CEO • 500,000 Followers • Seen on Bloomberg & FOX • Top Voice LinkedIn

50 subscribers

How to get URL link on X (Twitter) App

ASSET MANAGERS:

ASSET MANAGERS:

https://twitter.com/GRDecter/status/1676935546407378945?s=20

https://twitter.com/Grit_Capital/status/1669042924074434560?s=20

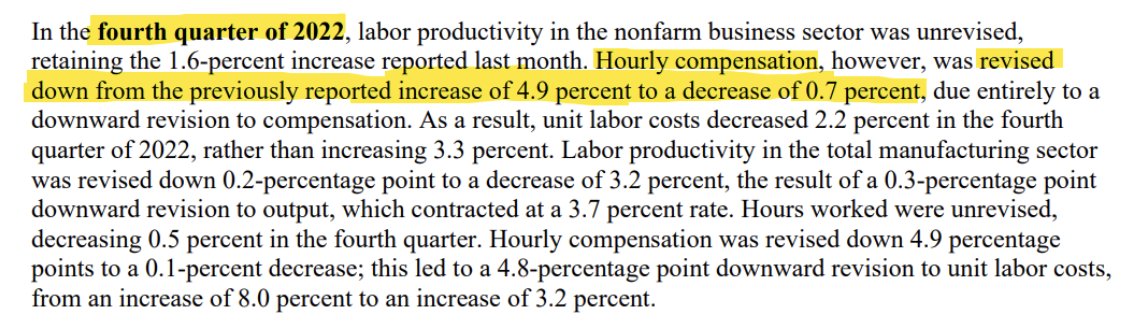

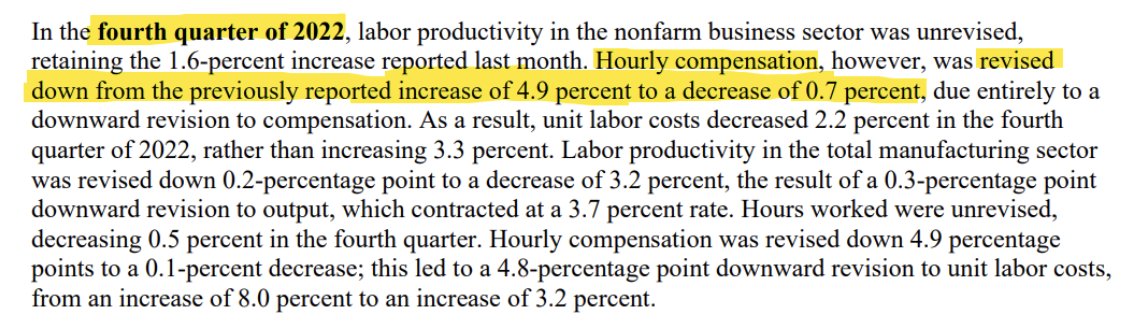

The US Department of Labor just released a report that shows hourly compensation actually DECREASED by 0.7% in Q4 of last year

The US Department of Labor just released a report that shows hourly compensation actually DECREASED by 0.7% in Q4 of last year

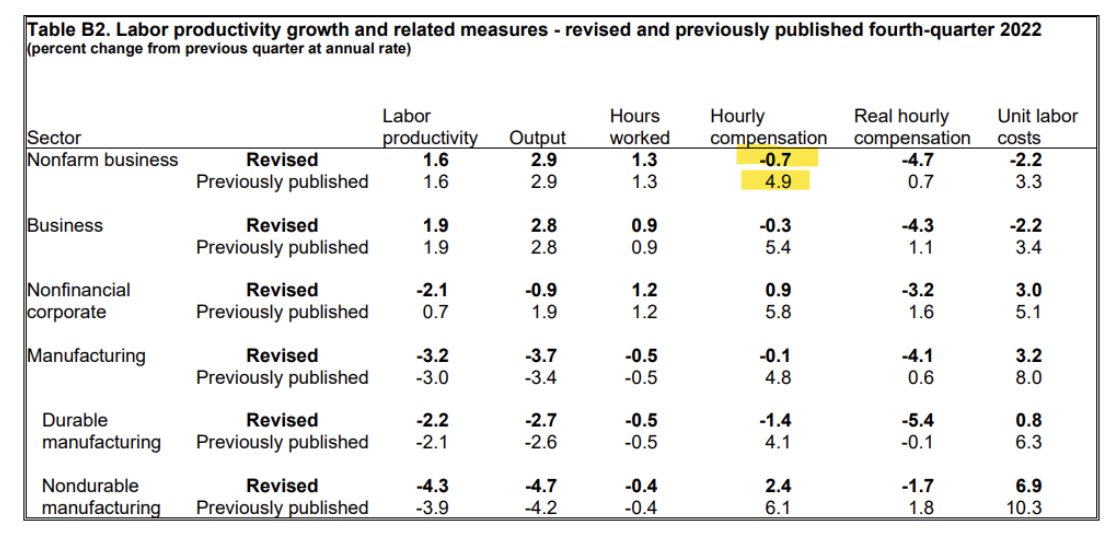

Regional banks have another huge problem besides bank runs:

Regional banks have another huge problem besides bank runs:https://twitter.com/GRDecter/status/1655935790818664452?s=20

The movie, “THIS IS NOT FINANCIAL ADVICE”, features Glauber "Pro" Contessoto, an immigrant working multiple jobs and living in a 220-square-foot apartment, who gambles his life savings on Dogecoin...

The movie, “THIS IS NOT FINANCIAL ADVICE”, features Glauber "Pro" Contessoto, an immigrant working multiple jobs and living in a 220-square-foot apartment, who gambles his life savings on Dogecoin...

There are two dominant economic groups of countries:

There are two dominant economic groups of countries:

Interest in gold investing has been surging lately. It seems like everyone wants at least some gold in their portfolio:

Interest in gold investing has been surging lately. It seems like everyone wants at least some gold in their portfolio:https://twitter.com/donnelly_brent/status/1647974832582062081?s=20

https://twitter.com/GRDecter/status/1650596748191039488?s=20

The Masters is probably the most prestigious sporting event in the world

The Masters is probably the most prestigious sporting event in the worldhttps://twitter.com/AmericanHIO/status/1643969378424061952?s=20

https://twitter.com/GRDecter/status/1633919732741992450?s=20