1/ 🐛 📝 🥞 🆚 2️⃣

🚨 Smart Contract Bug found in Pancake V2 🚨

🐛: Pancake new router is incompatible with Pancake LP implementation.

Users may get __revert__ txs upon __swaps__ due to the bug.

Vulnerability was reported to @PancakeSwap team asap.

Thread below 👇

🚨 Smart Contract Bug found in Pancake V2 🚨

🐛: Pancake new router is incompatible with Pancake LP implementation.

Users may get __revert__ txs upon __swaps__ due to the bug.

Vulnerability was reported to @PancakeSwap team asap.

Thread below 👇

2/ After @PancakeSwap V2 announcement, we have been working on supporting the new V2 pools.

✅ As with our security standard, we always perform smart contract review and testing, to ensure our users’ safety.

❗️ We have found and informed the @PancakeSwap team on the issue.

✅ As with our security standard, we always perform smart contract review and testing, to ensure our users’ safety.

❗️ We have found and informed the @PancakeSwap team on the issue.

3/ 🐛 So, what is the actual bug?

The question comes down to: what changes from Pancake V1 to V2?

1️⃣ Swap fees: 0.2% ➡️ 0.25%

2️⃣ Fee distribution to LPs, to dev address

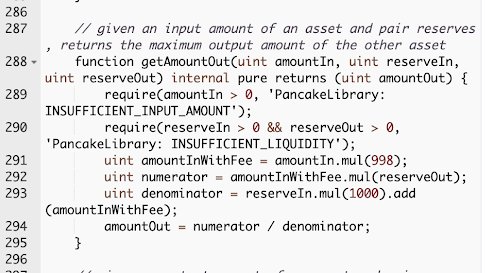

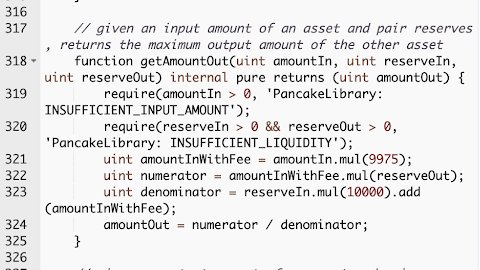

Below are the router __getAmountOut__ implementations (V1 & V2). The difference lies in the numbers.

The question comes down to: what changes from Pancake V1 to V2?

1️⃣ Swap fees: 0.2% ➡️ 0.25%

2️⃣ Fee distribution to LPs, to dev address

Below are the router __getAmountOut__ implementations (V1 & V2). The difference lies in the numbers.

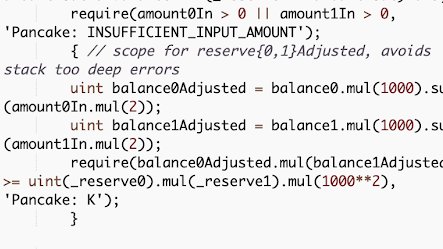

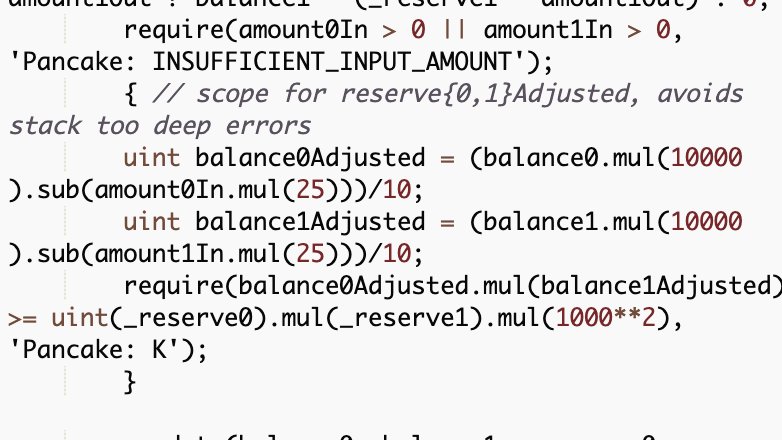

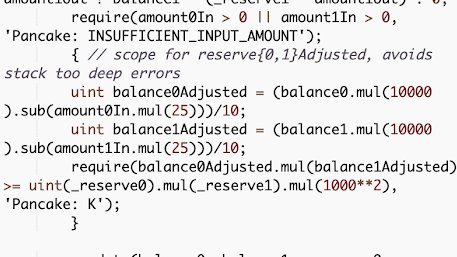

4/ On the LP pair side, __swap__ function also encodes the swap fee for constant product calculation. Here are the V1 and V2 implementation:

5/ 👀 At first glance, the implementation seems correct, as the parameters reflect 0.2% and 0.25% in the old and new versions, respectively.

However, in Solidity, there is no floating-point.

All divisions will be rounded down ⬇️.

However, in Solidity, there is no floating-point.

All divisions will be rounded down ⬇️.

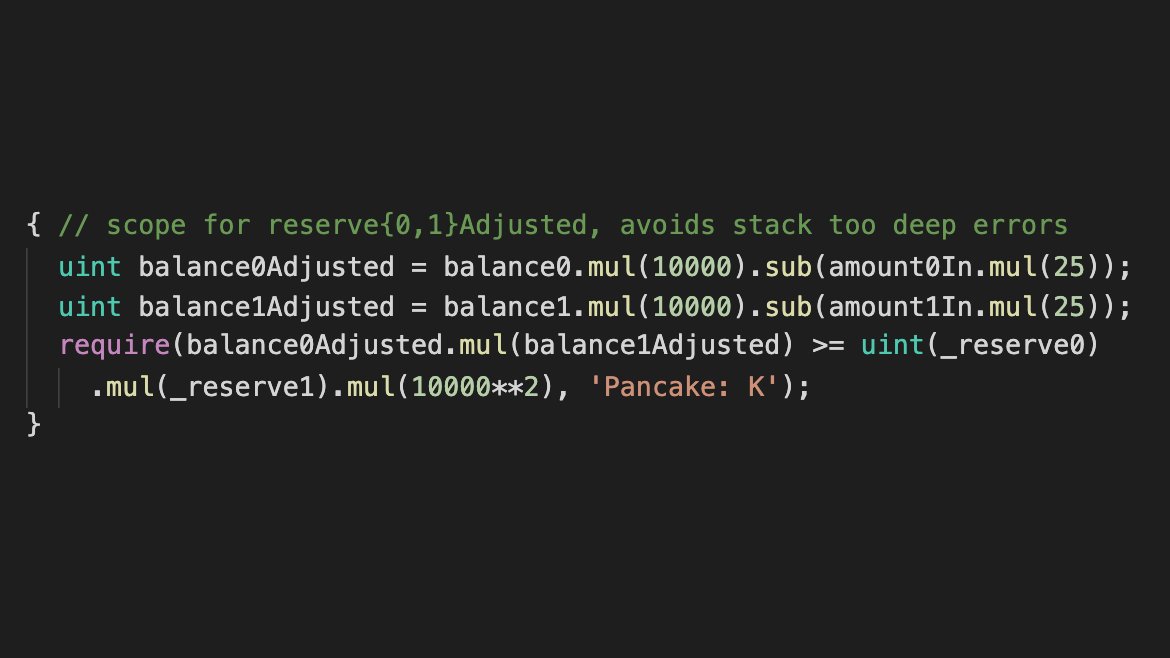

6/ So, __balance0Adjusted__ and __balance1Adjusted__ can have their actual values truncated, reverting the next __require__ statement when checked for the constant product monovariant.

7/ Instead of performing divisions, it’s mostly always better to compare the cross-multiplication. This should be the correct implementation:

9/ So, the next question is: How does this affect #AlphaHomora?

#AlphaHomora performs multiple complex txs into one, including swaps. This means that users who open new positions, refill existing positions, and also liquidations may get revert txs.

#AlphaHomora performs multiple complex txs into one, including swaps. This means that users who open new positions, refill existing positions, and also liquidations may get revert txs.

10/ 💦 As liquidation is one of the core security features of #AlphaHomora to keep the protocol solvent, this bug can cause security loopholes in our system.

Even if the chances of tx reversions are not high, security is one of @AlphaFinanceLab’s top priorities.

Even if the chances of tx reversions are not high, security is one of @AlphaFinanceLab’s top priorities.

11/ After we’ve found the bug and made sure it’s reproducible, we immediately contacted @PancakeSwap team to inform them re:vulnerability.

They immediately responded and confirmed the vulnerability within minutes.

They immediately responded and confirmed the vulnerability within minutes.

12/ To fix the issue, a new factory, router, and LP pairs need to be deployed.

We’ll be working towards supporting these new pools and again performing checks and tests on the new implementation.

🛄 And so let the new migration begin...

We’ll be working towards supporting these new pools and again performing checks and tests on the new implementation.

🛄 And so let the new migration begin...

https://twitter.com/PancakeSwap/status/1385501978667618304

• • •

Missing some Tweet in this thread? You can try to

force a refresh