End of April 2021 Portfolio Holdings

Top positions:

• $CRWD

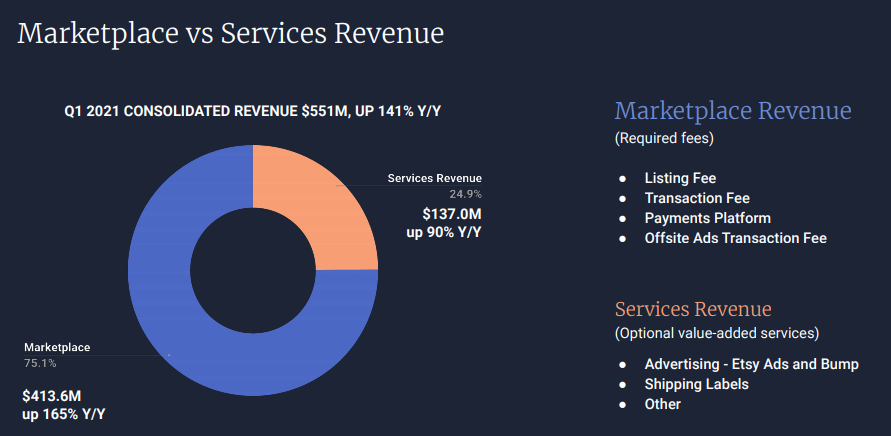

• $ETSY

• $PLTR

• $UPST

• $NET

• $APPS

Mostly Inactive in April.

• New position: $PATH | $KLIC

• Exits: $ATER | $OPEN [nothing fundamental, portfolio adjustments]

I'll share my thoughts and rationales later:

Top positions:

• $CRWD

• $ETSY

• $PLTR

• $UPST

• $NET

• $APPS

Mostly Inactive in April.

• New position: $PATH | $KLIC

• Exits: $ATER | $OPEN [nothing fundamental, portfolio adjustments]

I'll share my thoughts and rationales later:

2/ My account is pretty aggressive due to my horizon

Second managed Portfolio-2:

• Growth: $SE - $KLIC - $DOCU - $CRWD - $ZS

• Semi-Value: $MS - $BNS.TO - $FANG - $FCX

** [Strict balanced style for fam]

Other personal holdings:

- $BTC * $ETH

- Own a tiny bit into $HIVE.VN

Second managed Portfolio-2:

• Growth: $SE - $KLIC - $DOCU - $CRWD - $ZS

• Semi-Value: $MS - $BNS.TO - $FANG - $FCX

** [Strict balanced style for fam]

Other personal holdings:

- $BTC * $ETH

- Own a tiny bit into $HIVE.VN

3/ I bought $PATH - Leader in automation.

Example: $PATH helped hospitals cut waiting lines for Covid testing from 3mins to 15-secs; helped nurses reduce paperwork from 3-hours/day to 5-mins!

There is much more.. As promised, I plan to do a thread in May

Example: $PATH helped hospitals cut waiting lines for Covid testing from 3mins to 15-secs; helped nurses reduce paperwork from 3-hours/day to 5-mins!

There is much more.. As promised, I plan to do a thread in May

https://twitter.com/InvestiAnalyst/status/1384936644097236993

3ii) I bought $KLIC based on financials and fundamental reasons. They have the best revenue growth, earnings growth rates and EPS estimates in the semi-conductor industry.

Big transformation here and benefitting from the tailwinds.

Big transformation here and benefitting from the tailwinds.

https://twitter.com/InvestiAnalyst/status/1382433729898024963

4/ Portfolio highlights:

- $CRWD continued to deliver with their Investor day

- $NET's announcement w. $NVDA was delightful.

- $UPST added new partners

- $PLTR's double click demo was good

- $APPS completed acquisitions

- $AGC deal announced - I'm now analyzing $GRAB vs $SE.

- $CRWD continued to deliver with their Investor day

- $NET's announcement w. $NVDA was delightful.

- $UPST added new partners

- $PLTR's double click demo was good

- $APPS completed acquisitions

- $AGC deal announced - I'm now analyzing $GRAB vs $SE.

5/

- $AFRM showed data that the business is accelerating

- $DND.TO continues to show why they dominate the SaaS legal industry

- WELL.TO continues to show leadership in Canadian telehealth

- $KLIC posted good guidance

Hope to share much more over the next month!

- $AFRM showed data that the business is accelerating

- $DND.TO continues to show why they dominate the SaaS legal industry

- WELL.TO continues to show leadership in Canadian telehealth

- $KLIC posted good guidance

Hope to share much more over the next month!

6/ On general market:

Within the next 6-8 months, I expect two big market events to create a massive buying opportunity,

i) 10-yr rises to +2% to catch up to higher commodities & inflation.

ii) When the Fed starts reducing asset purchases.

This is just how history works..

Within the next 6-8 months, I expect two big market events to create a massive buying opportunity,

i) 10-yr rises to +2% to catch up to higher commodities & inflation.

ii) When the Fed starts reducing asset purchases.

This is just how history works..

7/ Cont'd:

Go back & study - 1980's, 2004-06, 2011, 2016 and 2018 market periods.

It's characteristics of an early stage of a bull market. Economic sensitive stocks outperforms. Tech/Growth don't lead, its fine.

I wrote extensively about business cycles:

investianalystnewsletter.substack.com/p/whats-happen…

Go back & study - 1980's, 2004-06, 2011, 2016 and 2018 market periods.

It's characteristics of an early stage of a bull market. Economic sensitive stocks outperforms. Tech/Growth don't lead, its fine.

I wrote extensively about business cycles:

investianalystnewsletter.substack.com/p/whats-happen…

8/ Leading sectors are banks, transportation, financials, industrials, anything outdoors, semi's etc

I highly recommend checking out @allstarcharts - Year 2 of a bull market. It's historically choppy after you get a strong year like 2020, we're in Y2 now

I highly recommend checking out @allstarcharts - Year 2 of a bull market. It's historically choppy after you get a strong year like 2020, we're in Y2 now

https://twitter.com/allstarcharts/status/1387114559161438213

9/ Except the virus takes a turn, if not, I expect 2021 to follow history about how markets perform in an early business cycle. Nothing is new in markets.

I'm focused on the next decade, so I'm prepared to underperform in 2021 / buy the dips / set my account for the long-run !

I'm focused on the next decade, so I'm prepared to underperform in 2021 / buy the dips / set my account for the long-run !

10/ 2021 for me is primarily focused on research & finding mid-cap / growth companies that meet my characteristics:

• Big TAM

• Scalability

• Optionality

• High margins.

• Bold leadership

• Emerging moat

• Disrupting old industries

• Expanding Network effects.

• Big TAM

• Scalability

• Optionality

• High margins.

• Bold leadership

• Emerging moat

• Disrupting old industries

• Expanding Network effects.

11/

Finally, I'm 90% invested, but prepared for big buying opportunities. I expect tech to start outperforming once the business cycle normalizes.

My horizon is truly focused on the next 5-10 years.

I'm an optimist on innovation. I'm committed to sharing research & threads🙂

Finally, I'm 90% invested, but prepared for big buying opportunities. I expect tech to start outperforming once the business cycle normalizes.

My horizon is truly focused on the next 5-10 years.

I'm an optimist on innovation. I'm committed to sharing research & threads🙂

12/ My apologies to my subscribers or followers, my schedule was busy in April, so I had lots of threads and newsletters that I missed writing on.

I'm hoping in May, I get more time and can do much more! Thank you!

investianalystnewsletter.substack.com/welcome

I'm hoping in May, I get more time and can do much more! Thank you!

investianalystnewsletter.substack.com/welcome

• • •

Missing some Tweet in this thread? You can try to

force a refresh