Further thoughts on yesterday’s revelations:

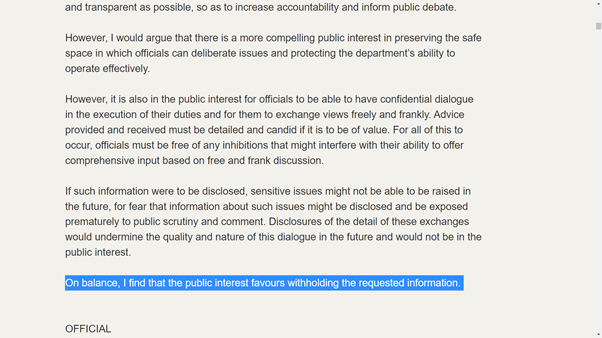

It should be noted that HMRC have not disclosed all information requested. They have taken the view that some information can be withheld “in the public interest”.

1/11

It should be noted that HMRC have not disclosed all information requested. They have taken the view that some information can be withheld “in the public interest”.

1/11

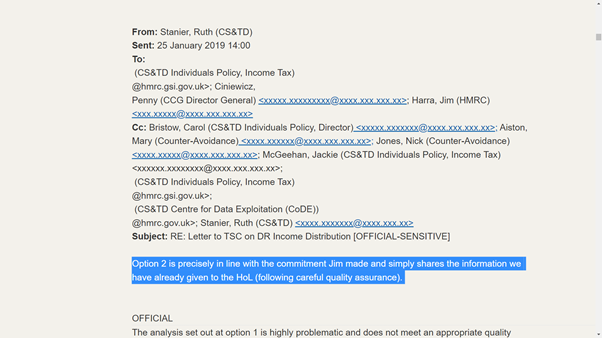

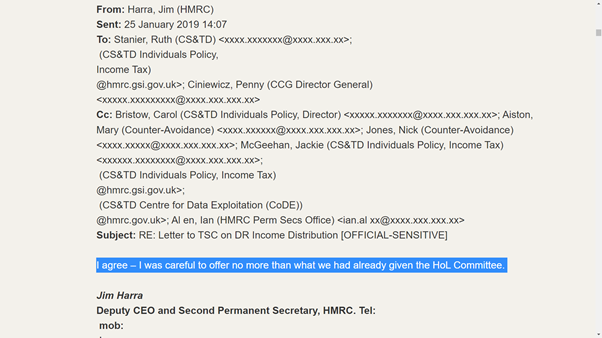

It is entirely possible that the exemption has been validly claimed on this occasion. However, given that trust in HMRC is so low, a greater element of candour might have been appropriate.

But it seems that candour is not the current Modus Operandi.

2/11

But it seems that candour is not the current Modus Operandi.

2/11

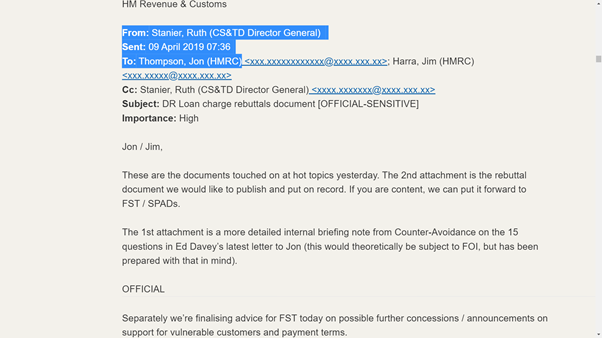

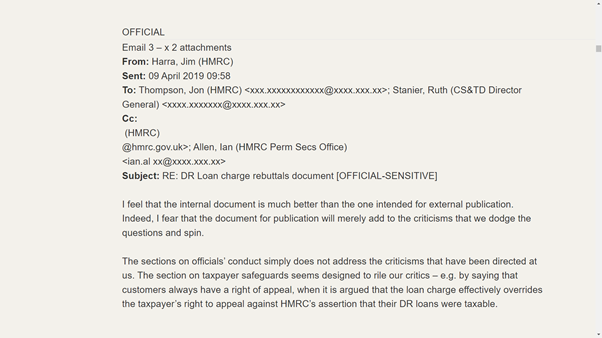

It seems that HMRC prepared two documents in April 2019 to discuss the loan charge – one was for internal consumption only and the other for publication.

But HMRC’s comments on the drafts are interesting.

3/11

But HMRC’s comments on the drafts are interesting.

3/11

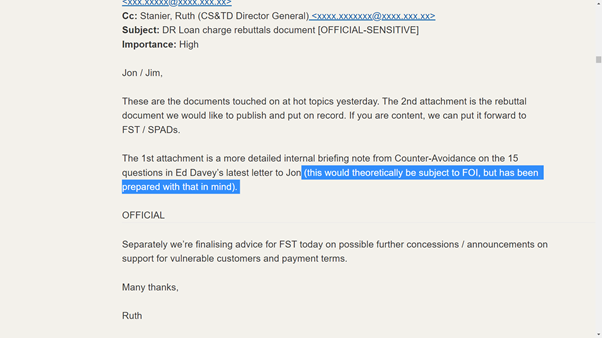

The document for internal consumption is described as “detailed”. HMRC acknowledge that it could be “theoretically subject to FOI” and they have prepared that in mind.

In other words, it is not necessarily accurate but at least it should not be embarrassing if made public.

4/11

In other words, it is not necessarily accurate but at least it should not be embarrassing if made public.

4/11

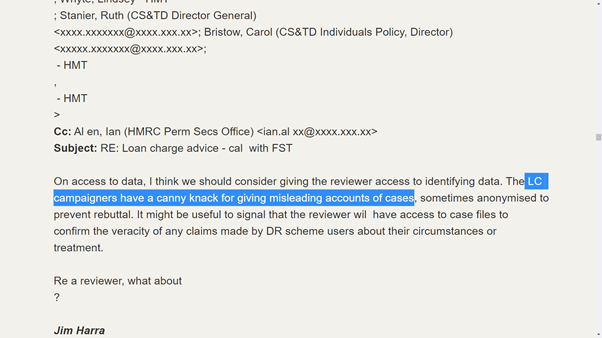

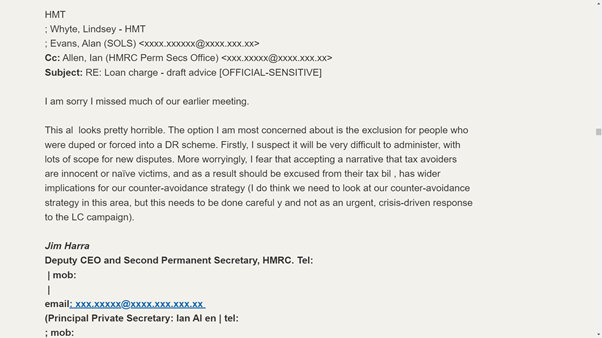

Indeed, even Jim Harra recognised that the document due to be publicised would reinforce criticisms that HMRC dodge difficult questions with spin.

5/11

5/11

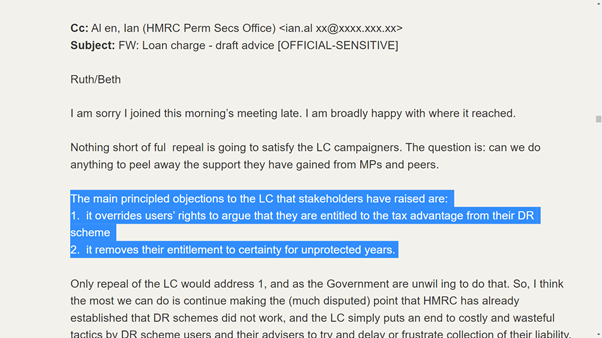

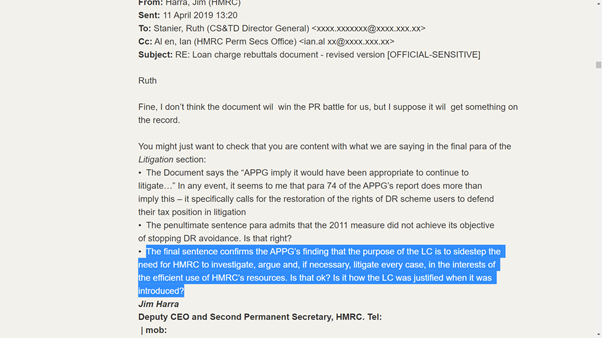

Two days later, there are some startling revelations.

It is clear that the document as drafted by HMRC confirms the purpose of the LC. Jim wants to check whether Ruth is really content to make this admission.

6/11

It is clear that the document as drafted by HMRC confirms the purpose of the LC. Jim wants to check whether Ruth is really content to make this admission.

6/11

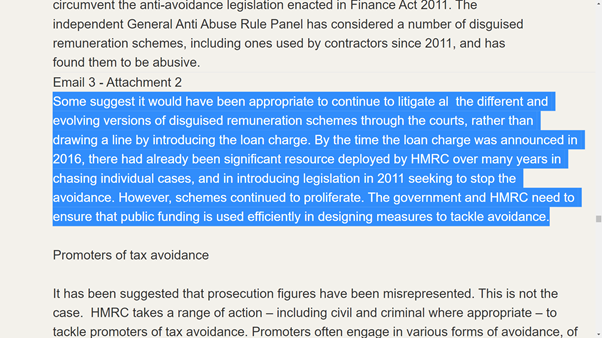

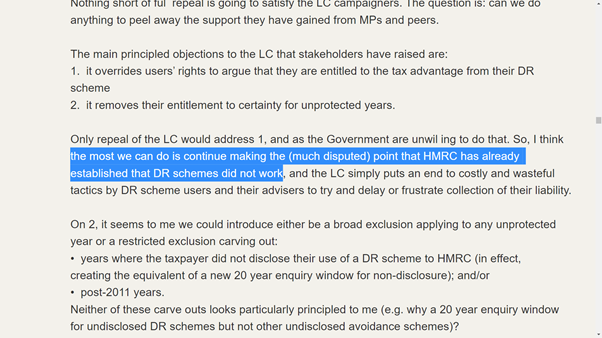

Here it is government who is being blamed for not backing down and it is for HMRC to try to defend the position. How? By repeating the line that HMRC have established that the schemes do not work.

But even Jim realises that that line is “much disputed”.

8/11

But even Jim realises that that line is “much disputed”.

8/11

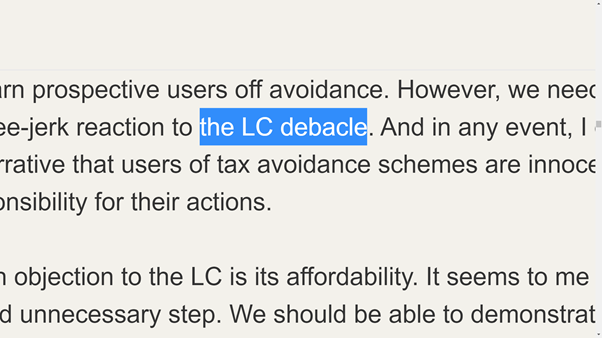

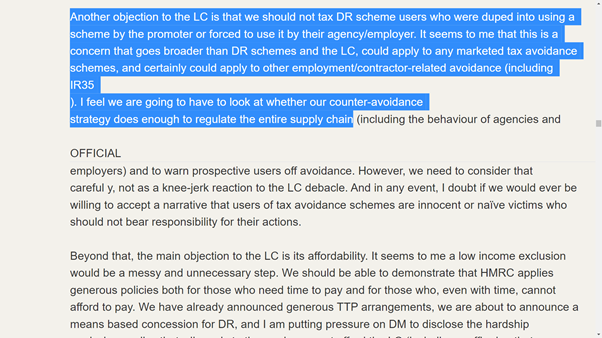

Jim also discusses how HMRC should try to stop these schemes gaining traction in future. It recognises that users might have been “duped” but says HMRC are not likely to accept that “narrative” officially.

9/11

9/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh