1/ This week we are visualizing @AaveAave growth with the analysis prepared by @Covalent_HQ Alchemist Ambassadors.

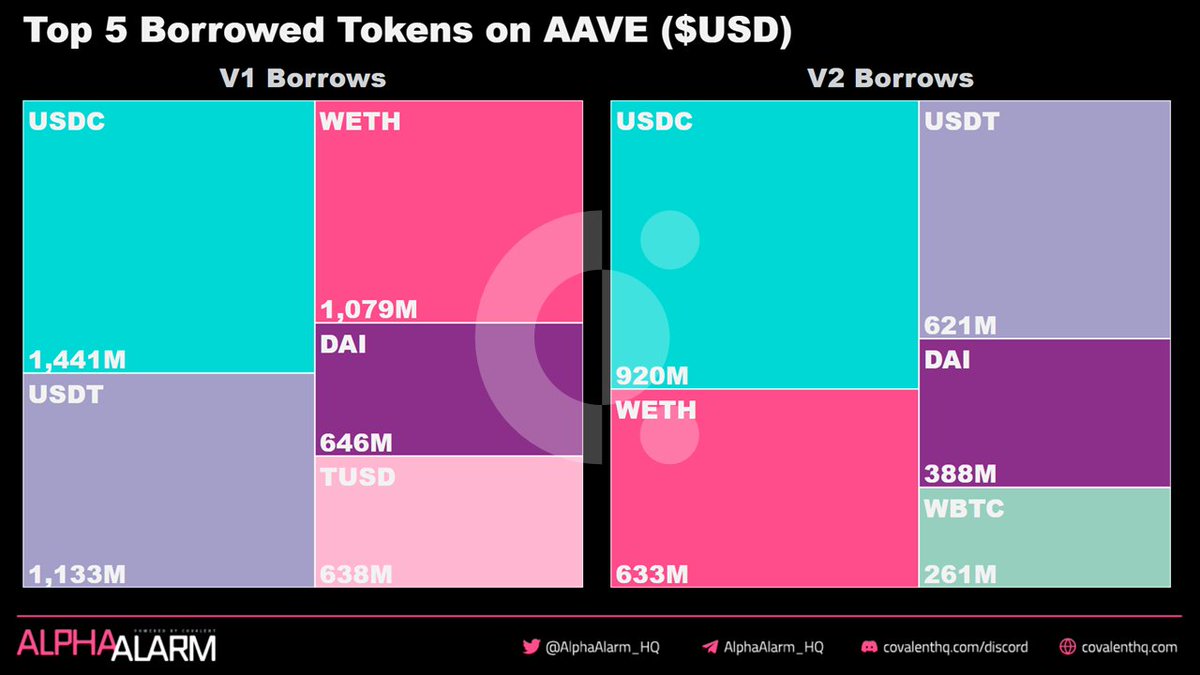

Today we show the different tokens deposited and borrowed on Aave. Please note that these are cumulative (i.e total amounts) and not snapshots.

Today we show the different tokens deposited and borrowed on Aave. Please note that these are cumulative (i.e total amounts) and not snapshots.

2/ There is some significant daily variability in the daily borrows as shown in the visual below. 2021 has seen consistent growth in daily borrows - I imagine that will accelerate with the newest liquidity incentive proposal AIP 16.

3/ Some quick @AaveAave borrowing facts to go with the above visuals.

- Average borrow: $89K

- Median borrow: $10k

- Unique borrowers: 15,203

- Total borrow events: 117K

- Average borrow: $89K

- Median borrow: $10k

- Unique borrowers: 15,203

- Total borrow events: 117K

4/ On the deposit front, there is also quite a bit of daily variability and growth through 2021. This should also increase significantly with the increased yields brought about by AIP 16.

5/ Some quick @AaveAave deposit facts to go with the above visual:

- Average deposit: $173K

- Median deposit: $3,500

- Unique depositors: 46,187

- Total deposit events: 239K

- Average deposit: $173K

- Median deposit: $3,500

- Unique depositors: 46,187

- Total deposit events: 239K

6/ The total deposits seen in the last visual are shown below broken down by token. Even though V2 was launched long ago, the deposits on V1 continue to grow - already more than 50% of the total V1 2020 deposits have been deposited into V1 in 2021.

7/ This visual is slightly skewed seeing that V2 was only launched at the end of 2020 but it does give a good representation of the growth in V2 thus far. The most popular V2 deposits have been $DAI, $USDC, $USDT, $WBTC, $WETH.

8/ Thanks to @thompland777 for helping create some of these visuals!

There is much more analysis that can be done here. Anything you want to see in particular?

We have some interesting analyses of flash loans and liquidations coming up later in the week.

There is much more analysis that can be done here. Anything you want to see in particular?

We have some interesting analyses of flash loans and liquidations coming up later in the week.

• • •

Missing some Tweet in this thread? You can try to

force a refresh