As Credit Suisse is aware, Counterparty credit risk is so complicated, that almost all the formulas in the CRR had to be corrected two years later !

A thread!

A thread!

Seriously, no one told you that a number inside a square root has better be positive? (I mean CCR is complex, but not in *that* sense)

Rule number 1 of mathematical logic : if you open a parenthesis, you have to close it & vice versa. You might not seen it, but the computer will.

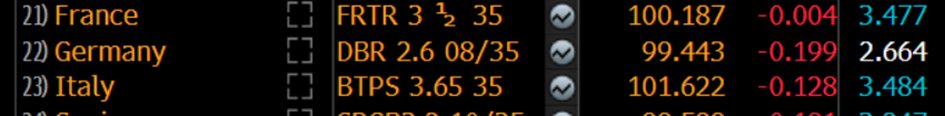

Yeah, I always make the same mistake when I price a bond. 1%, one Basis point, what’s the difference anyway. It’s only money.

Banking regulations are so complex that, after taking three years to draft a regulation, they have to publish a corrigendum two years after, because it was filled with errors.

I hope you feel reinsured.

I hope you feel reinsured.

• • •

Missing some Tweet in this thread? You can try to

force a refresh