Poor industry performance is responsible for high nuclear power costs and industry stagnation, not regulation. I’ve had several people ask about this post, so here is a thread on nuclear costs

https://twitter.com/ezraklein/status/1384707199172177926

The post reviews the argument in a recent book “Why Nuclear Power Has Been a Flop.” It notes that nuclear power plants in many countries are expensive, and lays much of the responsibility on nuclear safety regulation rootsofprogress.org/devanney-on-th…

The causes of high nuclear costs are complex and vary depending on projects. Regulation does have costs because safety has costs. That said the book and post do not reflect current literature on the causes of high costs

The large sizes of conventional nuclear power means reactors are construction megaprojects, typically defined as projects costing more than $1 billion.

Across countries and technologies, megaprojects are prone to cost overruns and escalation mckinsey.com/business-funct…

Across countries and technologies, megaprojects are prone to cost overruns and escalation mckinsey.com/business-funct…

This is true for energy infrastructure as well. When we examined it we found construction cost overruns for most electric infrastructure, but particularly nuclear and hydro units due to their large sizes sciencedirect.com/science/articl…

Complexity requires precise project management and even then unexpected events (i.e. a global pandemic) can cause workforce, parts, and other delays.

As capital-intensive infrastructure that must be financed, time overruns breed cost overruns (and higher future financing costs)

As capital-intensive infrastructure that must be financed, time overruns breed cost overruns (and higher future financing costs)

Looking at overnight construction costs (w/o financing), @J_Lovering , @arthurhcyip , and @TedNordhaus found wide variations in cost performance.

Many nations saw increases. Low costs were achieved with standardization, multiple units, and learning sciencedirect.com/science/articl…

Many nations saw increases. Low costs were achieved with standardization, multiple units, and learning sciencedirect.com/science/articl…

In the U.S., total costs quickly rose in the 1970s due to rising interest costs, limited workforces leading to salary escalations, poor quality workforces, and a lack of reactor standardization.

Further, the energy crisis evaporated demand for projects

Further, the energy crisis evaporated demand for projects

Notably, while largely missing from the literature and public debates, dozens of nuclear projects were cancelled.

So not only do nuclear plants carry a risk of going way over budget, they also have a high risk of being cancelled

So not only do nuclear plants carry a risk of going way over budget, they also have a high risk of being cancelled

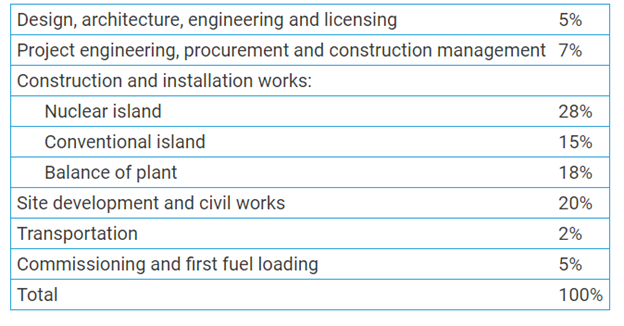

For nuclear projects, the construction issues are often driven by concrete and steel. The nuclear island is only a portion of the overall capital costs (and engineering/licensing is tiny on a PROJECT basis) world-nuclear.org/information-li…

Based on project analysis, industry experience, and academic literature know why some nuclear plants are cheap and others are expensive. @kirstygogan and Eric Ingersoll lay it out well d2umxnkyjne36n.cloudfront.net/documents/D7.3…

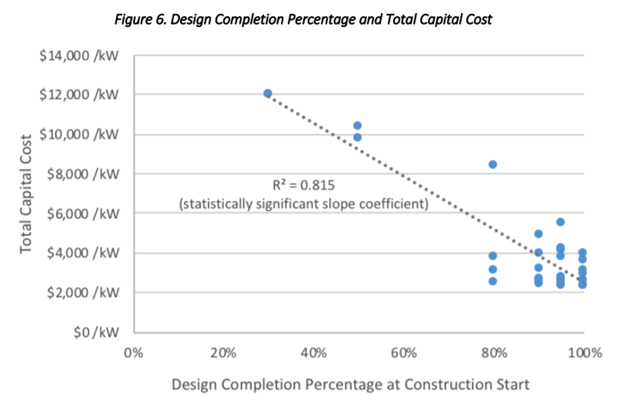

Not having standardized designs or, inexplicably, beginning construction before a design is complete are large drivers of high costs

What role does regulation have to play in in high costs? Its debatable but probably not a lot.

Specific regulatory changes during construction could cause delays for a project (like NEPA or TMI) but the general scheme of regulation is historically predictable

Specific regulatory changes during construction could cause delays for a project (like NEPA or TMI) but the general scheme of regulation is historically predictable

A recent analysis found that safety related costs were only a minor factor in rising costs.

More important were general increases in construction costs in the economy, and soft costs like labor supervision cell.com/joule/pdf/S254…

More important were general increases in construction costs in the economy, and soft costs like labor supervision cell.com/joule/pdf/S254…

So the question is how do we make nuclear cheap?

Reactor standardization, low labor costs, and effective megaproject project management are likely to support Russia and China’s dominance of markets for conventional nuclear power powermag.com/russia-china-d…

Reactor standardization, low labor costs, and effective megaproject project management are likely to support Russia and China’s dominance of markets for conventional nuclear power powermag.com/russia-china-d…

In the U.S. and many markets, however, advanced reactors appear to be the only (and perhaps last) hope for a revitalization of the nuclear industry. For the first time, we see dozens of advanced nuclear startups and innovations in the sector thirdway.org/graphic/2020-a…

This is important because business model diversity can be as important as technology for market success (and historical issues are tied to limited vendors/competition).

The reactor designer, EPC construction, and utility ownership model may be an aggravating factor in costs

The reactor designer, EPC construction, and utility ownership model may be an aggravating factor in costs

This is especially important as modern electricity markets are quickly moving away from vertically integrated IOUs (in part due to historical utility bankruptcies from nuclear cost overruns). Relying on utilities to finance and build nuclear power may no longer be a viable option

Even with this market uncertainty, there are many market opportunities for advanced nuclear if costs can be reduced and competitive business models developed @LucidCatalyst lucidcatalyst.com/arpa-e-report-…

To do this, new nuclear construction projects must stop cost overruns and assuage justified fears of risks of overruns.

This is a huge challenge for first-of-a-kind demonstration projects

This is a huge challenge for first-of-a-kind demonstration projects

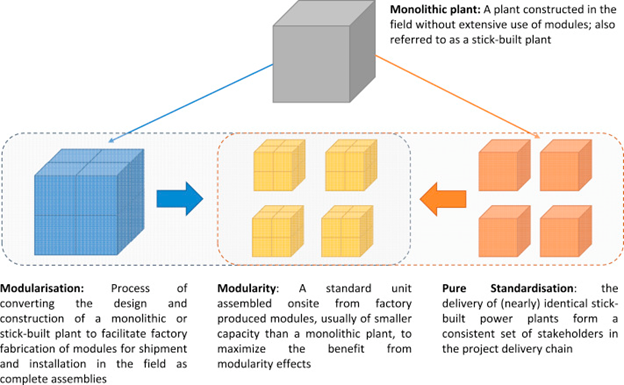

Modularity in terms of factory production is probably the most known cost and risk reducing feature of advanced reactors. In my opinion, this is likely to be only a minor actual factor, at least initially sciencedirect.com/science/articl…

Technological learning and experience project management from rapid iteration of small units is more likely to drive costs down per @J_Lovering @jamesonmcb nae.edu/239267/Chasing…

Smaller designs help considerably. Although they lose economies of scale in process efficiency they avoid diseconomies of scale in construction.

Small means simple simple, simple means quick, low risk of time overrun, low risk of cost overrun, rapid iteration and learning

Small means simple simple, simple means quick, low risk of time overrun, low risk of cost overrun, rapid iteration and learning

As a capital-intensive technology, nuclear power needs access to low-cost capital.

Despite its carbon-free nature, most ESG ratings and development banks explicitly exclude nuclear.

That is not analytically sound and somewhat colonialist

Despite its carbon-free nature, most ESG ratings and development banks explicitly exclude nuclear.

That is not analytically sound and somewhat colonialist

What role can regulations play in reducing costs?

Safety regulation can certainly increase costs and pose barriers if done poorly. NRC is embarking on an ambitious regulatory modernization effort so it can efficiently and effectively regulate the next generation of nuclear power

Safety regulation can certainly increase costs and pose barriers if done poorly. NRC is embarking on an ambitious regulatory modernization effort so it can efficiently and effectively regulate the next generation of nuclear power

Industry, academia, DOE, and NGO groups like @theNIAorg, @ThirdWayEnergy, @cleanaircatf, and @ClearPathAction are all working to assist and inform NRC in these efforts. Part 53, a new performance-based licensing pathway is critical clearpath.org/our-take/a-sim…

The book identifies fees as a cost driver. Licensing and annual fees were not substantial during the primary era of nuclear construction in the US. @mchammo provides a good overview of these issues

https://twitter.com/mchammo/status/1384712250959794176

Getting fees right is as much about making sure NRC (or other regulators) have sufficient capabilities to be efficient and effective as it is about minimizing industry costs.

Stay tuned as @theNIAorg has forthcoming work on exactly this topic

Stay tuned as @theNIAorg has forthcoming work on exactly this topic

I’ll end with this - I’ve met a lot of nuclear regulators, both staff and Commissioners. They are hard working, dedicated, and are not trying to stop nuclear power. Regulatory costs can be minimized, especially with next generation designs

Many are working to align the policy incentives and regulatory environment.

Ultimately, it is on industry to demonstrate that they can build cost competitive projects on-time, on-budget, and predictably (end)

Ultimately, it is on industry to demonstrate that they can build cost competitive projects on-time, on-budget, and predictably (end)

• • •

Missing some Tweet in this thread? You can try to

force a refresh