I had a fascinating conversation covering the payments industry with an early Square employee for @MosaicRM.

We discuss: Jack Dorsey, $SQ, $PYPL, Stripe, $AFRM, $APT, $V, $MA, & more

Here is a thread containing my highlights:

We discuss: Jack Dorsey, $SQ, $PYPL, Stripe, $AFRM, $APT, $V, $MA, & more

Here is a thread containing my highlights:

Part of Jack Dorsey's "secret sauce" was to scale himself out of multiple companies which forced him to build the right teams at $SQ and $TWTR early on

Square aimed to create a value-added product in a commoditized industry. Today it has established itself as a payment services "platform" $SQ

Square has two distinct and powerful customer acquisition vehicles: payment processing for merchants & Cash App for consumers $SQ

Why owning payment processing is a competitive advantage for Square $SQ

"[It] allows them to expand in all sorts of possibilities that if you didn't own those parts of the experience and of the stack, you wouldn't necessarily be able to."

"[It] allows them to expand in all sorts of possibilities that if you didn't own those parts of the experience and of the stack, you wouldn't necessarily be able to."

Why Square increasingly views Stripe as a competitor. $SQ

"I would say that there are aspects of Square that start poking into Stripe's domain of expertise"

"I would say that there are aspects of Square that start poking into Stripe's domain of expertise"

The competitive dynamics between PayPal and Square $PYPL $SQ

"[payments] start converging and eventually meet: on one end, on the merchant and how they get paid, and on the other end, on the consumer and how they choose to pay. They start going in competition with each other."

"[payments] start converging and eventually meet: on one end, on the merchant and how they get paid, and on the other end, on the consumer and how they choose to pay. They start going in competition with each other."

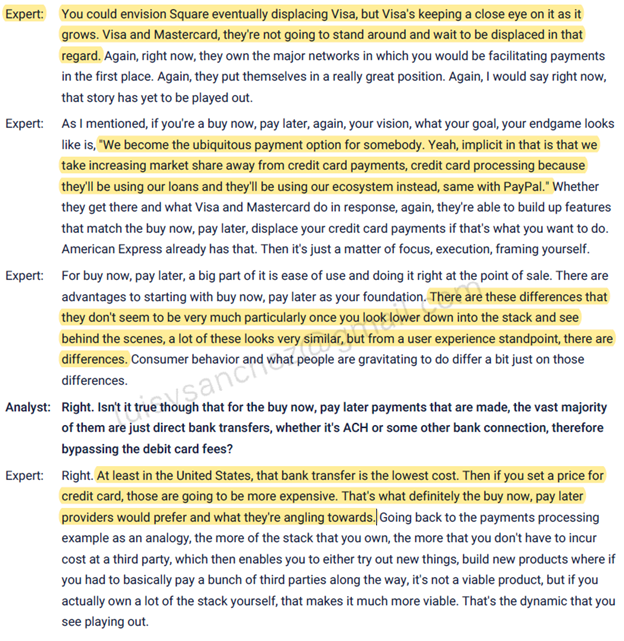

Can buy-now-pay-later companies evolve from 'payment feature' into 'payment platforms'?

"I worked at Square. I also saw how payments processing, previously thought of as a commodity, can really become its own thing."

"I worked at Square. I also saw how payments processing, previously thought of as a commodity, can really become its own thing."

Can Square eventually displace the Visa and Mastercard rails? $SQ $V $MA

"You could envision Square eventually displacing Visa, but Visa's keeping a close eye on it as it grows. Visa and Mastercard, they're not going to stand around and wait to be displaced in that regard."

"You could envision Square eventually displacing Visa, but Visa's keeping a close eye on it as it grows. Visa and Mastercard, they're not going to stand around and wait to be displaced in that regard."

Square's bank charter could help it create proprietary rails & lower cost. $SQ

"Square's move into becoming a bank makes this possible because you can't do a lot of stuff unless you're legally a bank to store money, transfer money, make loans, and do things like that officially"

"Square's move into becoming a bank makes this possible because you can't do a lot of stuff unless you're legally a bank to store money, transfer money, make loans, and do things like that officially"

Fintech companies will aim to push transaction costs to zero or near zero which could completely change the power balance of the payments industry.

The cost of transactions over blockchain is orders of magnitude greater than legacy payments rails and may never be cost-competitive due to the computing intensity.

Square and PayPal's blockchain initiative was in large part a customer acquisition strategy $SQ $PYPL

A full transcript of the call is available here: stream.mosaicrm.com/i/a2b41b

It requires a subscription to @MosaicRM

It requires a subscription to @MosaicRM

cc @MaxTheComrade @Matt_Cochrane7 @KermitCapital @JohnStCapital @LSValue @JerryCap @JRogrow @ElliotTurn @BlueToothDDS @investingnick

• • •

Missing some Tweet in this thread? You can try to

force a refresh