$PATH lists today!

I think RPA can feel a little bit intimidating to newcomers, so I thought I'd put together a super-quick summary of the company.

UiPath in 3 minutes.

👇

I think RPA can feel a little bit intimidating to newcomers, so I thought I'd put together a super-quick summary of the company.

UiPath in 3 minutes.

👇

TL;DR

- UiPath sells software "robots"

- It was started 16 years ago in Romania

- Its customers are usually big corporations

- It made $607M last year (+81% YoY)

readthegeneralist.com/briefing/uipath

- UiPath sells software "robots"

- It was started 16 years ago in Romania

- Its customers are usually big corporations

- It made $607M last year (+81% YoY)

readthegeneralist.com/briefing/uipath

History

- Founded in Bucharest by 2005

- CEO was a former Microsoft engineer

- Company was a devshop called "DeskOver"

- Pivoted to true RPA in 2013

- Only started scaling after that point

readthegeneralist.com/briefing/uipath

- Founded in Bucharest by 2005

- CEO was a former Microsoft engineer

- Company was a devshop called "DeskOver"

- Pivoted to true RPA in 2013

- Only started scaling after that point

readthegeneralist.com/briefing/uipath

Market

- RPA market pegged at $5.4B

- Grew 63% btwn 2019-20

- RPA is a sub-category of "business automation"

- Business automation market pegged at $65B

- RPA market pegged at $5.4B

- Grew 63% btwn 2019-20

- RPA is a sub-category of "business automation"

- Business automation market pegged at $65B

Financing

Seed: $1.6M (took 14 months)

A: $30M

B: $153M

C: $265M

D: $568M

E: $225M

F: $750M at $35B val

Total of $2B raised. Key investors @EarlybirdVC, @CredoVentures, @Accel, @CapitalG, @AlkeonCapital, @seedcamp, @sequoia

Seed: $1.6M (took 14 months)

A: $30M

B: $153M

C: $265M

D: $568M

E: $225M

F: $750M at $35B val

Total of $2B raised. Key investors @EarlybirdVC, @CredoVentures, @Accel, @CapitalG, @AlkeonCapital, @seedcamp, @sequoia

Product

- Full suite RPA

- Makes it easy for businesses to automate tasks

- Usually boring, mundane stuff (filling in spreadsheets)

- Offers attended and unattended automation*

*Attended: someone has to trigger the bot

*Unattended: bot runs solo

- Full suite RPA

- Makes it easy for businesses to automate tasks

- Usually boring, mundane stuff (filling in spreadsheets)

- Offers attended and unattended automation*

*Attended: someone has to trigger the bot

*Unattended: bot runs solo

Product differentiation

- Easy to use with a drag-and drop interface

- Good for coders and non-coders

- Free tier and "Academy" let people try before buying

- Truly horizontal platform; useful across sectors

- Easy to use with a drag-and drop interface

- Good for coders and non-coders

- Free tier and "Academy" let people try before buying

- Truly horizontal platform; useful across sectors

Business model

- Mostly sells B2B2B, using channel partners

- Channel partners are consulting firms and BPOs

- They sell to the end-customer much of the time

Example:

$PATH sells software to Deloitte. Deloitte whitelabels it and sells it to JPM.

- Mostly sells B2B2B, using channel partners

- Channel partners are consulting firms and BPOs

- They sell to the end-customer much of the time

Example:

$PATH sells software to Deloitte. Deloitte whitelabels it and sells it to JPM.

Revenue streams

- Selling software licenses (57% rev)

- Implementing software (4%)

- Maintaining software (39%)*

*RPA has been developing so fast that constant updates have been necessary. This might change as cloud becomes more important.

- Selling software licenses (57% rev)

- Implementing software (4%)

- Maintaining software (39%)*

*RPA has been developing so fast that constant updates have been necessary. This might change as cloud becomes more important.

Financials

- Revenue growth LTM: 81%

- GAAP GMs: ~90%

- GAAP operating margins: 7%

- S&M spend: 63% total revenue

- DBNR: 145%

- Rule of 40: 85%

What does this all mean? $PATH is a great growth story. Does a good job of upselling. Spends too much on S&M.

- Revenue growth LTM: 81%

- GAAP GMs: ~90%

- GAAP operating margins: 7%

- S&M spend: 63% total revenue

- DBNR: 145%

- Rule of 40: 85%

What does this all mean? $PATH is a great growth story. Does a good job of upselling. Spends too much on S&M.

Team

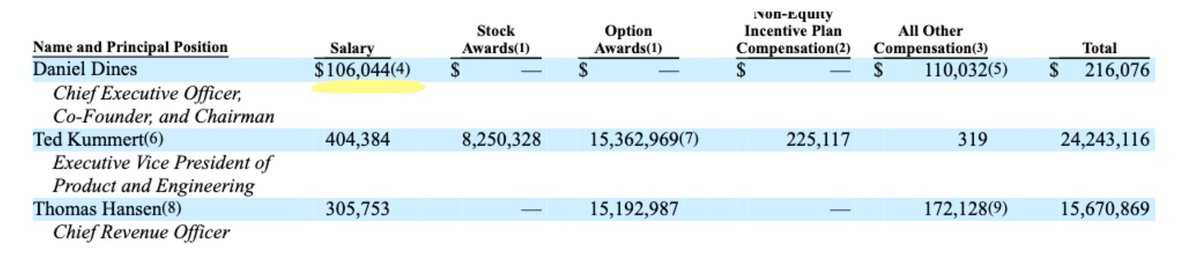

- CEO is Daniel Dines

- Dines has 88% voting power (!!)

- Dines has token compensation

- Quirky figure; though apparently highly intelligent

- Senior team has good enterprise software experience

- CEO is Daniel Dines

- Dines has 88% voting power (!!)

- Dines has token compensation

- Quirky figure; though apparently highly intelligent

- Senior team has good enterprise software experience

Investing wins

Earlybird

- Owns 10.3%

- Worth ~3.6B based on last round

- 18x fund returner

Accel

- Owns 26%

- Worth ~9B based on last round

- 4.5x fund returner

Earlybird

- Owns 10.3%

- Worth ~3.6B based on last round

- 18x fund returner

Accel

- Owns 26%

- Worth ~9B based on last round

- 4.5x fund returner

Competition

- Direct: Automation Anywhere, Blue Prism

- Challengers: WorkFusion, Kofax

- Big Tech: Microsoft (offers RPA for free with Office)

- Insurgents: Alloy, Kissflow, Bryter*

Increasing pressure from verticalized offerings, and startups selling bottom-up.

- Direct: Automation Anywhere, Blue Prism

- Challengers: WorkFusion, Kofax

- Big Tech: Microsoft (offers RPA for free with Office)

- Insurgents: Alloy, Kissflow, Bryter*

Increasing pressure from verticalized offerings, and startups selling bottom-up.

$PATH threats

- Automation market is changing

- RPA is becoming outdated

- AI, ML, and cloud are more important

- UiPath has *some* offerings here; but limited

- Has made acqs to modernize (e.g.: Cloud Elements)

- Needs to make more

- Automation market is changing

- RPA is becoming outdated

- AI, ML, and cloud are more important

- UiPath has *some* offerings here; but limited

- Has made acqs to modernize (e.g.: Cloud Elements)

- Needs to make more

Valuation

- Last round at $35B

- IPO expected to be at $26B

- 43x LTM sales multiple (!!)

- Compare that to $CRM, $MSFT, $ORCL

- Last round at $35B

- IPO expected to be at $26B

- 43x LTM sales multiple (!!)

- Compare that to $CRM, $MSFT, $ORCL

Check out the full, free report for more:

- Includes +100 hours of summarized research

- Analysis from RPA experts

- More details on valuation

H/t @aashaysanghvi_ @jaminball @sharpshoot @lafillemouen @Jer_Diamond @AdrienCipel @dlwei17

readthegeneralist.com/briefing/uipath

- Includes +100 hours of summarized research

- Analysis from RPA experts

- More details on valuation

H/t @aashaysanghvi_ @jaminball @sharpshoot @lafillemouen @Jer_Diamond @AdrienCipel @dlwei17

readthegeneralist.com/briefing/uipath

• • •

Missing some Tweet in this thread? You can try to

force a refresh