🚨ICYMI: Last week, @ETC_energy released two exciting deep dives; one on electrification, the other on #hydrogen

🧵with some of my favorite charts 👇(1/9)

🧵with some of my favorite charts 👇(1/9)

🏭Debates around future hydrogen demand are heated, but we can all agree on it's importance for the industrial sector.

🔥 Small role in building heat

🚛🚢✈️Important role in transport, but sub-sectoral allocation varies

⚡️I'd say power is the wildcard here (2/9)

🔥 Small role in building heat

🚛🚢✈️Important role in transport, but sub-sectoral allocation varies

⚡️I'd say power is the wildcard here (2/9)

Here's a more detailed breakdown of ETC's scenarios. Power sector demand could be x3 what's displayed in the previous tweet. My takeaway is that the power sector could very well turn out to be the largest consumer of hydrogen. (3/9)

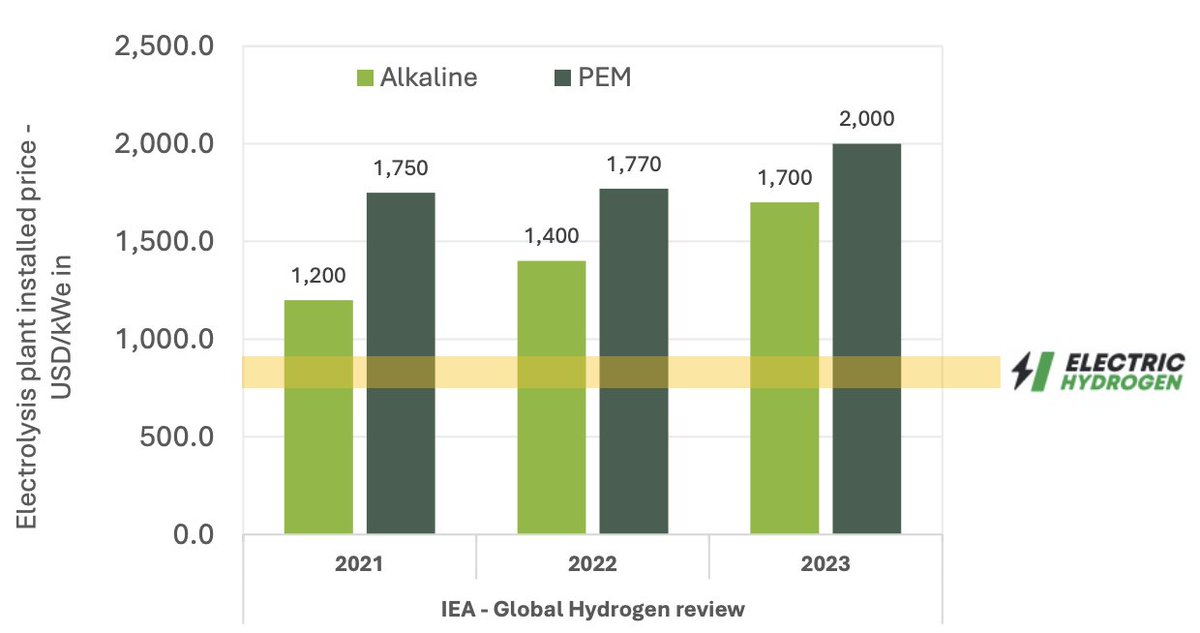

Hydrogen from electrolysis will become a competitive alternative to hydrogen from gas reforming with carbon capture *this decade*.

Locations with the best renewable resources might even produce hydrogen cheap enough to compete head-to-head with natural gas by 2030. (4/9)

Locations with the best renewable resources might even produce hydrogen cheap enough to compete head-to-head with natural gas by 2030. (4/9)

💨The picture is of course more nuanced than 280 characters. Not everyone has the same brilliant insollation of Chile, and some have really low cost gas. So expect some gas-derived hydrogen, even in 2050. The critical point here is to ensure MINIMAL upstream leakage. (5/9)

💦Some may ask, what about upstream electrolytic hydrogen i.e. sustainability of water use?

The way I think about it, we'll end up with more water once we exchange fossil fuel extraction and processing for renewable hydrogen. (6/9)

The way I think about it, we'll end up with more water once we exchange fossil fuel extraction and processing for renewable hydrogen. (6/9)

How do we get hydrogen to where it's needed?

🥊Molecules vs. electrons💥

New electron infrastructure could be a better alternative than new pipelines.

Retrofitted pipelines are a good idea if they are in the right place.

Local production can be cheapest still (7/9)

🥊Molecules vs. electrons💥

New electron infrastructure could be a better alternative than new pipelines.

Retrofitted pipelines are a good idea if they are in the right place.

Local production can be cheapest still (7/9)

🌱Nonetheless, even decarbonised hydrogen at $0.5/kg, will command a green premium in the absence of a carbon pricing mechanism. But green inflation is far less daunting, even negligible when spread along the value chain. (8/9)

🧑🏫If you found this educational, you ought to read the full report, because there is plenty more where that came from. Kudos to everyone involved in putting together this fantastic piece of work. (9/9)

https://twitter.com/andiwagner/status/1388188579898273792

• • •

Missing some Tweet in this thread? You can try to

force a refresh