How do professional traders balance the decay in Volatility, the VIX, & Options prices with their propensity to see large spikes.

How, on #MayThe4thBeWithYou , do the Jedi of Vol balance the Light and Dark side of the Vol Force?

Time for a thread:

👇👇👇

How, on #MayThe4thBeWithYou , do the Jedi of Vol balance the Light and Dark side of the Vol Force?

Time for a thread:

👇👇👇

How do you capture the natural decay in volatility pricing, while protecting against those nasty spikes which can wipe away everything you’ve gained up to that point?

You have to balance the two. You need to be a Jedi of Vol

You have to balance the two. You need to be a Jedi of Vol

And/or: How do you position your portfolio to be long volatility without experiencing the nasty bleed during periods vol doesn’t spike?

A new breed of managers are designed to do this – dynamically moving between 3 vol enviros of spikes, drops, & sideways mvmt. These mngrs are seeking to be ‘go anywhere’ strat in the vol space while retaining as much as possible of the convexity options & the VIX futures provide

Some are looking to capture the VRP, or Volatility Risk Premium (a fancy way of saying capture the erosion of the VIX futures covered above without getting run over by the spikes.) These are now called anything from volatility arbitrage to convexity to simply volatility traders.

And others are looking to be the most direct hedge available in the Alts toolbox these days, acting as dedicated, active long volatility strategies.

The main types of VIX/Vol Trading can be categorized into three main types of strategies:

1. Volatility arbitrage

2. Long options tail risk

3. Convexity strategies.

1. Volatility arbitrage

2. Long options tail risk

3. Convexity strategies.

Just who are the Jedi of Vol who run these types of strategies. We have them listed in our whitepaper here (link), but it’s so much more fun to put some pictures with those names

Without further ado, here are the Knights of the Volatility Trading Republic:

Without further ado, here are the Knights of the Volatility Trading Republic:

The OG, @nntaleb – who popularized the terms tail risk and black swans

Category = Options/Tail Risk

Avatar = Yoda

Category = Options/Tail Risk

Avatar = Yoda

Artemis’ @vol_christopher, with a decade+ trading long vol and top notch papers on all thing volatility.

Category = Options/Tail Risk

Avatar = Annakin Skywalker (the clone wars hero, don’t read any dark side into this)

Category = Options/Tail Risk

Avatar = Annakin Skywalker (the clone wars hero, don’t read any dark side into this)

Trader turned Professor turned Fund Manager, @bennpeiffert, who equally quizzes and dishes derivatives knowledge

Category = Options/Tail Risk

Avatar = Luke Skywalker

Category = Options/Tail Risk

Avatar = Luke Skywalker

Logical, tactical, mathematical @longtailalpha; with one of the largest vol focused funds

Category = Options/Tail Risk

Avatar = Mace Windu (revered Jedi Master and Clone Wars General)

Category = Options/Tail Risk

Avatar = Mace Windu (revered Jedi Master and Clone Wars General)

The ever philosophical @waynehimelsein, and his somewhat non-traditional 'At the Money' approach

Category = Options/Tail Risk

Avatar = Obi Wan Kenobi

Category = Options/Tail Risk

Avatar = Obi Wan Kenobi

Market Maker turned VolTwit hero, @jam_croissant, who’s constantly analyzing where Gary’s gamma is positioned

Category = Vol Arb

Avatar = Qui-Gon Jinn

Category = Vol Arb

Avatar = Qui-Gon Jinn

The young upstart @krisidiii and his own version of tracking flows and seeking dispersion

Category = Vol Arb

Avatar = Ezra Bridger (orphan turned force wielder in Rebels series)

Category = Vol Arb

Avatar = Ezra Bridger (orphan turned force wielder in Rebels series)

Nancy Davis, (who really needs to get on Twitter) and her devotion to finding underpriced vol in periphery markets

Category = Options/Tail Risk

Avatar = Ashoka Tano

Category = Options/Tail Risk

Avatar = Ashoka Tano

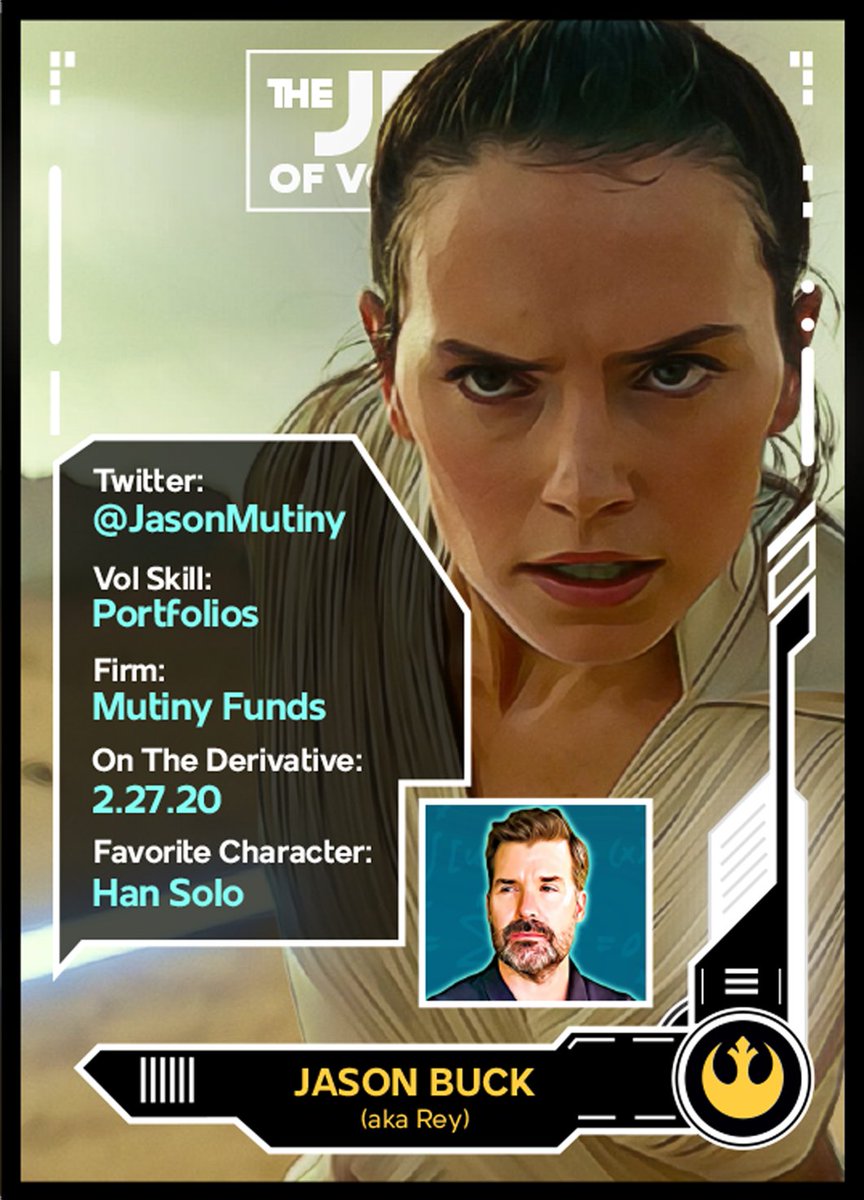

The outsider turned Vol rebel, @jasonmutiny, who seeks to combine managers to capture a sort of long vol beta

Category = All of the Above

Avatar = Rey

Category = All of the Above

Avatar = Rey

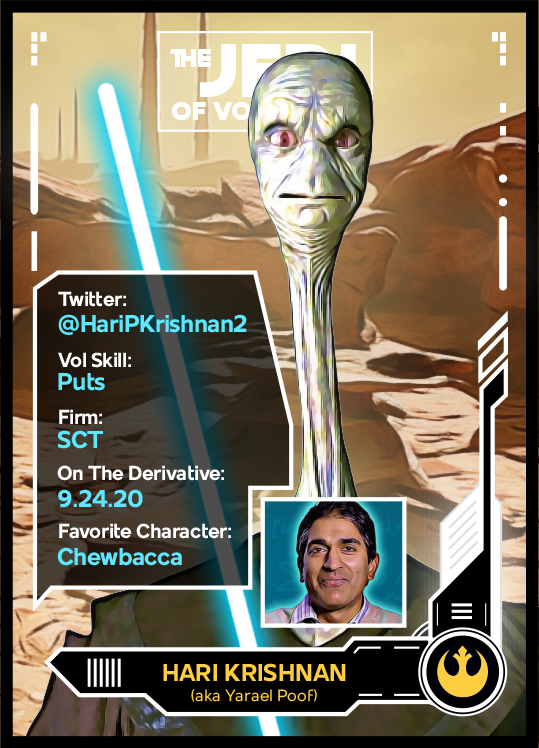

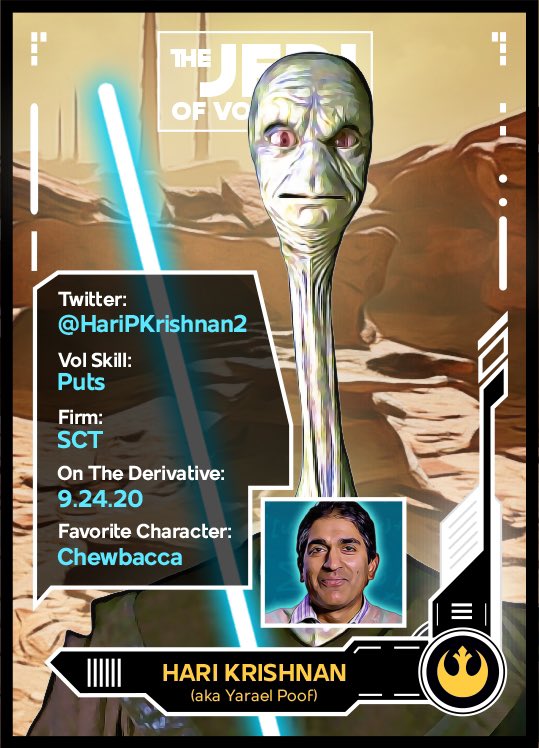

The soft spoken, wrote the book on put ladders, @hariskrishnan2

Category = Options/Tail Risk

Avatar = Yarael Poof (Ep. 1: expert practitioner of Jedi mind tricks and skilled diplomat and teacher)

Category = Options/Tail Risk

Avatar = Yarael Poof (Ep. 1: expert practitioner of Jedi mind tricks and skilled diplomat and teacher)

The lesser known outside vol trading, but highly respected inside vol trading, Jerry Haworth of 36 South, searching out optionality across the galaxy

Category = Options/Tail Risk

Avatar = Plo Kloon (Ep. 1: a master of telekinesis and extensive knowledge of physical sciences)

Category = Options/Tail Risk

Avatar = Plo Kloon (Ep. 1: a master of telekinesis and extensive knowledge of physical sciences)

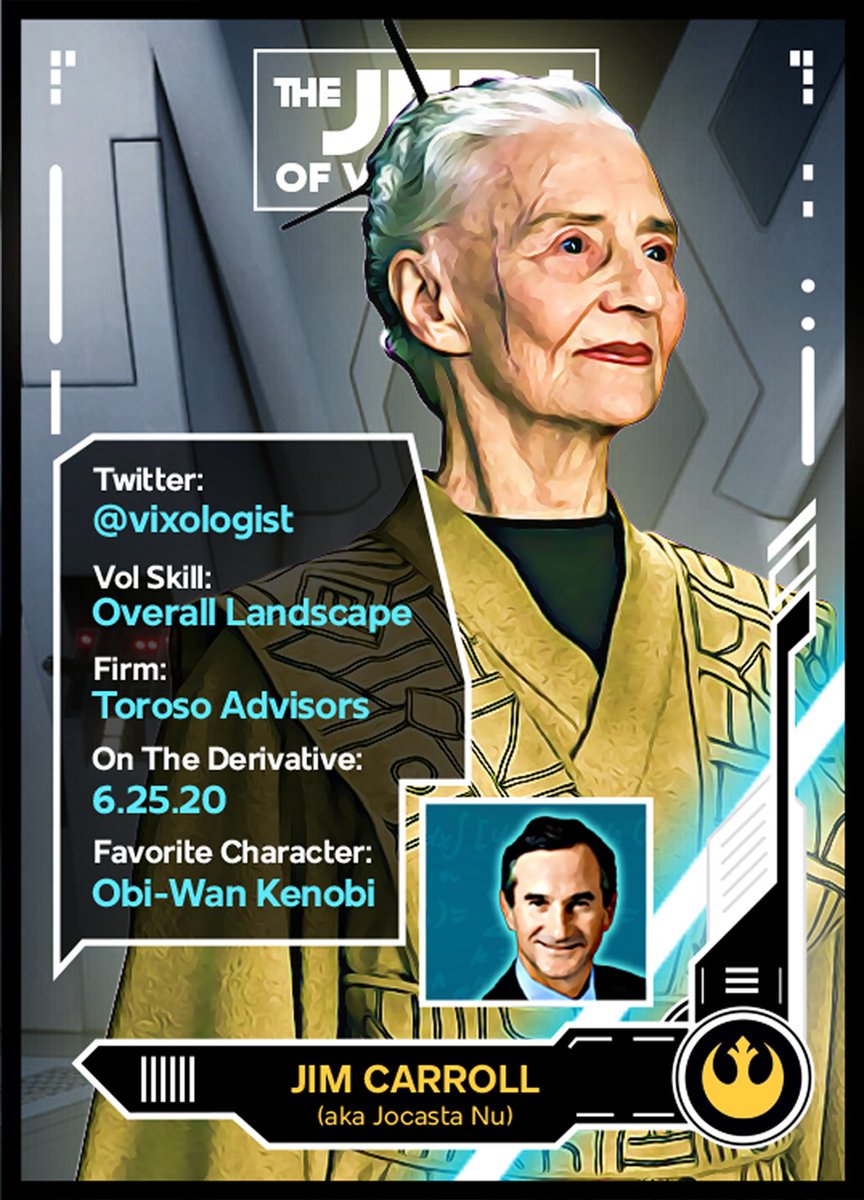

The ever humorous @vixologist, who keeps a near encyclopedic eye on the goings on in the vol space

Category = Vol Arb

Avatar = Jocasta Nu (Ep. II: in charge of the Jedi Archives and helping fellow Jedi access information)

Category = Vol Arb

Avatar = Jocasta Nu (Ep. II: in charge of the Jedi Archives and helping fellow Jedi access information)

The board game loving @KrisAbdelmessih who shares his real world experience with a needed does of always in short supply perspective

Category = Vol Arb?

Avatar = Kanan Jarrus (Rebels: Padawan turned teacher)

Category = Vol Arb?

Avatar = Kanan Jarrus (Rebels: Padawan turned teacher)

A newer VolTwit follow, @VolQuant, shares the quantitative side of vol trading

Category = Vol Arb

Avatar = Kit Fisto (Ep II: one of the greatest lightsaber duelists in the Jedi Order)

Category = Vol Arb

Avatar = Kit Fisto (Ep II: one of the greatest lightsaber duelists in the Jedi Order)

The go to guy for the CBOE to talk through VIX movements, @JoeTigay

Category = Convexity Strategies

Avatar = Sasee Tiln (Ep I: one of the best starfighter pilots in the Jedi Order)

Category = Convexity Strategies

Avatar = Sasee Tiln (Ep I: one of the best starfighter pilots in the Jedi Order)

The sharp-witted, dog avatar toting @pat_hennessy with his vol musings

Category = Convexity Strategies

Avatar = Deepa Bilaba (Ep I: a noted Jedi strategist)

Category = Convexity Strategies

Avatar = Deepa Bilaba (Ep I: a noted Jedi strategist)

The guy who says, the world needs another short VIX ETF, @volatilitystu

Category = Vol Arb

Avatar = Quinlan Vos (Ep I: the maverick Jedi who was an expert tracker)

Category = Vol Arb

Avatar = Quinlan Vos (Ep I: the maverick Jedi who was an expert tracker)

The VIX futures specialist @6_Figure_Invest with his great deep dives on the inner workings of VIX derivatives

Category = Vol Arb

Avatar = Adi Gallia (Ep I: well known and resourced within the political and judicial spheres)

Category = Vol Arb

Avatar = Adi Gallia (Ep I: well known and resourced within the political and judicial spheres)

The vol hedger plugged into the stats and the players, @dynamicvol

Category = Convexity Strategies

Avatar = Oppo Rancicis (Ep I: Jedi-counseled military tactics known for being cunning and effective)

Category = Convexity Strategies

Avatar = Oppo Rancicis (Ep I: Jedi-counseled military tactics known for being cunning and effective)

The student looking to join the order, yet leery of its true motives, @nope_its_lily

Category = Vol Arb

Avatar = Luminara Unduli (Ep II: extremely strong in the Force, so much so that her bones radiated it)

Category = Vol Arb

Avatar = Luminara Unduli (Ep II: extremely strong in the Force, so much so that her bones radiated it)

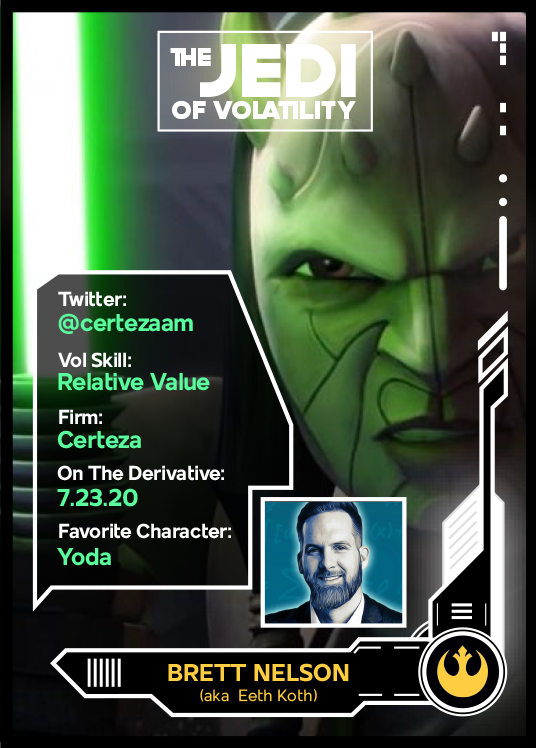

The applied mathematician seeking imbalances between vol surfaces, Brett Nelson @certezaAM

Category = Vol Arb

Avatar = Chirrut Imwe (Rogue One: believes all things connected through force)

Category = Vol Arb

Avatar = Chirrut Imwe (Rogue One: believes all things connected through force)

Supposed to read “a needed [dose]”

Oops, correct handle =

The young upstart @Ksidiii and his own version of tracking flows and seeking dispersion

Category = Vol Arb

Avatar = Ezra Bridger (orphan turned force wielder in Rebels series)

The young upstart @Ksidiii and his own version of tracking flows and seeking dispersion

Category = Vol Arb

Avatar = Ezra Bridger (orphan turned force wielder in Rebels series)

Oops, typo in handle here (corrected)

Trader turned Professor turned Fund Manager, @bennpeifert , who equally quizzes and dishes derivatives knowledge

Category = Options/Tail Risk

Avatar = Luke Skywalker

Trader turned Professor turned Fund Manager, @bennpeifert , who equally quizzes and dishes derivatives knowledge

Category = Options/Tail Risk

Avatar = Luke Skywalker

Typo fix =

The soft spoken, wrote the book on put ladders, @HariPKrishnan2

Category = Options/Tail Risk

Avatar = Yarael Poof (Ep. 1: expert practitioner of Jedi mind tricks and skilled diplomat and teacher)

The soft spoken, wrote the book on put ladders, @HariPKrishnan2

Category = Options/Tail Risk

Avatar = Yarael Poof (Ep. 1: expert practitioner of Jedi mind tricks and skilled diplomat and teacher)

• • •

Missing some Tweet in this thread? You can try to

force a refresh