A tax barrister who tweets occasionally on tax-related matters. All tweets written in a personal capacity. Even in deserving cases no advice given via Twitter

10 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/Stephen41792571/status/15439948112624066602. Indeed, after lying unused on the statute books for 15 years, the guidance as to its use kept changing over the next two or so years.

https://twitter.com/LCAG_2019/status/1542158606967226374When HMRC finally complied, they gave me a long list of snippets where I had been cited in internal despatches.

https://twitter.com/Mylerdoo/status/1474110405488390147Although statute provides that the employee is liable for income tax on employment income (s13), elsewhere in the Act (s684) it is made clear that the PAYE regs “have effect despite anything in the Income Tax Acts”.

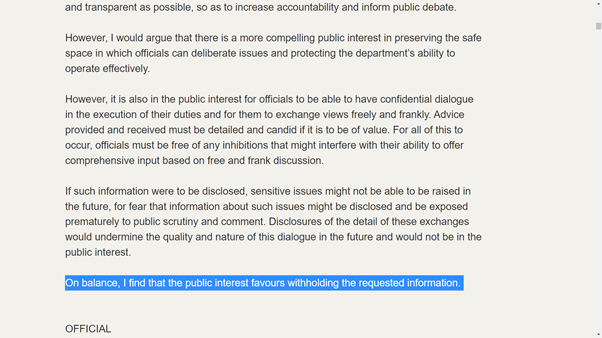

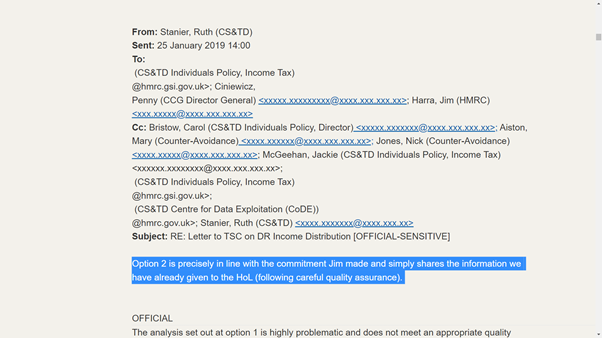

Senior officials had hoped to and continued to withhold data.

Senior officials had hoped to and continued to withhold data.

Again, this is one of the causes of dissonance.

Again, this is one of the causes of dissonance.

Ditto re HJ3. The original wording was full of jargon that many in the tax world just do not realise is meaningless to normal people.

Ditto re HJ3. The original wording was full of jargon that many in the tax world just do not realise is meaningless to normal people.

1.Interestingly, it asserts in the context of the use of non governmental lines of electronic communication "is not permitted when conducting government business. Further, the use of non-government email accounts to discuss government business is not allowed".

1.Interestingly, it asserts in the context of the use of non governmental lines of electronic communication "is not permitted when conducting government business. Further, the use of non-government email accounts to discuss government business is not allowed".

https://twitter.com/keithmgordon/status/1427919604089769984

More acknowledgement of HMRC’s delays (particularly pre-2009)

More acknowledgement of HMRC’s delays (particularly pre-2009)

HMRC have not actually disclosed the suspicious e-mail. But I can live without it. What the disclosures did reveal however is that HMRC send a monthly bulletin to MPs.

HMRC have not actually disclosed the suspicious e-mail. But I can live without it. What the disclosures did reveal however is that HMRC send a monthly bulletin to MPs.

Apparently different MPs (and their constituents) had different concerns and HMRC recognised that a meaningful standard response would be difficult to draft.

Apparently different MPs (and their constituents) had different concerns and HMRC recognised that a meaningful standard response would be difficult to draft.

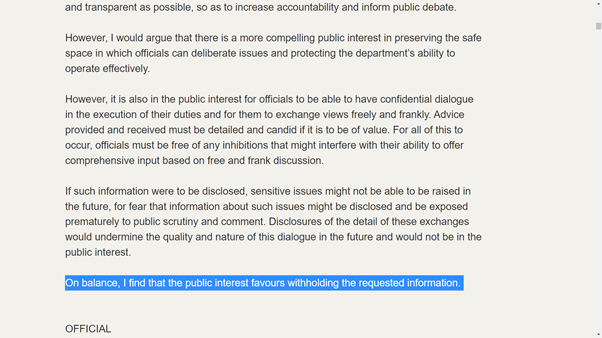

It is entirely possible that the exemption has been validly claimed on this occasion. However, given that trust in HMRC is so low, a greater element of candour might have been appropriate.

It is entirely possible that the exemption has been validly claimed on this occasion. However, given that trust in HMRC is so low, a greater element of candour might have been appropriate.

https://twitter.com/steve_packham/status/1384967680441167873Perhaps this is the nub of the issue: HMRC see contractors as the enemy and the loan charge was just one part of this battle.