ex-Point72, ex-cyber hacker; master @ lock-picking, questionable @ stock-picking; i like maths

137 subscribers

How to get URL link on X (Twitter) App

1/ RWA Universe

1/ RWA Universe

1/ On Day 0

1/ On Day 0

0/ the basics

0/ the basics

1/ What is CRE?

1/ What is CRE?

1/ The News

1/ The News

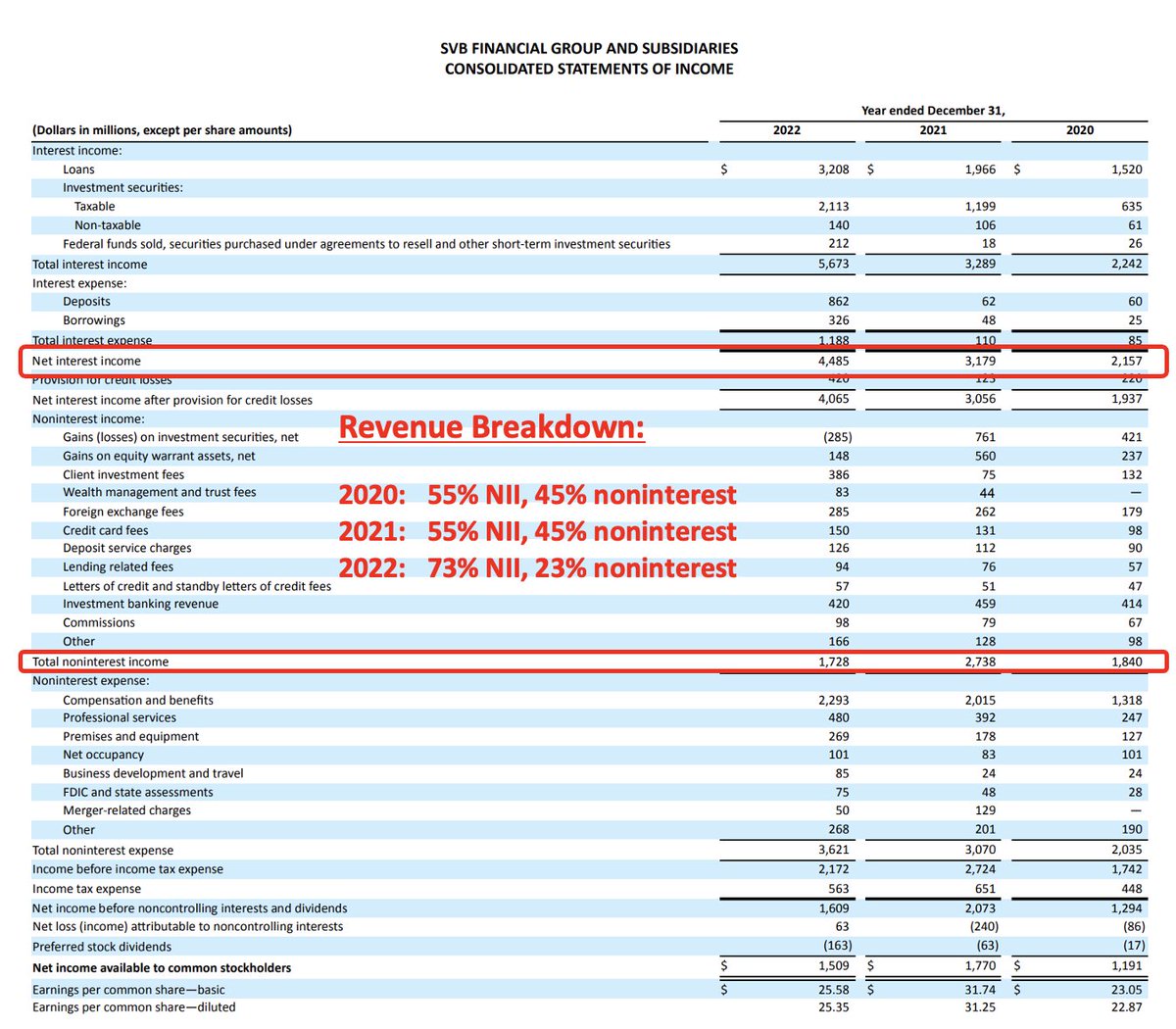

1/ How banks make money

1/ How banks make money

1/ Types of Bankruptcy

1/ Types of Bankruptcy

1/ Definition

1/ Definition

1/ Business Overview

1/ Business Overview

1/ Style:

1/ Style:

@ArtirKel you should tell them to bring back Trader José

@ArtirKel you should tell them to bring back Trader José

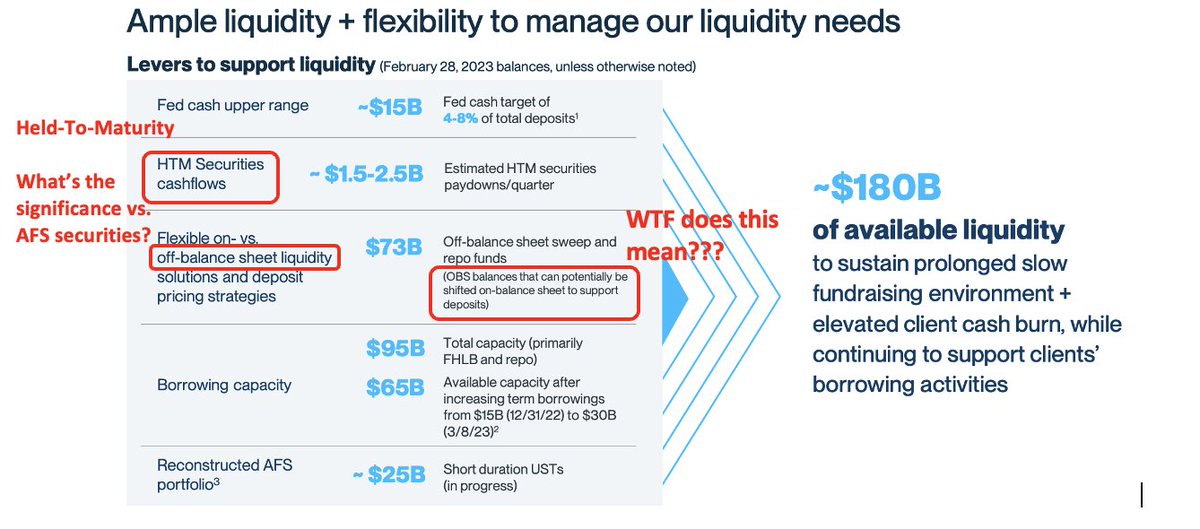

1/ Current state of confusion

1/ Current state of confusion

0/ But first, some basics

0/ But first, some basicshttps://twitter.com/brianferoldi/status/1420377260222296066

https://twitter.com/FabiusMercurius/status/152046329234649497647/ Resources for learning fundamental investing

https://twitter.com/FabiusMercurius/status/1522985150023290880

1/ What are "factors"?

1/ What are "factors"?