Typical reader question:

“I have money in the bank that I don’t know what to do with. I have never invested in stocks before. Where do I begin?”

I'm not a financial advisor but I can relate. You want to compound your capital but also be prudent and not gamble. Here is my advice

“I have money in the bank that I don’t know what to do with. I have never invested in stocks before. Where do I begin?”

I'm not a financial advisor but I can relate. You want to compound your capital but also be prudent and not gamble. Here is my advice

Some general advice:

• Diversify broadly. If you don't know what you're doing, just buy everything.

• Avoid leverage. Ruin kills compounding.

• Make contrarian bets. Buy before others do.

• Focus on long-term value. The long-term is easier to predict than the short-term.

• Diversify broadly. If you don't know what you're doing, just buy everything.

• Avoid leverage. Ruin kills compounding.

• Make contrarian bets. Buy before others do.

• Focus on long-term value. The long-term is easier to predict than the short-term.

1. First invest in freehold property with leverage

Most people who buy property do well because:

• True underlying inflation is probably 3%+

• You can use 5x leverage if not more

That causes the return on your initial housing deposit to reach double-digits. Hard to beat.

Most people who buy property do well because:

• True underlying inflation is probably 3%+

• You can use 5x leverage if not more

That causes the return on your initial housing deposit to reach double-digits. Hard to beat.

2. Set up an online brokerage account

I like Interactive Brokers and Saxo Bank for developed markets. For Asian EM, I recommend Boom Securities (HK) or Monex (Japan). Decent execution, market access, low commissions.

For EM, don't overtrade. Transaction costs can be very high.

I like Interactive Brokers and Saxo Bank for developed markets. For Asian EM, I recommend Boom Securities (HK) or Monex (Japan). Decent execution, market access, low commissions.

For EM, don't overtrade. Transaction costs can be very high.

3. Diversify broadly

Across:

• Property (including your own house)

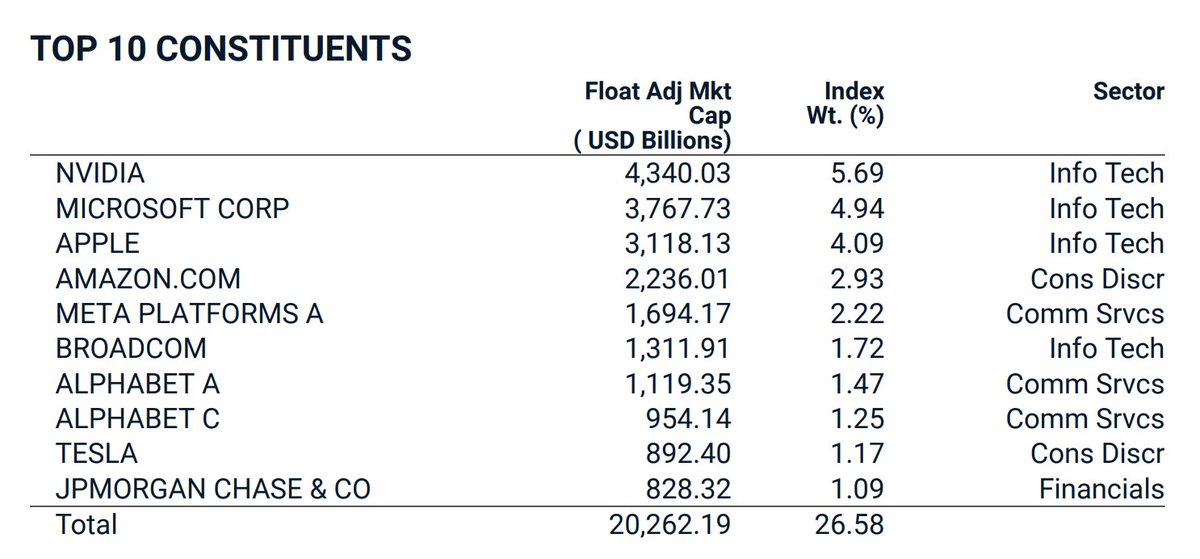

• Equities: Equal-weighted ETFs

• Cash / bonds: Gov bonds or corporate bonds, especially if near retirement but money loser otherwise

• Commodities: True commodity funds or commodity producer equities.

Across:

• Property (including your own house)

• Equities: Equal-weighted ETFs

• Cash / bonds: Gov bonds or corporate bonds, especially if near retirement but money loser otherwise

• Commodities: True commodity funds or commodity producer equities.

4. If you have an interest in stock speculation, experiment with small money.

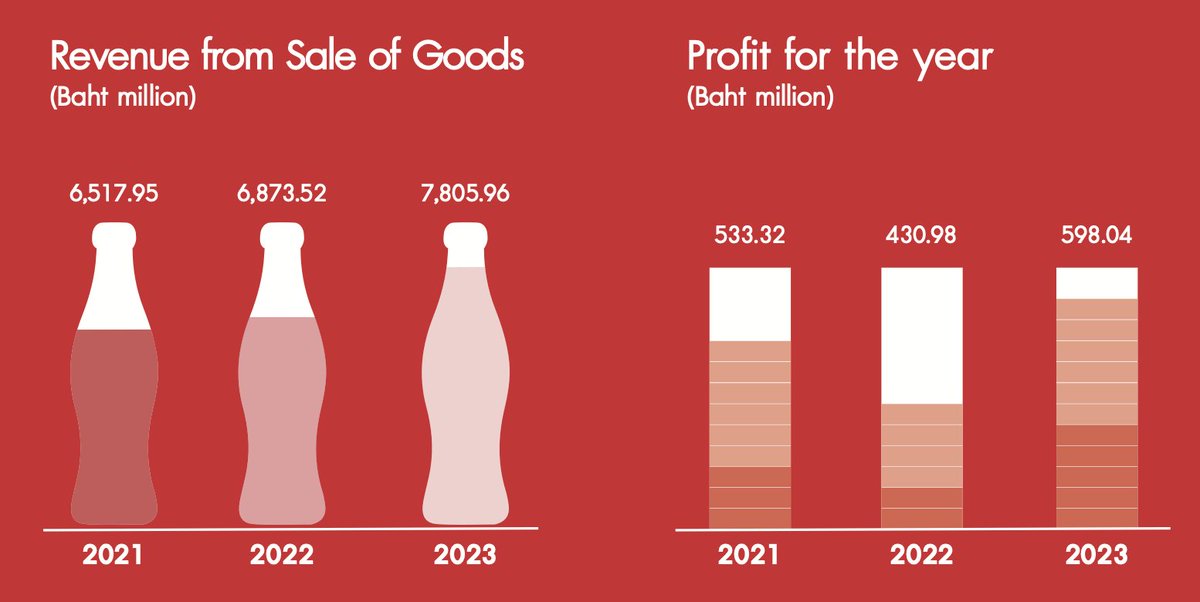

Your edge is as a consumer. Possible criteria:

• Product is unique / faces no competition

• Still potential to double in size

• PE below 20x

• Low debt

• Not popular among friends

Your edge is as a consumer. Possible criteria:

• Product is unique / faces no competition

• Still potential to double in size

• PE below 20x

• Low debt

• Not popular among friends

5. Check your portfolio a maximum 4x per year

If you over-trade, you lose both commission money and panic out of positions. Just read earnings results 4x per year then form a view of whether fundamentals are improving or deteriorating. If the latter, you might want to get out.

If you over-trade, you lose both commission money and panic out of positions. Just read earnings results 4x per year then form a view of whether fundamentals are improving or deteriorating. If the latter, you might want to get out.

• • •

Missing some Tweet in this thread? You can try to

force a refresh