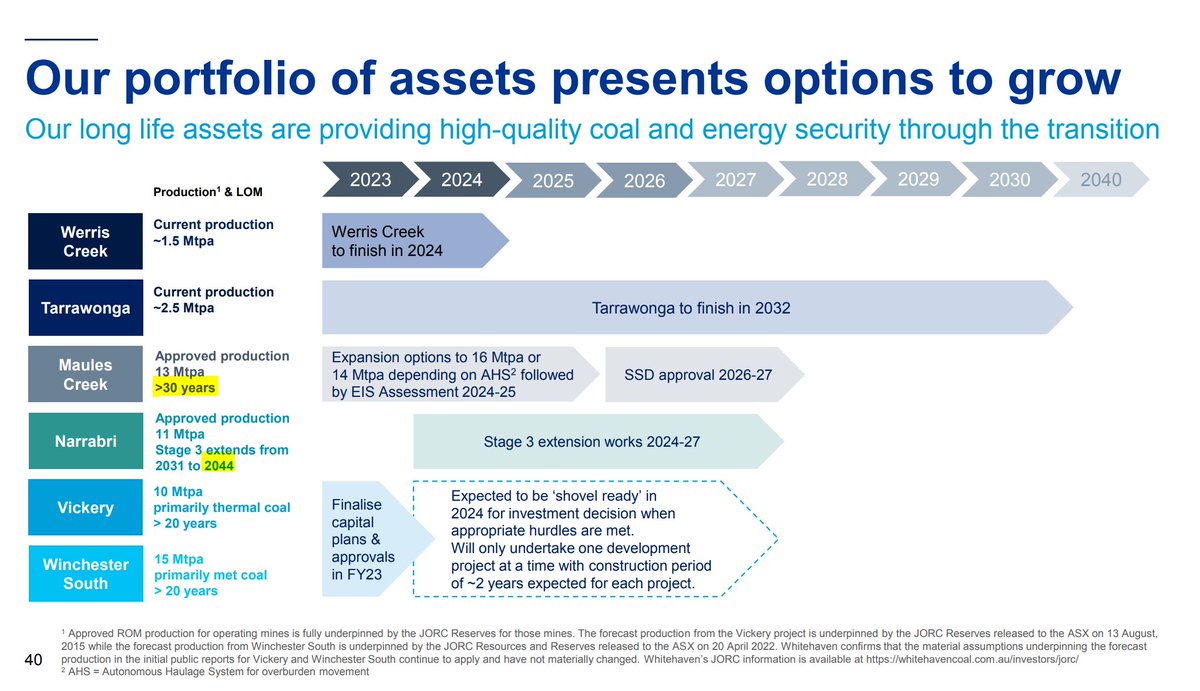

https://twitter.com/OneMoreif/status/1599616250770255874The world requires a certain amount of energy to function economically and just practically. And oh btw, that goes UP with economic growth despite innovation and thrifting (aint Jevons paradox a bitch, aint the koala right guys?)

https://twitter.com/thebiglong9/status/1587729257370984448

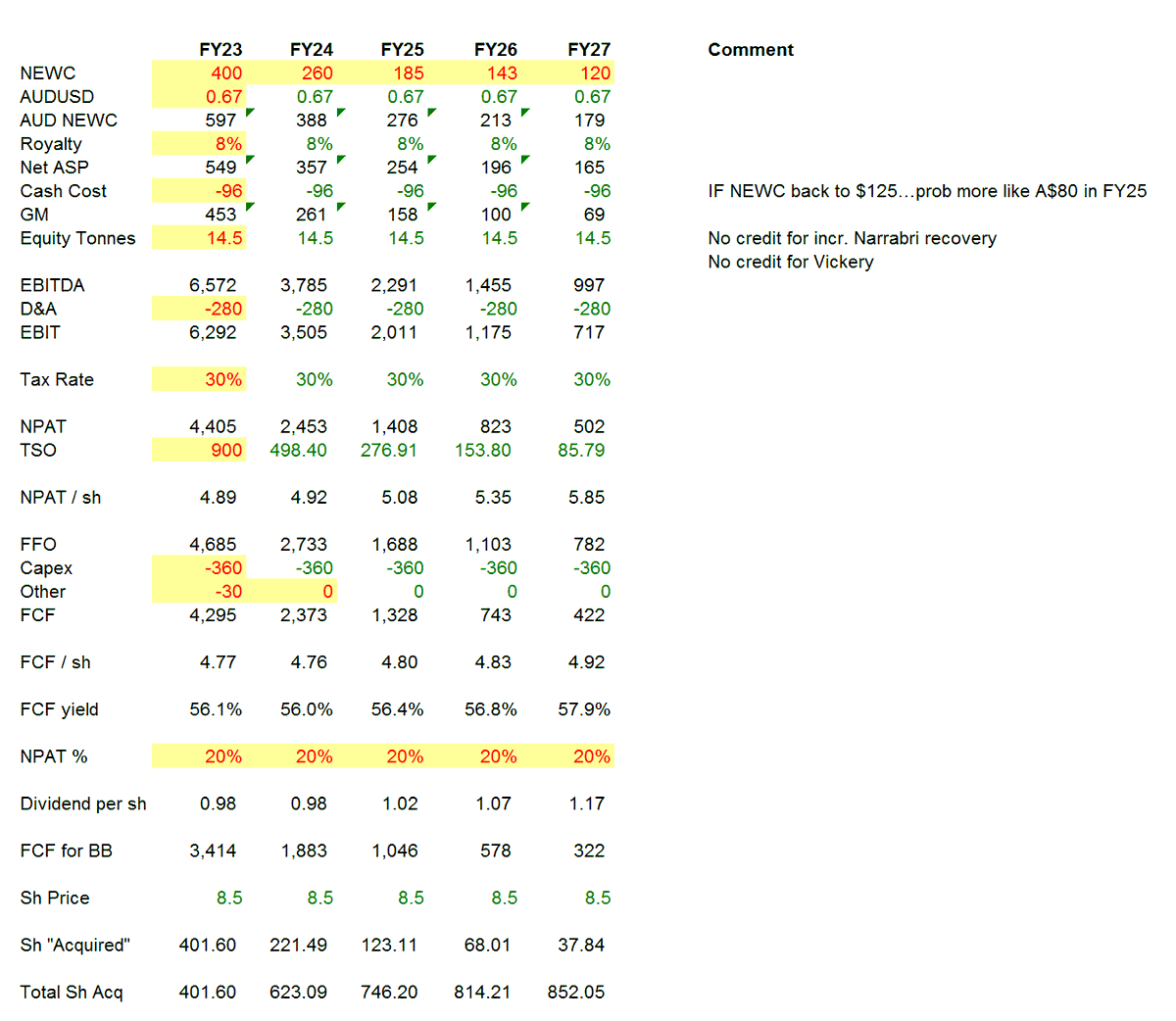

Also let's highlight a couple assumptions here:

Also let's highlight a couple assumptions here:

https://twitter.com/YellowLabLife/status/1579949776002777089The one key pushback to the koala's longer term observation which is TOTALLY VALID is "dude, look at CCJ EV/EBITDA & P/NAV, buybacks don't make sense, neither to dividends. If you got a growth multiple, use it or lose it."

https://twitter.com/nyetjgoldblum/status/1569136592077598720

Using those same parameters, extrapolate out FY24-27 with the established capital alloc policy (20% NPAT in divvy, rest in buyback up to 50%, and koala has allocated last 50% to buyback as well) & pretended stock didn't move, what's implied NEWC to get same FCF yield each yr 2/n

Using those same parameters, extrapolate out FY24-27 with the established capital alloc policy (20% NPAT in divvy, rest in buyback up to 50%, and koala has allocated last 50% to buyback as well) & pretended stock didn't move, what's implied NEWC to get same FCF yield each yr 2/n

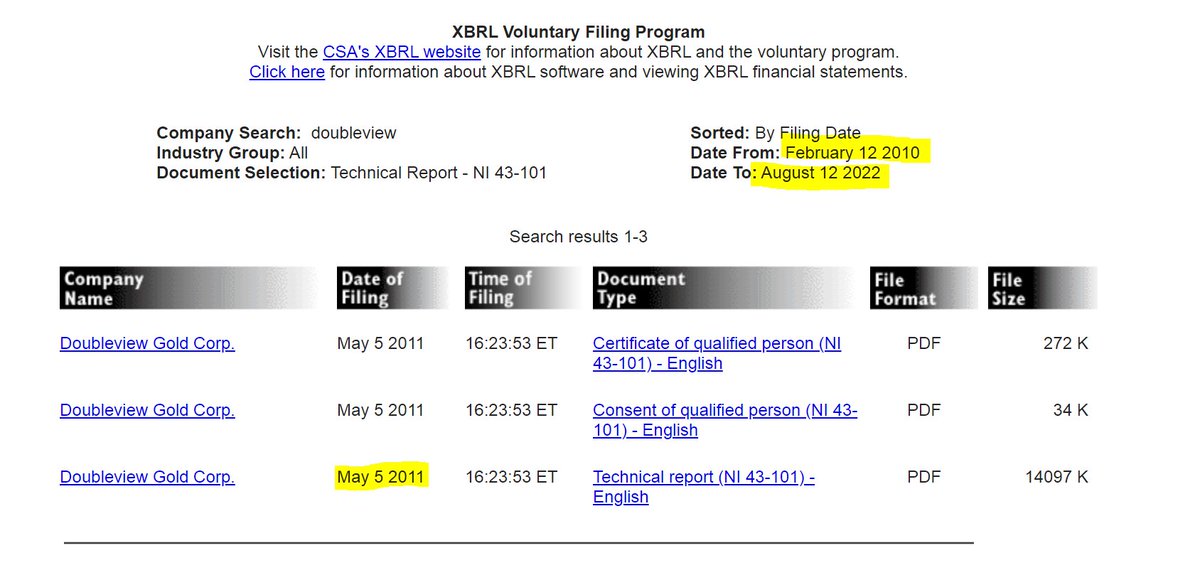

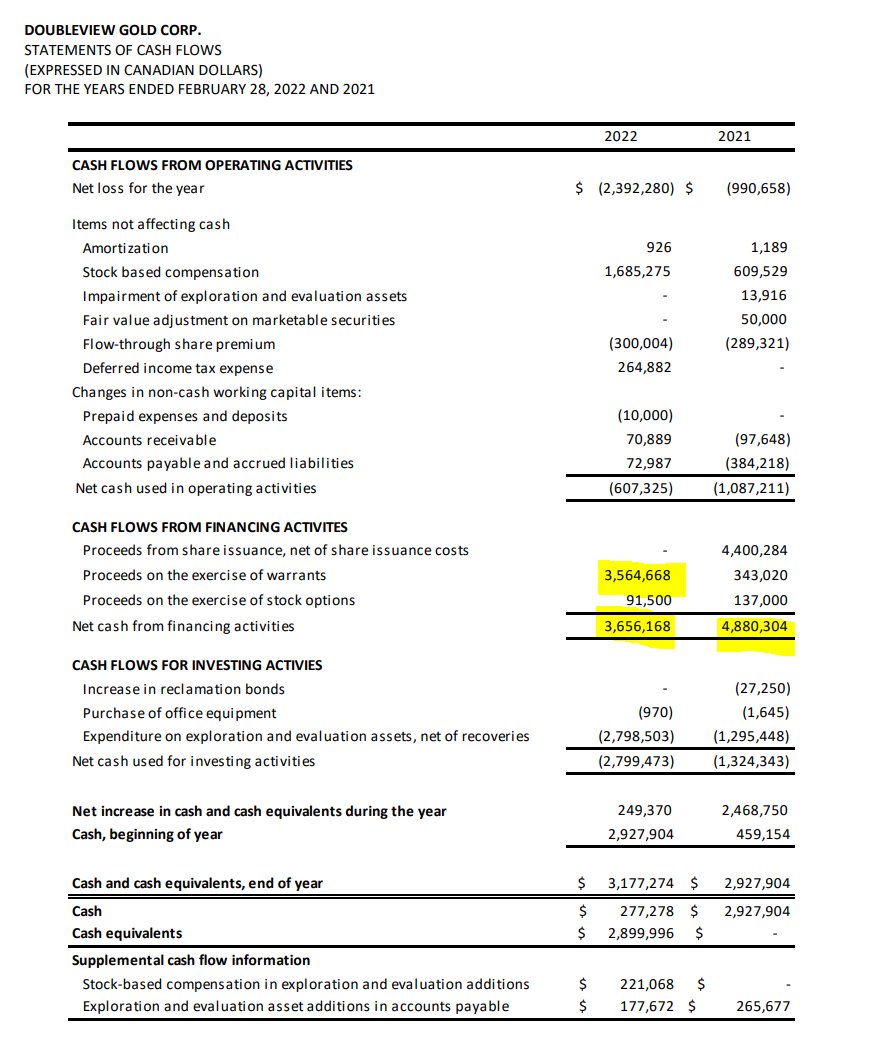

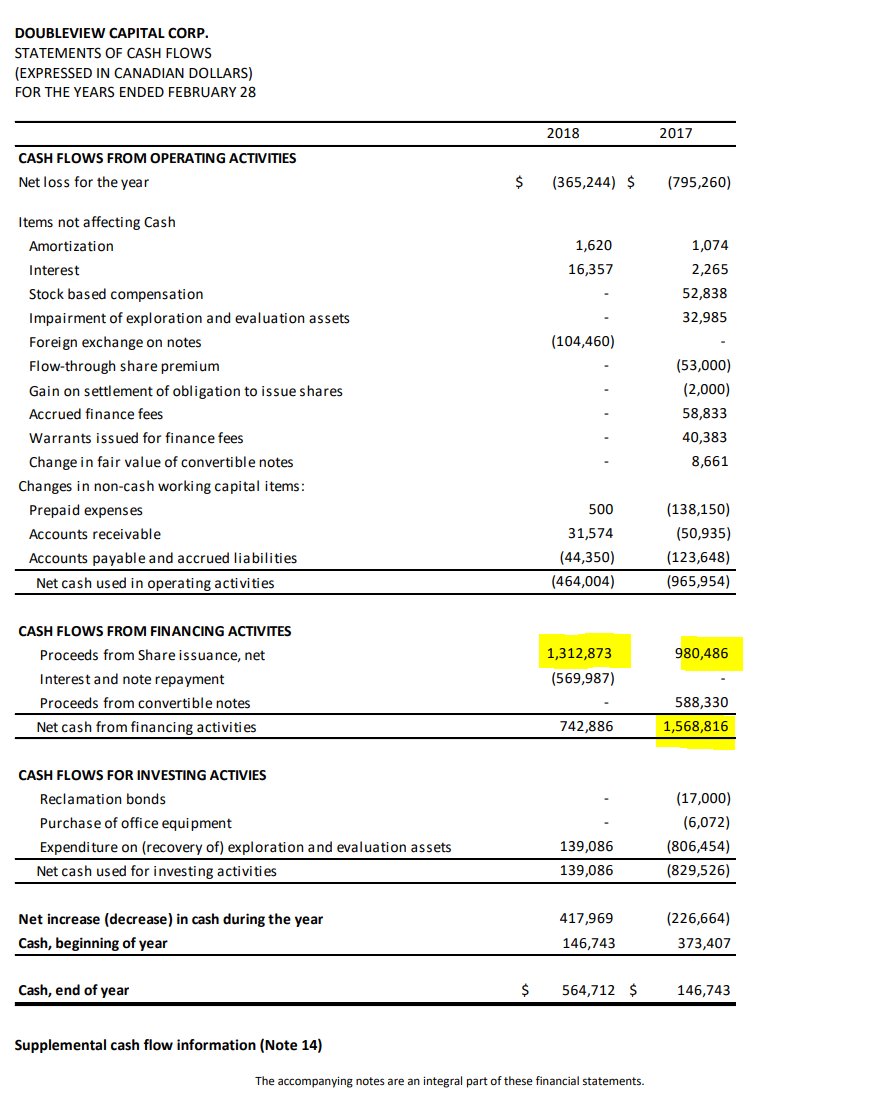

2015-22 screenshots (Feb YE)

2015-22 screenshots (Feb YE)

https://twitter.com/Edark94/status/1558066955613093891

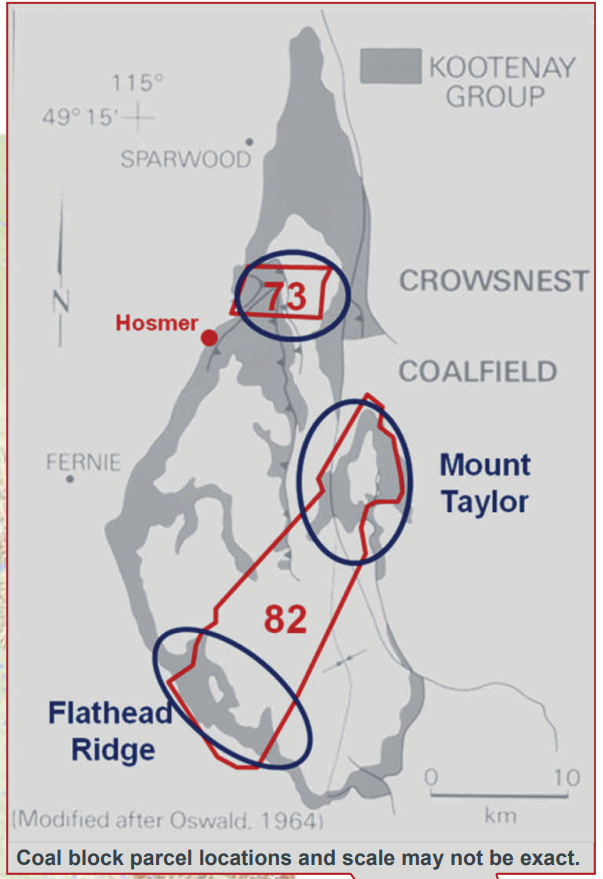

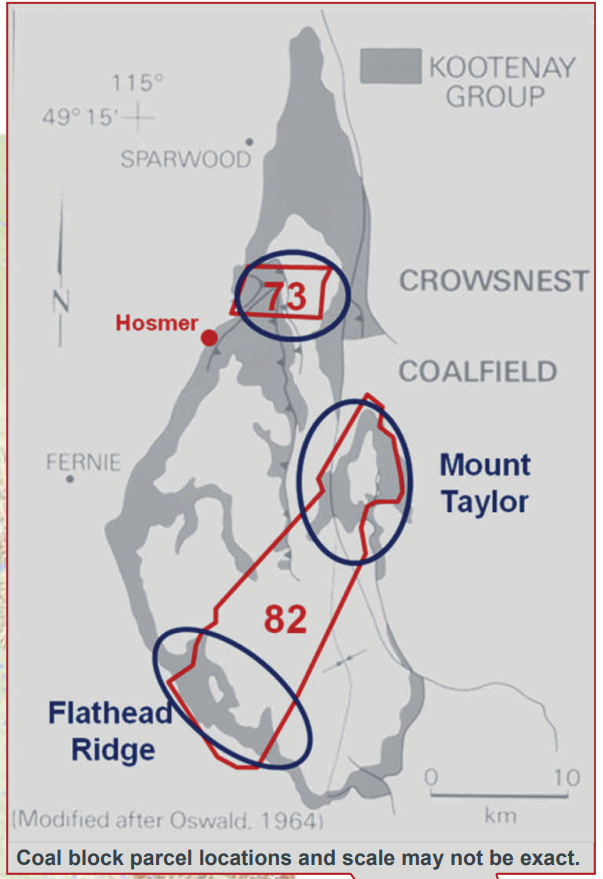

Two parcels of land the government kept while giving everything else to CP as incentive to build the railroad...and that the Canadian federal govt still hold today...Parcel 73 and 82 right in the heart of the Elk Valley 2/n

Two parcels of land the government kept while giving everything else to CP as incentive to build the railroad...and that the Canadian federal govt still hold today...Parcel 73 and 82 right in the heart of the Elk Valley 2/n

https://twitter.com/thebiglong9/status/15339402250046668842) Given the cash generation at these coking coal prices, and Don's commentary about the buybacks suggesting qtrly updates/reviews, is there a soft target for YE net debt? What is it? 2/n