🌴💰🍸⛵️ Tax Evasion For Traders & Founders: How Billionaires Pay Less Than Secretaries

With tax season around the corner, here’s a compiled list of (mostly legal) hacks to reduce your future bleeding.

👇

P.S. Not a lawyer. If you’re the IRS, don’t kill the informed aggregator

With tax season around the corner, here’s a compiled list of (mostly legal) hacks to reduce your future bleeding.

👇

P.S. Not a lawyer. If you’re the IRS, don’t kill the informed aggregator

1/ Set up a tax haven shell company

The Cayman Islands have only 2 types of residents: shells and shell co’s. No corporate tax, no income tax, no cap gains tax.

Half the world’s politicians have channel(ed) income to its sandy beaches to exploit this tax loophole...

Have you?

The Cayman Islands have only 2 types of residents: shells and shell co’s. No corporate tax, no income tax, no cap gains tax.

Half the world’s politicians have channel(ed) income to its sandy beaches to exploit this tax loophole...

Have you?

2/ Incorporate an LLC pass-through

As a founder/IC/celebrity, set up an LLC or S-corp so profit flows directly to the partner (aka you). Expense all your meals, party supplies, “office rent” as bizniz opex. Also invest directly from the LLC, pre-tax. Like a hedge fund.

As a founder/IC/celebrity, set up an LLC or S-corp so profit flows directly to the partner (aka you). Expense all your meals, party supplies, “office rent” as bizniz opex. Also invest directly from the LLC, pre-tax. Like a hedge fund.

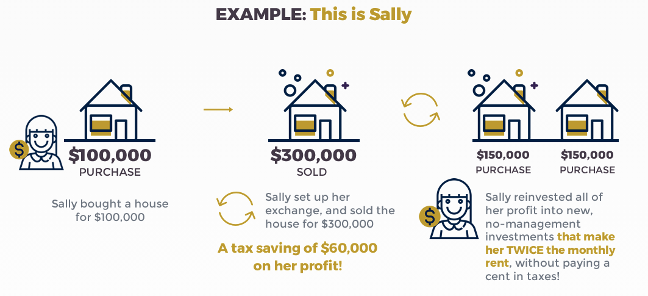

3/ Exploit 1031 repeatedly 🛖 ->🏠 ->🏘️

IRS Sec-1013 says: use proceeds from selling 1 property to buy another & defer all cap gains tax.

Do this on a loop.

i.e. use proceeds to keep buying ever-larger houses, defer taxes indefinitely, keep pocketing ever-larger rental income.

IRS Sec-1013 says: use proceeds from selling 1 property to buy another & defer all cap gains tax.

Do this on a loop.

i.e. use proceeds to keep buying ever-larger houses, defer taxes indefinitely, keep pocketing ever-larger rental income.

4/ QSBS

QSBS (qualified small business stock) tax exemption lets founders & angels avoid 100% capital gains tax up to $10M (or 10x initial investment, whichever higher) at exit.

Caveats:

⁃Must hold stock for >5 years

⁃Startup must be C-corp w/ <$50M at issuance

QSBS (qualified small business stock) tax exemption lets founders & angels avoid 100% capital gains tax up to $10M (or 10x initial investment, whichever higher) at exit.

Caveats:

⁃Must hold stock for >5 years

⁃Startup must be C-corp w/ <$50M at issuance

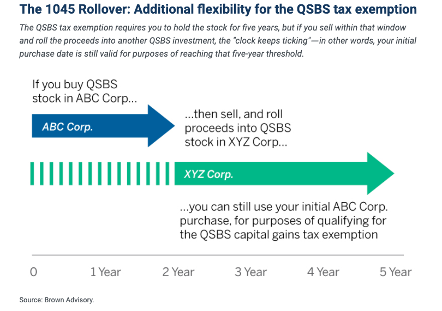

5/ QSBS part 2...

"What happens if I exit my startup before 5y?" you ask.

Well first, congratufuckinglations. Second, take advantage of 1045 rollover, i.e. you can roll proceeds from startup #1 into new startup #2 (another QSBS investment) and extend the clock until >5y 🕐🕒🕔

"What happens if I exit my startup before 5y?" you ask.

Well first, congratufuckinglations. Second, take advantage of 1045 rollover, i.e. you can roll proceeds from startup #1 into new startup #2 (another QSBS investment) and extend the clock until >5y 🕐🕒🕔

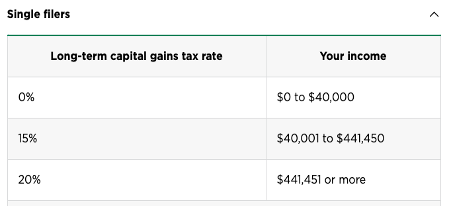

6/ Liquidate on low income years

Pretty vanilla, not really a "loophole" per se, but deserves clarification. Say u make $0 income & 500K gains selling $DOGE 🐶 in 2021. Only the first 40k is tax-free. The next 441.5K is 15% taxed, next 18.5K is 20%.

Pretty vanilla, not really a "loophole" per se, but deserves clarification. Say u make $0 income & 500K gains selling $DOGE 🐶 in 2021. Only the first 40k is tax-free. The next 441.5K is 15% taxed, next 18.5K is 20%.

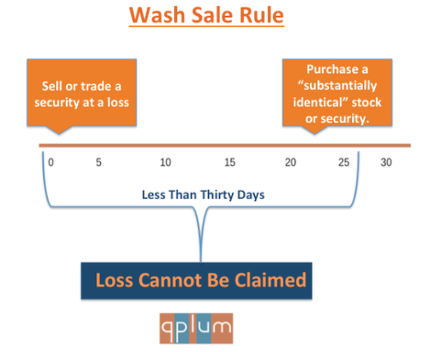

7/ Pseudo wash sale

Wash sale = selling a loser asset to tax-loss harvest & then buying back exact same asset (or its options) w/in 30d. Illegal.

To skirt anti-wash-sale rules, buy back a similar but not “substantially similar” asset (eg tokenized asset or same-industry basket)

Wash sale = selling a loser asset to tax-loss harvest & then buying back exact same asset (or its options) w/in 30d. Illegal.

To skirt anti-wash-sale rules, buy back a similar but not “substantially similar” asset (eg tokenized asset or same-industry basket)

8/ Borrow against whole-life insurance

“a clever transmogrifications of income -> loan”🤨

Loophole works like this: Bank lends u 90% surrender value of the policy. Bc its a loan, not eligible for income/gains tax. Bc its collateralized, interest rate will be super low, <3.5%.

“a clever transmogrifications of income -> loan”🤨

Loophole works like this: Bank lends u 90% surrender value of the policy. Bc its a loan, not eligible for income/gains tax. Bc its collateralized, interest rate will be super low, <3.5%.

9/ Buy crypto w/ international life insurance

Fund an offshore private-placement life ins (similar to Roth IRA, but no contribution limits). 💎🙌 ‘til death. Pass the policy to heirs. Step up in basis means your heirs receive all crypto & other assets at 0% tax on appreciation.

Fund an offshore private-placement life ins (similar to Roth IRA, but no contribution limits). 💎🙌 ‘til death. Pass the policy to heirs. Step up in basis means your heirs receive all crypto & other assets at 0% tax on appreciation.

10/ Shell trust fund

“a 2nd clever transmogrifications of income -> loan”🤨

Exploiters pay as little as 1% income tax.

First, they "donate" 💸 to a trust fund. Fund then offers cheap loans, which they conveniently "forget" to pay back. Result: can write off mucho income tax.

“a 2nd clever transmogrifications of income -> loan”🤨

Exploiters pay as little as 1% income tax.

First, they "donate" 💸 to a trust fund. Fund then offers cheap loans, which they conveniently "forget" to pay back. Result: can write off mucho income tax.

11/ Equity Swaps: swim w/ a buddy!

2 rich friends collude to exchange the gains on a set of assets without actually transferring ownership.

e.g Alice wants out of TSLA but instead of selling & incurring tax, she pays TSLA gains/loss for 1Y to Bob in return for LIBOR + spread

2 rich friends collude to exchange the gains on a set of assets without actually transferring ownership.

e.g Alice wants out of TSLA but instead of selling & incurring tax, she pays TSLA gains/loss for 1Y to Bob in return for LIBOR + spread

12/ NOL carry-forward

Only applicable to corporates. Net operating loss (NOL) is incurred when a corp make negative income during some taxable period. The IRS allows u to carry-forward this loss to offset tax in future positive-income years (and as of 2017, carry indefinitely).

Only applicable to corporates. Net operating loss (NOL) is incurred when a corp make negative income during some taxable period. The IRS allows u to carry-forward this loss to offset tax in future positive-income years (and as of 2017, carry indefinitely).

13/ Move to Puerto Rico

The only corner of the world where US citizens can hide from “worldwide taxation” on federal income.

Acts 20 & 22 exempts bonafide residents’ PR source income as long as they’re physically in PR for 183 days of the year.

But dat lifestyle tho.

The only corner of the world where US citizens can hide from “worldwide taxation” on federal income.

Acts 20 & 22 exempts bonafide residents’ PR source income as long as they’re physically in PR for 183 days of the year.

But dat lifestyle tho.

• • •

Missing some Tweet in this thread? You can try to

force a refresh