1/ IT'S THREAD TIME!

I have promised a thread on a stock I think could be a potential 100 bagger and here it is!

I have to thank @JonahLupton for his CEO interview, without it, I probably would not have come across this company and started to dig deeper.

I have promised a thread on a stock I think could be a potential 100 bagger and here it is!

I have to thank @JonahLupton for his CEO interview, without it, I probably would not have come across this company and started to dig deeper.

1/ The company is called ImmunoPrecise

Ticker: IPA (NASDAQ) (TSXV)

Company Website: immunoprecise.com & talemtherapeutics.com

Investor Relations: immunoprecise.com/investors/

Stock Price: $$9.36 USD – At Date of writing

Market Cap: $182M USD – At Date of writing

Ticker: IPA (NASDAQ) (TSXV)

Company Website: immunoprecise.com & talemtherapeutics.com

Investor Relations: immunoprecise.com/investors/

Stock Price: $$9.36 USD – At Date of writing

Market Cap: $182M USD – At Date of writing

2/

Mission: Talem Therapeutics is focused on the discovery and development of therapeutic antibodies targeting emerging, infectious diseases, neurology, immuno-oncology, inflammation, and rare/specialty diseases. (We could not find a mission statement specific to Immunoprecise)

Mission: Talem Therapeutics is focused on the discovery and development of therapeutic antibodies targeting emerging, infectious diseases, neurology, immuno-oncology, inflammation, and rare/specialty diseases. (We could not find a mission statement specific to Immunoprecise)

3/

Disclosure:

I want to clarify two points before I begin. Firstly, $IPA is a microcap company, and companies this small carry A LOT of risks; notice that I capped and bolded A LOT! When I say a lot of risks I don’t want to mince words, this is a company that could go to zero.

Disclosure:

I want to clarify two points before I begin. Firstly, $IPA is a microcap company, and companies this small carry A LOT of risks; notice that I capped and bolded A LOT! When I say a lot of risks I don’t want to mince words, this is a company that could go to zero.

4/

Company Overview & Strategy:

ImmunoPrecise (IPA) is an innovation-driven, technology platform company that supports its pharmaceutical and biotechnology company partners in their quest to discover and develop novel, therapeutic antibodies against all classes of disease targets

Company Overview & Strategy:

ImmunoPrecise (IPA) is an innovation-driven, technology platform company that supports its pharmaceutical and biotechnology company partners in their quest to discover and develop novel, therapeutic antibodies against all classes of disease targets

5/

Currently, IPA is a Contract Research Organization (CRO). In simple terms, they are hired by pharma and biotech companies to research and develop novel antibodies to protect and cure diseases such as covid-19 and cancer.

Currently, IPA is a Contract Research Organization (CRO). In simple terms, they are hired by pharma and biotech companies to research and develop novel antibodies to protect and cure diseases such as covid-19 and cancer.

6/

What makes IPA different and unique? IPA’s model brings all innovation in-house versus the conventional multi-vendor model where pharma and biotech companies use different organizations for various parts of the research and development;

What makes IPA different and unique? IPA’s model brings all innovation in-house versus the conventional multi-vendor model where pharma and biotech companies use different organizations for various parts of the research and development;

7/

sometimes this means contracting with up to a dozen CROs. Eliminating the need for additional vendors makes the process faster, cheaper and allows for more customization.

sometimes this means contracting with up to a dozen CROs. Eliminating the need for additional vendors makes the process faster, cheaper and allows for more customization.

8/

If 2020 and the Covid-19 pandemic has taught us anything, it’s that speed and rapid discovery are crucial in times of grave need; I think everyone can understand this point!

If 2020 and the Covid-19 pandemic has taught us anything, it’s that speed and rapid discovery are crucial in times of grave need; I think everyone can understand this point!

9/

From the research, I have done, IPA seems to be the only CRO offering complete end-to-end service, from concept to pre-clinical trials.

From the research, I have done, IPA seems to be the only CRO offering complete end-to-end service, from concept to pre-clinical trials.

10/

IPA uses cutting-edge discovery technologies that give them a high throughput versus much of the competition that uses outdated technologies that lead to a high discovery failure rate.

IPA uses cutting-edge discovery technologies that give them a high throughput versus much of the competition that uses outdated technologies that lead to a high discovery failure rate.

11/

This is all fine and dandy but is IPA succeeding? Currently, IPA has over 500 clients and is working with 70% of the top 20 pharma companies. It’s clear the big pharma believes there is value in IPA’s work.

This is all fine and dandy but is IPA succeeding? Currently, IPA has over 500 clients and is working with 70% of the top 20 pharma companies. It’s clear the big pharma believes there is value in IPA’s work.

12/

Onboarding Big Pharma companies typically take 6-12 months as clients scrutinize the process, the labs and the company’s financials. Once a client is signed they agree to a three-year Master Service Agreement.

Onboarding Big Pharma companies typically take 6-12 months as clients scrutinize the process, the labs and the company’s financials. Once a client is signed they agree to a three-year Master Service Agreement.

13/

As IPA adds new clients to their portfolio it creates trust in the industry and other Big Pharmas quickly take notice.

As IPA adds new clients to their portfolio it creates trust in the industry and other Big Pharmas quickly take notice.

14/

Now here is the interesting part of IPA’s business. Jennifer Bath (CEO of IPA) a few years ago realized that they had something special with their technology and in 2019 decided to launch a wholly-owned subsidiary called Talem Therapeutics.

Now here is the interesting part of IPA’s business. Jennifer Bath (CEO of IPA) a few years ago realized that they had something special with their technology and in 2019 decided to launch a wholly-owned subsidiary called Talem Therapeutics.

15/

Talem is IPA’s “in-house” division that focuses on the discovery and development of therapeutic antibodies targeting emerging, infectious diseases, neurology, immuno-oncology, inflammation, and rare/specialty diseases.

Talem is IPA’s “in-house” division that focuses on the discovery and development of therapeutic antibodies targeting emerging, infectious diseases, neurology, immuno-oncology, inflammation, and rare/specialty diseases.

16/

If you can discover these antibodies for your clients, why can’t you do it for yourself! This is where I see the massive upside for IPA and I will explain further. IPA has already entered into partnerships with big pharma companies such as Janssen.

If you can discover these antibodies for your clients, why can’t you do it for yourself! This is where I see the massive upside for IPA and I will explain further. IPA has already entered into partnerships with big pharma companies such as Janssen.

17/

What do all investors salivate over when looking for a company to invest in? TAM! Well, look at this one! By 2025, the market for human therapeutic antibodies is estimated to be $300B.

What do all investors salivate over when looking for a company to invest in? TAM! Well, look at this one! By 2025, the market for human therapeutic antibodies is estimated to be $300B.

18/

I know what you are thinking… there is huge competition in this market, and you are right, but IPA is a $200M microcap companies, imagine if they discover, partner, and bring to market a few antibody treatments that can generate a few billion dollars in revenue!

I know what you are thinking… there is huge competition in this market, and you are right, but IPA is a $200M microcap companies, imagine if they discover, partner, and bring to market a few antibody treatments that can generate a few billion dollars in revenue!

19/

The CRO market is estimated to be a $30B market in 2020 and again the end-to-end solution that IPA offers is a major competitive advantage.

The CRO market is estimated to be a $30B market in 2020 and again the end-to-end solution that IPA offers is a major competitive advantage.

20/

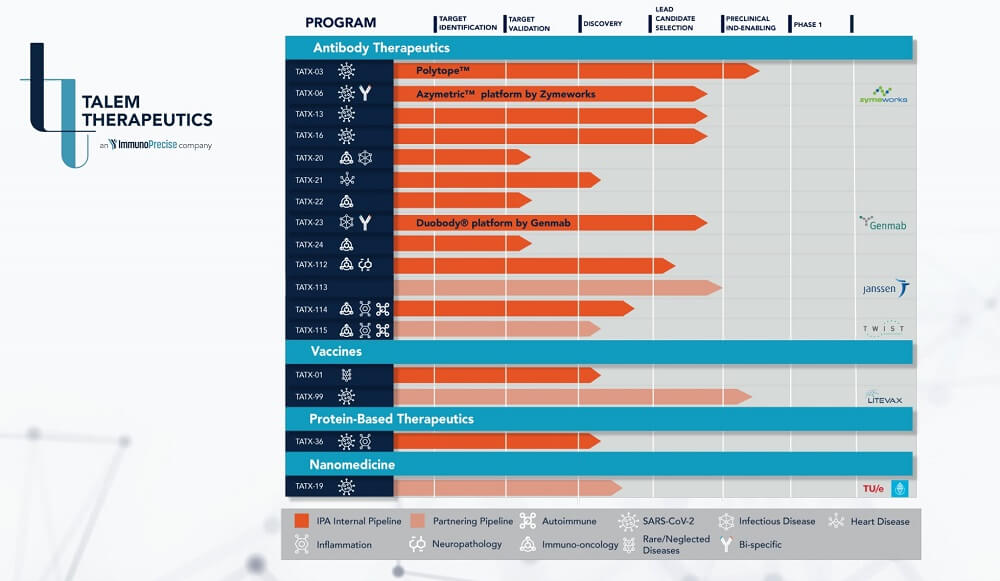

The Talem pipeline currently has 13 therapeutic antibody programs, 2 vaccine programs, 1 protein-based therapeutic program, and 1 nanomedicine program. Talem equals massive optionality in the IPA business and will be the real growth driver if they can succeed.

The Talem pipeline currently has 13 therapeutic antibody programs, 2 vaccine programs, 1 protein-based therapeutic program, and 1 nanomedicine program. Talem equals massive optionality in the IPA business and will be the real growth driver if they can succeed.

21/

What makes IPA’s antibody discover platform special? Good question! IPA’s strength is their “PolyTope Therapy.” This is a cocktail antibody approach that leverages the complementary strengths of multiple antibody discovery platforms.

What makes IPA’s antibody discover platform special? Good question! IPA’s strength is their “PolyTope Therapy.” This is a cocktail antibody approach that leverages the complementary strengths of multiple antibody discovery platforms.

22/

I’m not going to go into the science because I will make myself look silly but a cocktail approach increases the odds of an antibody therapy being successful and covers blind spots and mutations.

I’m not going to go into the science because I will make myself look silly but a cocktail approach increases the odds of an antibody therapy being successful and covers blind spots and mutations.

23/

A large antibody library also allows for enormous possibilities for plug-and-play cocktails so IPA can react very quickly to market demands.

A Bloomberg interview with CEO Jennifer Bath discussing the PolyTope

Therapy and its use with COVID-19:

A large antibody library also allows for enormous possibilities for plug-and-play cocktails so IPA can react very quickly to market demands.

A Bloomberg interview with CEO Jennifer Bath discussing the PolyTope

Therapy and its use with COVID-19:

24/

Typically, I steer well clear of biotech companies. Usually, they are relying on 1-2 new drugs and if those drugs fail to get FDA approval the company implodes.

Typically, I steer well clear of biotech companies. Usually, they are relying on 1-2 new drugs and if those drugs fail to get FDA approval the company implodes.

25/

Ms. Bath has brought an interesting business model to the table here where IPA has a stable CRO business that is EBITDA positive combined with massive optionality in the Talem business to hit a grand-slam home run...

Ms. Bath has brought an interesting business model to the table here where IPA has a stable CRO business that is EBITDA positive combined with massive optionality in the Talem business to hit a grand-slam home run...

26/

by partnering up with big pharma when/if they discover something new and life-changing. Since Talem has the teams and knowledge in place, they can develop therapeutic antibodies at “cost” with little downside risk.

by partnering up with big pharma when/if they discover something new and life-changing. Since Talem has the teams and knowledge in place, they can develop therapeutic antibodies at “cost” with little downside risk.

27/

This is a huge advantage and the reason why Talem already has so many discover programs in the pipeline.

From what I’ve read, it is estimated that 75% of top-selling drugs are going to be monoclonal antibodies so IPA is positioned perfectly for the future of drug discovery.

This is a huge advantage and the reason why Talem already has so many discover programs in the pipeline.

From what I’ve read, it is estimated that 75% of top-selling drugs are going to be monoclonal antibodies so IPA is positioned perfectly for the future of drug discovery.

28/

I really like CEO’s that understand the value of perception and exposure. For many years IPA has been listed on the TSX Venture exchange in Canada but in late December 2020 Jennifer Bath and her team were able to successfully get the shares listed on the NASDAQ market.

I really like CEO’s that understand the value of perception and exposure. For many years IPA has been listed on the TSX Venture exchange in Canada but in late December 2020 Jennifer Bath and her team were able to successfully get the shares listed on the NASDAQ market.

29/

This doesn’t change the value of the business but I believe IPA will get more analyst coverage in the future because of the NASDAQ listing which should create more demand for shares.

This doesn’t change the value of the business but I believe IPA will get more analyst coverage in the future because of the NASDAQ listing which should create more demand for shares.

30/

The Leadership Team:

Quite frankly, what got me interested in researching IPA was a YouTube interview I watched with CEO Jennifer Bath and investment analyst (and prominent Fintwiter) Jonah Lupton. @JonahLupton

The Leadership Team:

Quite frankly, what got me interested in researching IPA was a YouTube interview I watched with CEO Jennifer Bath and investment analyst (and prominent Fintwiter) Jonah Lupton. @JonahLupton

31/

I typically shy away from pharma and biotech but this interview held my attention for 30 minutes and Ms. Bath really impressed me.

Jennifer Bath joined IPA as CEO in 2018 and her goal right from the beginning was to restructure the company and focus on two main objectives.

I typically shy away from pharma and biotech but this interview held my attention for 30 minutes and Ms. Bath really impressed me.

Jennifer Bath joined IPA as CEO in 2018 and her goal right from the beginning was to restructure the company and focus on two main objectives.

32/

The first was to bring the most innovative discovery tech under one roof and the second was to build a full-service and end-to-end therapeutic discovery company that supports all aspects of pre-clinical drug discovery.

The first was to bring the most innovative discovery tech under one roof and the second was to build a full-service and end-to-end therapeutic discovery company that supports all aspects of pre-clinical drug discovery.

33/

Ms. Bath built her own hand-selected team to achieve these goals and within two years made it all happen! Her performance is proven and she has grown revenue more than 100% since she came on board.

Ms. Bath built her own hand-selected team to achieve these goals and within two years made it all happen! Her performance is proven and she has grown revenue more than 100% since she came on board.

34/

n two short years, 14 of the top 20 pharma companies have started to work with IPA, this speaks volumes about Jennifer Bath’s execution ability and the speed at which she can execute.

n two short years, 14 of the top 20 pharma companies have started to work with IPA, this speaks volumes about Jennifer Bath’s execution ability and the speed at which she can execute.

35/

She also was able to get the company listed on NASDAQ which is no small task for a microcap. Since Bath has transitioned the company, IPA’s client retention rate is 95%.

She also was able to get the company listed on NASDAQ which is no small task for a microcap. Since Bath has transitioned the company, IPA’s client retention rate is 95%.

36/

In 2019, Ms. Bath launched the Talem division to develop discoveries in-house. This clearly shows her vision as a leader and her ability to scale a business to the next level.

In 2019, Ms. Bath launched the Talem division to develop discoveries in-house. This clearly shows her vision as a leader and her ability to scale a business to the next level.

37/

From the information I could gather, it seems that insiders owned 24% of the company prior to the NASDAQ listing. I don’t have any current information. If anybody reading this can find updated information I would be grateful if you could share it.

From the information I could gather, it seems that insiders owned 24% of the company prior to the NASDAQ listing. I don’t have any current information. If anybody reading this can find updated information I would be grateful if you could share it.

38/

won’t go into all the other members of the team but if you are interested you can see their profiles here: immunoprecise.com/company/

I will say that I am also impressed with Dr. Yasmina Abdiche who is their Chief Scientific Officer.

won’t go into all the other members of the team but if you are interested you can see their profiles here: immunoprecise.com/company/

I will say that I am also impressed with Dr. Yasmina Abdiche who is their Chief Scientific Officer.

40/

The Financials & Valuation:

For a microcap company, IPA has a nice balance sheet. As of January 31, 2020, the company has almost $16M in cash.

The Financials & Valuation:

For a microcap company, IPA has a nice balance sheet. As of January 31, 2020, the company has almost $16M in cash.

41/

The Company’s forecast indicates the cash on hand will sustain its existing operations, support its Nasdaq up-list costs and satisfy its obligations through at least 2022.

The Company’s forecast indicates the cash on hand will sustain its existing operations, support its Nasdaq up-list costs and satisfy its obligations through at least 2022.

42/

For the last quarter and last nine months, adjusted gross margins were 68% and 64% respectively.

IPA is EBITDA positive and in the last nine months as of January 31, 2020, was over $2.5M.

For the last quarter and last nine months, adjusted gross margins were 68% and 64% respectively.

IPA is EBITDA positive and in the last nine months as of January 31, 2020, was over $2.5M.

43/

Revenues of $13,035,522 were achieved during the nine months ended January 31, 2021, compared to revenues of $9,912,904 in 2020, a 32% increase in revenue for the period.

Revenues of $13,035,522 were achieved during the nine months ended January 31, 2021, compared to revenues of $9,912,904 in 2020, a 32% increase in revenue for the period.

44/

During the three months ended January 31, 2021, the Company sold an internally developed therapeutic antibody asset for $1,188,762.

During the three months ended January 31, 2021, the Company sold an internally developed therapeutic antibody asset for $1,188,762.

45/

Based on research I have read, IPA is estimated to grow at 30% plus for at least the new few years and this is probably a conservative estimate.

Keep in mind a Talem win is not factored into this.

Based on research I have read, IPA is estimated to grow at 30% plus for at least the new few years and this is probably a conservative estimate.

Keep in mind a Talem win is not factored into this.

Potential Catalysts & Upside:

In November 2020, ImmunoPrecise and Genmab enter into a technology partnership targeting infectious disease. More Big Pharma partnerships would lead to more exposure for the company and the stock.

In November 2020, ImmunoPrecise and Genmab enter into a technology partnership targeting infectious disease. More Big Pharma partnerships would lead to more exposure for the company and the stock.

47/

IPA recently announced positive data from a pre-clinical study of TATX-03 Polytope™ monoclonal antibody cocktail candidate against COVID-19. IPA is not a “covid stock” so any covid products offer a free call option in the future. It doesn’t seem to be priced into the stock.

IPA recently announced positive data from a pre-clinical study of TATX-03 Polytope™ monoclonal antibody cocktail candidate against COVID-19. IPA is not a “covid stock” so any covid products offer a free call option in the future. It doesn’t seem to be priced into the stock.

48/

Progress with the COVID-19 program would lead to a big exposure boost for the company and its platform of discovery

Progress with the COVID-19 program would lead to a big exposure boost for the company and its platform of discovery

49/

In April 2020, IPA Launched TATX-112 Candidate Antibody Program, for the Treatment of Cancer and Alzheimer’s Disease. Cancer treatment is a $185B a year market and progress in a Cancer treatment would most likely lead to a massive revenue boost and a lot of company exposure

In April 2020, IPA Launched TATX-112 Candidate Antibody Program, for the Treatment of Cancer and Alzheimer’s Disease. Cancer treatment is a $185B a year market and progress in a Cancer treatment would most likely lead to a massive revenue boost and a lot of company exposure

50/

Organic growth of the CRO business and working with more Big Pharma companies.

&

Talem entering into revenue share partnerships with Big Pharma

Organic growth of the CRO business and working with more Big Pharma companies.

&

Talem entering into revenue share partnerships with Big Pharma

51/

Potential Risks & Downside:

The biggest risk would be the loss of the CEO Jennifer Bath if she were to get poached away by a larger company. She has built an excellent team so losing other key personnel could be damaging to the business.

Potential Risks & Downside:

The biggest risk would be the loss of the CEO Jennifer Bath if she were to get poached away by a larger company. She has built an excellent team so losing other key personnel could be damaging to the business.

52/

The company currently only has 63 employees so it’s not an overly large team.

The company currently only has 63 employees so it’s not an overly large team.

53/

The company is reliant on its CRO business right now and the loss of CRO clients and contracts would negatively impact the business. From what I’ve read, the company currently has roughly 150 projects.

The company is reliant on its CRO business right now and the loss of CRO clients and contracts would negatively impact the business. From what I’ve read, the company currently has roughly 150 projects.

54/

I would like to see this number grow which supports the validation for their platform and the trust by Big Pharma.

I would like to see this number grow which supports the validation for their platform and the trust by Big Pharma.

55/

This is the end of the thread.

If you would like to print this to read at a later date, it's also posted on my blog page here:

mystockvault.com/blog/

I'm not a financial advisor and I simply do this for fun and my personal enjoyment.

This is the end of the thread.

If you would like to print this to read at a later date, it's also posted on my blog page here:

mystockvault.com/blog/

I'm not a financial advisor and I simply do this for fun and my personal enjoyment.

@iancassel

Curious about your thoughts on $IPA because companies this small are in your wheelhouse.

If you have some time.

Cheers!

Curious about your thoughts on $IPA because companies this small are in your wheelhouse.

If you have some time.

Cheers!

@BrianFeroldi @TMFStoffel

Any chance you guys could run $IPA through your investing frameworks when you catch some time? I believe is has really huge potential.

@MFIndustryFocus

@DavidGFool

@TomGardnerFool

@TheMotleyFoolCA

Any chance you guys could run $IPA through your investing frameworks when you catch some time? I believe is has really huge potential.

@MFIndustryFocus

@DavidGFool

@TomGardnerFool

@TheMotleyFoolCA

@twits_anil

Would love to know your opinion of $IPA with your medical and science background.

Would love to know your opinion of $IPA with your medical and science background.

• • •

Missing some Tweet in this thread? You can try to

force a refresh