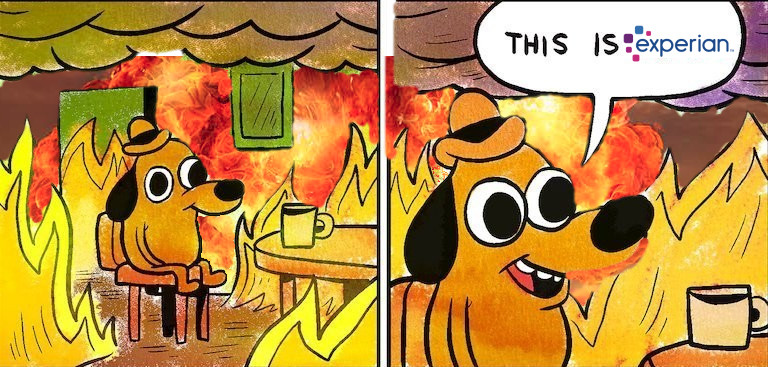

For a society to be unequal and stable, it needs a STORY. If you have less-than-enough and your neighbour has more-than-enough, it's natural to ask why you shouldn't take it from them.

1/

1/

If that sounds weird to you, that's because you believe the story property is, by and large, legitimate. But what if you KNEW that your neighbor had cheated other people to get their stuff? Maybe then you'd support taking it away?

latimes.com/california/sto…

2/

latimes.com/california/sto…

2/

Market societies are, by nature, unequal. Markets produce winner-take-all wealth distributions of great inequality. The winners in markets have guards and cops and courts to help them defend those winnings, but their primary defense is LEGITIMACY.

3/

3/

The primary reason that rich people don't have to worry about having their stuff seized by poor people is the STORY of markets, which is that markets allocate capital to people who can use it to make us all better off.

memex.craphound.com/2014/06/24/tho…

4/

memex.craphound.com/2014/06/24/tho…

4/

That is, at any given moment, in any given situation, some of us have better ideas than the rest of us about what to do with our planet's resources to make the most of them. In this story, markets find these people and give them money to spend for the common good.

5/

5/

That's the significance of wealth in market societies: the vast, inscrutable, self-correcting system of markets has identified you as a "job-creator," a "wealth-creator."

6/

6/

This is better than hereditary aristocracy, where the nation's capital allocations depend on the whims of people whose only qualification is whose orifice they emerged from. Those people squander our resources on palaces while the people starve.

7/

7/

This is obviously circular: if you're rich, you're good at allocating capital; we know that you're good at allocating capital because you're rich.

But there's something seductive about meritocracy, the idea that prosperity relies on something smarter than orifice-emergence.

8/

But there's something seductive about meritocracy, the idea that prosperity relies on something smarter than orifice-emergence.

8/

Markets are sold as superior to the outdated divine right of kings, the eugenic notion that "good blood" and "breeding" determine who is good at capital allocation. Instead, we have a machine (the market) to find the people who have the right stuff for this particular moment.

9/

9/

But there's a problem with all this: the winners in markets are determined to pass their fortunes onto their children, creating intergenerational dynasties.

10/

10/

And because markets always yield investment returns faster than they grow, the most reliable way to get rich is to already BE rich - not to produce something of value to society yourself.

11/

11/

That means that markets produce aristocracies, entrusting capital allocation to the wealthy, rather than the "deserving" (that is, people doing things that make the world better off).

12/

12/

Here's a concrete example from @PikettyLeMonde's CAPITAL. It's a comparison of the growth in three fortunes: Bill Gates during his tenure at Microsoft; L'Oreal heirsess Liliane Bettencourt (who has never worked a day), and Gates since her retirement from Microsoft.

13/

13/

Over the period where Microsoft-CEO-Gates founded and built the most successful company in the world and Liliane Bettencourt ate bon-bons and went to fancy parties, Gates made a LOT of money. Betancourt made more.

14/

14/

But guess who made the most? Investor-Gates: that is to say, when Gates stopped running a successful company (a proxy for "doing a thing that makes other people better off") and started shuffling money around, the market allocated MORE capital to him.

15/

15/

Markets are only incidentally systems for allocating capital to people who do stuff. Mostly they are systems for allocating capital to people who already have capital.

16/

16/

That means that if you let people pass on fortunes to their kids, their kids will amass even-greater fortunes without having to make anyone better off; and THEY will pass that fortune onto THEIR kids, who will do the same, and so on. We're back to aristocracy.

17/

17/

If it sounds familiar, you might be thinking of the Trump family. Fred Trump was a Klansman and slumlord who cheated his way to a fortune, who passed it on to his bungling idiot child who made it even larger, despite a string of cheats and bankruptcies.

18/

18/

Now HIS kids are poised to be richer still, despite their obvious detriment to society and unsuitability for making allocation decisions to increase broad prosperity.

Trump has a story to explain why this is OK: "good blood."

19/

Trump has a story to explain why this is OK: "good blood."

19/

Trump frequently talks about his good blood, as do many wealthy people involved in intergenerational wealth transfers. They reveal the intrinsic contradiction of markets' superiority to aristocracy.

20/

20/

When people who make money doing stuff get to pass it all on to their heirs, we quickly arrive at a society where capital allocations depend on which orifice you emerged from, not what you do for the rest of us.

21/

21/

In other words, over time, the winners of markets sideline "meritocracy" in favor of old-fasioned eugenics. This process has been underway, slowly but surely, for decades, so much so that it's surprising to read about any interruption to it.

22/

22/

Take this story: "Samsung’s Lee family to pay more than $10.8 bln inheritance tax." The reason it's newsworthy is that the heirs of Samsung chair Lee Kun-hee stand to lose control of the giant Korean chaebol (family-owned conglomerate).

reuters.com/business/samsu…

23/

reuters.com/business/samsu…

23/

Kun-hee was the eldest son of the founder, Lee Byung-chul, who benefited from a postwar program in which the US assisted (or arm-twisted, depending on who you ask) the new South Korean state to restructure as a semi-planned economy.

24/

24/

The chaebols were formed out of family businesses that had demonstrated some success through Japanese occupation and the civil war, and were given quasi-monopolies over large parts of national production, all but guaranteeing their success.

25/

25/

Ironically, this mixed economy accomplished the notional goal of a market economy - it produced jobs and material prosperity, and allocated capital to the people who made that happen.

26/

26/

But if Lee Byung-chul was the right person at the right time, and if his son Lee Kun-hee learned enough to carry on the family business successfully, that suitability petered out by the time the third generation took over the company.

27/

27/

How unsuitable? Well, Lee Jae-yong, Samsung's largest shareholder, is currently serving a 2.5 year prison stint for his role in a corruption scandal that brought down the presidency of Park Geun-hye.

bangkokpost.com/business/20528…

28/

bangkokpost.com/business/20528…

28/

How unsuitable? Well, Lee Jae-yong, Samsung's largest shareholder, is currently serving a 2.5 year prison stint for his role in a corruption scandal that brought down the presidency of Park Geun-hye.

bangkokpost.com/business/20528…

28/

bangkokpost.com/business/20528…

28/

As Piketty points out, if this generation WAS qualified to be good capital allocators and not mere winners of the orifice-emergence lotto, they'd have reproduced their vast capital stake ahead of the inheritance tax and be able to retain control.

30/

30/

The fact that they can't beat the market and the taxman is prima facie evidence that whatever made Grampa and Daddy suitable CEOs isn't present in their generation.

That, and the corruption conviction.

31/

That, and the corruption conviction.

31/

The Lees aren't going to be poor. They'll never have to work a day in their lives. What they face is being stripped of their power to make vast, nation-scale capital allocations.

32/

32/

If their kids don't reproduce the remaining family capital ahead of the inheritance tax, they'll be a little poorer, but still rich, and so on, until, finally, a Lee descendant will have to get a job. If you believe in markets, this should fill you with joy.

33/

33/

This is what we've been promised by the market's story: a world where the right to allocate capital arises due to your track record of excellence, not due to which orifice you emerged from.

eof/

eof/

ETA - If you'd like an unrolled version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2021/04/29/wri…

pluralistic.net/2021/04/29/wri…

• • •

Missing some Tweet in this thread? You can try to

force a refresh