“The request is simple, please include... supply chain finance” Bank of England release FOI correspondence with former PM Cameron, lobbying for inclusion of supply chain finance, offered by Greensill Capital, within post COVID support scheme to buy forms of commercial debt:

Greensill contacted Bank/HMT on ‘a number of occasions’.

Cameron contacted Bank on 5th and 7th March 2020.

DC/ Greensill/ Bank call on 17 March.

On 18 March Bank announced CCFF scheme, excluding supply chain finance.

DC asks for clarity twice in April

bankofengland.co.uk/-/media/boe/fi…

Cameron contacted Bank on 5th and 7th March 2020.

DC/ Greensill/ Bank call on 17 March.

On 18 March Bank announced CCFF scheme, excluding supply chain finance.

DC asks for clarity twice in April

bankofengland.co.uk/-/media/boe/fi…

This is a rather interesting sentence from Cameron to then Governor Carney’s private secretary introducing Greensill...

“GC is now the world’s largest provider of Supply Chain Finance and has the mandate for the UK government”.. which is a reference to...

“GC is now the world’s largest provider of Supply Chain Finance and has the mandate for the UK government”.. which is a reference to...

... the point elaborated on in Greensill’s specific proposal to Deputy Gov Cunliffe for why the Bank’s emergency debt purchases should (as in 2010) include supply chain finance...

“We are the sole provider of HMGs supply chain finance programmes across all areas...”

“We are the sole provider of HMGs supply chain finance programmes across all areas...”

DC’s email pleads with Deputy Governor over objections relating to Greensills use of foreign currency, support for foreign supply chains, and in particular that this corporate facility was not for a financial institution...

Greensill caught between that and not being a bank...

Greensill caught between that and not being a bank...

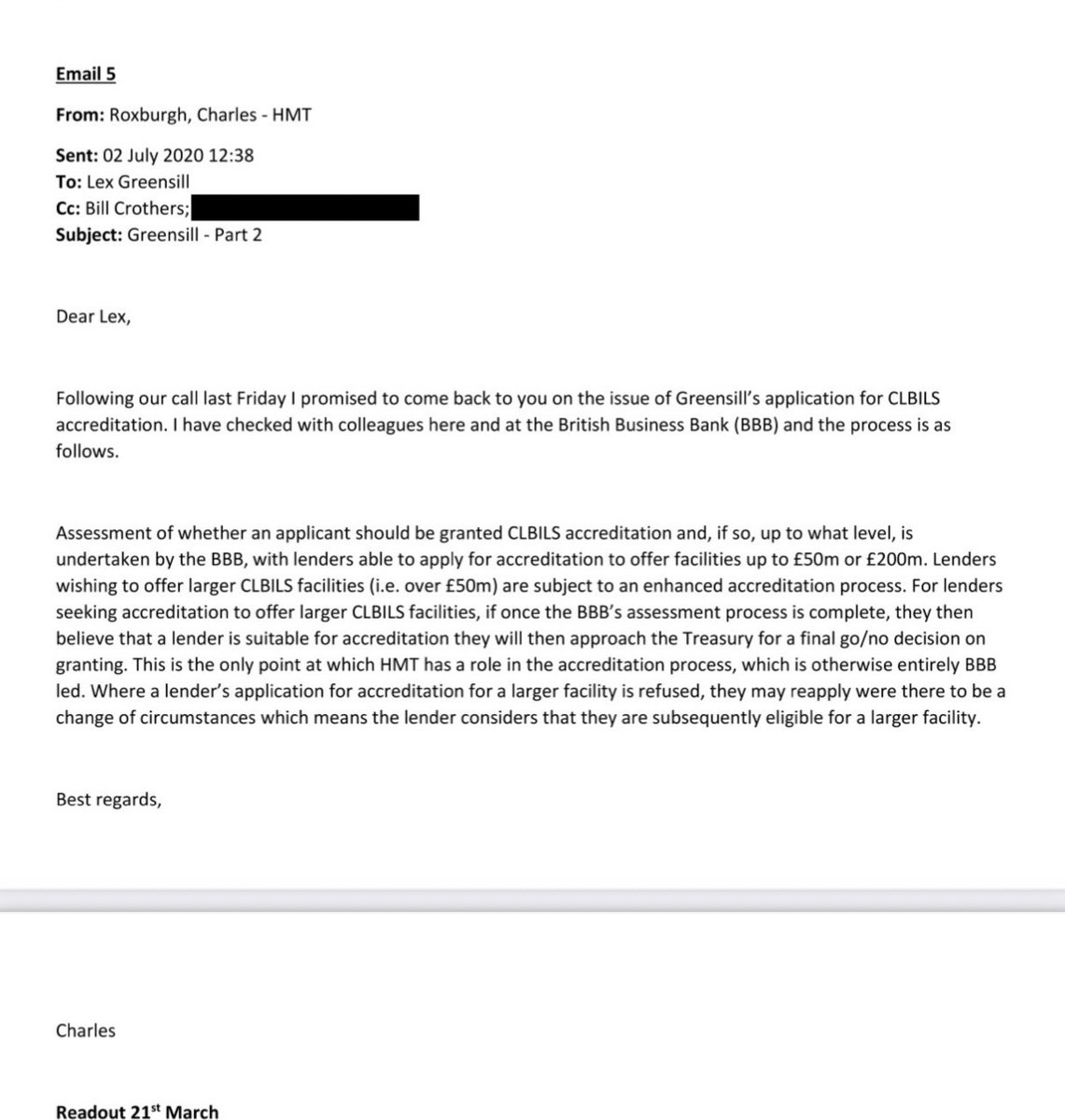

New set of emails to the Treasury released...

Of note: an amount of between £4-10bn mentioned for the refused application for the Commercial Paper facility.

Treasury seem pretty sceptical at this point, and Cameron and Greensill basically argue its to help NHS/ pharmacies...

Of note: an amount of between £4-10bn mentioned for the refused application for the Commercial Paper facility.

Treasury seem pretty sceptical at this point, and Cameron and Greensill basically argue its to help NHS/ pharmacies...

... so what changed by June? At that point Greensill is entrusted with actually itself handing out taxpayer backed COVID support loans under separate CLBILs scheme, after having badgered Treasury over its support for NHS and pharmacies, and lends money to Gupta’s steel companies.

Again back in March - pretty sceptical note - Treasury Perm Sec reports “incoming from my old boss” - Cameron.... and “well done for holding off ⬛️⬛️⬛️⬛️”...

And then the mention of the former Cabinet Secretary Sedwill is new - he introduces Greensill to second perm sec of Treasury - which rather suggests there were more emails/texts/ lobbying elsewhere (ie other than HMT & Bank of England that we have seen)...

• • •

Missing some Tweet in this thread? You can try to

force a refresh