Why @SushiSwap is one of the most overlooked DeFi protocols. [Thread]

Many see $Sushi as simply another AMM competitor to Uniswap. However, Sushi’s plans are to be more than just a DEX. They want to be the home of DeFi through the creation of a synergistic ecosystem. 1/n

Many see $Sushi as simply another AMM competitor to Uniswap. However, Sushi’s plans are to be more than just a DEX. They want to be the home of DeFi through the creation of a synergistic ecosystem. 1/n

@SushiSwap has partnered with several of the most well known DeFi protocols as part of their aggressive expansion strategy. These partnerships will allow Sushi to tap into additional liquidity and further build their Moat.

@iearnfinance @AaveAave 2/n

@iearnfinance @AaveAave 2/n

Let’s take a look into the various aspects of Sushi.

SushiSwap is the most well known part of the SushiSwap ecosystem. Similar to $UNI it uses a constant product market maker. Sushi does about 20% of all DEX volume and is expanding to become multi chain 3/n

SushiSwap is the most well known part of the SushiSwap ecosystem. Similar to $UNI it uses a constant product market maker. Sushi does about 20% of all DEX volume and is expanding to become multi chain 3/n

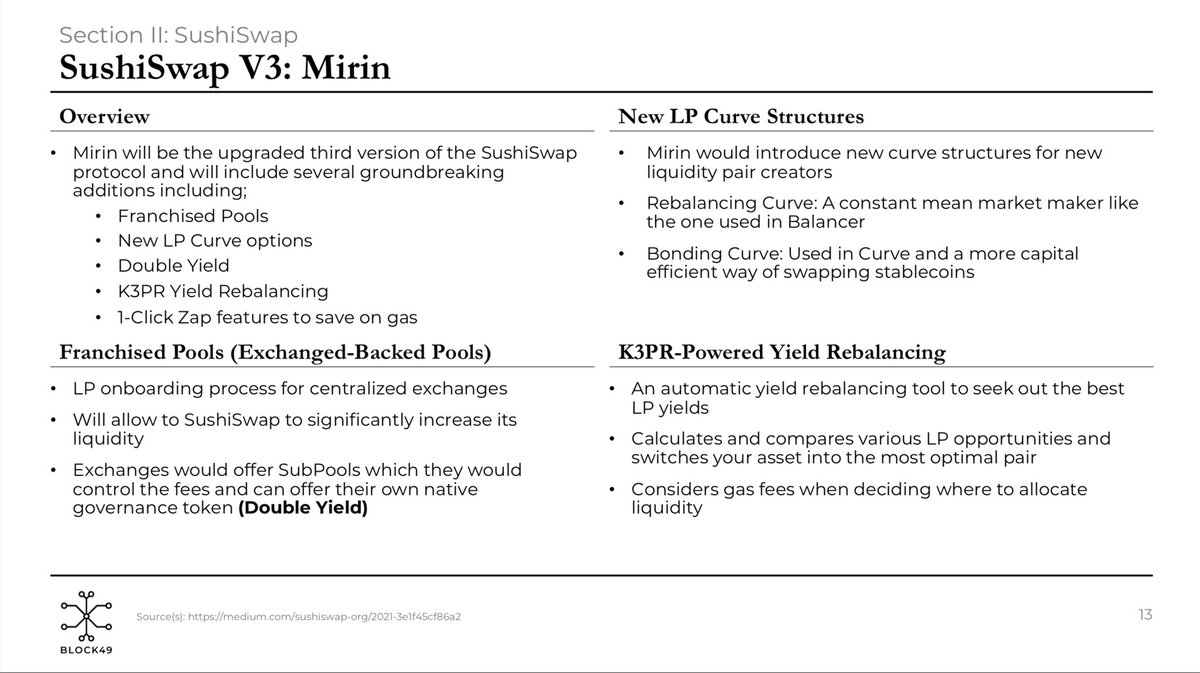

In V3 there will be several additions to SushiSwap which will further increase it’s liquidity and capital efficiency. 4/n

Another aspect of Sushi is Onsen. Onsen is a liquidity mining incentivization program. Onsen is critical for the formation of future partnerships as well as bootstrapping liquidity for new DeFi project. This will further increase Sushi’s liquidity. In Defi liquidity is 👑 5/n

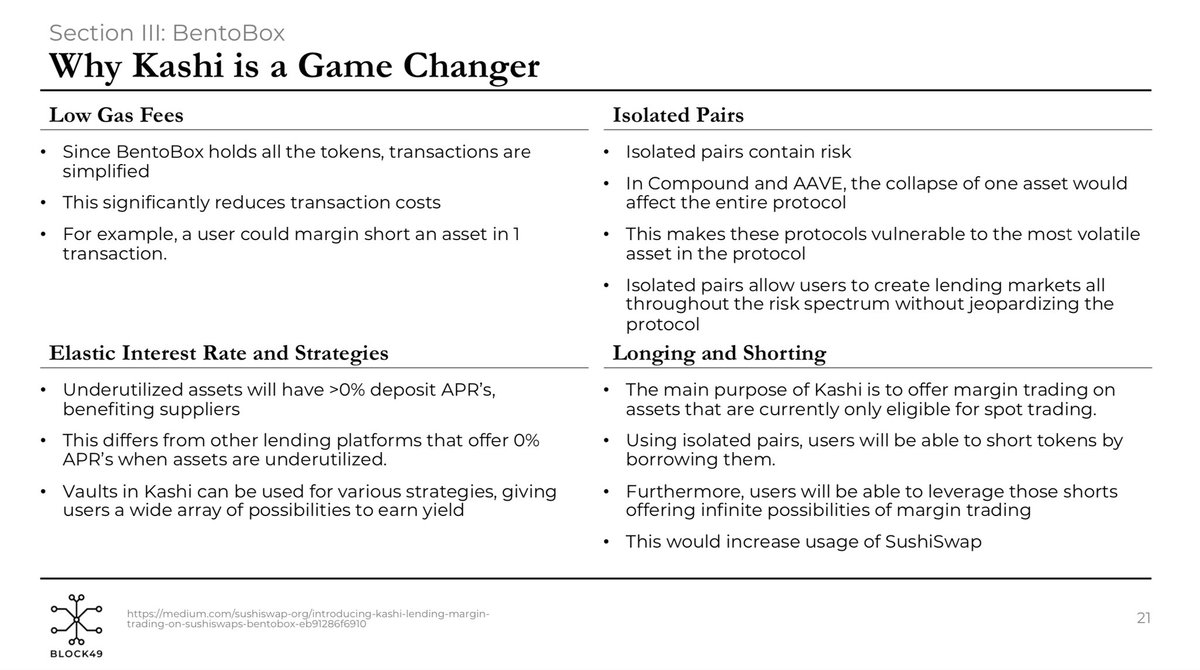

BentoBox is another big addition to the Sushi ecosystem. Bento is a gas efficient ecosystem for dApps. It will allow for increased capital efficiency and development in the Sushi ecosystem. Again this will drive more liquidity to the Sushi ecosystem 6/n

Kashi lending is the first dApp built in BentoBox. Kashi is an isolated lending market and margin trading platform. Users are able to create their own lending pairs, creating an infinite amount about shorting possibilities that were previously not possible 7/n

If you need another reason to hold $Sushi. Holders are able to stake their sushi for xSushi. xSushi holders receive 0.05% of all trading fees on the platform. Furthermore, xSushi is available on @AaveAave to be used as collateral. 8/n

If you would like to read our full exploratory report on @SushiSwap which goes into a bit more depth it is available for free on our newly launched website.

Block49capital.com

$SUSHI $UNI $AAVE $BAL $MKR $COMP $YFI

Block49capital.com

$SUSHI $UNI $AAVE $BAL $MKR $COMP $YFI

• • •

Missing some Tweet in this thread? You can try to

force a refresh