woah exhibit 16. more Facebook docs quietly unsealed yesterday - it gets worse. A full, damning senior execs' email thread (CFO, COO) unsealed. Facebook slowed unsealings in this fraud case and spun it as "cherrypicking."

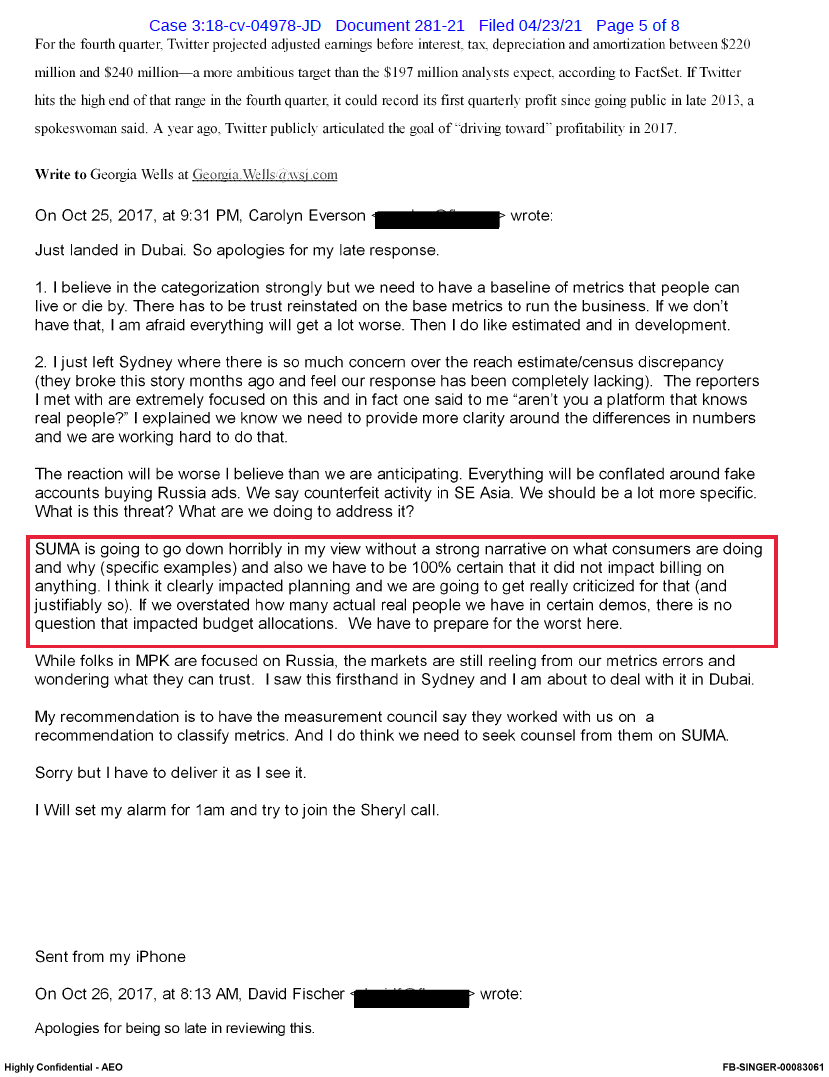

Top marketing exec, Carolyn Everson, weighs in here. /1

Top marketing exec, Carolyn Everson, weighs in here. /1

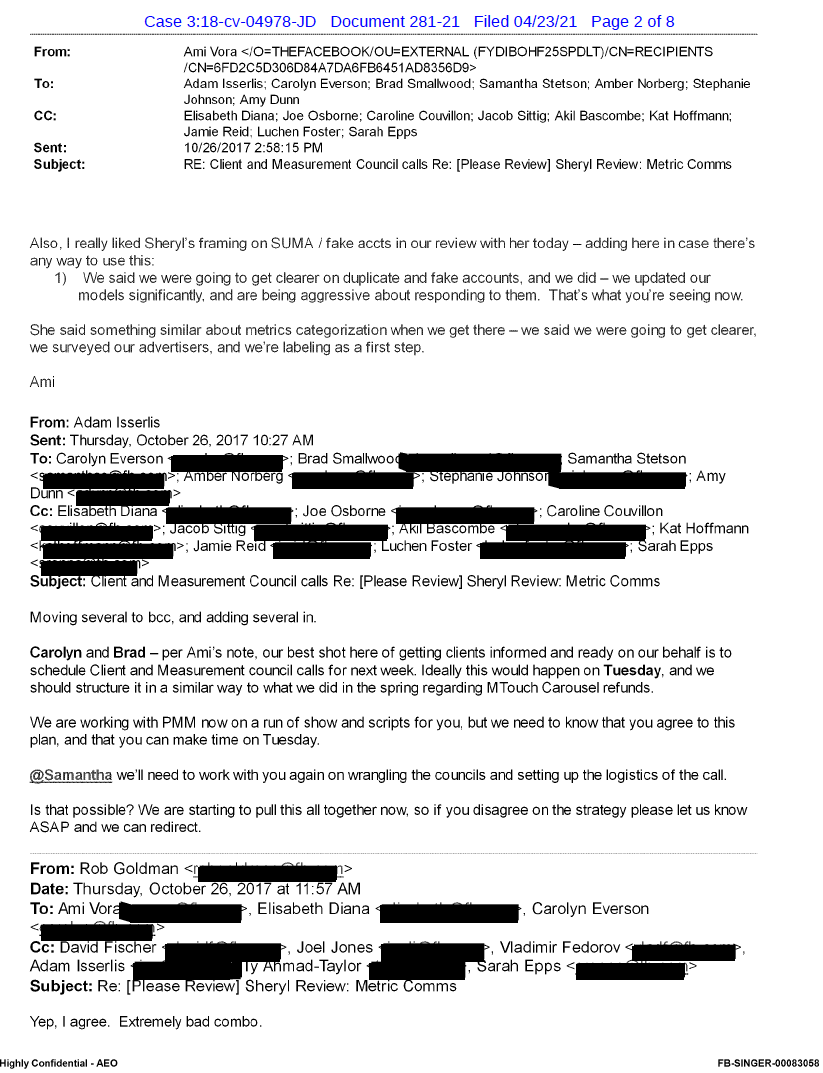

exhibit 16 (one of 75 in the case) is an entire thread of senior executives - probably why they classified as "Highly Confidential - Attorneys' Eyes Only". It is most damning IMHO and entirely blows up Facebook's "taken out of context" narrative. /2

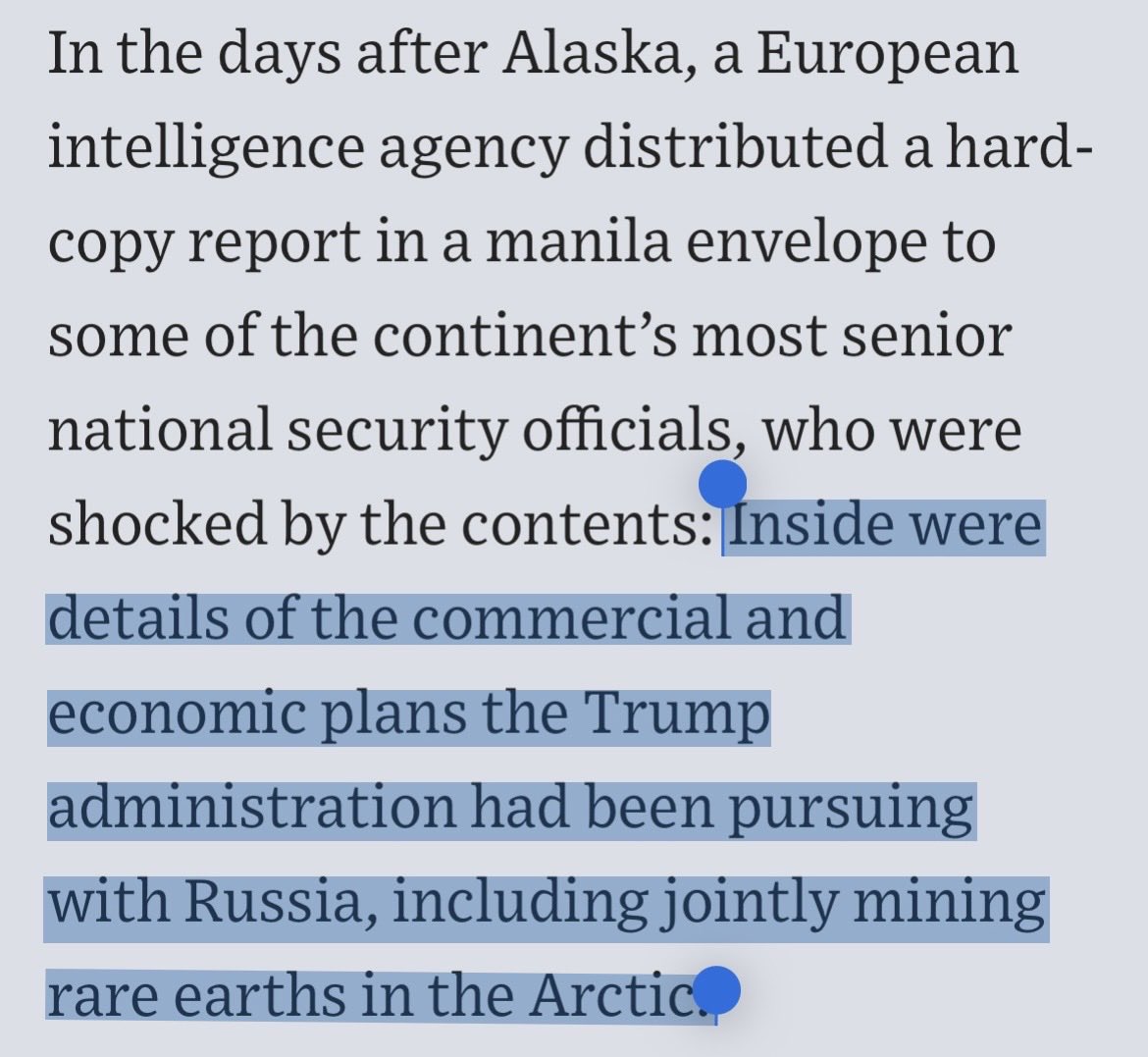

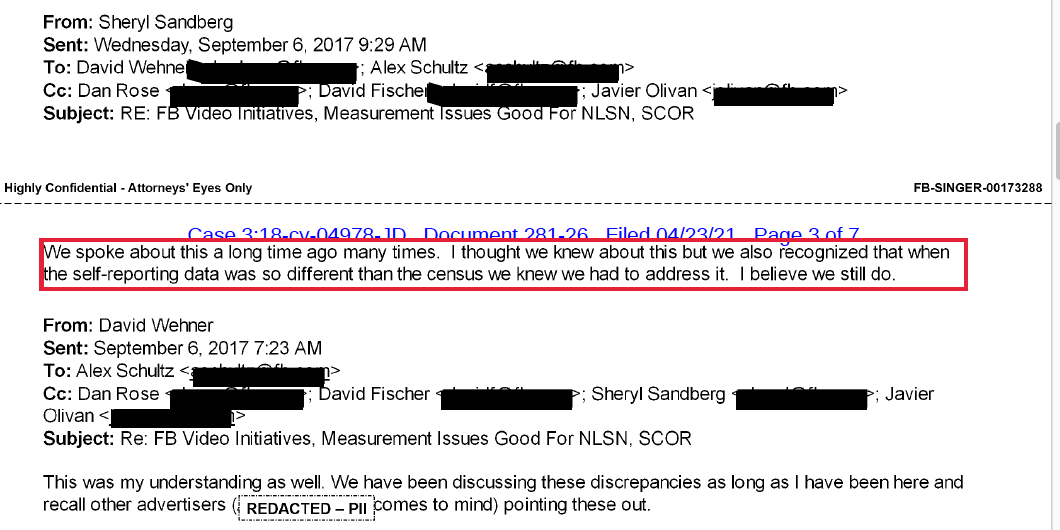

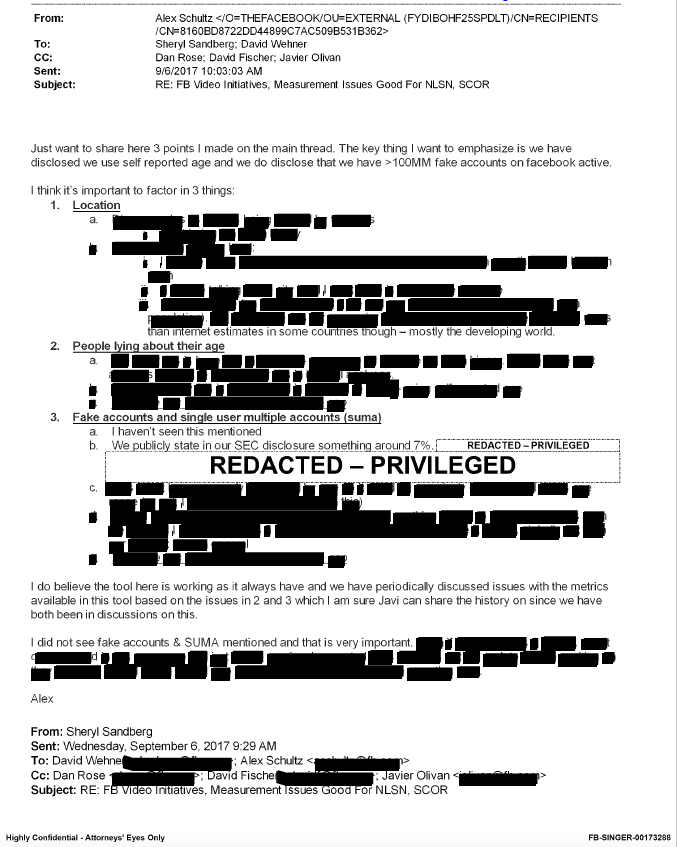

We've learned in this case why "SUMA" was such a sensitive topic. I believe it stands for Single User Multiple Accounts. Here is a part of another thread when metrics issue broke and Facebook CFO Wehner flagged with COO Sandberg who says she believes they need to address it. /3

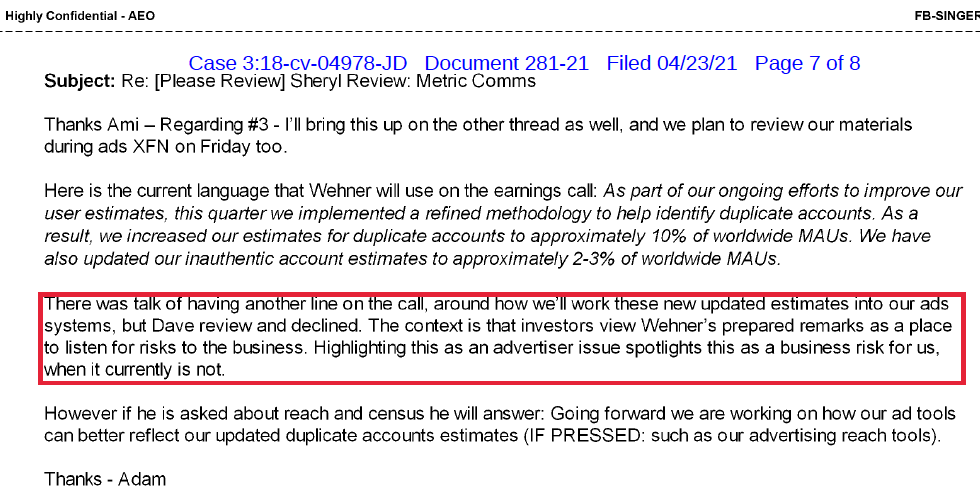

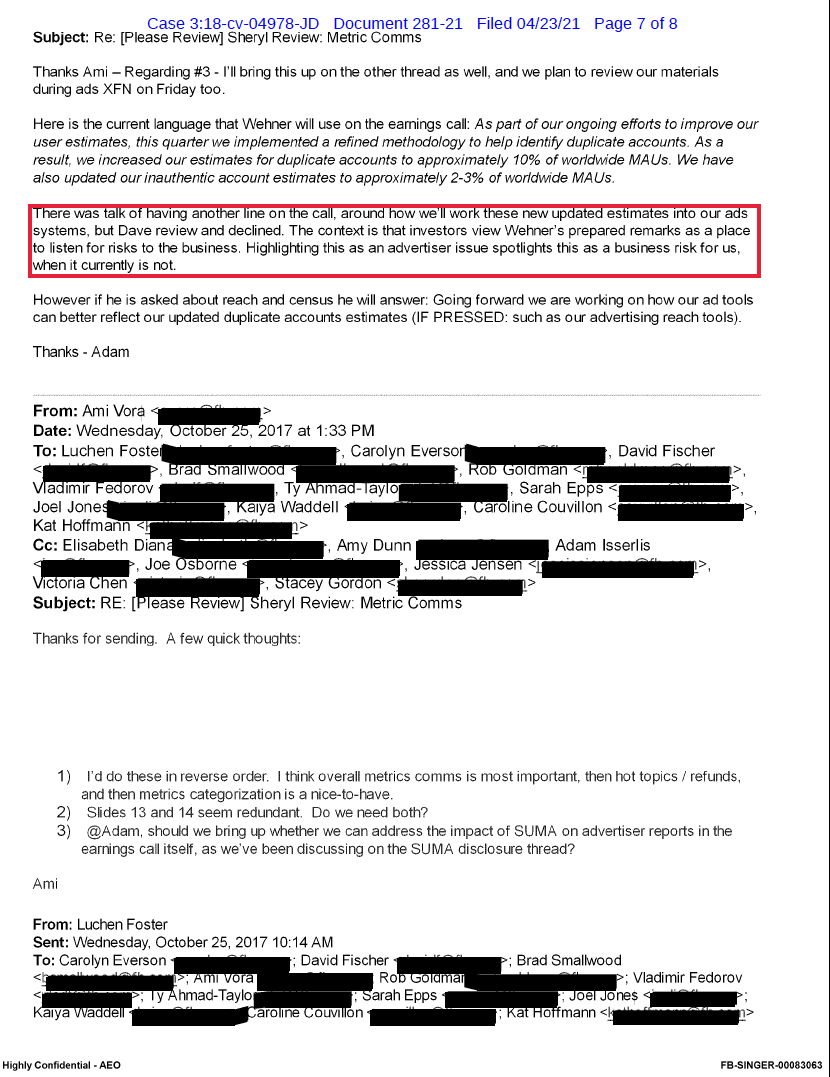

ex16 appears to be exec scramble on eve of prep meeting with Sandberg the week prior to earnings. In the thread, there is also a note why CFO doesn't plan to put it into FB's prepared earnings remarks as it only matters to clients but he doesn't deem it a business risk 👀!!!

/4

/4

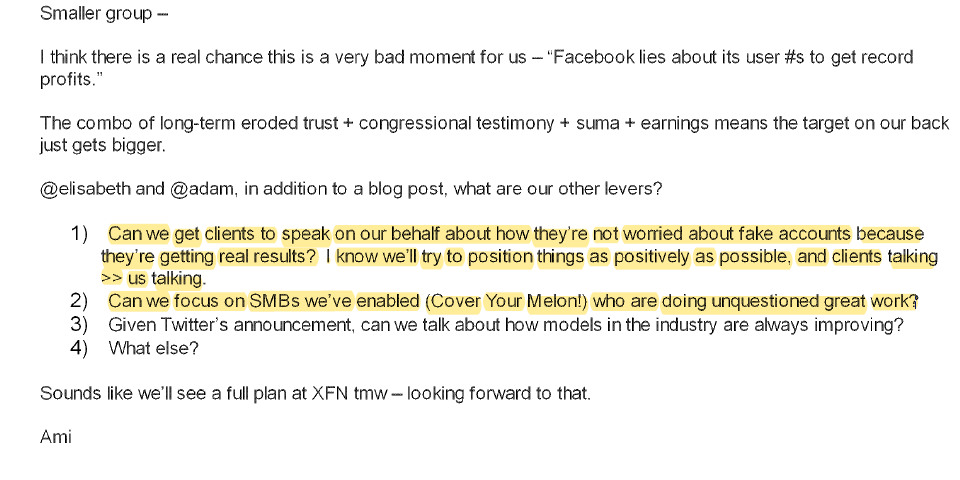

"I think there is a real chance this is a very bad moment for us - 'Facebook lies about its user #s to get record profits.'" <- Facebook employee.

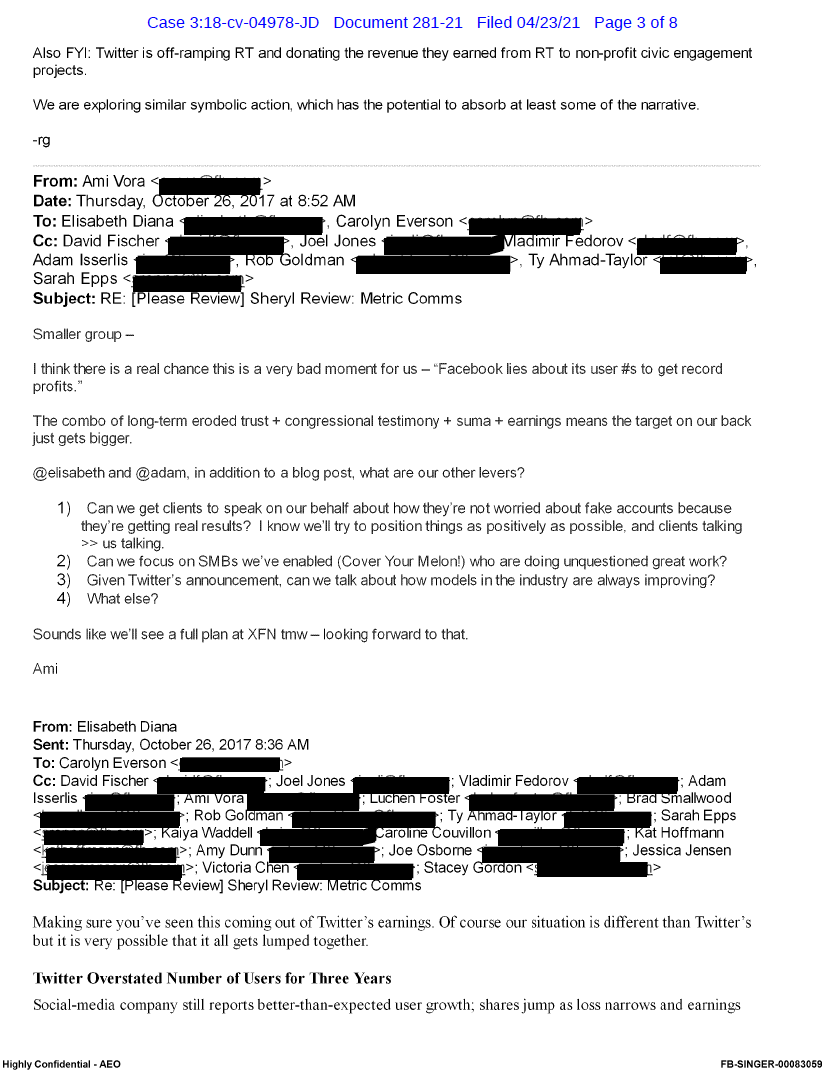

You can see (familiar) how they strategize spin 1) captured advertising clients lobbying for them, 2) small business!!! etc etc /5

You can see (familiar) how they strategize spin 1) captured advertising clients lobbying for them, 2) small business!!! etc etc /5

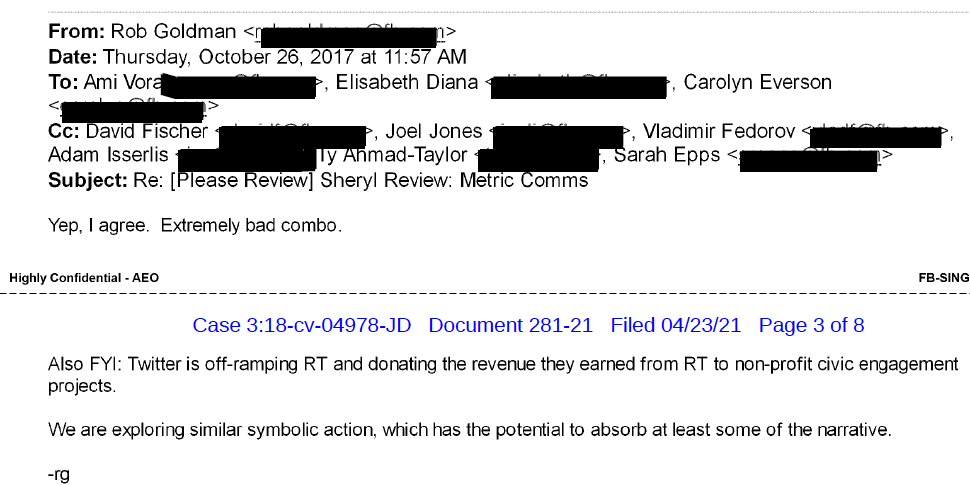

On a side note regarding spinning, buried in the thread is also how they explored a "symbolic action" when they kicked Russia Today off Facebook's platforms to "absorb at least some of the narrative." Not sure if they did this. /6

If you're wondering why I'm the one sharing this all, we happened to have the tweet sparking this lawsuit several years ago. I hadn't followed it super closely until the fraud complaint was added to it along with seeing other evidence of FB cover-ups. /7

https://twitter.com/jason_kint/status/905237289588199425?s=20

DCN is also party to case as we filed with Judge to have unsealed. You can read our rationale here - if a monopoly gets to grade its own homework then transparency is critical. Facebook's redactions were ridiculous - protecting its vanished trust. /8

https://twitter.com/jason_kint/status/1252796340398166016

Here is a thread from Feb when very first doc was unsealed (the fraud complaint itself). Again FB managed to creatively hold up much of the other docs from being unsealed. They lost, trust and trust wins. 👋🏼

I'll stop there - 75 exhibits in all. Cheers. /9

I'll stop there - 75 exhibits in all. Cheers. /9

https://twitter.com/jason_kint/status/1362256358213627905?s=20

I should note, yellow highlights are mine. In the first tweet, it's worth noting how even FB top marketing exec, Everson, recognized and focused on how this would have impacted planning, budgets and marketplace. Like with other cover-ups, their decisions harm everyone else. /10

Bless you 🙏🏽 , @FBoversight /11

https://twitter.com/FBoversight/status/1386429287180300289

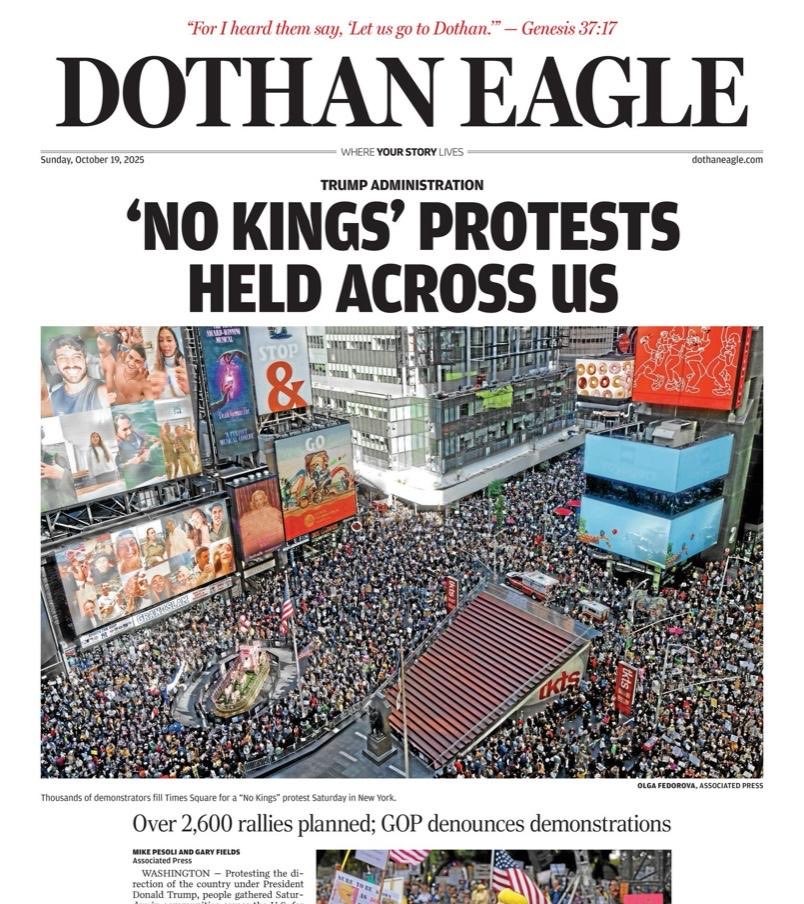

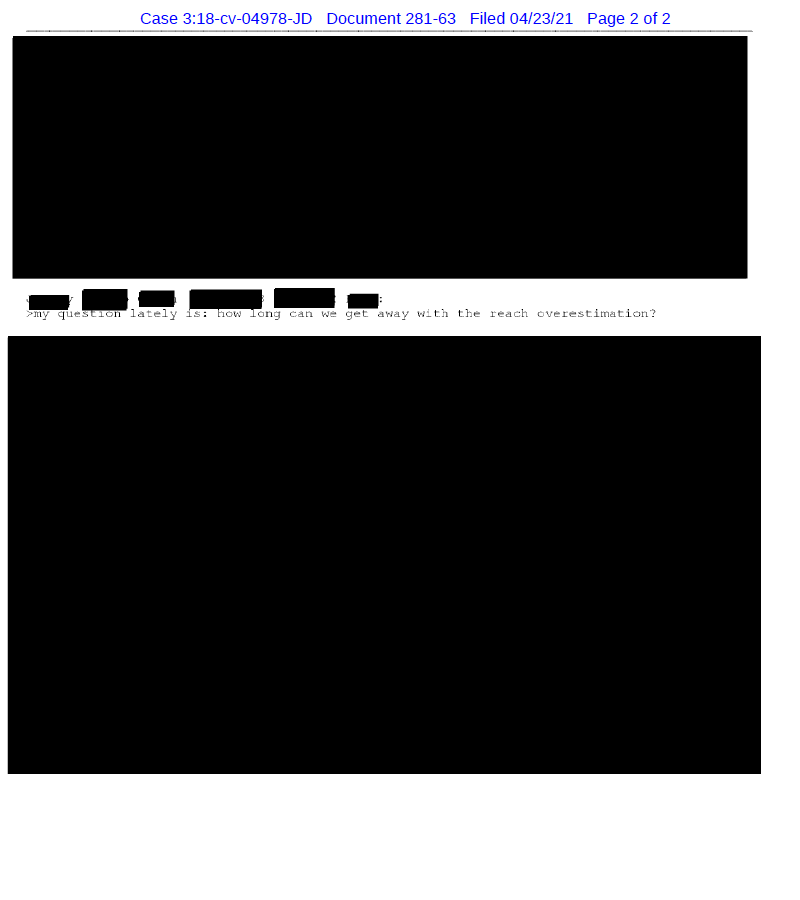

Here are a few other exhibits. Redactions like this are how Facebook attempted to frame evidence as cherry-picked.

"how long can we get away with the reach overestimation?"

"This is a lawsuit waiting to happen." /12

"how long can we get away with the reach overestimation?"

"This is a lawsuit waiting to happen." /12

And again, here are the key pages of the email thread in exhibit 16 which was posted here (…d-40e9-822b-081bc894b6af.filesusr.com/ugd/372b91_40f…). My take is: (1) allegations are not all taken out of context and (2) top execs confirmed it impacted ad market and (3) Facebook's CFO is overconfident. /13

Rather than policy execs testifying, it would be much more interesting to hear from the chief growth hackers (Alex worked for Javi). My two cents. Another piece of evidence expresses a SUMA concern in having to lose a "people-based" narrative and shift to "accounts-based." /14

First news report on this I’ve seen. Facebook’s provided quote didn’t change much but is now patently absurd considering exhibit 16 is a full thread with some of the most senior execs in the company. /15 ft.com/content/5b8d1c…

Still digging thru these exhibits. Facebook's VP Rob Goldman, was asked if it would be a good thing if they could significantly reduce their inflated #s and he said, "no." 🤦🏼♂️I don't get it. Maybe it's out of context or maybe it just wouldn't be a good thing **for Facebook.** /16

Excellent. Appreciate Parliament (@stellacreasy) has asked UK Competition authority to look into the ⬆️by Facebook. Even more important to me than the inflated figures is the evidence they once again intentionally covered up risk to investors and market.

https://twitter.com/HelCahill/status/1393892365568520193?s=20

Just reading thru Facebook's weekend response to its deceptive reach and fake accounts' lawsuit⬆️. The redactions they try to get away with are insane. Facebook gets to seal their known overlap between Instagram and Facebook accounts??? Relevant to their antitrust cases, too.

when Facebook tries to defend by suggesting potential reach doesn't matter to advertisers, it spend significant efforts explaining why they are incredibly reliant on surveillance. Considering more than half their data collection is at risk with Apple's new privacy defaults, ouch.

deep in Facebook's response it also has ten declarations from advertising clients. Each of them seems to not really care about "fake accounts" and doesn't use Potential Reach either.... but what I find to be most remarkable....

...it's remarkable Facebook has such good friends in these small businesses just sitting around ready to understand a complex lawsuit about Fake Accounts and defend them. Found out about it on a Monday and signed in support by Thursday. For Facebook. Remarkable.

• • •

Missing some Tweet in this thread? You can try to

force a refresh