1/ Investing in Crises (Baron, Laeven, Penasse, Usenko)

"Returns of equity & other asset classes generally underperform after banking crises. Investors do not fully anticipate the consequences of debt overhang, which results in lower long-run dividends."

papers.ssrn.com/sol3/papers.cf…

"Returns of equity & other asset classes generally underperform after banking crises. Investors do not fully anticipate the consequences of debt overhang, which results in lower long-run dividends."

papers.ssrn.com/sol3/papers.cf…

2/ LCU excess (real) returns = local currency returns in excess of the local short-term interest rate (local inflation rate)

USD excess (real) returns = U.S. dollar-based returns in excess of the U.S. short-term interest rate (U.S. inflation rate)

USD excess (real) returns = U.S. dollar-based returns in excess of the U.S. short-term interest rate (U.S. inflation rate)

3/ BVX indicator uses (1) 30% banking equity index drop and (2) narrative information and credit spreads used to identify 'panic' month

LV indicator defines start of a crisis when 3 of 6 policy interventions are implemented

"Bank equity crash" = 30% drop in bank equity index

LV indicator defines start of a crisis when 3 of 6 policy interventions are implemented

"Bank equity crash" = 30% drop in bank equity index

4/ "Long-run equity returns of both banks and nonfinancial firms are not elevated if one invests in banking crises.

"Bank stocks' high level of risk is shown by the large variation across outcomes and risk of large subsequent drops (often associated with double-dip crises)."

"Bank stocks' high level of risk is shown by the large variation across outcomes and risk of large subsequent drops (often associated with double-dip crises)."

5/ "For bank equity crashes, returns for bank equity and nonfinancial equity are not significantly greater than the benchmark unconditional returns.

"The BVX & LV definitions might inadvertently contain hindsight bias, selecting crises that were ex-post severe or long-lasting."

"The BVX & LV definitions might inadvertently contain hindsight bias, selecting crises that were ex-post severe or long-lasting."

6/ "Nonfinancial equity returns decline up to six months after the crisis begins and partially bounce back by 12 months. However, on a longer timescale of years, the returns to investing in crises tend not to be elevated."

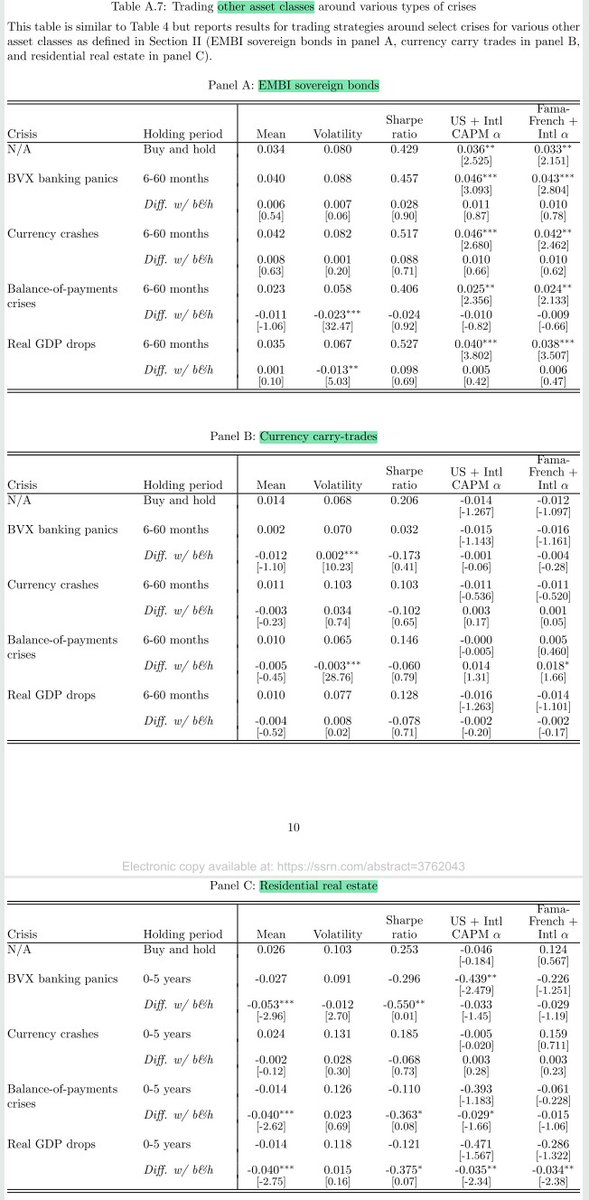

7/ "Returns for emerging market sovereign bonds, currency carry trades, and real estate are generally not elevated after banking crises relative to the unconditional benchmark, and in particular, the returns for residential real estate seem to be especially low."

8/ "Why do other types of crises, such as currency crises and balance-of-payment crises, see high returns?

"Banking crisis recessions tend to be unusually deep and persistent. Balance sheet problems in the household and banking sectors can take many years to resolve."

"Banking crisis recessions tend to be unusually deep and persistent. Balance sheet problems in the household and banking sectors can take many years to resolve."

9/ "Similar results also hold when restricting the analysis to the 1960-2006 sample, demonstrating our main results are not simply driven by the banking crises of 2007-8 or 2011."

10/ "Similar results are obtained when restricting the analysis to either advanced countries or developing countries."

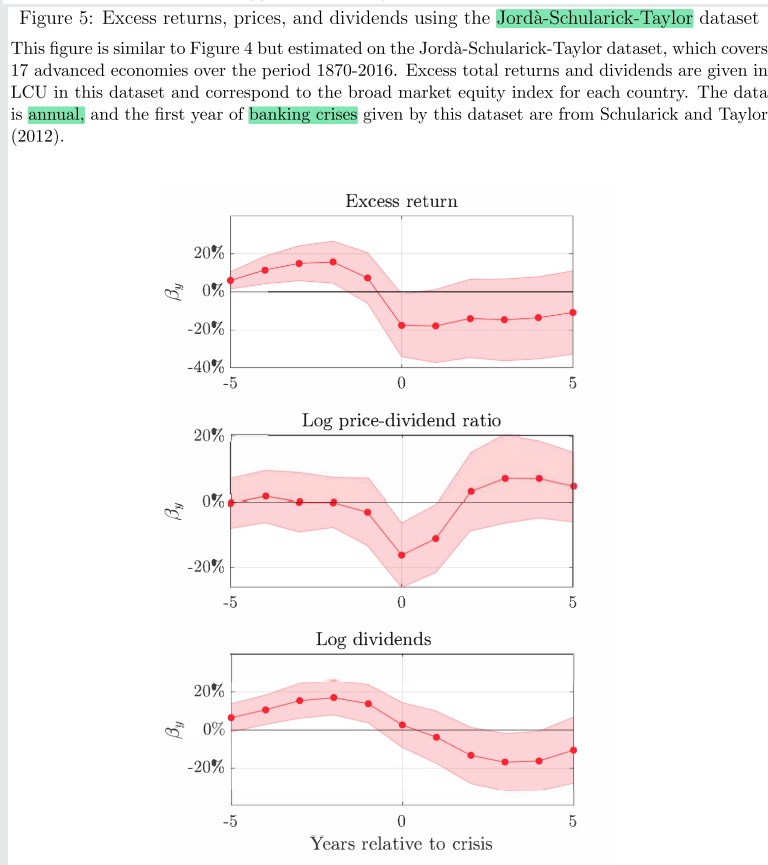

11/ "The Jordà-Schularick-Taylor dataset (17 advanced economies from 1870-2016) has fewer countries, is annual in frequency, and only contains broad stock market index returns.

"Nevertheless, similar results seem to hold for this longer sample and specifically over 1870-1945."

"Nevertheless, similar results seem to hold for this longer sample and specifically over 1870-1945."

12/ "Even given the good timing to buy at the six-month point after crisis where prices tend to trough, returns are only slightly elevated for nonfinancial equity & still underperform for bank equity. We thus consider the '6-60 month' results to be an upper bound on performance."

13/ "Similar results hold for the 1960-2006 sample, demonstrating the results are not simply driven by the banking crises of 2007-8 and 2011.

"Results are also similar when restricting the analysis to either advanced or developing economies."

"Results are also similar when restricting the analysis to either advanced or developing economies."

14/ "Returns for EMBI sovereign debt and currency carry trades are not significantly elevated at any horizon and are approximately the same as the buy-and-hold benchmark. Residential real estate price returns relative to the buy-and-hold benchmark are consistently negative."

15/ "Dividend-price ratios are temporarily high during banking crises (prices fall at the onset, while dividends are sticky in the short-run).

"However, D/P then adjusts, not because prices rebound (discount-rate effect), but from a systematic fall in future dividends."

"However, D/P then adjusts, not because prices rebound (discount-rate effect), but from a systematic fall in future dividends."

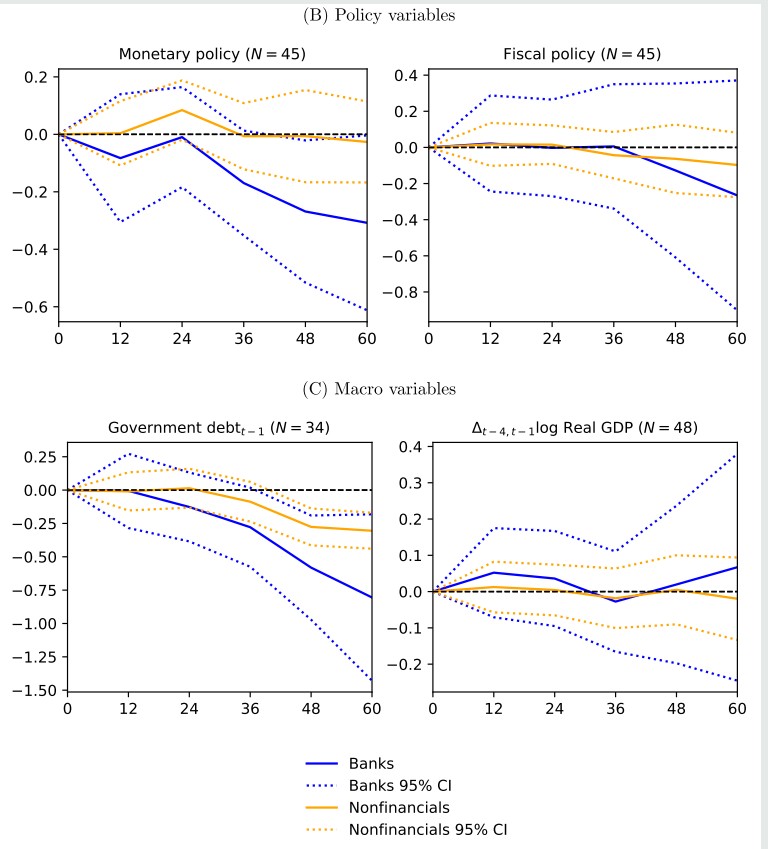

16/ "The variation in investment outcomes across crises is best explained by the extent of debt defaults and debt overhang at the time of the crisis.

"Fiscal or monetary policy at the time of the crisis and macro indicators have little correlation with outcomes across crises."

"Fiscal or monetary policy at the time of the crisis and macro indicators have little correlation with outcomes across crises."

17/ "Increases in all the debt overhang-related variables are associated with lower future dividends.

"Thus, according to our interpretation, investors may not fully anticipate that the long-lasting consequences of debt overhang may lower future dividends."

"Thus, according to our interpretation, investors may not fully anticipate that the long-lasting consequences of debt overhang may lower future dividends."

18/ "Our findings can explain why sophisticated investors are reluctant to buy during banking crises, particularly for bank stocks.

"The outperformance following 2007-8 is the exception, not the rule. This stresses the importance of using historical data to study rare events."

"The outperformance following 2007-8 is the exception, not the rule. This stresses the importance of using historical data to study rare events."

• • •

Missing some Tweet in this thread? You can try to

force a refresh