16 years in Asian equities. I'm the author of the "Asian Century Stocks" newsletter. Personal account.

4 subscribers

How to get URL link on X (Twitter) App

2/ The justification? The government claims these plantations are in protected "forest zones."

2/ The justification? The government claims these plantations are in protected "forest zones."

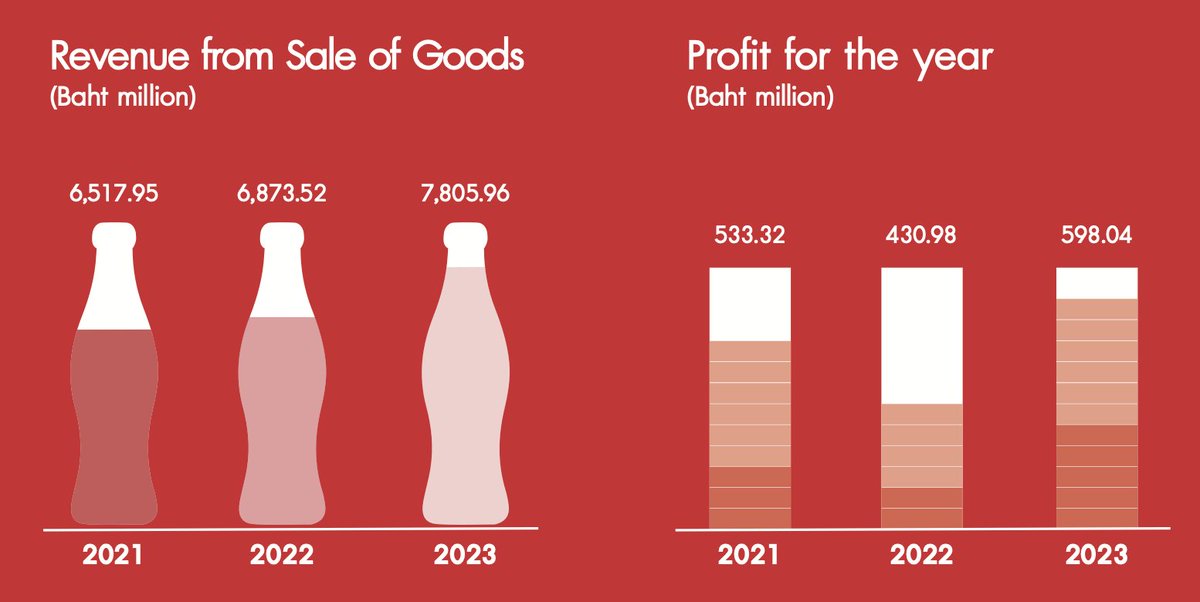

Haad Thip is a Coca-Cola bottler in Southern Thailand across 14 provinces. The typical brands, incl Coke, Fanta, Sprite, Minute Maid. Founded in 1969, two manufacturing plants. Seems to be a steady grower. 80% market share in sugar-sweetened soft drinks in the south.

Haad Thip is a Coca-Cola bottler in Southern Thailand across 14 provinces. The typical brands, incl Coke, Fanta, Sprite, Minute Maid. Founded in 1969, two manufacturing plants. Seems to be a steady grower. 80% market share in sugar-sweetened soft drinks in the south.

A core tenet of Marxism is about dividing people into groups: oppressors and victims. For example, capitalists exploiting workers, encouraging workers to engage in class struggle.

A core tenet of Marxism is about dividing people into groups: oppressors and victims. For example, capitalists exploiting workers, encouraging workers to engage in class struggle.

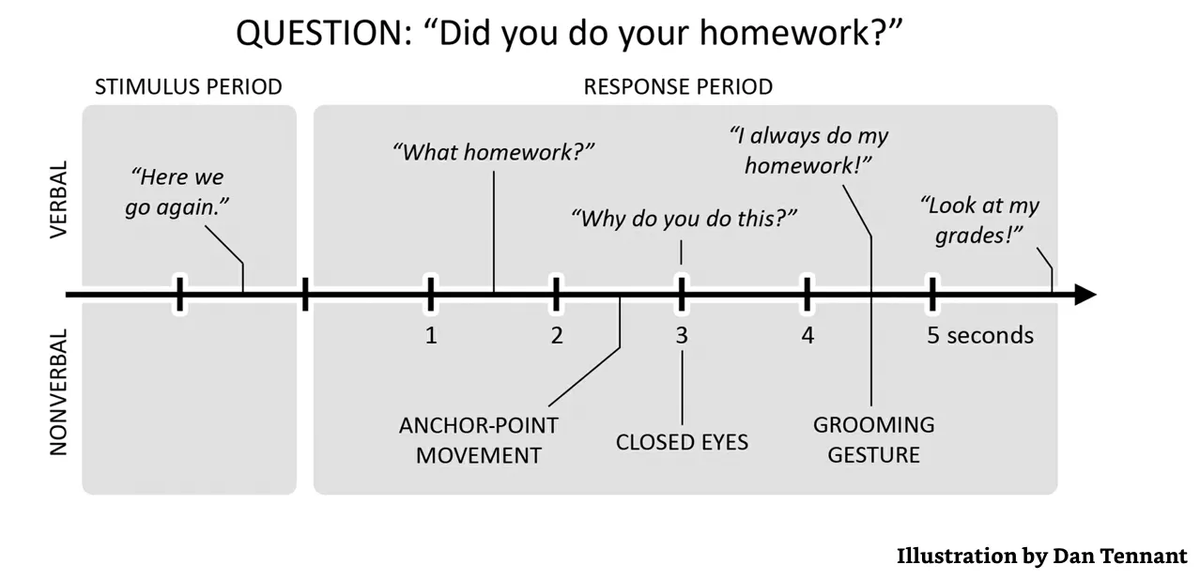

When trying to get at the truth, you'll want to ask specific questions and then 1) listen and 2) look for reactions from the other person to that question.

When trying to get at the truth, you'll want to ask specific questions and then 1) listen and 2) look for reactions from the other person to that question.

1. Write about a passion

1. Write about a passion

BACKGROUND

BACKGROUND

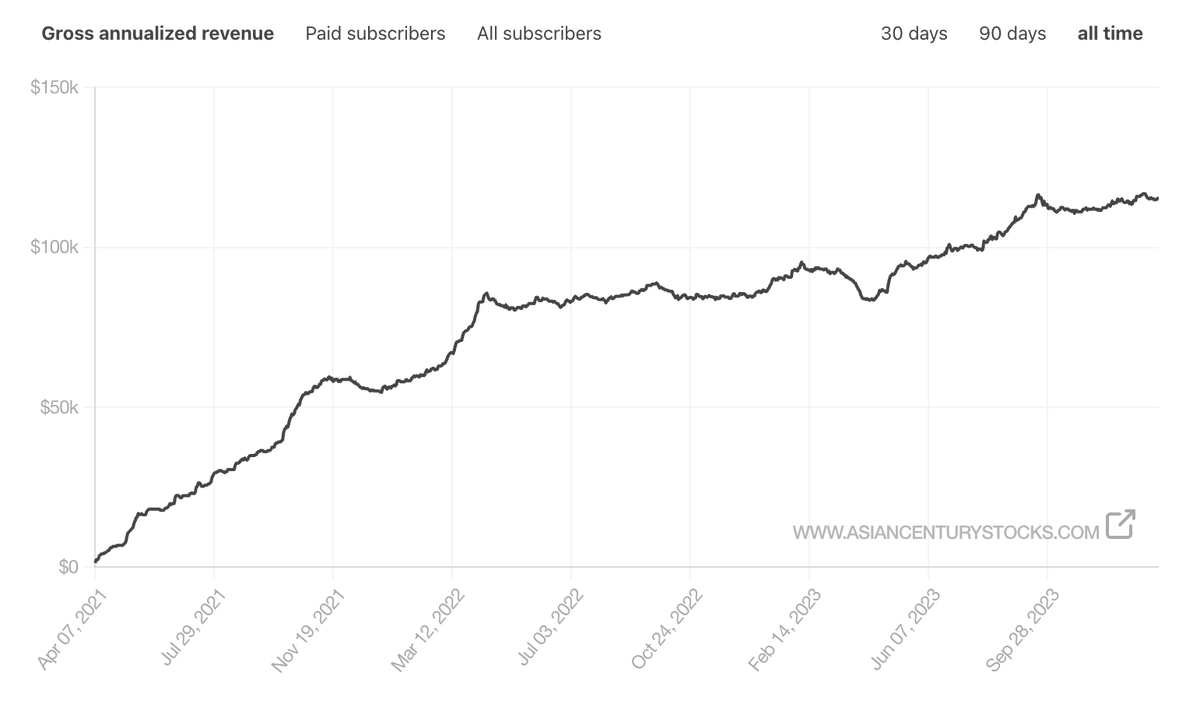

The company has four major divisions:

The company has four major divisions:

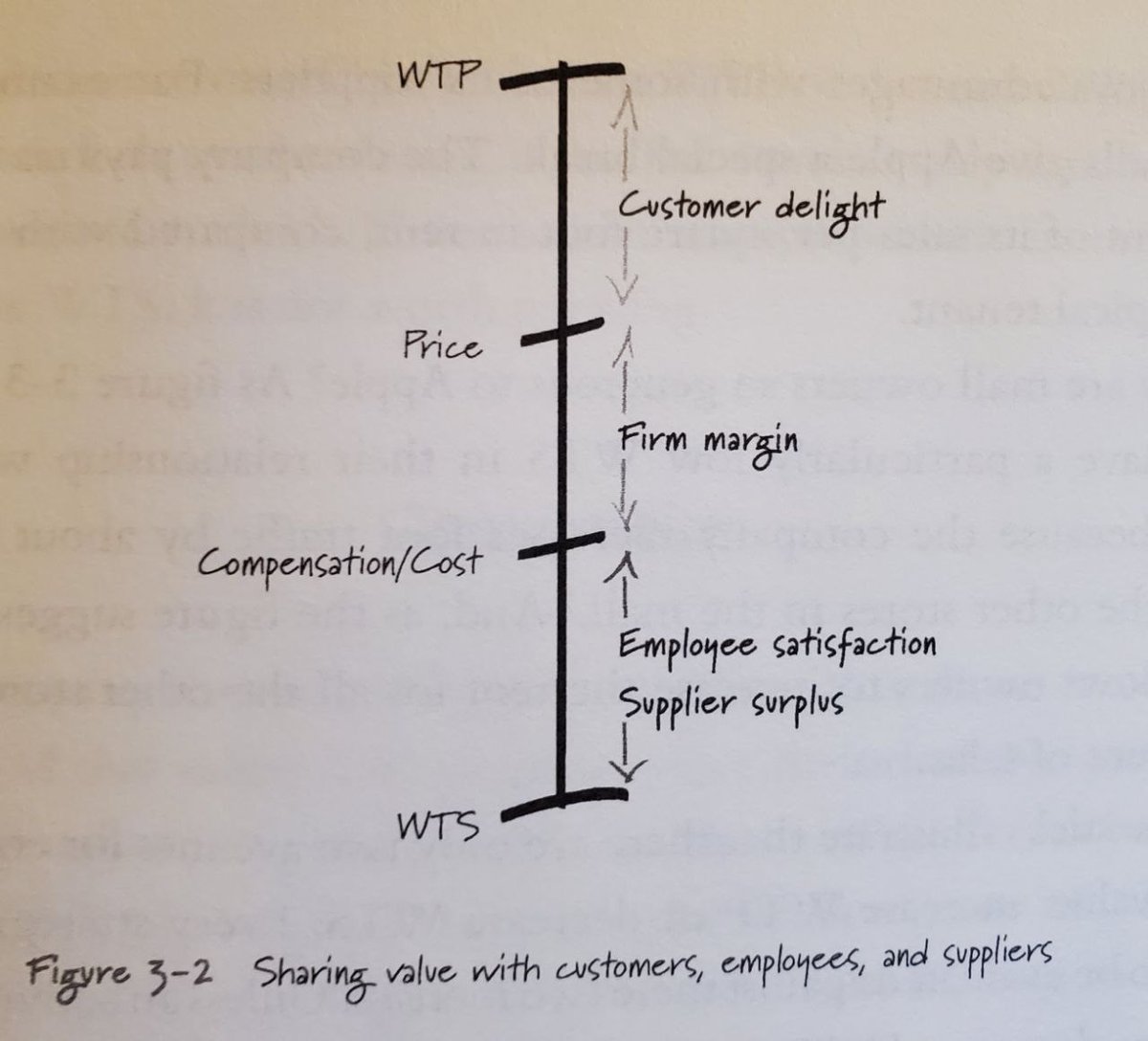

His key point is that a firm's strategy should either focus on increasing a customer's willingness-to-pay (WTP) or employees/suppliers willingness-to-sell (WTP).

His key point is that a firm's strategy should either focus on increasing a customer's willingness-to-pay (WTP) or employees/suppliers willingness-to-sell (WTP).

Juror #1 (Martin Balsam): Avoiding conflict

Juror #1 (Martin Balsam): Avoiding conflict

Who was Adolf Lundin?

Who was Adolf Lundin?

Beijing does not want war with Washington. It just wants to undermine the pillars of US strategy and foreign policy. It wants to carve out an authoritarian sphere of influence, making Asia repressive and closed.

Beijing does not want war with Washington. It just wants to undermine the pillars of US strategy and foreign policy. It wants to carve out an authoritarian sphere of influence, making Asia repressive and closed.