Liverpool publish 2020 results: Headlines

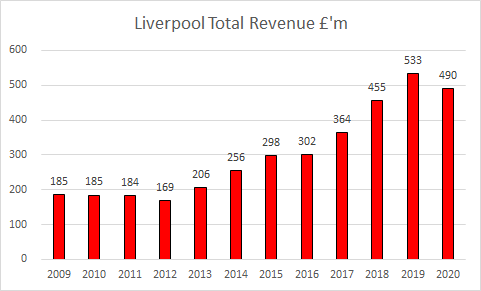

Revenue down 8% to £490m

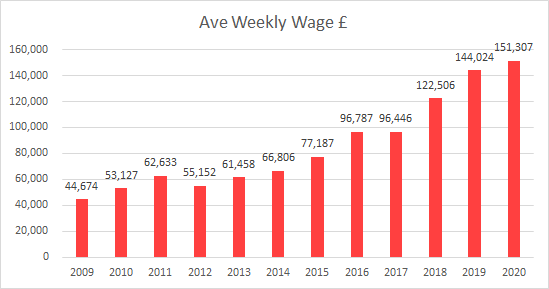

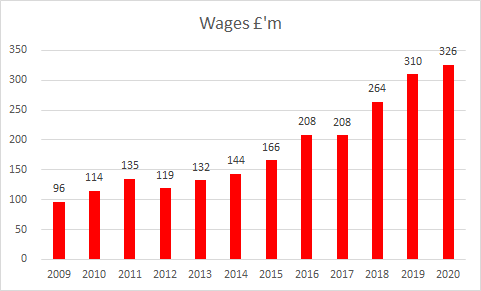

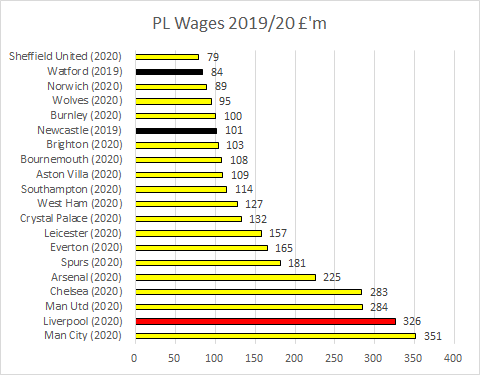

Wages up 5% to £326m

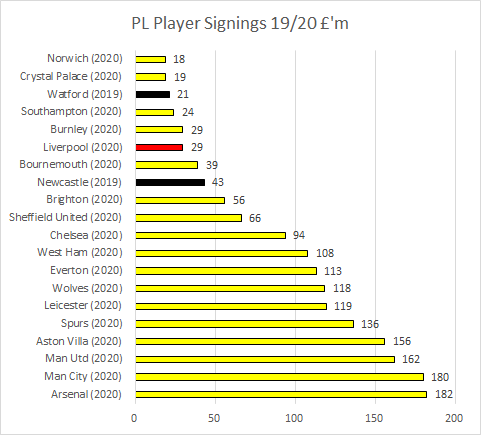

Net transfer spend zero

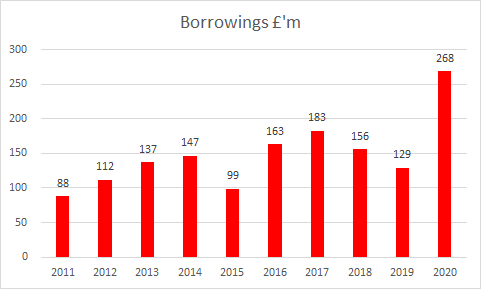

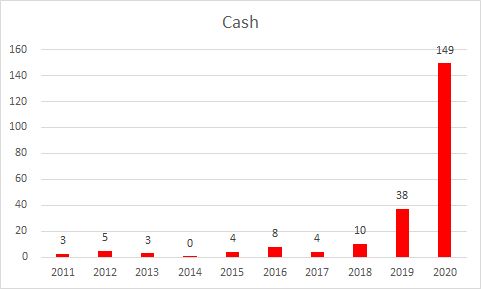

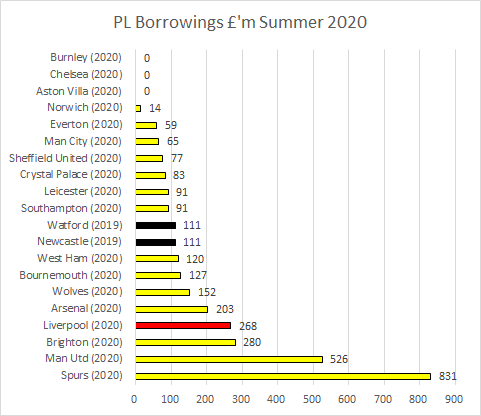

Net debt (borrowings less cash) up £28m to £119m #LFC

Revenue down 8% to £490m

Wages up 5% to £326m

Net transfer spend zero

Net debt (borrowings less cash) up £28m to £119m #LFC

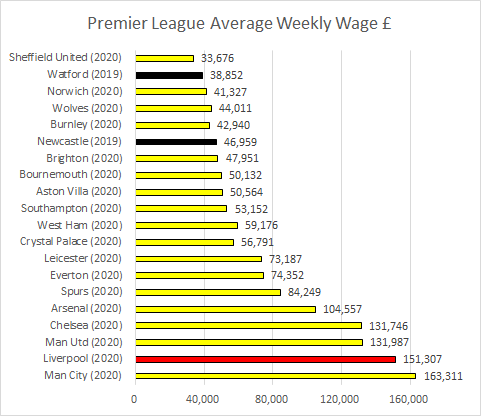

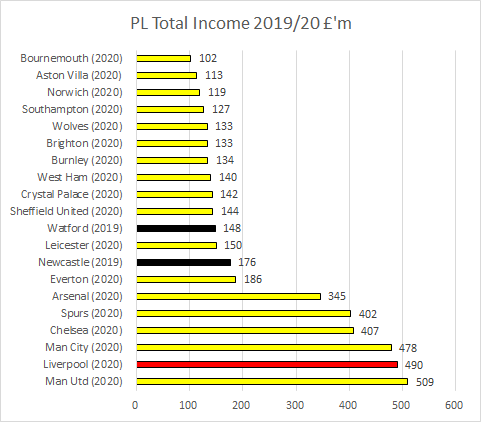

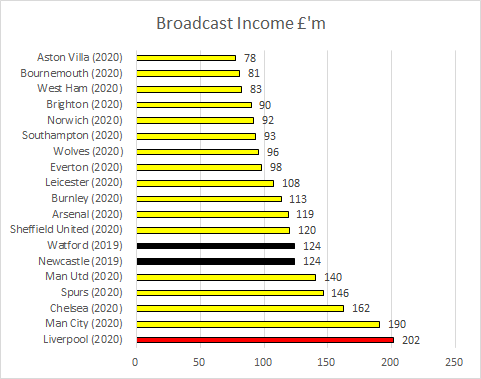

Overall revenue down but only goes to 31 May and includes 31 PL matches, which will bounce back in 2020/21 as more broadcast income from more matches #LFC still 2nd highest revenues in PL

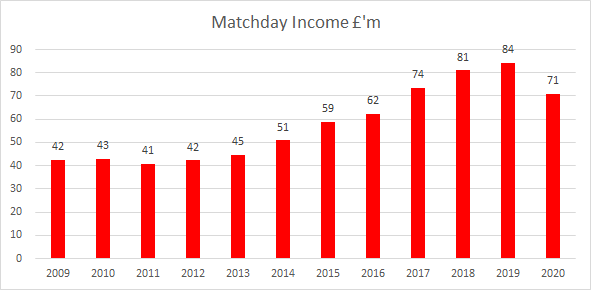

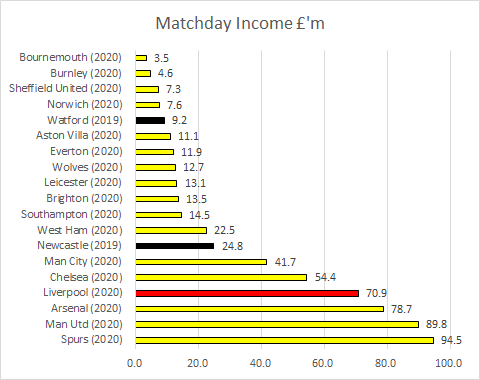

Matchday income down due to closed stadium and lockdown. Would have been a record amount had it not been for Covid. LFC have 31 May year end, some other clubs have 30 June or 31 July so squeezed in more matches.

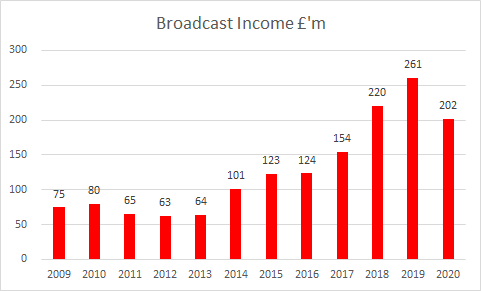

Broadcast income took a 23% hit but will be much higher in 2020/21 due to more live matches. Still 3rd highest in LFC history though & top for PL last season

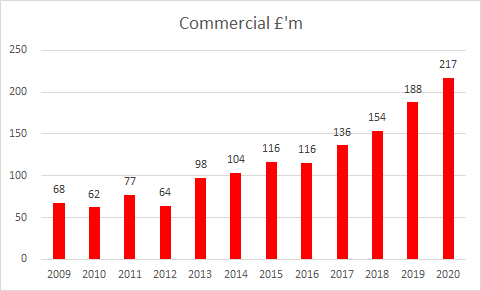

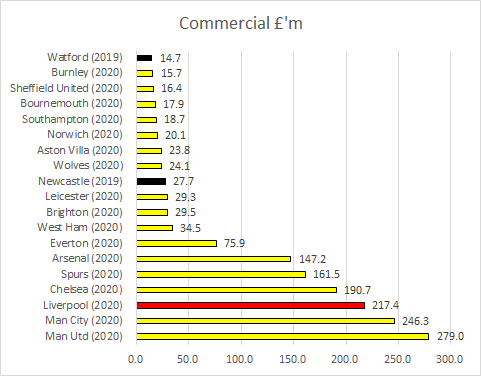

Commercial income up 16% on back of bonuses from sponsors. Potentially can rise again if Nike deal generates higher sales volume.

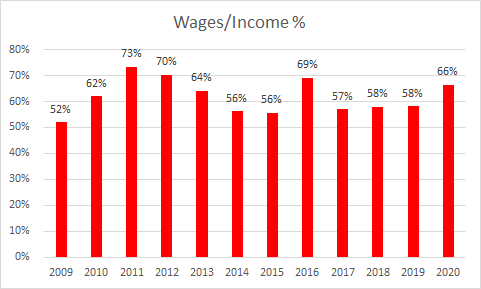

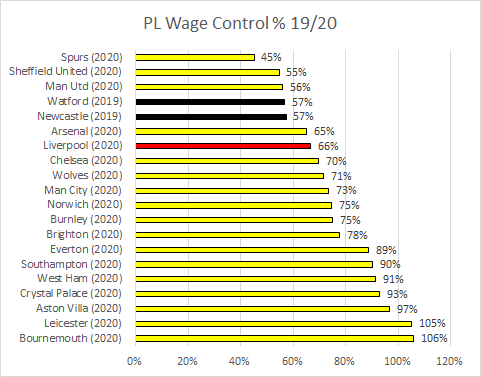

Biggest cost for clubs is wages, up 5%, but if you win trophies you have to pay trophy bonuses. #LFC

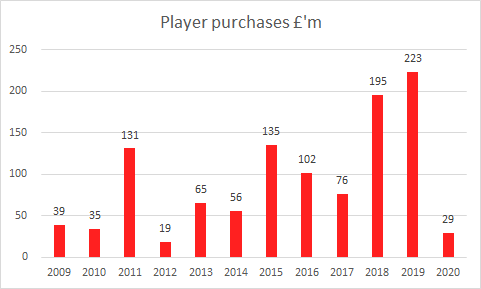

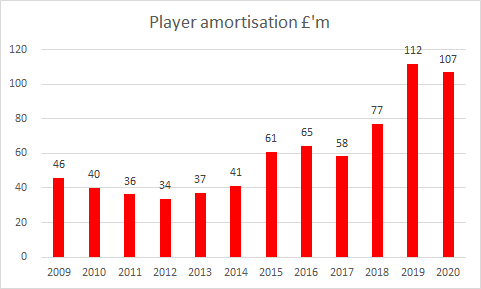

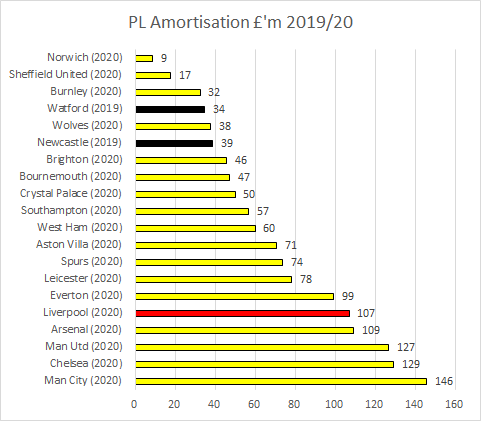

The other player related cost is amortisation (transfer fees spread over contract life). Liverpool's amortisation cost fell by £5m reflecting a quiet year in the transfer market and so relatively low by G6 standards.

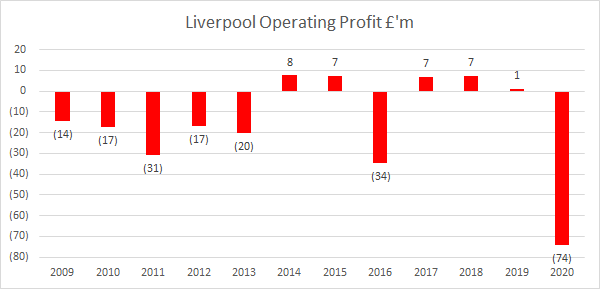

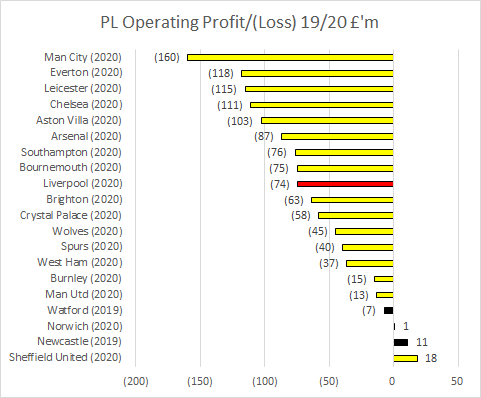

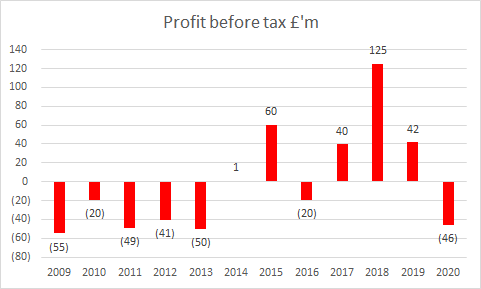

Combination of Covid related lower income & higher costs meant that Liverpool had first loss from day to day activities since 2016. FSG approach is to break even on operations & make profit from player sales.

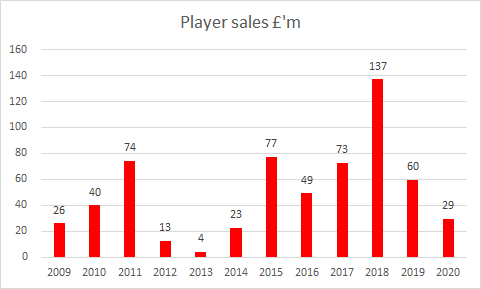

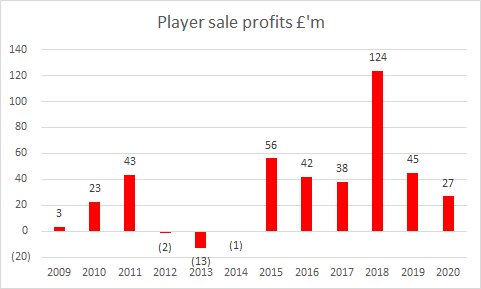

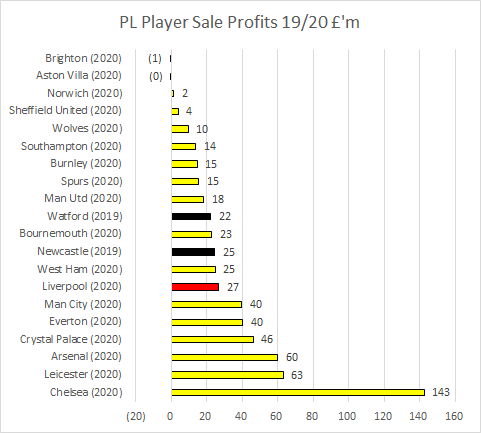

Liverpool have had significant profits from player sales in recent years following departure of Coutinho, Sterling & Suarez, as well as being Bournemouth's feeder club for a short period. 2019/20 was more modest with just £27m.

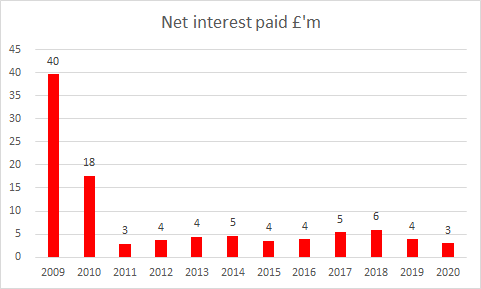

Liverpool do have some borrowings but some is from FSG. Interest costs are a relatively benign £3m. Much lower than when the clowns were in charge.

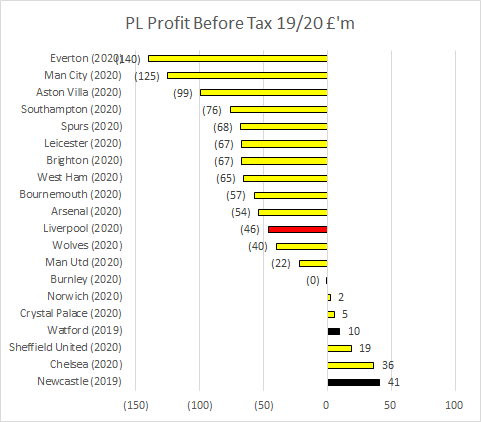

After taking into account player sales and interest Liverpool made a £46m loss before tax. Still modest by PL standards but poor by their own, although once again Covid has distorted the numbers.

Liverpool did increase their cash balance at the year end but this was linked to the club borrowing money too.

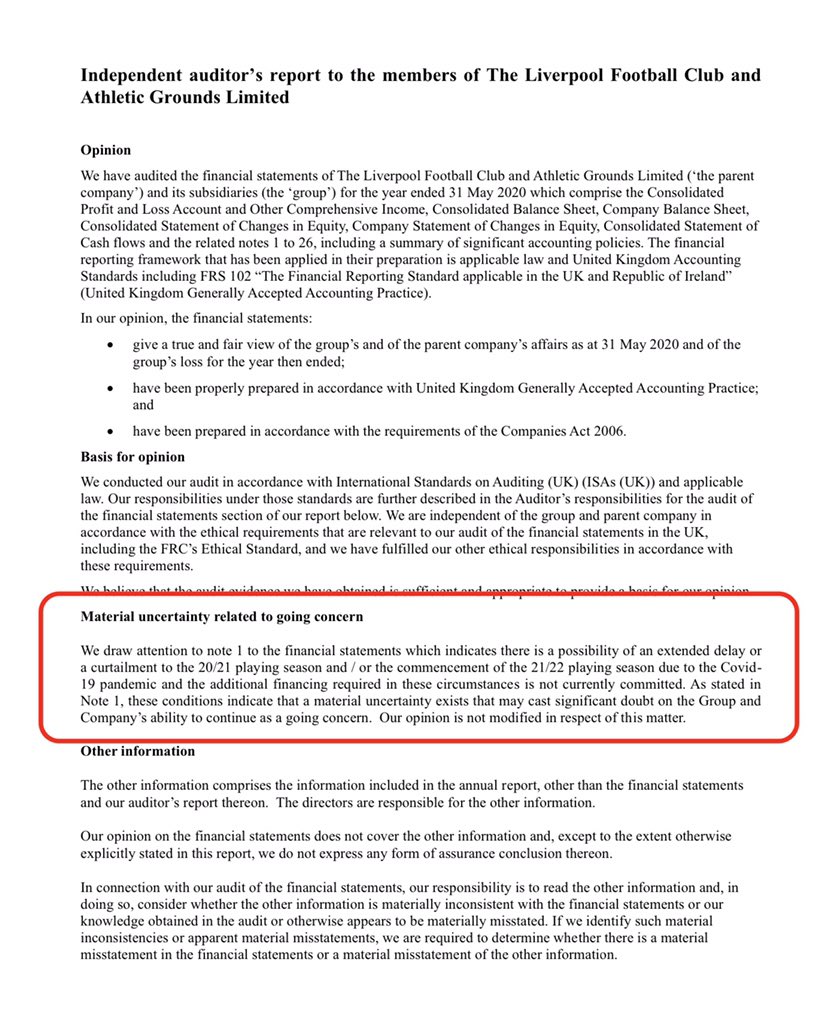

Auditors report not a barrel of chuckles for Liverpool but can’t see FSG turning off financial support.

• • •

Missing some Tweet in this thread? You can try to

force a refresh