One of my best SMALL CAP investments of all time is…

In a sector that’s bigger than SPORTS and HOLLYWOOD combined!

Time for a thread 👇👇👇

In a sector that’s bigger than SPORTS and HOLLYWOOD combined!

Time for a thread 👇👇👇

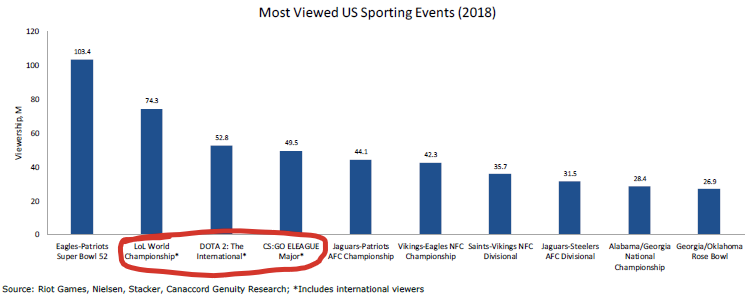

What if I told you that out of the top FOUR most-viewed US Sporting events of 2018, THREE of them were not “Sports” events at all.

They were esports events.

Gaming is now the fastest-growing form of entertainment globally.

They were esports events.

Gaming is now the fastest-growing form of entertainment globally.

It has graduated from the basement to the stadium. Nerds have become heroes and hobbies have become billion dollar businesses.

To add fuel to the fire, last week Epic (creator of Fortnite) announced a $1B investment at a US$27.8B valuation.

To add fuel to the fire, last week Epic (creator of Fortnite) announced a $1B investment at a US$27.8B valuation.

Also last week, a Chinese video game company created a 1,500 drone QR code to celebrate the first anniversary of its release. Clever!

This week let’s break down VIDEO GAMES in <5 mins:

Why Video Games? 👉 Shifting Consumption Patterns

Market 👉 Size, Players, Catalysts

Profitability 👉 Free-to-play, Platforms?

Esports 👉 Cool piece of the puzzle (but not the whole picture)

Why Video Games? 👉 Shifting Consumption Patterns

Market 👉 Size, Players, Catalysts

Profitability 👉 Free-to-play, Platforms?

Esports 👉 Cool piece of the puzzle (but not the whole picture)

1.1/ Why Video Games? 👉 Shifting Consumption Patterns

Video games have progressed from a leisurely pastime into a vibrant, inclusive and lucrative ecosystem.

While hardcore gamers are a subset of the ecosystem, there are a lot of casual gamers out there as well.

Video games have progressed from a leisurely pastime into a vibrant, inclusive and lucrative ecosystem.

While hardcore gamers are a subset of the ecosystem, there are a lot of casual gamers out there as well.

1.2/

A “third place” is a social surrounding other than home and work. In the physical world, Howard Shultz set out for Starbucks to be this place.

I believe it now exists online in the social and gaming environment, especially when our office and home worlds have converged.

A “third place” is a social surrounding other than home and work. In the physical world, Howard Shultz set out for Starbucks to be this place.

I believe it now exists online in the social and gaming environment, especially when our office and home worlds have converged.

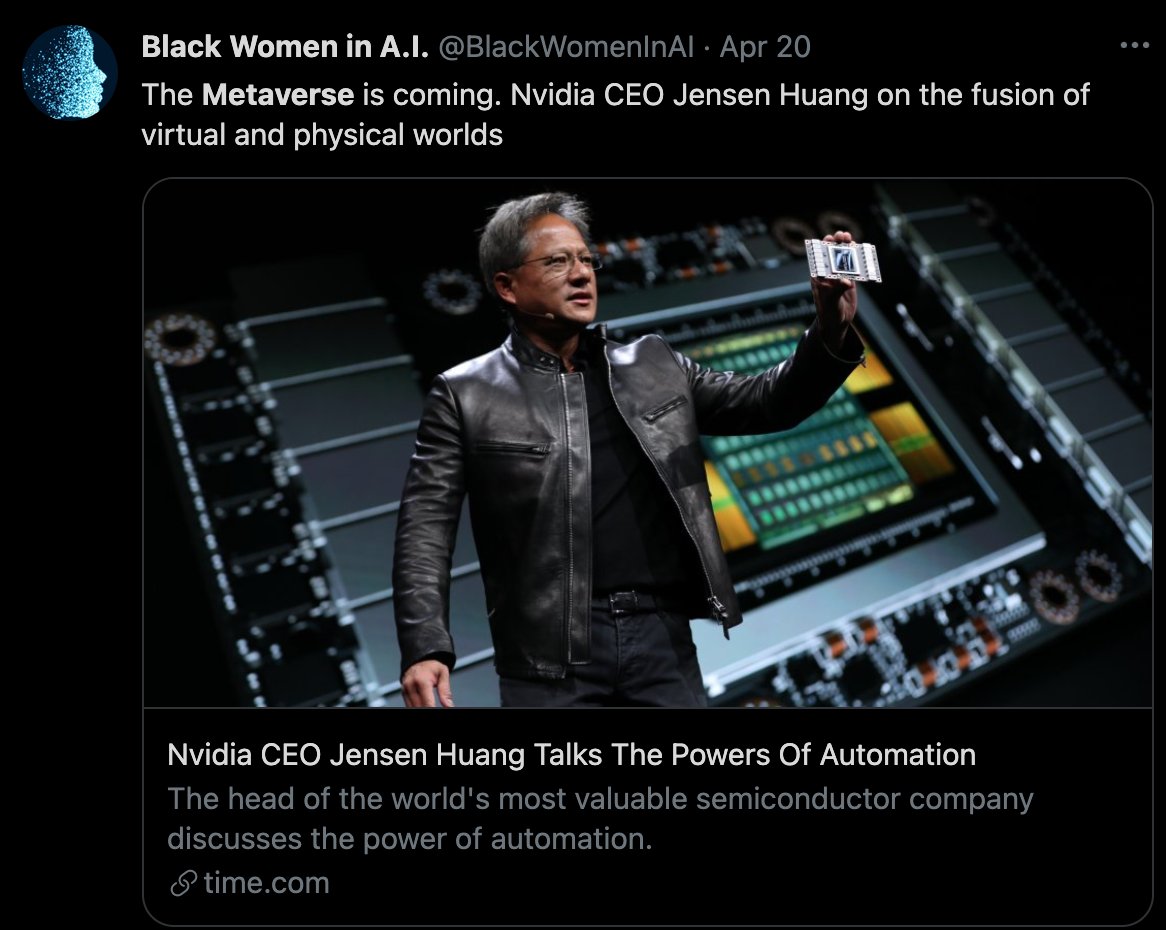

1.3/ METAVERSE

If you’ve ever seen the movie “Ready Player One”, it’s kind of the same thing. You create a virtual character and do really cool things in that virtual world through that character.

This virtual world can also have its own economy (Robux on Roblox).

If you’ve ever seen the movie “Ready Player One”, it’s kind of the same thing. You create a virtual character and do really cool things in that virtual world through that character.

This virtual world can also have its own economy (Robux on Roblox).

1.4/ FORTNITE CONCERTS?

It also has experiences that span across genres.

For example, a Travis Scott concert in Fortnite brought in 12.3MM viewers.

It seems like a lot of the entertainment lines are blurring, and there is more and more IP that is crowding around gaming.

It also has experiences that span across genres.

For example, a Travis Scott concert in Fortnite brought in 12.3MM viewers.

It seems like a lot of the entertainment lines are blurring, and there is more and more IP that is crowding around gaming.

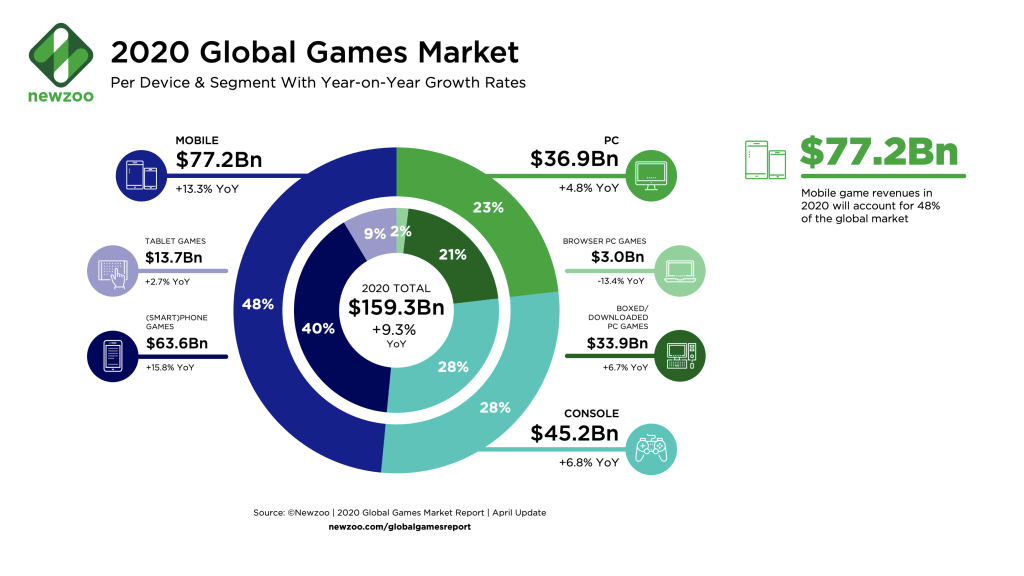

2.1/ Market 👉 Size, Players, Catalysts

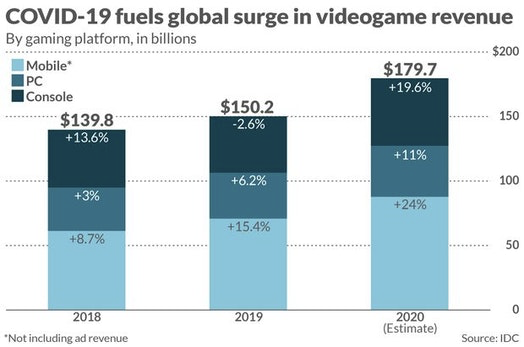

I think the most important part to understand is the amount of dollars spent on video games.

According to IDC, video game revenue ($180B), is now larger than the global film industry ($100B) and North American Sports ($73B) combined!

I think the most important part to understand is the amount of dollars spent on video games.

According to IDC, video game revenue ($180B), is now larger than the global film industry ($100B) and North American Sports ($73B) combined!

2.2/ NEW GEN

COVID sent the growth into hyperdrive in 2020, but I think this should be sustainable as NextGen consoles — Xbox and Playstation — keep the momentum going.

If you further break down the global games market, mobile eats a big piece of the growing pie.

COVID sent the growth into hyperdrive in 2020, but I think this should be sustainable as NextGen consoles — Xbox and Playstation — keep the momentum going.

If you further break down the global games market, mobile eats a big piece of the growing pie.

2.3/ ECOSYSTEM

If you look at the overall ecosystem, you can break it down into these categories:

Publishers: Make/acquire the games. Tencent, Activision, EA, TakeTwo, Roblox, Microsoft, and Ubisoft.

If you look at the overall ecosystem, you can break it down into these categories:

Publishers: Make/acquire the games. Tencent, Activision, EA, TakeTwo, Roblox, Microsoft, and Ubisoft.

2.4/

Channels: Facilitate the consumption and distribution of games: YouTube Gaming, Facebook Gaming, Twitch, Steam, and Discord.

Engines: The pipes of the system: Unity and Unreal Engine

Let’s follow the money and see how it flows through the categories of the ecosystem…

Channels: Facilitate the consumption and distribution of games: YouTube Gaming, Facebook Gaming, Twitch, Steam, and Discord.

Engines: The pipes of the system: Unity and Unreal Engine

Let’s follow the money and see how it flows through the categories of the ecosystem…

3.1/ Profitability 👉 $60/ea —> Free-to-play

Back in the day, big rich publisher like Activision would go out and spend $300MM developing and marketing a game, then sell $60 copies and hope to sell enough to turn a sexy profit!

BUT the game has changed.

Back in the day, big rich publisher like Activision would go out and spend $300MM developing and marketing a game, then sell $60 copies and hope to sell enough to turn a sexy profit!

BUT the game has changed.

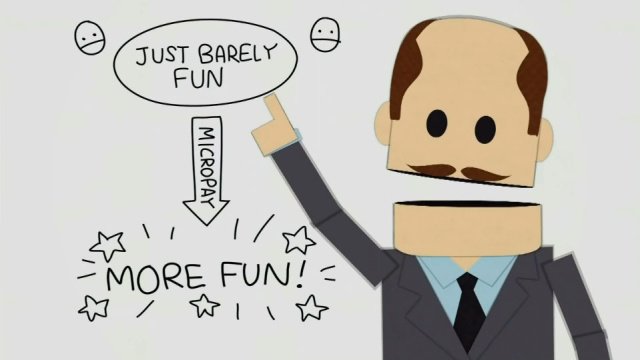

3.2/ FREEMIUM

Gaming companies today operate on what is called Free-to-play or F2P. AKA they hook you with freebies.

The concept is that you can play and start off for free, but then you spend money on microtransactions to either speed up your progression or just to look cool.

Gaming companies today operate on what is called Free-to-play or F2P. AKA they hook you with freebies.

The concept is that you can play and start off for free, but then you spend money on microtransactions to either speed up your progression or just to look cool.

3.3/ IN-GAME SKINS

Below is what is referred to, in Fortnite, as a “No Skin,” meaning you have the basic character design that you were given from the start.

But, you could run to your mom’s room, steal her credit card, and buy a skin to make you look like Venom from Marvel.

Below is what is referred to, in Fortnite, as a “No Skin,” meaning you have the basic character design that you were given from the start.

But, you could run to your mom’s room, steal her credit card, and buy a skin to make you look like Venom from Marvel.

3.4/

Now you’re a cool new character, but you paid something like $3-5 to look like this. If you do this over and over, it adds up.

If you’re a video game publisher, this changes your revenue from one-time to repeat almost/recurring revenue.

Now you’re a cool new character, but you paid something like $3-5 to look like this. If you do this over and over, it adds up.

If you’re a video game publisher, this changes your revenue from one-time to repeat almost/recurring revenue.

4.1/ Esports 👉 Piece of the Puzzle

Everyone and their nephew is talking about esports. This is people watching other people play video games.

Everyone and their nephew is talking about esports. This is people watching other people play video games.

4.2/ ADS

Esports already has the viewership to match traditional sports. And this is where the BIG MONEY comes in.

If you’re a media exec, you’re licking your chops because the younger demographic is being served up on a silver platter through esports.

Esports already has the viewership to match traditional sports. And this is where the BIG MONEY comes in.

If you’re a media exec, you’re licking your chops because the younger demographic is being served up on a silver platter through esports.

4.3/ ADS

This all comes down to one thing: EYEBALLS. The more people watch, the more ads you can sell, so the higher the sponsorships and media rights.

This all comes down to one thing: EYEBALLS. The more people watch, the more ads you can sell, so the higher the sponsorships and media rights.

4.4/ ESPORTS

The other component is that Lebron James cannot be Lebron James outside of the NBA. This is the exact opposite in esports.

Frequently, pro-gamers will ditch professional leagues and focus on building themselves out as a brand and build up their following on Twitch.

The other component is that Lebron James cannot be Lebron James outside of the NBA. This is the exact opposite in esports.

Frequently, pro-gamers will ditch professional leagues and focus on building themselves out as a brand and build up their following on Twitch.

4.5/ STREAMERS

In traditional sports, higher skill = higher entertainment value. People watch more based on skill than anything else.

In video games, people allocate much more weight to the character and charisma of the streamer. Call it 30 parts skill and 70 parts personality.

In traditional sports, higher skill = higher entertainment value. People watch more based on skill than anything else.

In video games, people allocate much more weight to the character and charisma of the streamer. Call it 30 parts skill and 70 parts personality.

5/ GRIT NEWSLETTER

Every week I write a newsletter to +24k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

Every week I write a newsletter to +24k investors including hedge funds, pension funds, investment advisors & billionaires.

SUBSCRIBE to see how we’re playing this! 👇

gritcapital.substack.com/welcome

@WeAreEnthusiast @TencentGames @Activision @EA @Roblox @Microsoft @Ubisoft @UbisoftToronto @YouTubeGaming @FacebookGaming @Twitch @Steam @discord @unity3d @UnrealEngine

• • •

Missing some Tweet in this thread? You can try to

force a refresh