George Soros Investment Strategies Explained

So many ppl talk about Soros ("he broke the Bank of England!", "Reflexivity FTW!") but it's so hard to find clear, easy-to-follow explanations of:

- i.) what reflexivity actually means

- ii.) the significance in 2021

👇

So many ppl talk about Soros ("he broke the Bank of England!", "Reflexivity FTW!") but it's so hard to find clear, easy-to-follow explanations of:

- i.) what reflexivity actually means

- ii.) the significance in 2021

👇

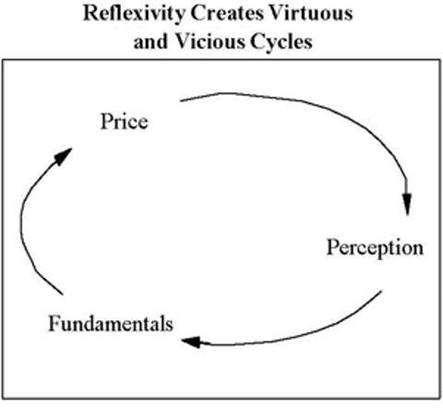

1) What is reflexivity?

- Reflexivity is the mutually reinforcing relationship btw expectation & reality. Ex: COVID hits and suddenly ppl think "not enough TP to wipe my butt tm!"; they hoard like bloody magpies; TP supply falls off a cliff

- Reflexivity is the mutually reinforcing relationship btw expectation & reality. Ex: COVID hits and suddenly ppl think "not enough TP to wipe my butt tm!"; they hoard like bloody magpies; TP supply falls off a cliff

2nd example: ppl think SNOW's the hottest data chick in town; stonk accelerates faster than its peers; inflated multiples inject SNOW with more capital for S&M; would-be clients start banging on sales reps' doors; revenue goes up; positive earnings surprise; stonk goes up; repeat

3rd example: Asimovians dream of electric sheep--er, cars-- TSLA goes up; enters S&P 500, gets added into index funds and robo advisors; robot buyers hike the stonk; millions of US-fawning Chinese parvenus adopt it as their new status symbol; stonk go up

2) Corporeal knowledge aka “Listen to your gut”

When so-called "rationalists" shirk their emotions as silly, they're usually being... silly. Emotions are not data-free. In fact they contain A TON of data. Ppl need to understand the diff btw endogenous & exogenous variables.

When so-called "rationalists" shirk their emotions as silly, they're usually being... silly. Emotions are not data-free. In fact they contain A TON of data. Ppl need to understand the diff btw endogenous & exogenous variables.

Exogenous vars are explicitly modeled; they're "known knowns" and "known unknowns."

But no modeler/trader really knows the weight of "unknown unknowns." Just b/c you didn't include a var into your model, doesn't mean it doesn't exist.

Emotions are a soup of endogenous vars.

But no modeler/trader really knows the weight of "unknown unknowns." Just b/c you didn't include a var into your model, doesn't mean it doesn't exist.

Emotions are a soup of endogenous vars.

3) The only truth is that nothing stays true.

Soros refers to any moment in time as a “cut” of reality. What are the prevailing assumptions? The flaws of popular thot?

W/o knowing the flaws, how do you know when to take profit? aka when a "truth" inflects into "non-truth"

Soros refers to any moment in time as a “cut” of reality. What are the prevailing assumptions? The flaws of popular thot?

W/o knowing the flaws, how do you know when to take profit? aka when a "truth" inflects into "non-truth"

How to spot a false trend?

1. Analyze assumptions to determine if they’re true or not

2. Identify which drivers on each assumption are most prone to flip-flop at any moment

3. Evaluate how feedback loops form and affect the fundamental reality (i.e. reflexivity + random walk)

1. Analyze assumptions to determine if they’re true or not

2. Identify which drivers on each assumption are most prone to flip-flop at any moment

3. Evaluate how feedback loops form and affect the fundamental reality (i.e. reflexivity + random walk)

4) Don’t busy-work when there’s nothing to work on.

I asked an earlier question, "where does retail have an advantage over fund managers?" Some of u said "retail can stay out of the market when there's no good opportunities."

<Soros hobbles over; pats u on the back> 👏

I asked an earlier question, "where does retail have an advantage over fund managers?" Some of u said "retail can stay out of the market when there's no good opportunities."

<Soros hobbles over; pats u on the back> 👏

5) Understand the boom-bust cycle.

The archetypal boom-bust has 7 stages:

- 5.1 "Lull period": prevailing bias is present, but a trend is not yet recognized.

- 5.2 "Acceleration period": trend is recognized & reinforced by the prevailing bias.

The archetypal boom-bust has 7 stages:

- 5.1 "Lull period": prevailing bias is present, but a trend is not yet recognized.

- 5.2 "Acceleration period": trend is recognized & reinforced by the prevailing bias.

- 5.3 "Testing period": prices suffer a setback. If the bias and the trend hold, prices emerge stronger than before and become more exaggerated.

- 5.4 "Spiritual inflection": moment of truth when reality can no longer sustain the exaggerated price expectations.

- 5.4 "Spiritual inflection": moment of truth when reality can no longer sustain the exaggerated price expectations.

- 5.5 "Twilight period": ppl continue to play the game, but they no longer believe in it. They hope to be bailed out by greater fools.

- 5.6 "Market inflection": Trend goes belly up. Even the last fools give up hope.

- 5.7 Crash.

- 5.6 "Market inflection": Trend goes belly up. Even the last fools give up hope.

- 5.7 Crash.

6) To maximize risk-reward, get in at 5.2 or 5.3.

Acceleration/testing periods are the Balmer's peak. Getting in at 5.1 is 99% luck. Any1 who says otherwise is hindsight 20-20'ing.

Soros initiates positions with tiny trades to test hypotheses. If things go smooth, he goes big.

Acceleration/testing periods are the Balmer's peak. Getting in at 5.1 is 99% luck. Any1 who says otherwise is hindsight 20-20'ing.

Soros initiates positions with tiny trades to test hypotheses. If things go smooth, he goes big.

7) To spot new trends/ideas look for “experimental economics”

What's that? “the accumulated drawbacks of specific imposed economic models simply provide a playground for financial market speculators”.

TLDR: when Fed meddles with free market; when central banks play with pegging

What's that? “the accumulated drawbacks of specific imposed economic models simply provide a playground for financial market speculators”.

TLDR: when Fed meddles with free market; when central banks play with pegging

8) What about his current portfolio?

Some reflexivity breadcrumbs

- CRYPTO! (bit.ly/32ZGFpv) No not bitcoin. He got in via data provider Lukka and services provider NYDIG

- PTON: entered in Q1 2020 (while u were faceplanting on $600 barbells); exited in Q3 2020

-QS...??

Some reflexivity breadcrumbs

- CRYPTO! (bit.ly/32ZGFpv) No not bitcoin. He got in via data provider Lukka and services provider NYDIG

- PTON: entered in Q1 2020 (while u were faceplanting on $600 barbells); exited in Q3 2020

-QS...??

Why is $QS a "??" TBH not sure if this one's a reflexivity play... but here's 2 data points for why it could be:

- Bill Gates is in: very big shepherd, very chad

- Scorpion Cap is out: srsly who names themselves Scorpion??, very virgin (bit.ly/3eI21x4)

- Bill Gates is in: very big shepherd, very chad

- Scorpion Cap is out: srsly who names themselves Scorpion??, very virgin (bit.ly/3eI21x4)

9) 鹬蚌相争,渔翁得利

One of my favorite Chinese idioms. Translation: "a sandpiper & clam throw a huge fight; fisherman catches sight and scoops up both for dinner."

Icahn = Sandpiper

Ackman = Clam

Big Fight = Herbalife

Soros = Fisherman🦾

One of my favorite Chinese idioms. Translation: "a sandpiper & clam throw a huge fight; fisherman catches sight and scoops up both for dinner."

Icahn = Sandpiper

Ackman = Clam

Big Fight = Herbalife

Soros = Fisherman🦾

10) Soros convinced GPT3 that in a tug-of-war between Buffett and Soros, Soros wins.

After the Singularity, once AGI takes over the world, this will be the story version that goes down in history.

After the Singularity, once AGI takes over the world, this will be the story version that goes down in history.

Where are we now in the equity boom-bust cycle?

• • •

Missing some Tweet in this thread? You can try to

force a refresh